West Virginia Line of Credit Promissory Note

Description

How to fill out Line Of Credit Promissory Note?

Choosing the best authorized record format can be quite a struggle. Of course, there are tons of themes available on the Internet, but how will you obtain the authorized type you will need? Take advantage of the US Legal Forms internet site. The support offers a large number of themes, including the West Virginia Line of Credit Promissory Note, which you can use for enterprise and private demands. Each of the kinds are checked out by specialists and satisfy state and federal requirements.

Should you be presently registered, log in for your account and click the Down load button to find the West Virginia Line of Credit Promissory Note. Make use of your account to appear throughout the authorized kinds you might have ordered formerly. Visit the My Forms tab of the account and have yet another copy from the record you will need.

Should you be a brand new consumer of US Legal Forms, here are basic guidelines that you can adhere to:

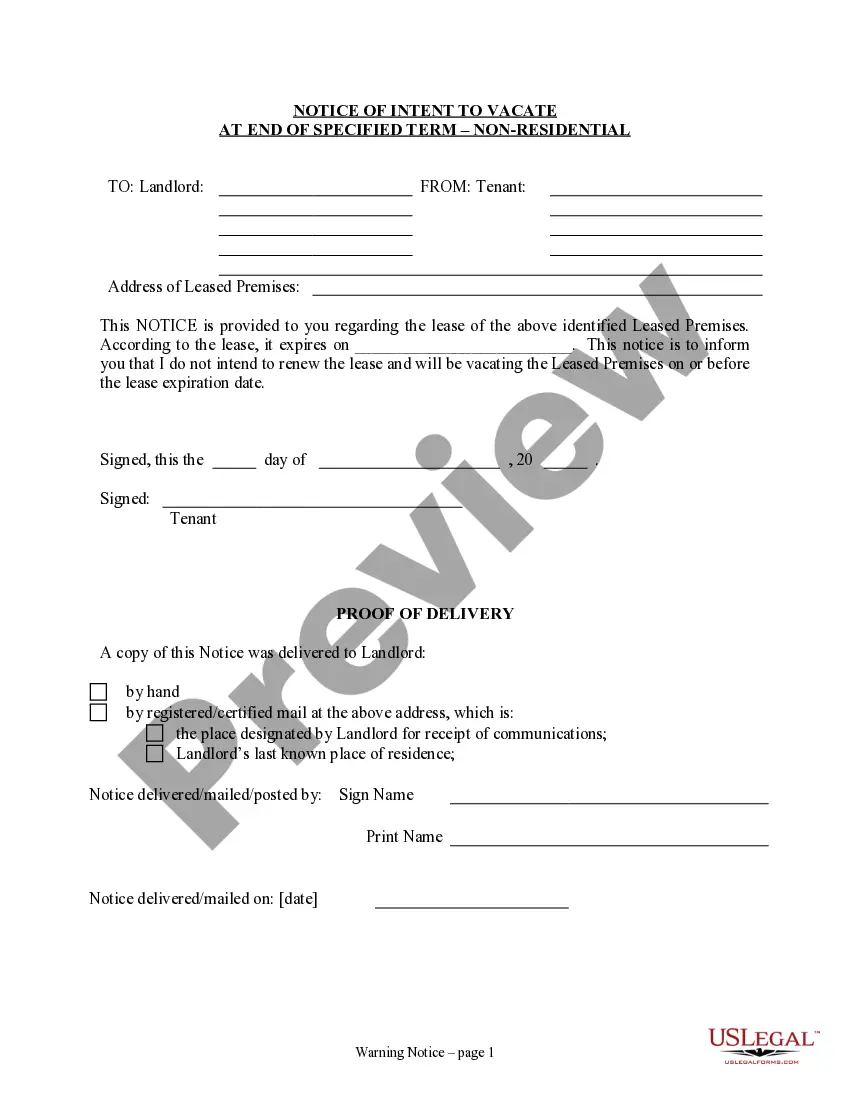

- First, make certain you have selected the appropriate type for the area/county. You can check out the form making use of the Review button and study the form description to guarantee this is the best for you.

- In the event the type fails to satisfy your preferences, use the Seach field to get the correct type.

- Once you are positive that the form is acceptable, click the Acquire now button to find the type.

- Pick the costs strategy you want and enter the necessary information and facts. Make your account and pay for your order with your PayPal account or bank card.

- Choose the submit format and acquire the authorized record format for your gadget.

- Total, change and printing and signal the received West Virginia Line of Credit Promissory Note.

US Legal Forms will be the greatest catalogue of authorized kinds where you can find various record themes. Take advantage of the company to acquire expertly-produced files that adhere to state requirements.

Form popularity

FAQ

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Before a promissory note can be canceled, the lender must agree to the terms of canceling it. A well-drafted and detailed promissory note can help the parties involved avoid future disputes, misunderstandings, and confusion. When canceling the promissory note, the process is referred to as a release of the note.

Rule #5 - In order to pay off the debt, or what is called "discharging the debt"; all one has to do is write/ (or create) your own certified promissory note (a negotiable instrument under Uniform Commercial Code (UCC) Section 3- 104 paragraph (e)), with your signature on the promissory note in the amount of the ...

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Statute of limitations. (a) Except as provided in subsection (e), an action to enforce the obligation of a party to pay a note payable at a definite time must be commenced within six years after the due date or dates stated in the note or, if a due date is accelerated, within six years after the accelerated due date.

If the borrower does not repay you, your legal recourse could include repossessing any collateral the borrower put up against the note, sending the debt to a collection agency, selling the promissory note (so someone else can try to collect it), or filing a lawsuit against the borrower.