West Virginia Revocable Trust for Grandchildren

Description

How to fill out Revocable Trust For Grandchildren?

Are you currently in a situation where you need documents for either professional or personal purposes nearly every day.

There are numerous legal document templates available online, but finding ones you can trust can be challenging.

US Legal Forms provides thousands of form templates, such as the West Virginia Revocable Trust for Grandchildren, that are designed to comply with federal and state regulations.

You can find all the document templates you have purchased in the My documents menu.

You can obtain another copy of the West Virginia Revocable Trust for Grandchildren at any time if needed. Just follow the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the West Virginia Revocable Trust for Grandchildren template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

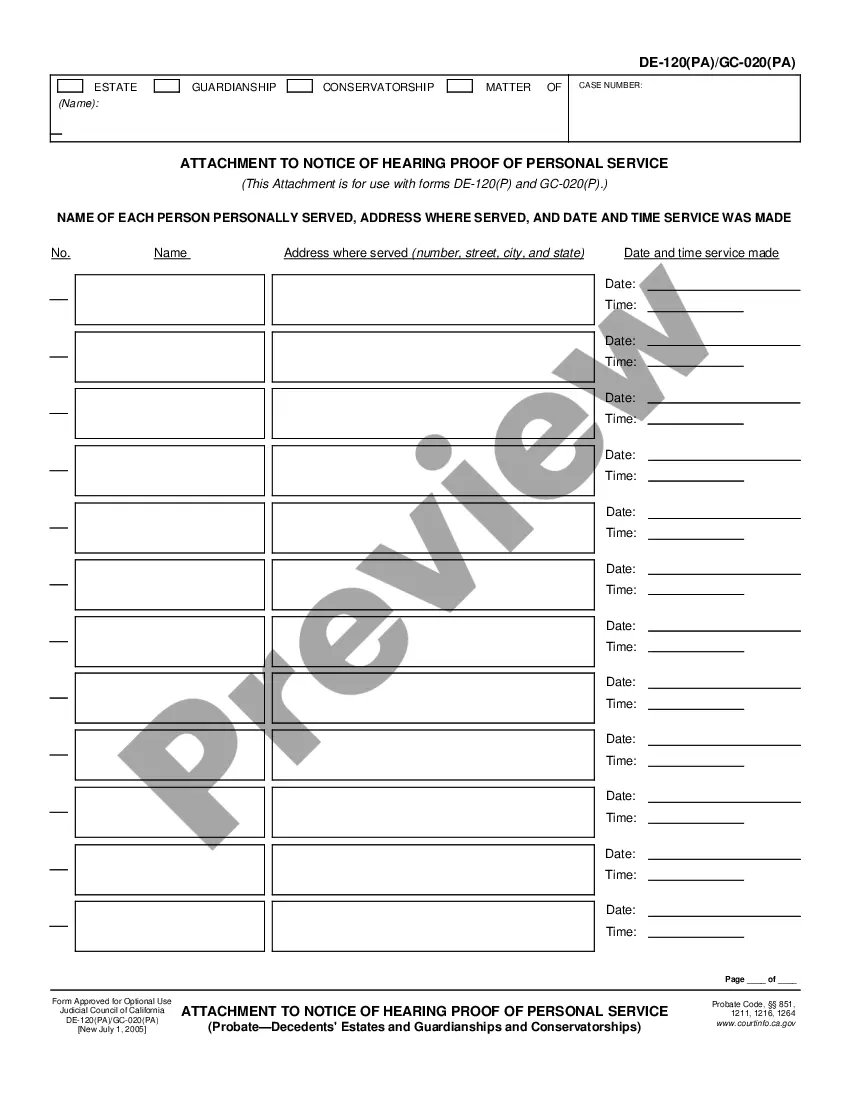

- Use the Review button to view the form.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search section to find the document that fits your needs and criteria.

- Once you find the right form, click on Purchase now.

- Select the pricing plan you require, fill in the necessary details to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient format and download your copy.

Form popularity

FAQ

The least expensive method to set up a West Virginia Revocable Trust for Grandchildren is often through online legal platforms, such as uslegalforms. These services provide user-friendly templates and guidance, which can significantly lower costs compared to hiring a traditional attorney. However, it's essential to ensure that your approach aligns with your specific family and financial circumstances for optimal results. A well-structured trust protects your grandchildren's inheritance while minimizing expenses.

A West Virginia Revocable Trust for Grandchildren can be changed or canceled by the grantor during their lifetime, offering flexibility. In contrast, an irrevocable trust generally cannot be altered once established, which offers potential tax and asset protection benefits. This distinction is crucial for anyone considering how best to protect their assets while making provisions for their grandchildren. Understanding these differences helps you make informed decisions tailored to your family's needs.

Setting up a West Virginia Revocable Trust for Grandchildren does not have a strict minimum amount. However, it is wise to consider the total value of assets you want to include in the trust. Generally, having at least a few thousand dollars can make the trust worthwhile, as it allows you to manage and distribute those assets effectively. Remember, the value of the trust can influence how benefits are allocated to your grandchildren.

structured West Virginia Revocable Trust for Grandchildren can help reduce the exposure to inheritance tax. While revocable trusts do not eliminate taxes completely, they offer strategies to minimize your taxable estate. By carefully allocating assets and utilizing trust provisions, you can enhance tax efficiency for your beneficiaries. Consulting with a professional can further help optimize your trust for tax advantages.

Establishing a West Virginia Revocable Trust for Grandchildren is one of the best ways to leave an inheritance. This trust allows you to define specific terms for how and when your grandchildren receive their assets, making it easier to meet their needs as they grow. Additionally, it can help you avoid probate, ensuring a faster and more private distribution of your inheritance. By using this trust, you create a lasting legacy tailored to your grandchildren.

For children, a West Virginia Revocable Trust for Grandchildren is a highly effective choice. It offers the ability to allocate assets while permitting changes throughout your lifetime. You can create provisions to deliver funds or property when your children reach a certain age or milestone, ensuring they are well-prepared to manage their inheritance. This type of trust combines flexibility with protective measures.

A West Virginia Revocable Trust for Grandchildren often serves as one of the best options. This type of trust allows you to manage assets for your grandchildren while maintaining the flexibility to alter the trust during your lifetime. You can specify when and how your grandchildren receive their inheritance, ensuring they benefit from your assets responsibly. Overall, it provides both control and security.

Yes, a West Virginia Revocable Trust for Grandchildren becomes irrevocable upon the death of the trust creator. This change secures the assets for the beneficiaries, like your grandchildren, according to the trust's terms. It ensures that your wishes, once set, cannot be altered after your passing. This feature provides peace of mind, knowing your grandchildren's inheritance is protected.

In the UK, a significant mistake parents often make when setting up a trust fund is not understanding the tax implications involved. Without properly considering these implications, the trust could incur unexpected liabilities, impacting the intended benefits for the children. Consulting with a legal expert is crucial to navigate these complexities, ensuring that the trust serves its intended purpose effectively.

There are several pitfalls when setting up a trust, such as underestimating the administrative responsibilities involved. Managing a trust requires careful record-keeping and may involve tax implications. Additionally, families might overlook the importance of clear communication about the trust's purpose and provisions, which can lead to misunderstandings among beneficiaries.