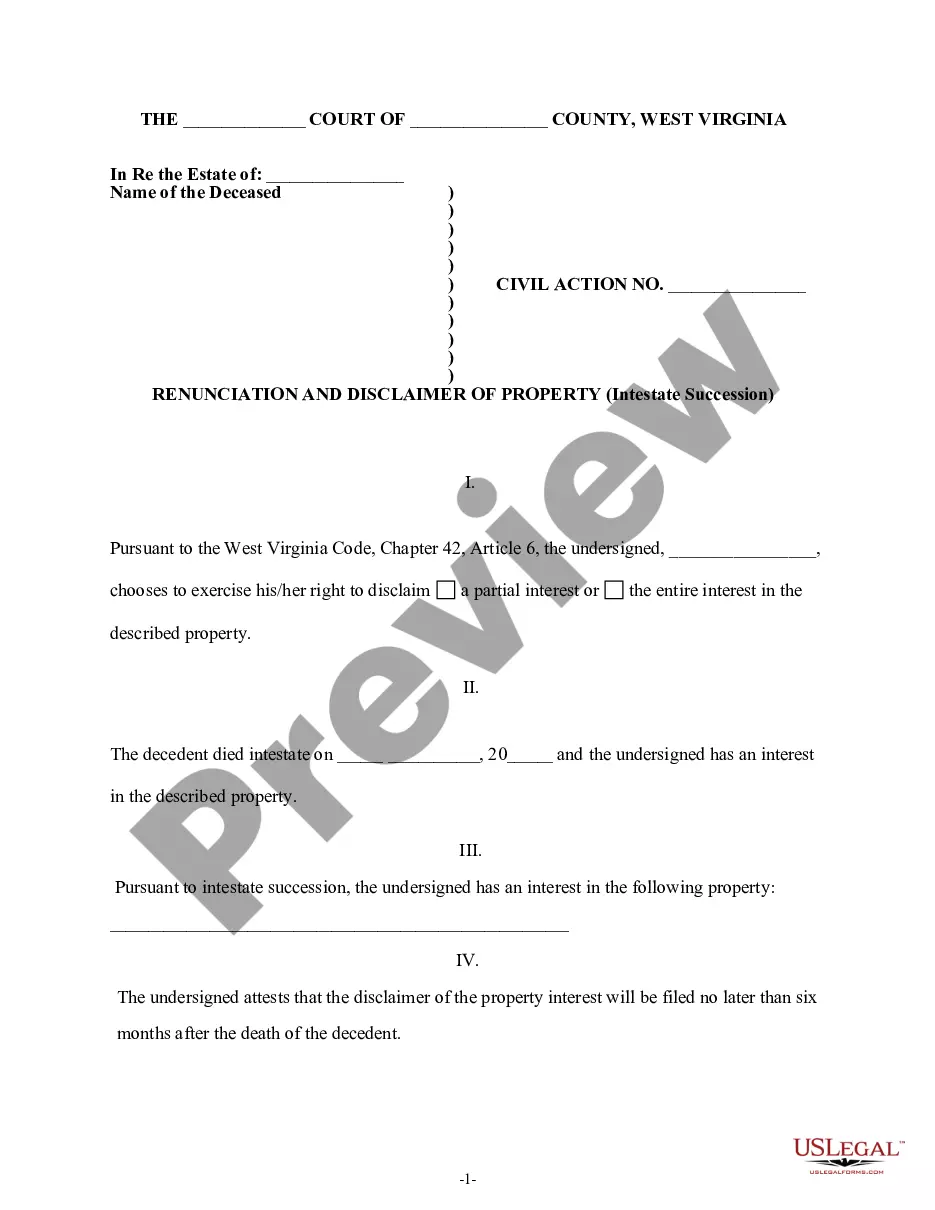

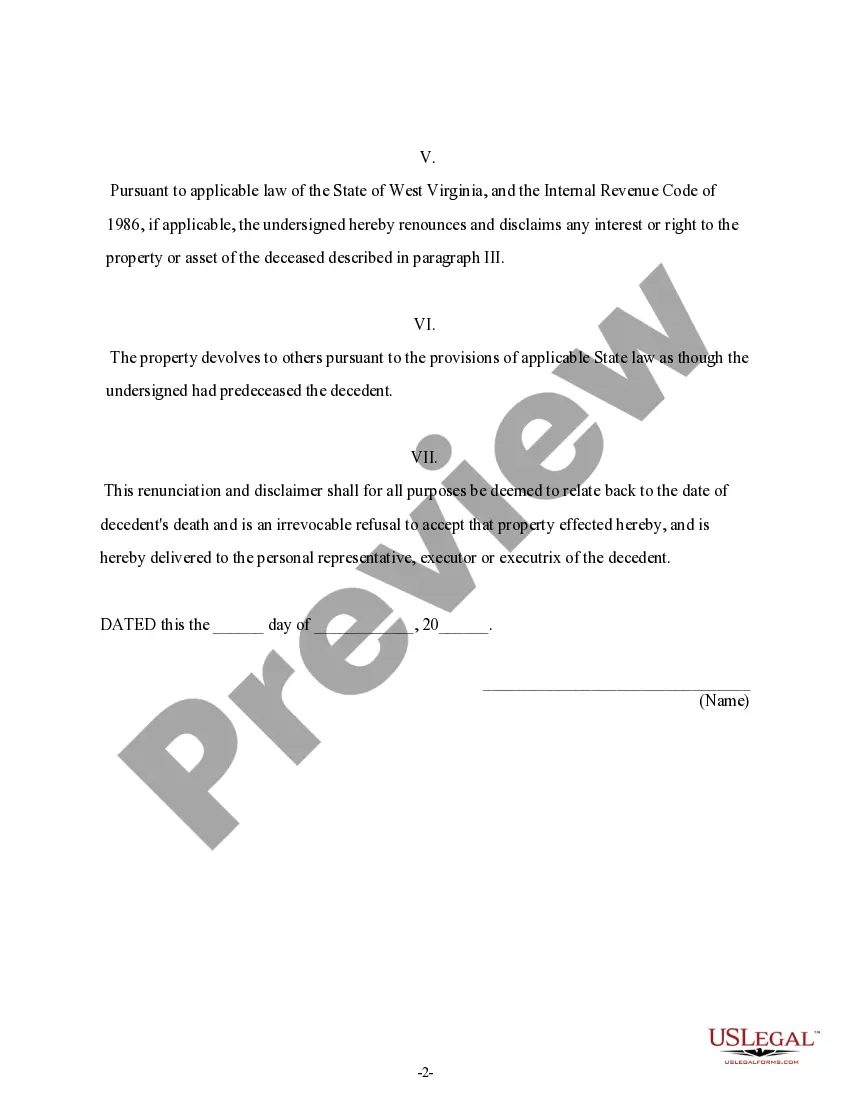

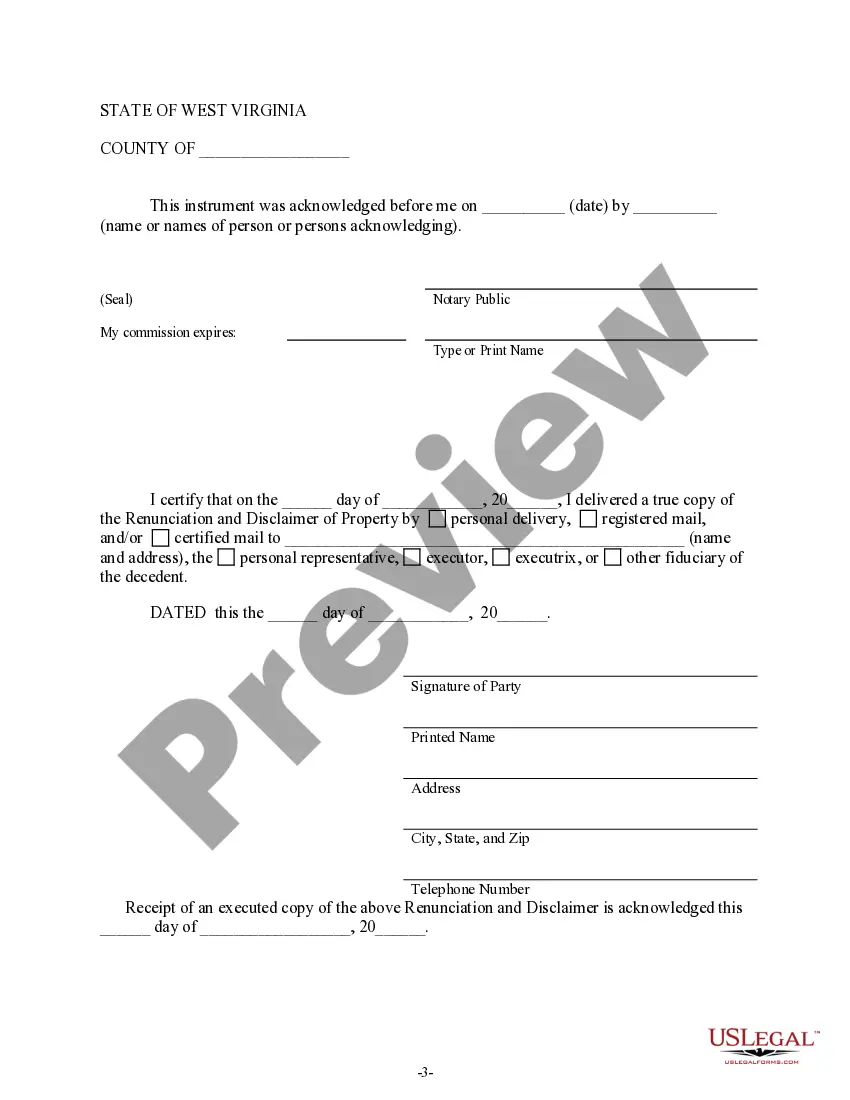

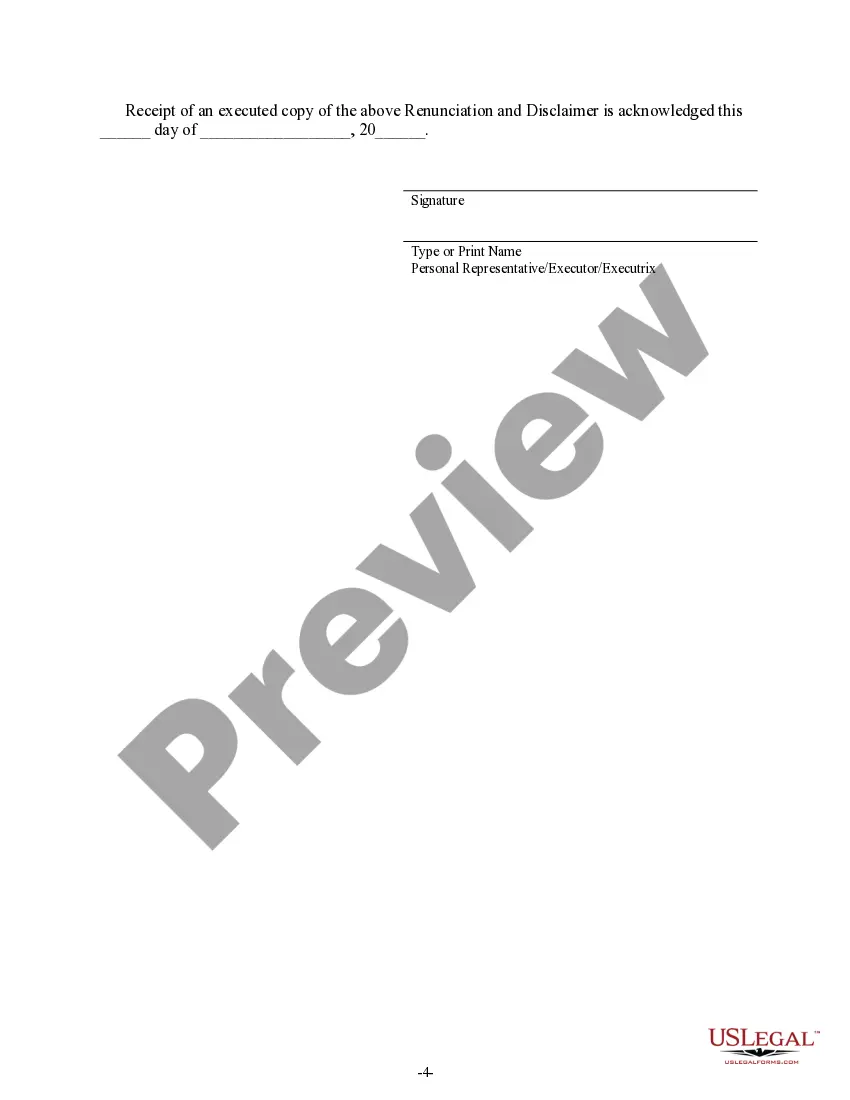

This is a Renunciation and Disclaimer of Property acquired by the beneficiary through Intestate Succession, where the beneficiary gained an interest in the property upon the death of the decedent, but, pursuant to the West Virginia Code, Chapter 42, Article 6, has chosen to waive a portion of or the entire interest in the property. The beneficiary will file the disclaimer no later than six months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the documentation.

West Virginia Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out West Virginia Renunciation And Disclaimer Of Property Received By Intestate Succession?

Out of the large number of platforms that provide legal samples, US Legal Forms provides the most user-friendly experience and customer journey when previewing templates prior to buying them. Its extensive catalogue of 85,000 samples is categorized by state and use for simplicity. All the documents on the platform have already been drafted to meet individual state requirements by qualified lawyers.

If you already have a US Legal Forms subscription, just log in, search for the form, press Download and obtain access to your Form name from the My Forms; the My Forms tab holds all of your saved documents.

Keep to the guidelines listed below to get the document:

- Once you see a Form name, ensure it’s the one for the state you really need it to file in.

- Preview the form and read the document description just before downloading the sample.

- Look for a new template via the Search engine if the one you have already found isn’t correct.

- Simply click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a card or PayPal and download the template.

Once you have downloaded your Form name, you may edit it, fill it out and sign it in an online editor of your choice. Any document you add to your My Forms tab might be reused many times, or for as long as it continues to be the most updated version in your state. Our platform provides quick and easy access to templates that suit both lawyers as well as their customers.

Form popularity

FAQ

The cost of buying land in West Virginia is not too steep. Depending on the neighborhood, you can get an acre of land for $1000 but a 2-hour drive to a nice locality may give you an acre for $10000.

Assessed value of the vehicle is $8,000. Apply the $4.20 tax rate: ($4.20 / 100) x $8,000 = $336. Calculate personal property relief: 35% (for 2020) x $336 = $117.60. Reduce the tax by the relief amount: $336 - $117.60 = $218.40. Annual Tax Amount = $218.40.

Fees required to title a new vehicle include a $15 title fee, 6% titling sales tax on vehicles with a purchase price over $500 or $30 on vehicles with a purchase price under $500, $10 lien fee (if applicable), and the registration fee and/or registration transfer fee.

Both real and personal business property are subject to the property tax in West Virginia. Real property includes land, structures, and certain equipment attached to structures. Personal property includes furnishings, inventory, machinery, equipment, fixtures, supplies, and tools.

West Virginia has some of the lowest property tax rates in the country. Its average effective property tax rate of 0.57% is the ninth-lowest state rate in the U.S., as comes in at about half of the national average.

Vienna. Dunbar. Morgantown. Nitro. South Charleston. New Martinsville. Weirton. Elkins.

West Virginia collects a 5% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in West Virginia may be subject to other fees like registration, title, and plate fees. You can find these fees further down on the page.

New Martinsville. Oak Hill. Weston. Weirton. Charles Town.

The tax is so bad that West Virginia is one of just two states that imposes it.And then every year there is a personal property tax bill on the value of the vehicle that must be paid before you can get your license renewed!