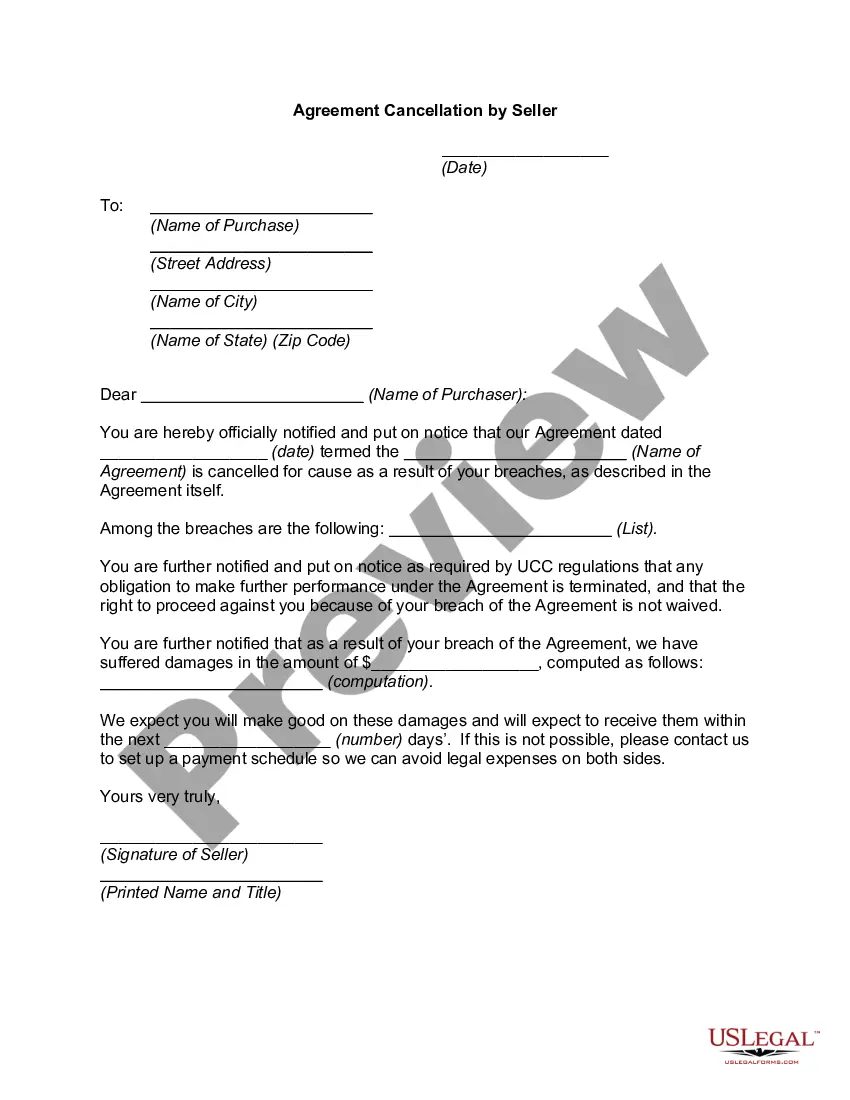

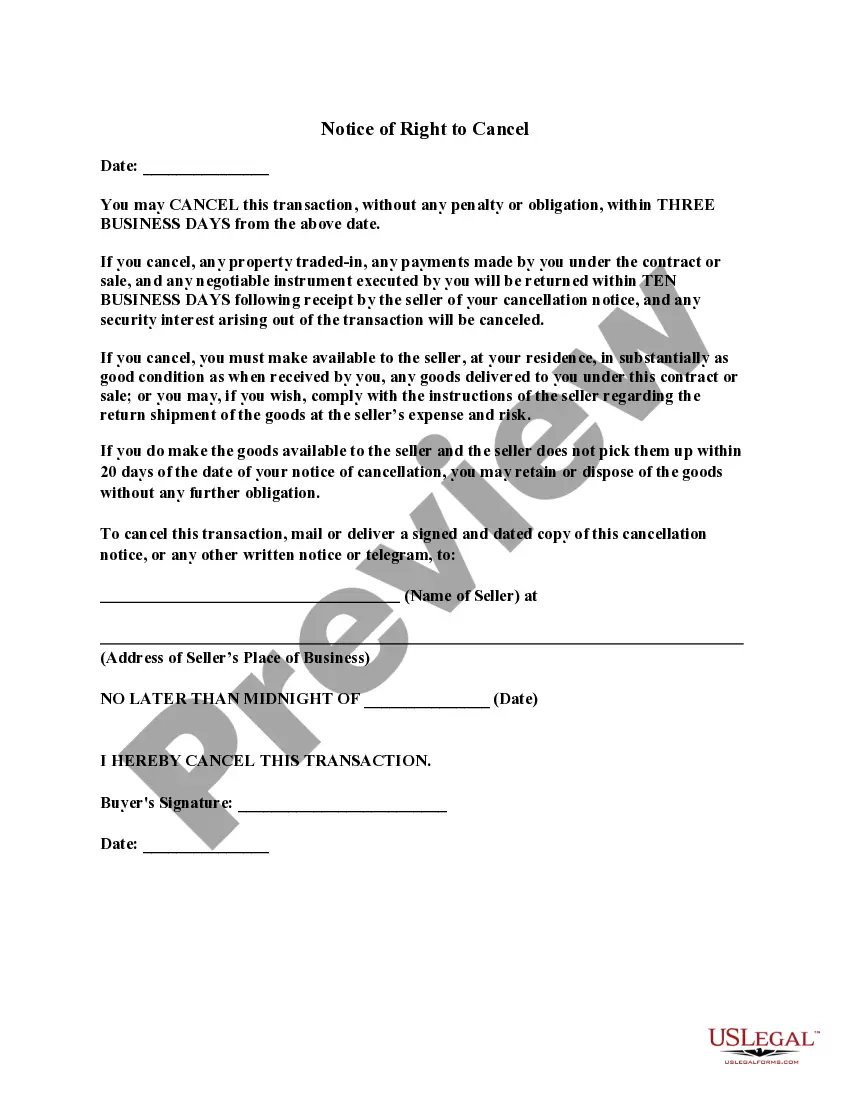

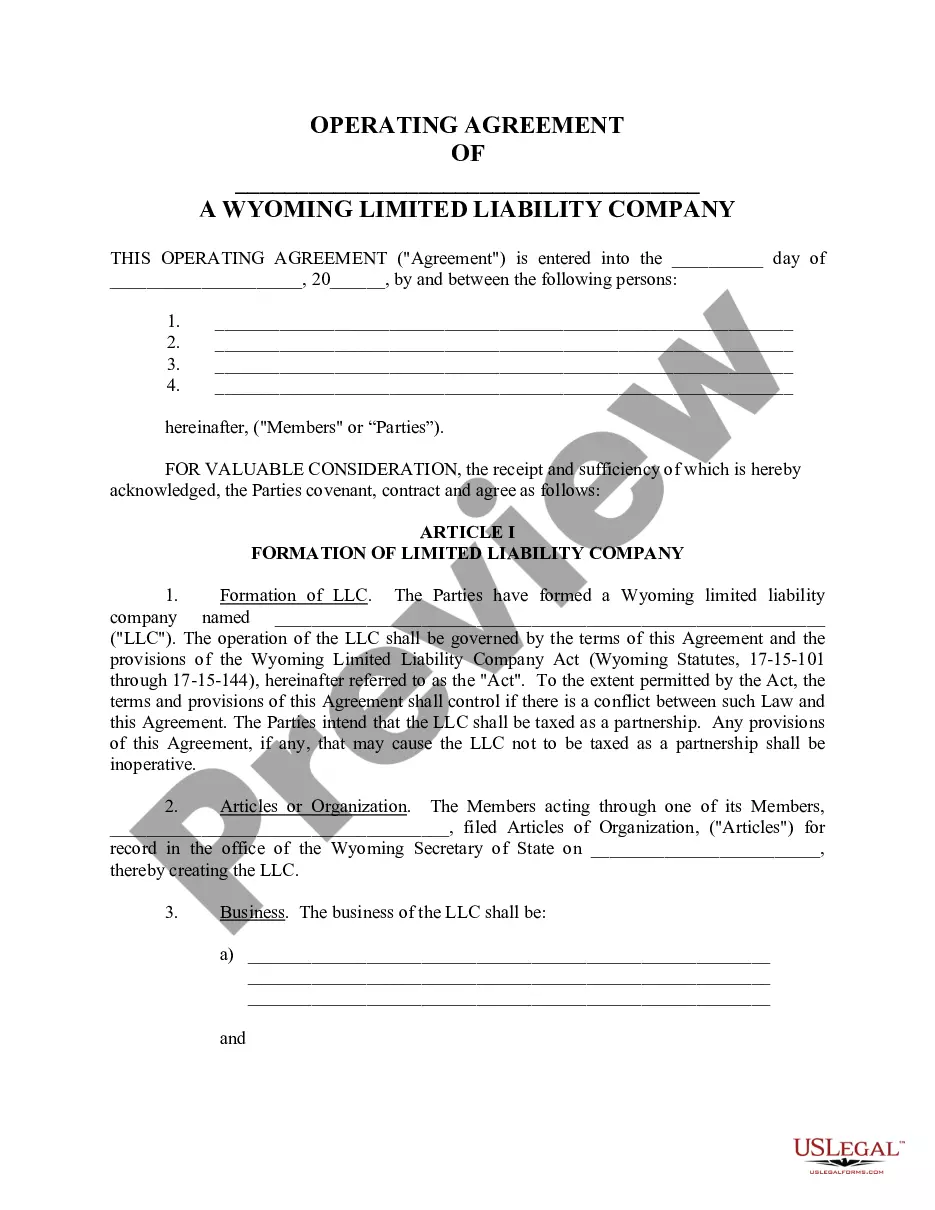

This form is a model Authority to Cancell Lien. Lienholder files with court certifying that indebtedness has been satisfied and lien should be cancelled. Adapt to fit your specific facts and circumstances.

West Virginia Authority to Cancel

Description

How to fill out Authority To Cancel?

Selecting the appropriate legal document format can be somewhat challenging. It goes without saying that there are numerous templates accessible online, but how can you acquire the legal form you require? Visit the US Legal Forms website.

The service provides a vast array of templates, such as the West Virginia Authority to Cancel, which you can utilize for both business and personal purposes. All forms are vetted by experts and comply with state and federal regulations.

If you are currently signed up, Log In to your account and then click on the Acquire button to obtain the West Virginia Authority to Cancel. Use your account to browse through the legal forms you have previously ordered. Navigate to the My documents section of your account and download another copy of the document you require.

US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- First, ensure you have selected the correct form for your city/county. You can review the form using the Preview option and read the form description to confirm this is suitable for you.

- If the form doesn’t satisfy your needs, utilize the Search field to find the right form.

- Once you are convinced that the form is appropriate, click on the Buy now button to procure the form.

- Select the pricing plan you prefer and input the necessary information. Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the legal document for your usage.

- Complete, modify, print, and sign the acquired West Virginia Authority to Cancel.

Form popularity

FAQ

What do I have to do before I Dissolve a West Virginia Corporation?Hold a Directors meeting and record a resolution to Dissolve the West Virginia Corporation.Hold a Shareholder meeting to approve Dissolution of the West Virginia Corporation.File all required Annual Reports with the West Virginia Secretary of State.More items...

If there are no longer operations or assets in your entity and there is no intention to place new business or assets in the entity, then you should consider dissolving your entity.

6 Steps to Dissolve a Corporation#1 Seek Approval from the Board of Directors and Shareholders. First, hold a meeting with the board of directors.#2 File Articles of Dissolution.#3 Finalize Taxes.#4 Notify Creditors.#5 Liquidate and Distribute Assets.#6 Wrap Up Operations.

File a dissolution, termination, withdrawal, or cancellation online quickly and conveniently through the One Stop Business Portal. The Secretary of State's Office also provides forms that meet minimum state law requirements available online through the Secretary of State Form Search.

Businesses that are incorporated in another state will typically apply for a West Virginia certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

Visit the State Tax Department Business Registration section online for more information, or contact (304) 558-3333, or toll free (800) 982-8297 for further assistance terminating your business registration through the Tax Department.

To dissolve an LLC in West Virginia, simply follow these three steps: Follow the Operating Agreement....Step 1: Follow Your West Virginia LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.08-Dec-2021

The first is voluntary dissolution, which is an elective decision to dissolve the entity. A second is involuntary dissolution, which occurs upon the happening of statute-specific events such as a failure to pay taxes. Last, a corporation may be dissolved judicially, either by shareholder or creditor lawsuit.

File a dissolution, termination, withdrawal, or cancellation online quickly and conveniently through the One Stop Business Portal. The Secretary of State's Office also provides forms that meet minimum state law requirements available online through the Secretary of State Form Search.