West Virginia General Form of Agreement to Incorporate

Description

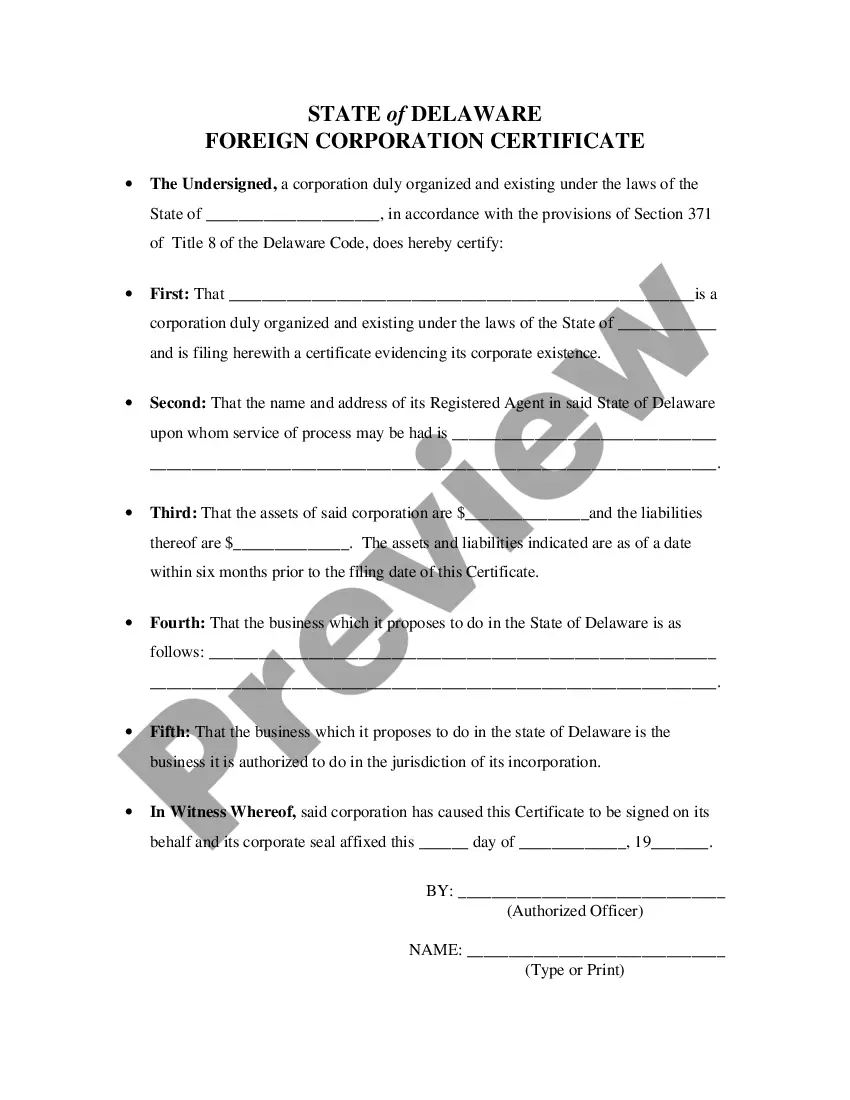

How to fill out General Form Of Agreement To Incorporate?

Locating the appropriate authorized document template can be quite challenging.

Naturally, there is a plethora of templates accessible online, but how can you obtain the authorized document you require.

Utilize the US Legal Forms website.

Initially, ensure that you have selected the correct form for your municipality or county.

- The service offers thousands of templates, including the West Virginia General Form of Agreement to Incorporate, which you can utilize for business and personal purposes.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to access the West Virginia General Form of Agreement to Incorporate.

- Use your account to review the authorized forms you may have previously ordered.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some basic steps to follow.

Form popularity

FAQ

In West Virginia, notarization of the title is generally not required for the transfer process. However, both parties may choose to have the transaction notarized for additional security and validation. This step can offer peace of mind, especially in a private sale. To simplify your paperwork, the West Virginia General Form of Agreement to Incorporate can provide clarity on title requirements and other essential details.

To fill out the back of a WV title, locate the section for the buyer's information and accurately complete each required field. Include the buyer's name, address, and your signature as the seller. Make sure to review all entries for correctness, as errors can complicate the transfer. Consider referencing the West Virginia General Form of Agreement to Incorporate to streamline the completion process.

Filling out a West Virginia title involves several key steps. Begin by writing the buyer's information in the seller section, then indicate the year, make, model, and VIN of the vehicle. Ensure you sign and date the title to confirm the transaction's legitimacy. If you are unsure about the process, the West Virginia General Form of Agreement to Incorporate can guide you through the necessary documentation.

Several states accept federal extensions for individuals, including West Virginia and Virginia. This can offer taxpayers more time to file their returns without facing penalties. When considering your personal tax situation, remember the importance of accurate and timely filing—this is where the West Virginia General Form of Agreement to Incorporate comes into play for business owners.

Indeed, West Virginia accepts federal extensions for partnerships, which can alleviate some stress during tax season. By properly submitting IRS Form 700, partnerships can gain additional time to prepare their necessary documentation. This gives you a chance to focus on accurately completing the West Virginia General Form of Agreement to Incorporate.

Forming an LLC in West Virginia involves selecting a unique business name, appointing a registered agent, and filing your articles of organization with the Secretary of State. You will also need to create an operating agreement to govern your LLC. Once everything is in order, you are well on your way to utilizing the West Virginia General Form of Agreement to Incorporate for your business.

To obtain articles of organization in West Virginia, you must complete the appropriate application forms provided by the Secretary of State's office. This documentation includes key details about your business structure and purpose. When you file these articles, you are effectively laying the groundwork for the West Virginia General Form of Agreement to Incorporate.

Yes, West Virginia accepts federal extensions for partnerships. By filing the IRS Form 700, partnerships can secure more time to prepare their state tax returns. This extension eases the pressure of meeting deadlines, allowing partners to focus on completing the West Virginia General Form of Agreement to Incorporate accurately.

Virginia does accept federal extensions for corporations, which allows businesses to extend their filing deadlines. By filing a federal extension, corporations gain a better timeframe to prepare their documents. This can be particularly beneficial when incorporating in West Virginia, as it provides you with more time to finalize the West Virginia General Form of Agreement to Incorporate.

Yes, you can file an extension for a partnership in West Virginia. To do so, you need to submit Form 700, which allows you to request additional time to file your partnership return. This extension is crucial to ensure you have enough time to gather accurate information for the West Virginia General Form of Agreement to Incorporate.