West Virginia Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members

Description

How to fill out Limited Liability Operating Agreement For Manager Managed Real Estate Development With Specification Of Different Amounts Of Capital Contributions By Members?

Are you presently in the situation that you need paperwork for sometimes organization or personal reasons almost every day time? There are tons of authorized papers layouts available on the Internet, but discovering ones you can depend on isn`t easy. US Legal Forms delivers thousands of type layouts, such as the West Virginia Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members, that are created to meet federal and state demands.

When you are already familiar with US Legal Forms site and get your account, merely log in. After that, it is possible to obtain the West Virginia Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members web template.

Unless you provide an bank account and want to begin to use US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for your correct metropolis/state.

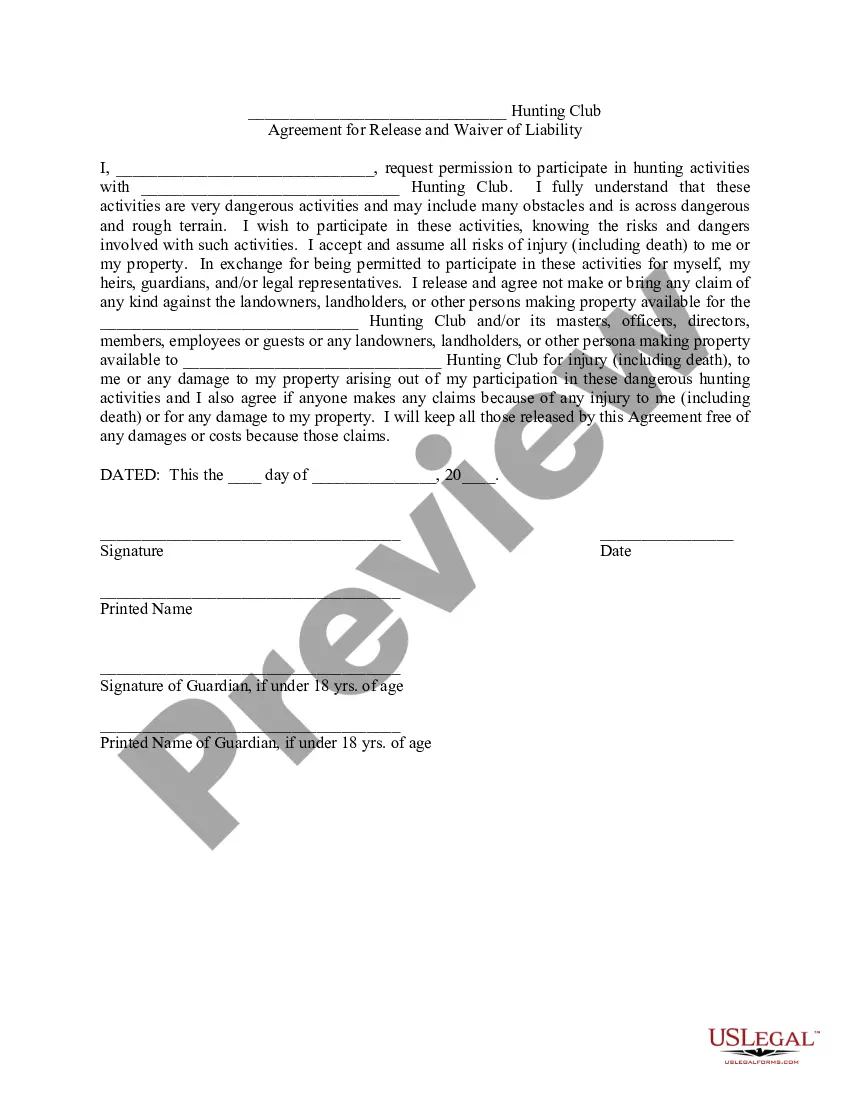

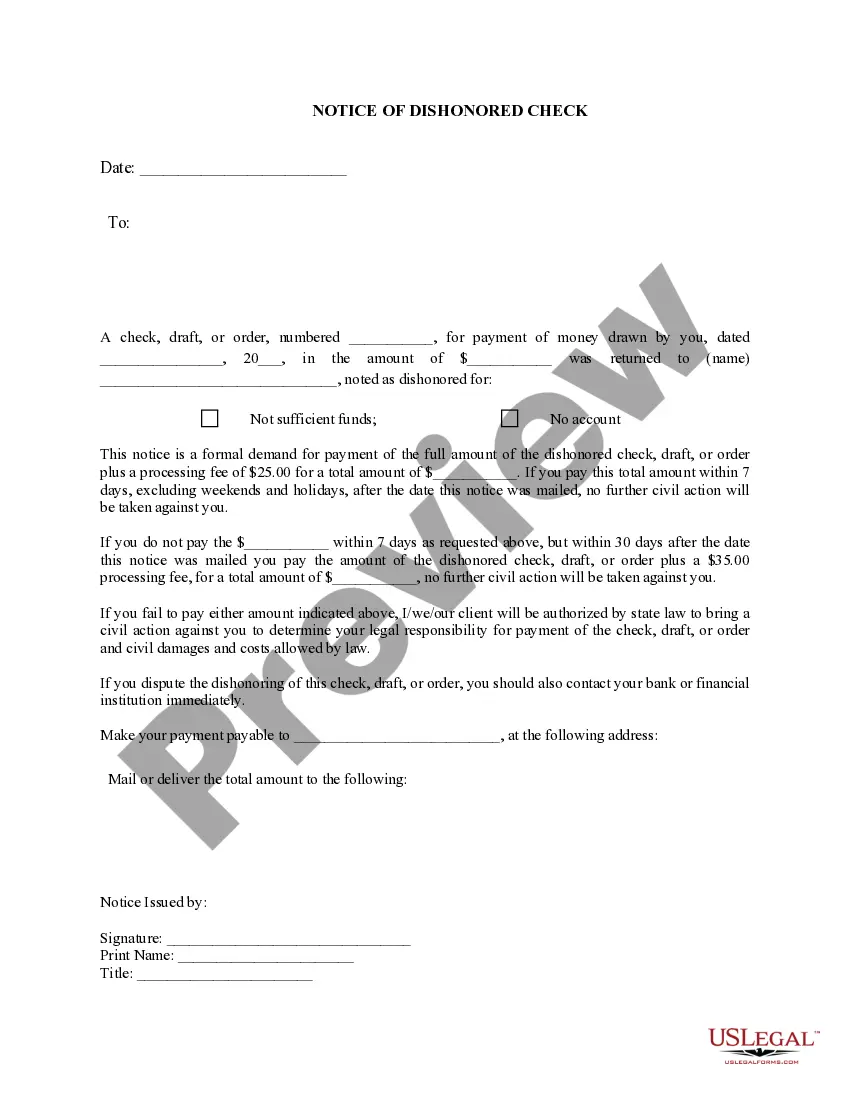

- Utilize the Review key to review the form.

- Read the description to actually have chosen the right type.

- In the event the type isn`t what you are trying to find, make use of the Research area to obtain the type that meets your needs and demands.

- Once you obtain the correct type, just click Get now.

- Select the costs strategy you desire, submit the necessary details to produce your bank account, and purchase the order making use of your PayPal or bank card.

- Choose a practical file structure and obtain your duplicate.

Get all the papers layouts you might have bought in the My Forms food list. You may get a additional duplicate of West Virginia Limited Liability Operating Agreement for Manager Managed Real Estate Development with Specification of Different Amounts of Capital Contributions by Members at any time, if necessary. Just go through the essential type to obtain or print the papers web template.

Use US Legal Forms, one of the most comprehensive selection of authorized kinds, to save lots of some time and steer clear of errors. The assistance delivers professionally created authorized papers layouts that can be used for a selection of reasons. Make your account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Most often, operating agreements provide that each owner's distributive share corresponds to his or her percentage of ownership in the LLC. For example, because Tony owns only 35% of his LLC, he receives just 35% of its profits and losses.

In Texas, an operating agreement isn't required to form a limited liability company (LLC). However, business attorneys, accountants and advisors agree that no LLC should form without one. An LLC operating agreement is a legally binding document that defines critical aspects of the LLC.

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

Additionally, the LLC agreement may address (a) procedures management is expected to follow in performance of its duties, (b) compensation for management (if any), (c) management's ability to delegate authority to certain officers of the company, and (d) management indemnity provisions.

Capital contributions are the money or other assets members give to the LLC in exchange for ownership interest. Members fund the LLC with initial capital contributions?these are usually recorded in the operating agreement. Additional capital contributions can be made at any time later on.

The LLC operating agreement, also known as an LLC agreement, establishes the rules and structure for the LLC and can help address any issues that arise during business operations. Most states have default provisions that address many of these difficulties, but the operating agreement can override these presumptions.

managed LLC is a business entity in which all members participate in the decisionmaking process. Each member has an equal right to manage the LLC's business, unless otherwise stated in the operating agreement. If a dispute arises, the vote of a majority generally rules.