West Virginia Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

Selecting the finest sanctioned document template can be challenging. Clearly, there are numerous templates accessible online, but how do you find the authorized form you require.

Utilize the US Legal Forms platform. The service offers thousands of templates, including the West Virginia Option of Remaining Partners to Acquire, which you can use for both business and personal needs. All forms are reviewed by experts and comply with state and federal standards.

If you are currently registered, Log In to your account and click the Download button to obtain the West Virginia Option of Remaining Partners to Acquire. Use your account to check the legal forms you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired West Virginia Option of Remaining Partners to Acquire. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Use the service to obtain properly crafted paperwork that meet state regulations.

- First, ensure you have selected the correct form for your city/state.

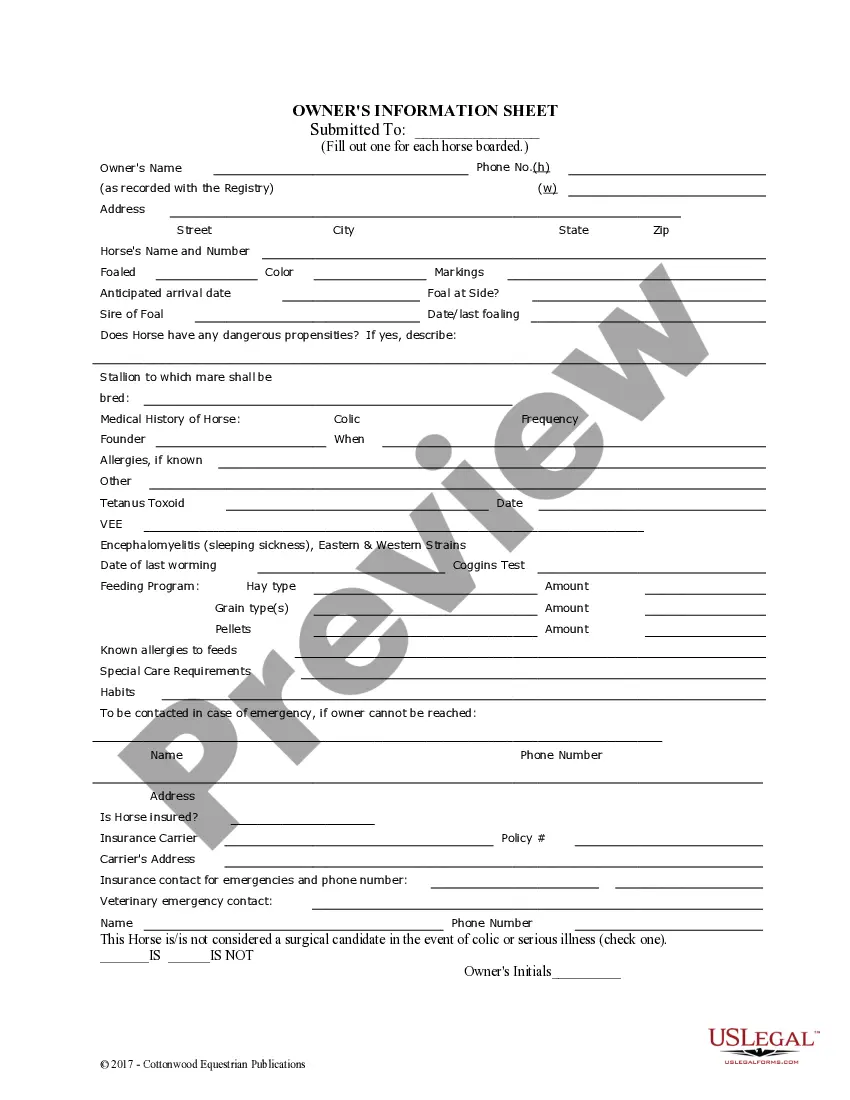

- You can preview the form using the Preview button and read the form description to confirm this is indeed the right one for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are certain the form is suitable, click the Get now button to acquire the form.

- Choose the pricing plan you wish and provide the required information.

- Create your account and complete the transaction using your PayPal account or credit card.

Form popularity

FAQ

Yes, West Virginia grants an automatic extension to partnerships, but only if the extension request is submitted in a timely manner. This extension typically provides an additional six months to file your return. However, it is crucial to note that this extension does not apply to any taxes owed. Users seeking comprehensive assistance can utilize platforms like USLegalForms to ensure they adhere to extension regulations correctly.

In West Virginia, the nonresident withholding for a partnership is typically set at 6.5% of the distributive share of income allocated to nonresident partners. This withholding ensures that the state collects taxes on income distributed to partners who do not reside in West Virginia. To manage this effectively, partnerships should consider using resources like USLegalForms to ensure compliance with state regulations. Understanding these rates helps maintain financial clarity for partners in a partnership.

Disinheriting a SpouseSurviving spouses in West Virginia have the right to take what is called an elective share of the estate instead of inheriting under the will or as provided under intestacy laws.

What are the steps in probate?Contact the County Clerk's Office to Start Probate Process.Appoint an Administrator/Executor.Appraise the Person's Estate.Settle any Claims Against the Estate from Creditors.Close the Estate.Distribute the Remaining Property.

Disinheriting a SpouseSurviving spouses in West Virginia have the right to take what is called an elective share of the estate instead of inheriting under the will or as provided under intestacy laws.

There two ways to close the estate: (1) final settlement; or (2) waiver of final settlement. Generally, you must close the estate within 5 years of starting the probate process. W. Va.

What is California's Law on Disinheriting a Spouse? To disinherit someone is to take specific steps to ensure they do not inherit any of your estates after you die. This needs to be properly done to avoid Will Contests.

This means that you are free to set out who you want to benefit from your Estate in your Will and exclude anyone you don't want to inherit from you, including your children or even your spouse. So, technically you can disinherit anyone under your Will.

Spouses in West Virginia Inheritance LawIf you have no living descendants, your spouse will inherit all of your intestate property. Your spouse will also inherit all of your intestate property if the only descendants either of you have are from your relationship with your spouse.

DISINHERITING A CHILD OF THE TESTATORA child generally has no right under West Virginia law to inherit from a parent. If a child is born or adopted after a will is signed and is not provided for by the will, that child may be entitled to a pretermitted child's share (W. Va. Code § 41-4-1).