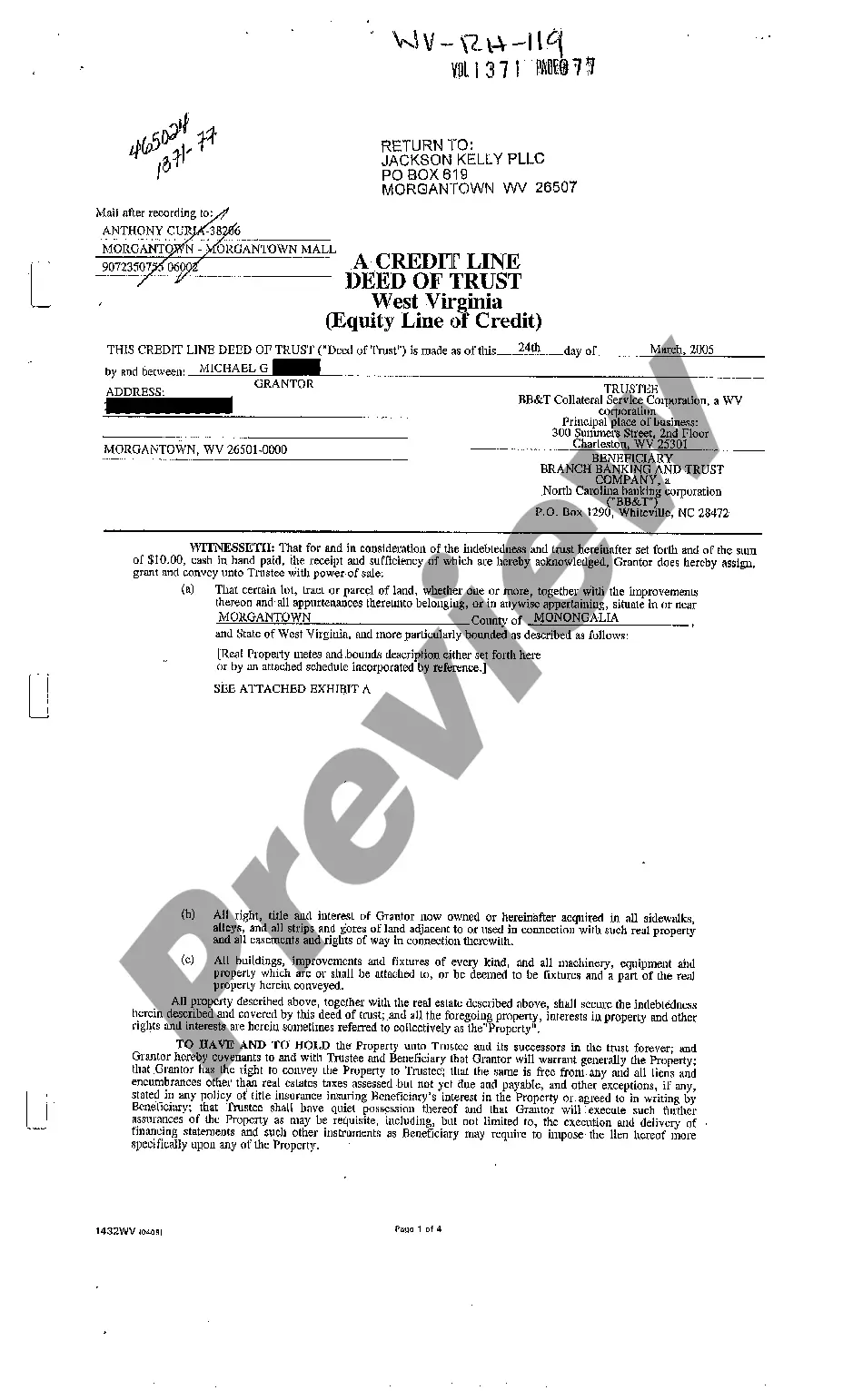

West Virginia A Credit Line Deed of Trust Equity Line of Credit

Description

How to fill out West Virginia A Credit Line Deed Of Trust Equity Line Of Credit?

Among numerous free and paid templates that you can get on the internet, you can't be sure about their accuracy. For example, who made them or if they’re competent enough to deal with the thing you need those to. Always keep relaxed and utilize US Legal Forms! Locate West Virginia A Credit Line Deed of Trust Equity Line of Credit samples created by skilled attorneys and avoid the costly and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you’re searching for. You'll also be able to access all your previously acquired documents in the My Forms menu.

If you are utilizing our website the very first time, follow the instructions below to get your West Virginia A Credit Line Deed of Trust Equity Line of Credit fast:

- Ensure that the file you find applies in your state.

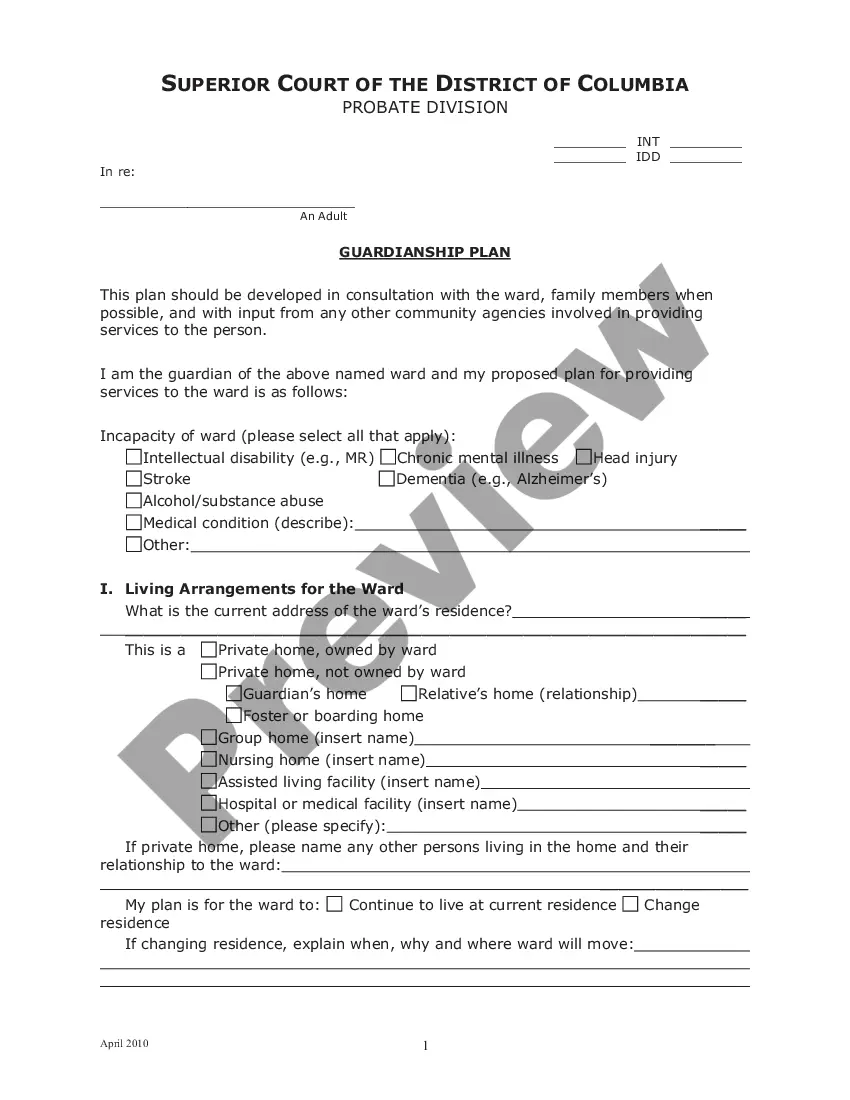

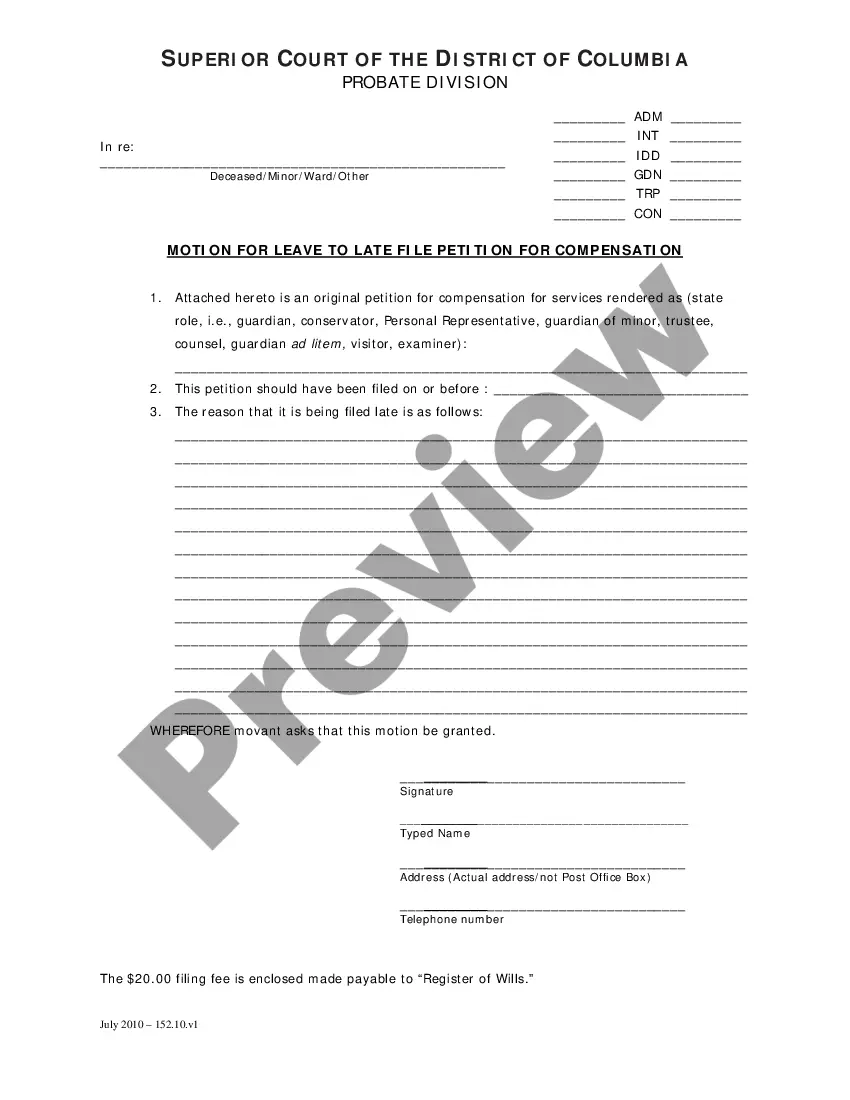

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another sample utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you’ve signed up and paid for your subscription, you can utilize your West Virginia A Credit Line Deed of Trust Equity Line of Credit as often as you need or for as long as it continues to be active where you live. Edit it in your preferred editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

Since HELOCs typically do not require title insurance, no title company was used for the new HELOC, and Bank A never bothered to release the original HELOC.Typically issues with HELOCs can be resolved, but they do often cause settlement delays.

In contrast to your regular mortgage, HELOC accounts offer funds that can be drawn, paid back, and then redrawn.Keep in mind, too, that where the lender does not require a title insurance policy, a HELOC can fall through the cracks, failing to get recorded or released.

An equity line is essentially a revolving line of credit secured by a mortgage Deed of Trust against a piece of property.Sometimes the seller doesn't realize a HELOC attaches to the property and is a lien that has to be paid off in order to sell the property.

Essentially, the deed of trust is an agreement between three parties: the grantor, the beneficiary, and the trustee. The grantor (borrower) grants an interest in their property to the beneficiary (lender) and the trustee.

For homeowners considering a refinance, you'll need to purchase lender's title insurance, as lenders won't fund your mortgage without it. Choosing to purchase an owner's title insurance policy is optional.

It is good for the entire time you own the loan. This insurance is not required, but helps protect you if a claim arises down the road.

A deed of trust is similar to a mortgage in that it establishes security interest in your home. A deed of trust (sometimes called a trust deed) has three parties involved: the borrower, the lender and a trustee.The first trust deed secures your primary home loan, and a second trust deed secures additional loans.

The most common form of borrowing is the home equity line of credit (HELOC). With a HELOC, the lender is given a lien against the equity of the property, which serves as collateral for the loan.If it remains unfunded, the HELOC will not add any financial risk in the form of required interest or principal repayments.

A deed of entrust, including your home equity loan or line of credit (HELOC), is recorded for public record upon closing a loan, which means anyone, including a scam artist, can take a look at that record at your town hall.