Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

West Virginia Declaration of Gift Over Several Year Period

Description

How to fill out Declaration Of Gift Over Several Year Period?

Have you ever found yourself in a situation where you need documents for both business or personal purposes nearly every day.

There are countless legal document templates available online, but finding reliable ones isn’t simple.

US Legal Forms provides thousands of form templates, including the West Virginia Declaration of Gift Over Several Years, designed to comply with state and federal regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you prefer, complete the required information to create your account, and purchase the order using your PayPal or credit card. Choose a convenient paper format and download your copy. Access all the document templates you have purchased in the My documents menu. You can download another copy of the West Virginia Declaration of Gift Over Several Years anytime if needed. Just click on the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the West Virginia Declaration of Gift Over Several Years template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it corresponds to the correct city/county.

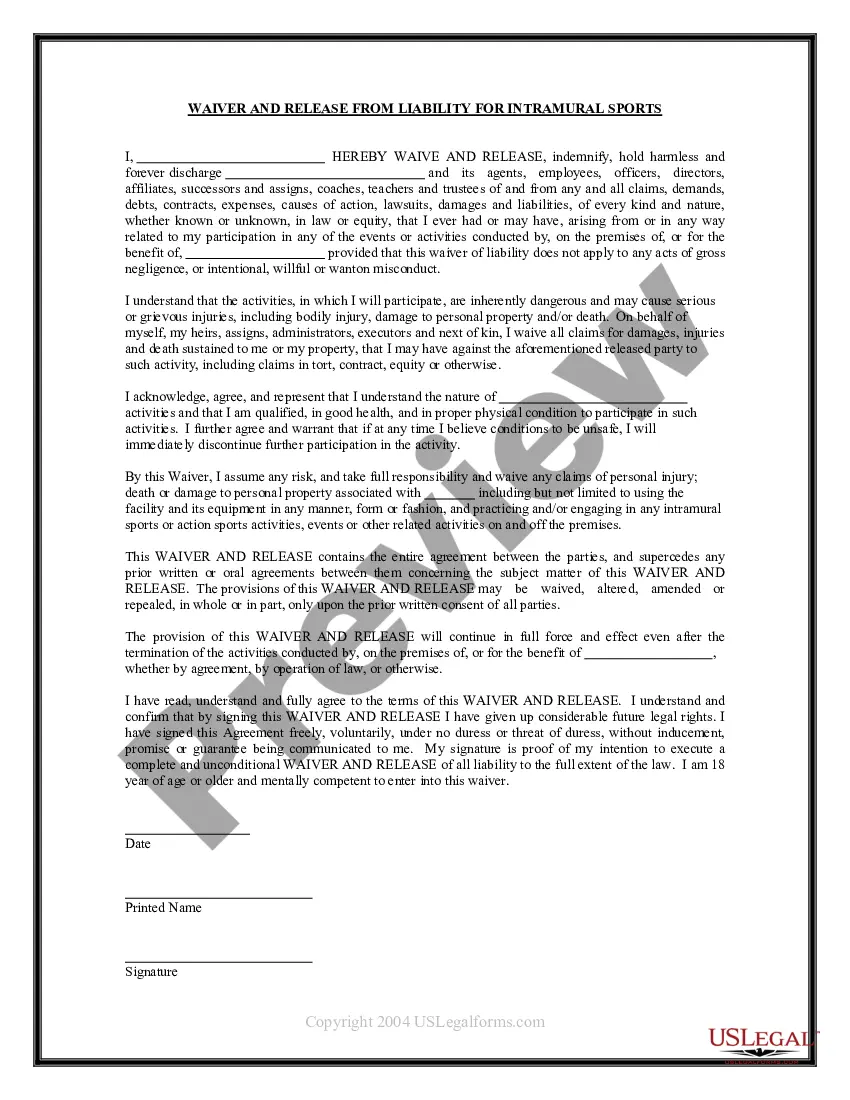

- Use the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

Filling out a West Virginia title requires specific information about the property and the parties involved. Begin by accurately completing the relevant sections describing the property being gifted and the beneficiaries involved in your West Virginia Declaration of Gift Over Several Year Period. It's essential to ensure that all details are correct to avoid any legal implications. If you need assistance, the uslegalforms platform can provide helpful resources and templates to guide you through this process effectively.

The annual gift exclusion allows individuals to give a specified amount each year without triggering gift taxes. For those managing a West Virginia Declaration of Gift Over Several Year Period, understanding this exclusion is vital. Every recipient can receive gifts up to the exclusion limit without any tax implication for the giver. This approach encourages generosity while ensuring tax benefits are retained, making it an effective tool in financial planning.

The annual exclusion form for gifts allows individuals to gift up to a certain amount each year without incurring gift taxes. In the context of a West Virginia Declaration of Gift Over Several Year Period, this form is critical for managing and reporting your gifts correctly. This process ensures that you remain compliant with IRS regulations while maximizing your gifting potential. Utilizing this form simplifies the procedure of claiming the annual exclusion benefit for your loved ones.

The annual gift exclusion has changed over the years, generally increasing with inflation adjustments. Staying updated on these changes is crucial for effective financial planning. Relying on resources that detail the West Virginia Declaration of Gift Over Several Year Period can enhance your understanding of past and current exclusions.

West Virginia has an inheritance tax that varies based on the relationship to the deceased and the value of the inheritance. Spouses are usually exempt from this tax, while distant relatives may face varying rates. By familiarizing yourself with the West Virginia Declaration of Gift Over Several Year Period, you can plan your inheritance strategy effectively.

In West Virginia, the maximum amount you can inherit without paying taxes varies depending on the family's situation and individual estate values. Typically, inheritances below a certain threshold may not incur taxes. Understanding the provisions within the West Virginia Declaration of Gift Over Several Year Period can provide additional insight on effective estate planning.

The gift tax in West Virginia is aligned with federal tax regulations. The rates based on the value of the gifts can vary, and most individuals may not face significant taxes due to the annual exclusion limits. Familiarizing yourself with the West Virginia Declaration of Gift Over Several Year Period allows for effective tax planning.

If you gift someone more than $15,000 in one year, you will need to file a gift tax return. However, this does not necessarily mean you will owe taxes; you may be able to use your lifetime exclusion to offset any taxes owed. Utilizing the West Virginia Declaration of Gift Over Several Year Period can provide clarity on handling larger gifts.

A declaration of consideration or value in West Virginia is a formal statement that explains the worth of the gifts made. This document can assist in preventing disputes about the value of gifts given over several years. Understanding the West Virginia Declaration of Gift Over Several Year Period can help clarify this process.

While the exact annual gift tax exclusion for 2026 is not yet established, it is subject to inflation adjustments. Typically, the IRS reviews and modifies these figures periodically. Keeping track of these changes is essential for complying with the West Virginia Declaration of Gift Over Several Year Period and ensuring you optimize your gifts.