West Virginia Secured Promissory Note

Description

How to fill out Secured Promissory Note?

It is feasible to spend time online searching for the authentic document template that fulfills the federal and state criteria you require.

US Legal Forms provides a vast array of authentic forms that are vetted by experts.

You can easily obtain or print the West Virginia Secured Promissory Note from our platform.

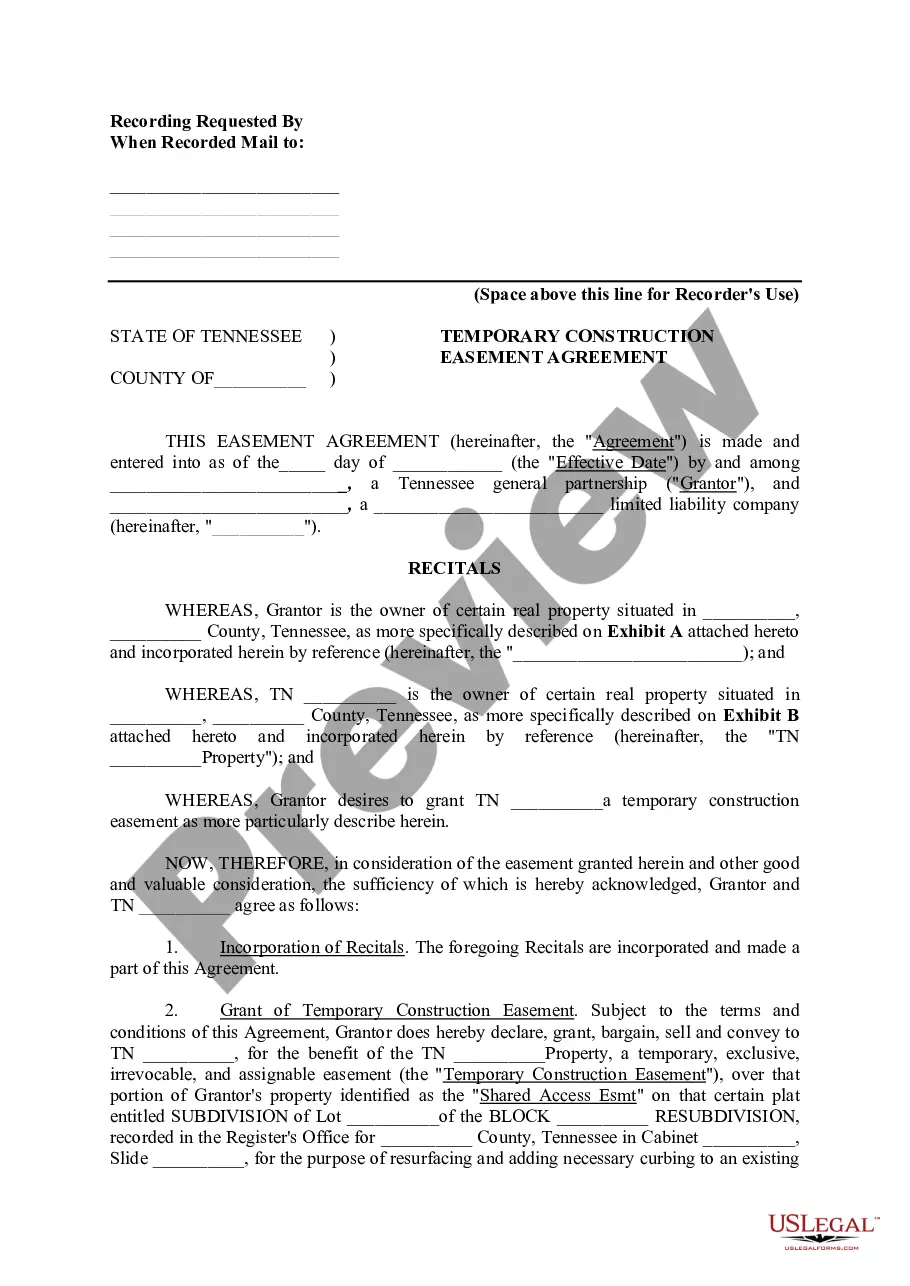

First, ensure that you have selected the correct document template for your specific region. Review the form description to confirm you have chosen the appropriate document. If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Afterward, you can complete, edit, print, or sign the West Virginia Secured Promissory Note.

- Each authentic document template you purchase belongs to you indefinitely.

- To get an additional copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

Form popularity

FAQ

A security agreement and a promissory note serve different functions in the realm of finance. While a West Virginia Secured Promissory Note outlines the borrower's promise to repay a debt, a security agreement typically describes the collateral pledged against that debt. Keeping these distinctions in mind can aid you in better managing your financial arrangements.

To turn a promissory note into a security, you typically need to follow legal procedures, such as registering the note and disclosing relevant information to potential investors. A West Virginia Secured Promissory Note may involve creating a formal security agreement that outlines how the note can be traded or sold as a financial instrument. Consulting legal resources or platforms like US Legal Forms can help navigate this complex process.

Filling out a promissory note requires clear information about the borrower, lender, the amount borrowed, interest rates, and repayment terms. For a West Virginia Secured Promissory Note, ensure that you include any collateral involved to protect both parties. Using reliable templates, such as those found on the US Legal Forms platform, can streamline this process and ensure accuracy.

In general, a promissory note can be considered a security under certain circumstances, particularly when it meets the criteria set by the SEC. However, a West Virginia Secured Promissory Note often serves a specific purpose in securing loans and may not fall under the broad classification of securities. It is crucial to understand the details surrounding its use, especially in legal matters.

Filling out a promissory demand note requires you to include the amount owed, the interest rate, and the terms of repayment. The note should clearly state that the full amount is due upon demand. Templates from US Legal Forms can provide you with a solid framework for this process.

An example of a West Virginia Secured Promissory Note would list a borrower who agrees to repay $10,000 with a 5% interest rate over three years. It would detail monthly payments and specify what happens in case of default. Referencing a template can simplify drafting this document.

To write a West Virginia Secured Promissory Note, start by stating the date and the parties involved. Include the amount borrowed, the interest rate, and the repayment schedule. Make sure to sign the document and consider using a template from US Legal Forms for guidance.

The format of a West Virginia Secured Promissory Note typically includes the title, names of the borrower and lender, the principal amount, interest rate, repayment terms, and signatures. It is crucial to clearly outline all terms to avoid disputes. You can find templates on platforms like US Legal Forms to streamline the process.

Absolutely, a promissory note can be secured, and this structure is often advantageous for both lenders and borrowers. A West Virginia Secured Promissory Note involves the borrower pledging collateral, which offers the lender assurance. This arrangement can lead to more favorable terms and lower interest rates.

Yes, a West Virginia Secured Promissory Note is a legally binding document. It creates an obligation for the borrower to repay the specified amount under the agreed terms. Both the lender and borrower are typically held accountable to the agreement, making it crucial to understand all terms before signing.