West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Leased Premises?

Selecting the optimal legal document format can be quite a challenge. Naturally, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises, which can be utilized for commercial and personal purposes.

All of the forms are reviewed by professionals and adhere to federal and state requirements.

If the form does not fulfill your needs, use the Search field to locate the appropriate form. Once you are confident that the form is suitable, click the Get now button to obtain the form. Choose the pricing plan you want and input the necessary information. Create your account and pay for the order with your PayPal account or credit card. Choose the file format and download the legal document format to your system. Complete, edit, print, and sign the received West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises. US Legal Forms is the largest collection of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises.

- Use your account to browse through the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, make certain that you have chosen the correct form for your area/state.

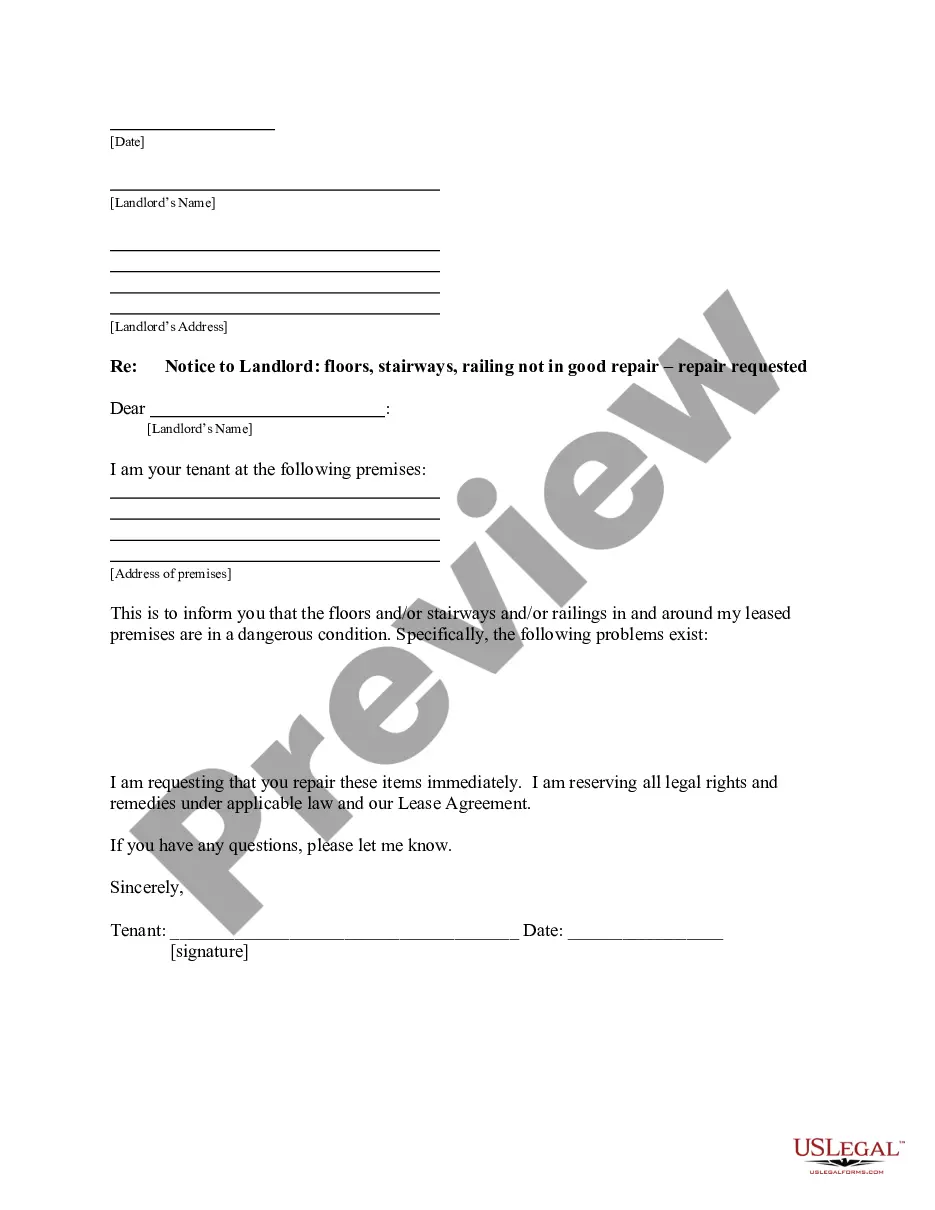

- You can preview the form using the Preview button and read the form description to ensure it is suitable for you.

Form popularity

FAQ

A business qualifies as such when it operates with the intent to provide a product or service for profit. This encompasses various organizational structures, including sole proprietorships and partnerships. If you are thinking about formalizing your operations, a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises could be a beneficial step to establish your enterprise reliably within the state’s legal framework.

Activities that do not seek to generate profit or those conducted as a hobby typically are not regarded as businesses in West Virginia. Non-commercial activities, such as volunteer work or personal projects, fall outside the business definition. Understanding these distinctions will aid you when considering a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises to ensure you're on the right path toward regulation and compliance.

In West Virginia, a business is any organization or individual engaged in commercial activities for profit. This includes sole proprietors, partnerships, corporations, and LLCs. If you are considering launching a new venture, you may want to delve into a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises to formalize your operations. Clear definitions can help you succeed in your business endeavors.

To establish an LLC in West Virginia, you must first choose a unique name and file the appropriate formation documents with the Secretary of State. You'll also need to draft an operating agreement, which outlines the structure of your business. After accomplishing these steps, consider exploring a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises as your next move for growth and legitimacy.

Doing business in West Virginia generally involves actions that seek to earn income within the state. This could include operating a storefront, providing services, or any consistent revenue-generating activities. If you plan on entering a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises, understanding the definitions surrounding business operation in the state is essential. Consulting a legal expert can help clarify your situation.

In the United States, sole proprietors generally need a business license to operate legally, and this varies by state and locality. If you're establishing a business in West Virginia using a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises, you must obtain the proper licenses. This will not only help you comply with the law but also build credibility with your customers.

Code 11 12 3 in West Virginia refers to specific regulations regarding business operations and fair practices. It is important for business owners, including those using a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises, to understand how this may impact their business. Familiarizing yourself with local laws is crucial for maintaining compliance and ensuring smooth operations.

Yes, most businesses in Virginia require a business license to operate legally. This applies to various types of entities and sole proprietorships as well. If you are considering a West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises, it is essential to confirm licensing requirements specific to your business type. Always consult local regulations to ensure compliance.

Yes, West Virginia recognizes federal extensions for partnership tax filings. This means that if you have a valid federal extension, you can also apply it at the state level. This coordination can be beneficial when addressing the intricacies of the West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises, ensuring you meet all tax obligations accurately.

The PTE tax rate in West Virginia is currently set at 1 percent of the business's income. This rate applies to qualified PTEs, allowing them to pass on taxes to individual owners rather than taxing the entity itself. Understanding how this rate interplays with the West Virginia Agreement for Sale of Business by Sole Proprietorship with Leased Premises is essential for effective financial planning.