West Virginia Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

What is this form?

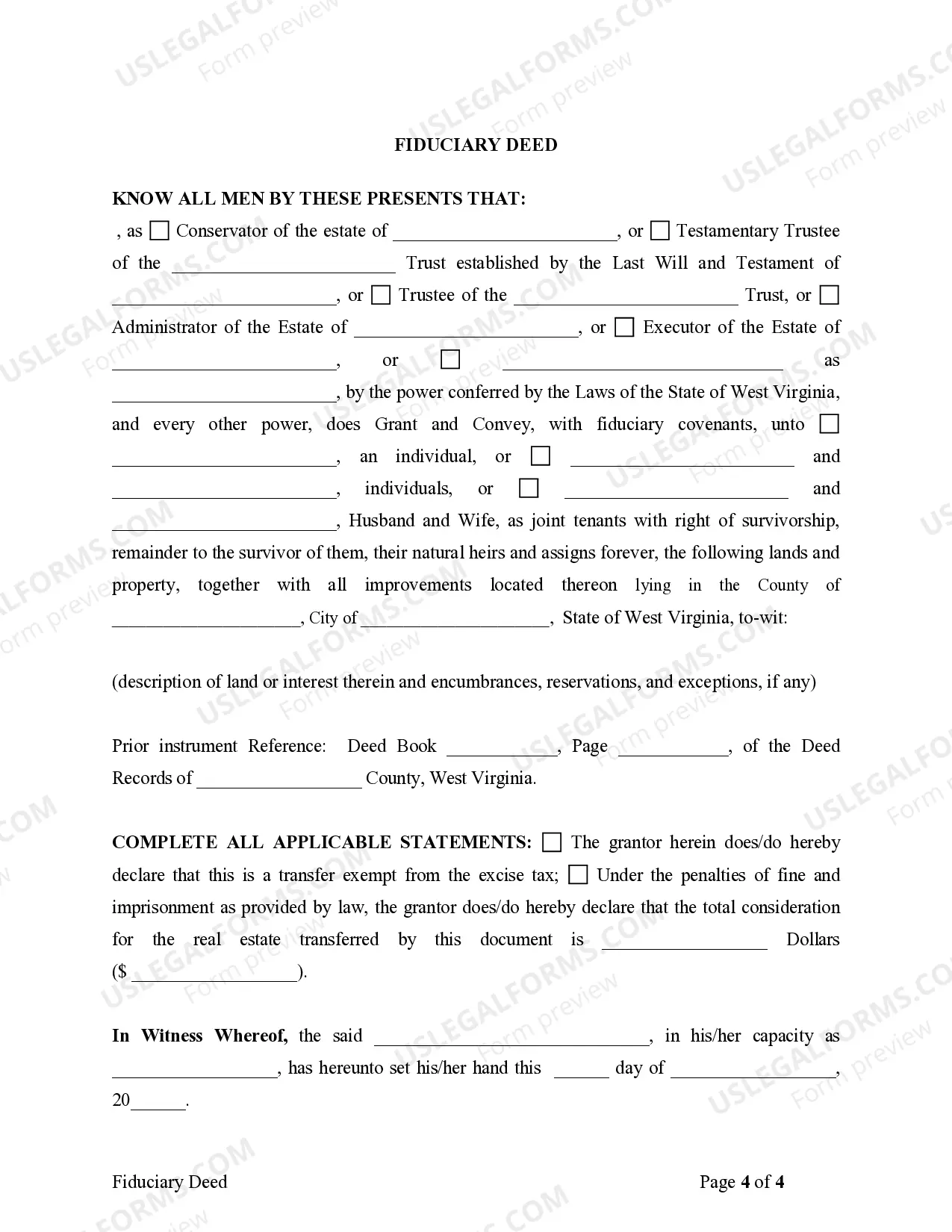

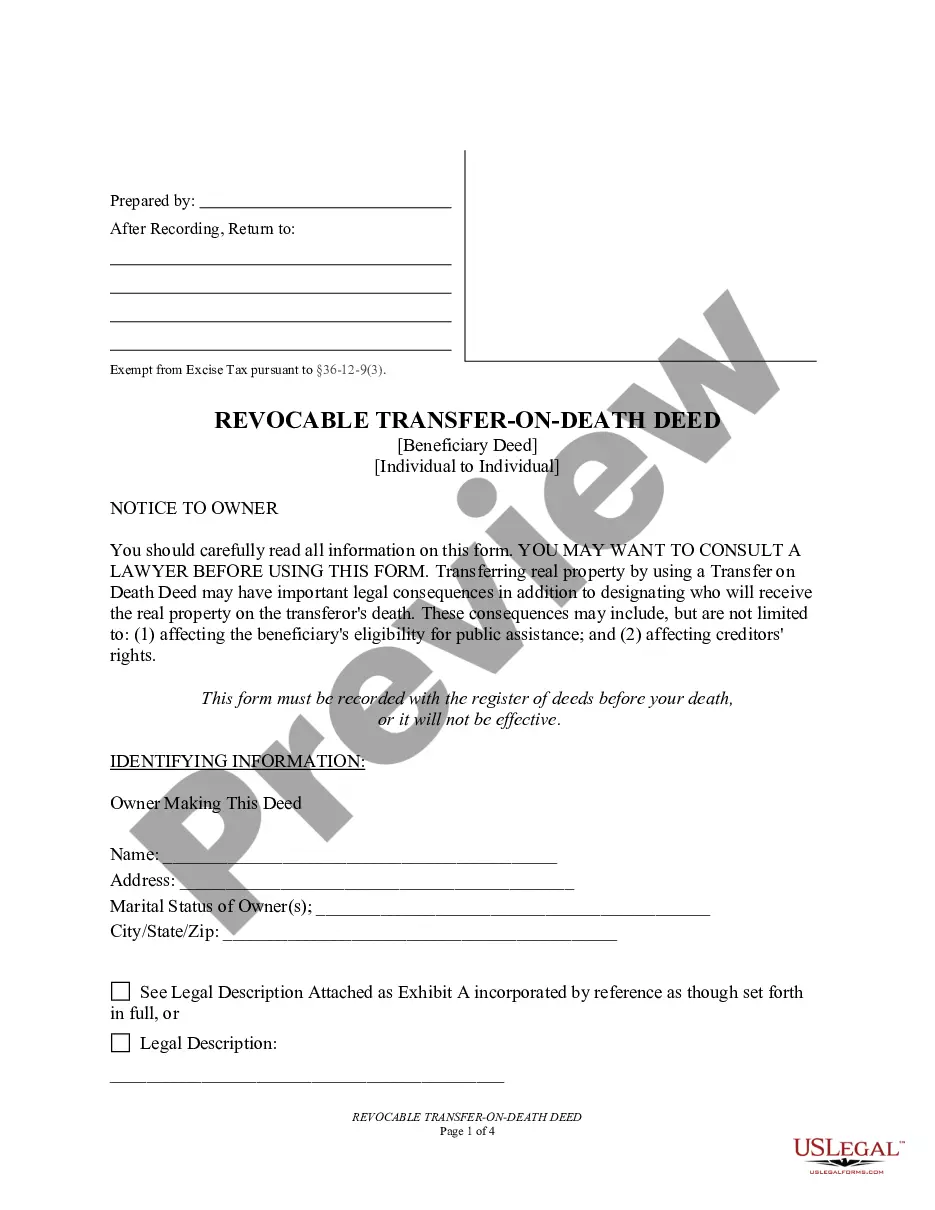

The Fiduciary Deed is a legal document that enables a fiduciary, such as an executor, trustee, or administrator, to transfer property on behalf of another person. This form differs from other deeds as it specifically caters to fiduciaries handling estates or trusts, ensuring proper legal transfer of assets while adhering to the laws of the state of West Virginia.

Main sections of this form

- Grantor Information: Details about the fiduciary, including their capacity (e.g., executor, trustee).

- Grantee Information: Information about the recipient of the property.

- Description of Property: A detailed description of the property being transferred.

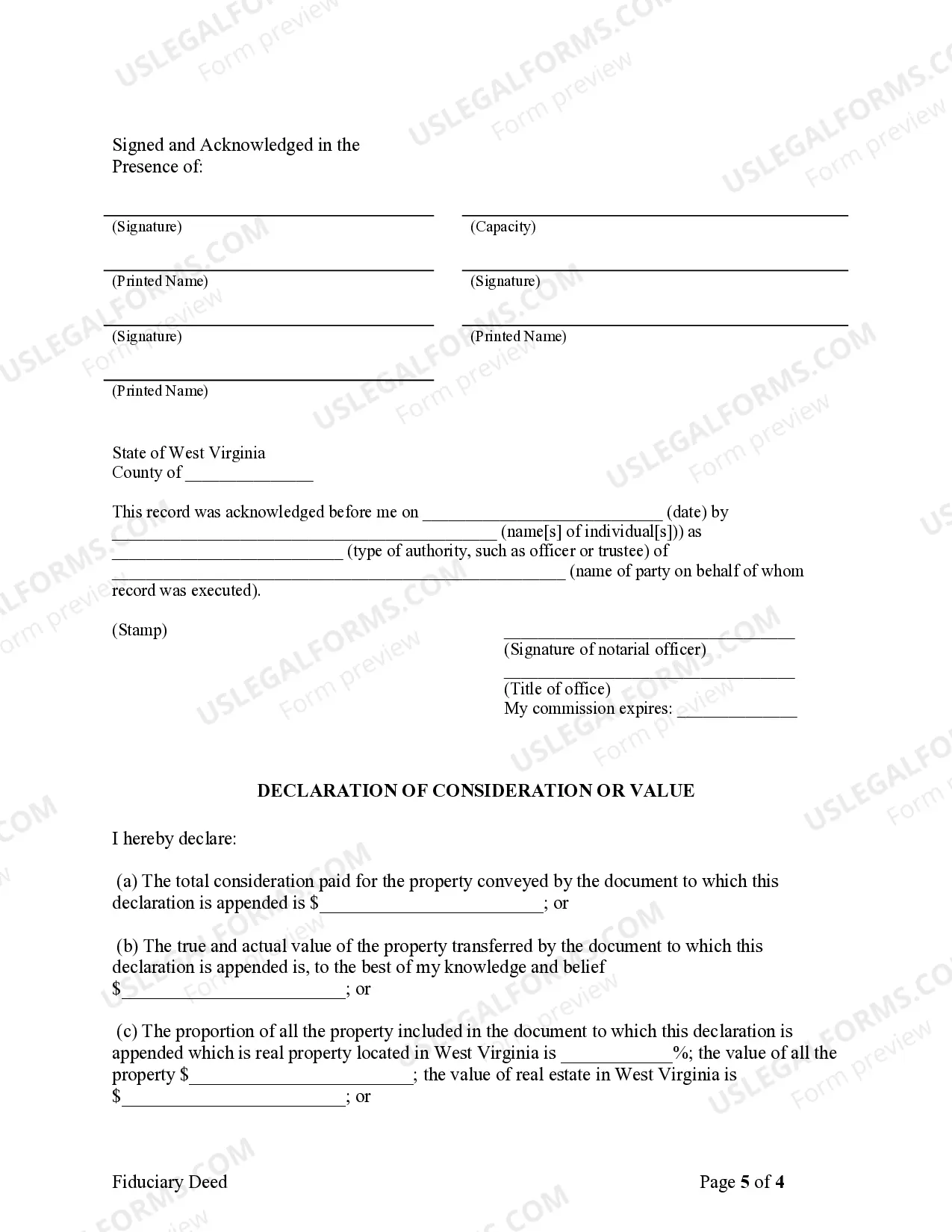

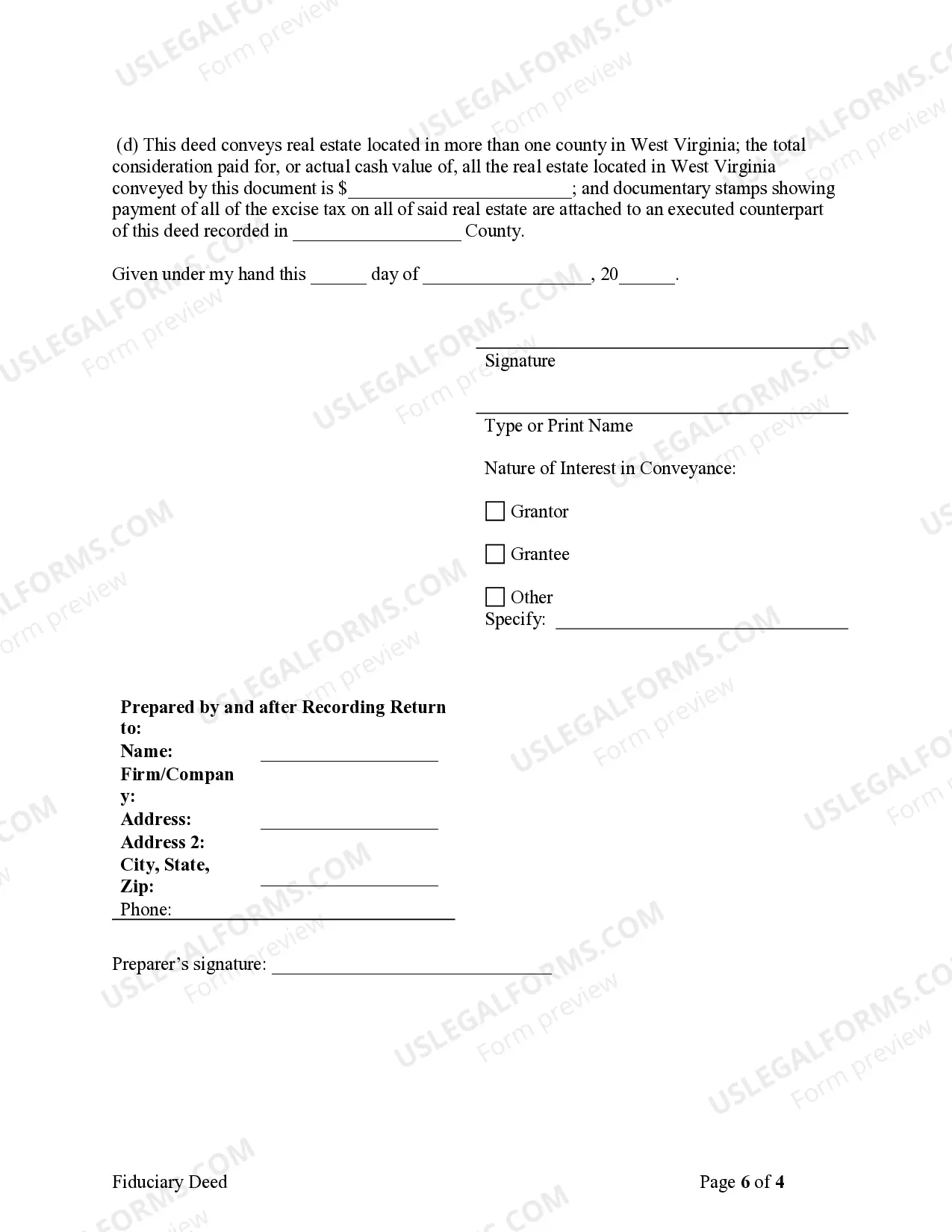

- Consideration Declaration: A statement regarding the value or consideration involved in the transfer.

- Signatures: Spaces for required signatures and acknowledgments by witnesses and a notary public.

Situations where this form applies

This form should be used when a fiduciary needs to transfer real estate or property as part of their duties to manage an estate or trust. Common situations include executing a will, transferring property held in trust, or managing assets as a conservator for an individual who is unable to handle their affairs.

Who can use this document

- Executors of estates handling property transfers after a person's death.

- Trustees managing trust property and needing to convey assets.

- Administrators handling the estate of individuals without a will.

- Conservators appointed to manage an individual's assets.

- Guardian or fiduciaries acting on behalf of incapacitated individuals.

Steps to complete this form

- Identify the grantor by filling in their name and capacity (e.g., executor, trustee).

- Specify the grantee's name and any joint tenants if applicable.

- Provide a clear description of the property being transferred.

- Enter the total consideration amount for the property being conveyed.

- Have the grantor sign the document in the presence of witnesses and a notary.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Typical mistakes to avoid

- Failing to accurately describe the property being conveyed.

- Not including required signatures from witnesses or a notary.

- Omitting the declaration of consideration or value.

- Providing incorrect information about the grantor's capacity.

Benefits of completing this form online

- Convenient access to legal documents tailored for specific state requirements.

- Easy to fill out and edit as needed before finalizing the deed.

- Immediate download helps expedite the property transfer process.

- Forms are prepared by licensed attorneys, ensuring legal compliance.

Form popularity

FAQ

Three basic types of deeds commonly used are the grant deed, the quitclaim deed, and the warranty deed. A sample grant deed. the property he or she is transferring is implied from such language.

The words with fiduciary covenants means the seller promises to the buyer that he or she is duly appointed, qualified and acting in his or her fiduciary capacity, is duly authorized to make the sale and convey the property to buyer.

A fiduciary deed is for use by a fiduciary such as an executor or administrator of an estate or a trustee of a trust. In this type of deed there is a warranty, but only as a fiduciary. A fiduciary does not own the property, rather they essentially manage it for another.

The General Warranty Deed. A general warranty deed provides the highest level of protection for the buyer because it includes significant covenants or warranties conveyed by the grantor to the grantee. The Special Warranty Deed. The Bargain and Sale Deed. The Quitclaim Deed.