West Virginia Financial Record Storage Chart

Description

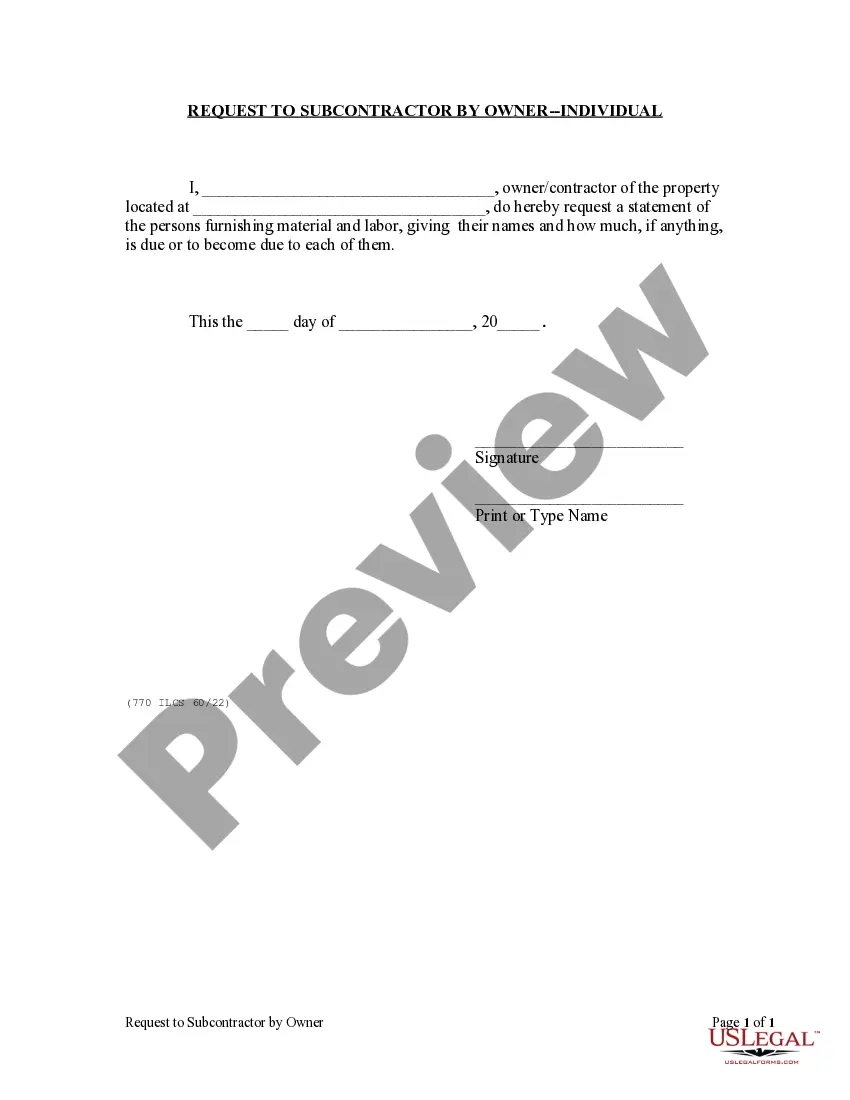

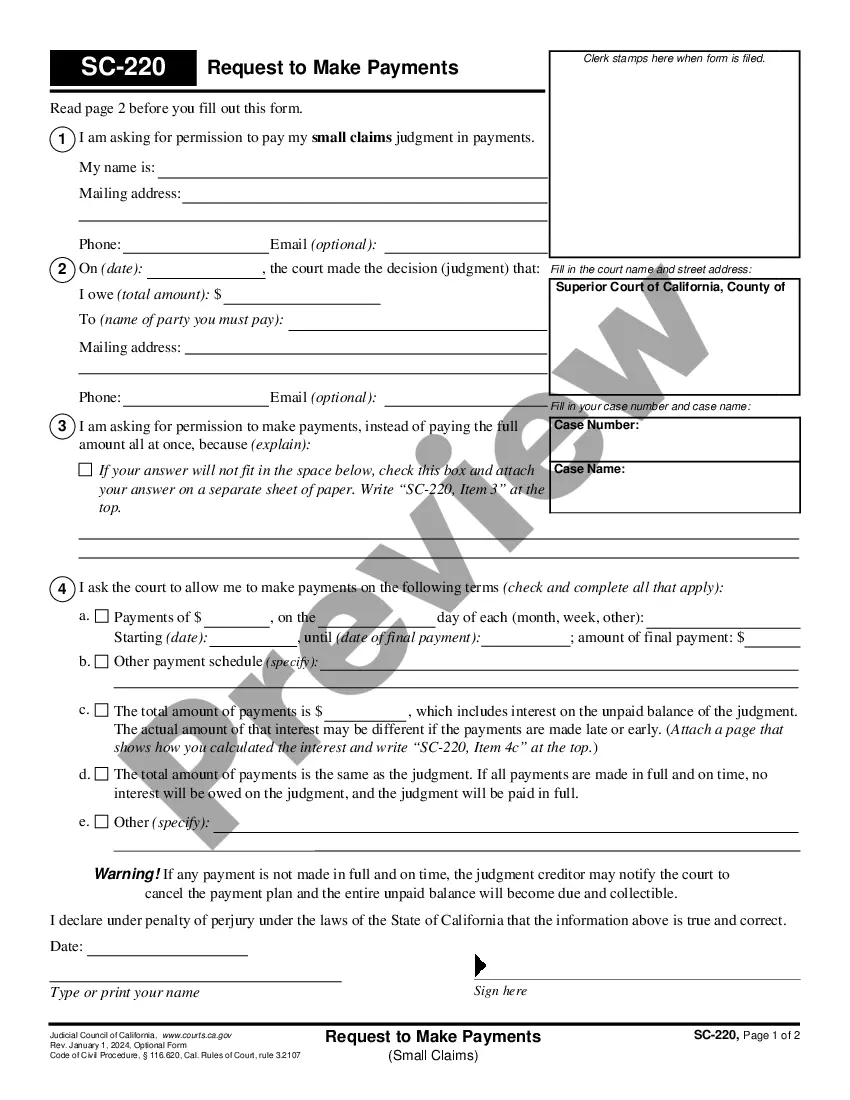

How to fill out Financial Record Storage Chart?

US Legal Forms - one of the most prominent collections of legal templates in the USA - offers a range of legal document templates that you can download or print.

On the site, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You will be able to access the latest versions of forms like the West Virginia Financial Record Storage Chart within minutes.

If you have a subscription, Log In and download the West Virginia Financial Record Storage Chart from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make adjustments. Fill out, edit, and print and sign the downloaded West Virginia Financial Record Storage Chart. Each template you have saved in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print a different version, simply navigate to the My documents section and click on the form you need. Access the West Virginia Financial Record Storage Chart with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have chosen the correct form for your locality/region.

- Select the Review option to examine the form's content.

- Check the form's description to confirm you have selected the right form.

- If the form does not suit your needs, utilize the Search bar at the top of the screen to find one that does.

- When satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select your preferred pricing plan and provide your details to register for the account.

Form popularity

FAQ

A company is generally required to keep financial records for seven years, according to West Virginia law. This requirement helps ensure that you have adequate documentation for audits and financial assessments. For clarity and compliance, refer to the West Virginia Financial Record Storage Chart, which can guide you in keeping the essential records your business needs.

Companies typically must retain financial records for a minimum of seven years in West Virginia. This includes all documentation related to income, expenses, and other financial transactions that may affect tax filings. By following the guidelines detailed in the West Virginia Financial Record Storage Chart, you can ensure that your records are both comprehensive and compliant.

Employers should retain specific employee records for seven years, including payroll records, time sheets, and any documentation related to employee benefits. This timeframe helps protect you against potential legal issues or claims. The West Virginia Financial Record Storage Chart outlines these requirements, ensuring your organization stays compliant and well-organized.

Various records must be maintained for seven years in West Virginia, particularly those related to tax obligations. Financial statements, ledgers, and any documents associated with the financial performance of your business fall into this category. Utilizing the West Virginia Financial Record Storage Chart can provide you with a clear framework for what to retain, minimizing the risk of errors.

In West Virginia, businesses should keep records related to federal income tax returns for at least seven years. This includes receipts, invoices, and any documentation supporting deductions. Referencing the West Virginia Financial Record Storage Chart can help you identify specific records necessary for compliance, ensuring you are prepared for potential audits.

Maintaining financial records is often a collective responsibility shared among business owners, accountants, and financial officers. Each person plays a crucial role in ensuring accuracy and compliance. Leveraging the West Virginia Financial Record Storage Chart can simplify these duties, making it clear who needs to manage what.

In general, business owners should keep records relating to taxes for at least seven years. This includes returns, additional documentation for income, and expense receipts. To help you navigate this, the West Virginia Financial Record Storage Chart provides a reliable framework for determining which documents to retain for long periods.

Typically, a business’s financial records are maintained by the accounting department or by hired bookkeepers. This team ensures that all transactions are accurately recorded and reported. By referring to the West Virginia Financial Record Storage Chart, you can streamline your storage and make sure that each record stays organized and ready for audits or reviews.

The IRS recommends keeping records that support income, deductions, and credits for at least three years. However, certain documents may need to be stored for longer, especially if they relate to property or special situations. Following the West Virginia Financial Record Storage Chart can assist you in understanding which records to keep and for how long.

The responsibility for financial record keeping often falls on business owners and designated employees. Accurate record keeping is essential for tax compliance and business operations. Utilizing the West Virginia Financial Record Storage Chart can help clarify roles and ensure that all necessary records are maintained properly.