West Virginia Assignment of Money Due

Description

How to fill out Assignment Of Money Due?

Have you been in a placement in which you require documents for both business or personal reasons almost every time? There are a variety of authorized record layouts available on the net, but discovering ones you can rely is not effortless. US Legal Forms gives a huge number of kind layouts, such as the West Virginia Assignment of Money Due, which are created to fulfill state and federal specifications.

Should you be presently acquainted with US Legal Forms internet site and get a merchant account, basically log in. Following that, you can acquire the West Virginia Assignment of Money Due template.

If you do not offer an accounts and would like to start using US Legal Forms, abide by these steps:

- Obtain the kind you will need and ensure it is for the proper city/county.

- Take advantage of the Preview switch to check the form.

- Browse the outline to ensure that you have selected the right kind.

- In the event the kind is not what you are trying to find, utilize the Lookup discipline to find the kind that fits your needs and specifications.

- Whenever you find the proper kind, click Get now.

- Pick the pricing prepare you desire, fill in the desired info to create your money, and pay for your order making use of your PayPal or Visa or Mastercard.

- Decide on a practical document file format and acquire your duplicate.

Discover all of the record layouts you have bought in the My Forms food selection. You can get a additional duplicate of West Virginia Assignment of Money Due at any time, if needed. Just click on the required kind to acquire or print the record template.

Use US Legal Forms, probably the most comprehensive collection of authorized varieties, to conserve time and stay away from faults. The support gives skillfully created authorized record layouts which you can use for a range of reasons. Produce a merchant account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

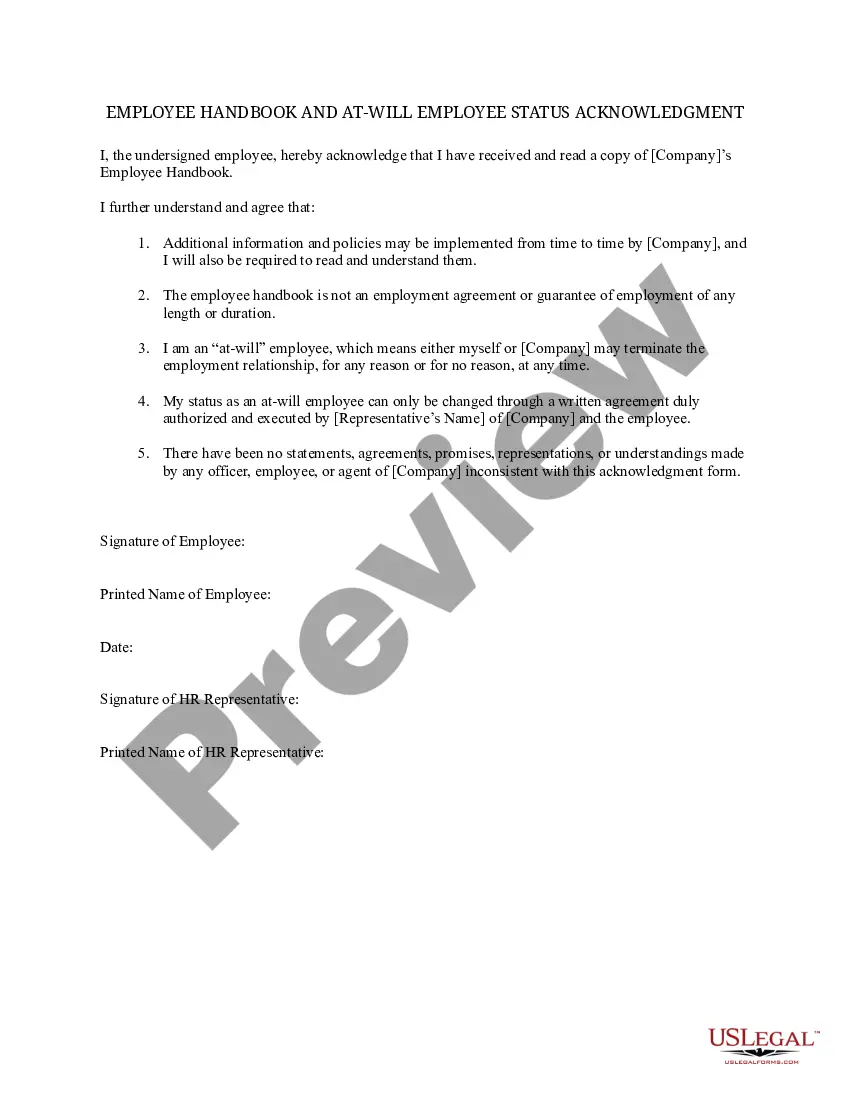

No employer shall withhold any part of the wages or salaries of any employee except for payroll, wage or withholding taxes or in ance with law, without the written and signed authorization of the employee.

Employers must pay their employees all wages due at least twice a month, with no more than nineteen days between paydays, unless granted a special agreement by the Commissioner of Labor to pay less frequently.

When a West Virginia state employee has been overpaid, the employee may voluntarily authorize a written assignment or order for future wages to repay the overpayment in an amount not to exceed ?three-fourths? of his or her periodical earnings or wages.

One Minute Takeaway: StateIf the Employee QuitCaliforniaWithin 72 hours or immediately if the employee gave at least 72 hours' noticeColoradoNext scheduled paydayConnecticutNext scheduled paydayDelawareNext scheduled payday47 more rows ?

Lay Off The next regular payday. Whenever an employee is terminated, quits, or resigns from employment, the employer must pay that employee's final wages, including any fringe benefits that are payable directly to the employee, on or before the next regular payday on which the wages would otherwise be due and payable.

Generally, under W. Va. Code § 21-5-4, an employer must issue a final paycheck to a terminated employee within seventy-two (72) hours.

If the regular payday for the last pay period an employee worked has passed and the employee has not been paid, contact the Department of Labor's Wage and Hour Division or the state labor department. The Department also has mechanisms in place for the recovery of back wages.

Even though West Virginia doesn't have a law requiring payment of accrued, unused vacation at termination, employers can still be responsible for paying this if there is a company policy that requires it.