US Legal Forms - one of many greatest libraries of authorized types in the USA - gives a variety of authorized file themes you can obtain or printing. Utilizing the web site, you will get a huge number of types for organization and specific reasons, sorted by types, suggests, or search phrases.You can get the latest models of types much like the Wisconsin Deed Transfer Questionnaire in seconds.

If you already have a subscription, log in and obtain Wisconsin Deed Transfer Questionnaire in the US Legal Forms collection. The Acquire key will appear on every form you view. You have accessibility to all in the past downloaded types inside the My Forms tab of your own accounts.

If you would like use US Legal Forms the very first time, here are straightforward recommendations to get you started:

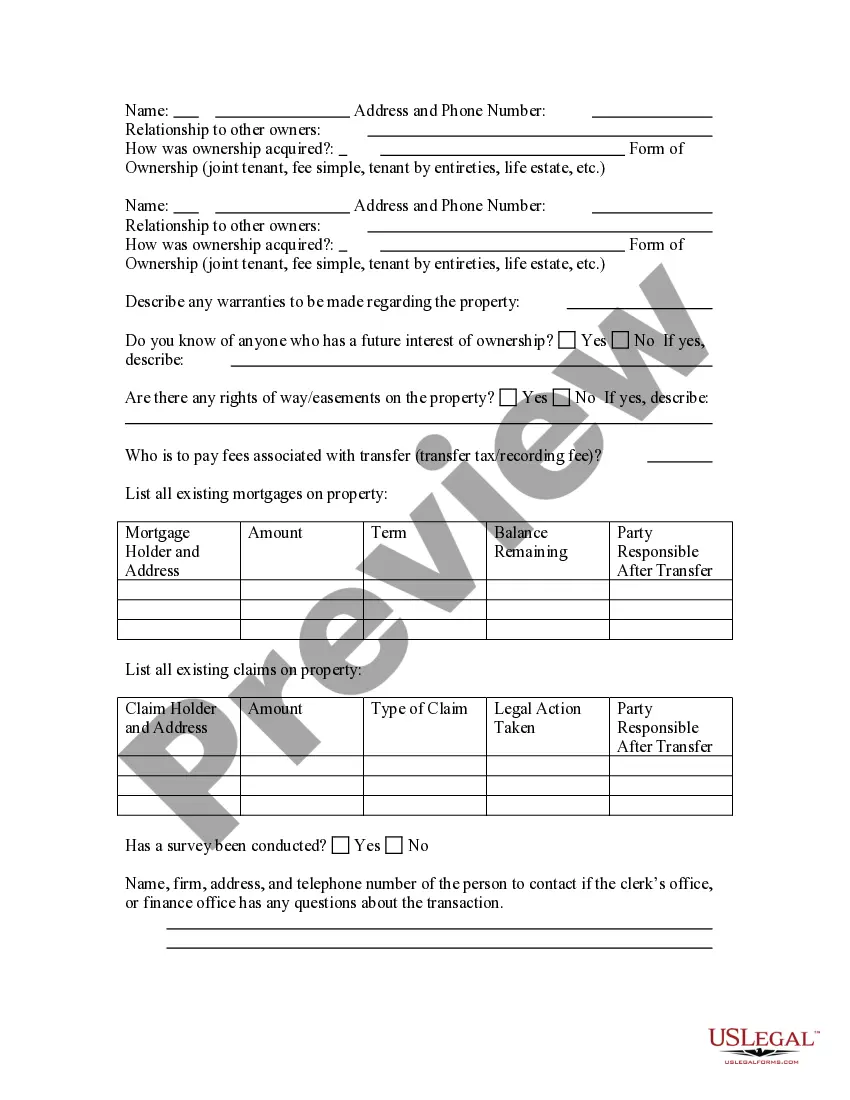

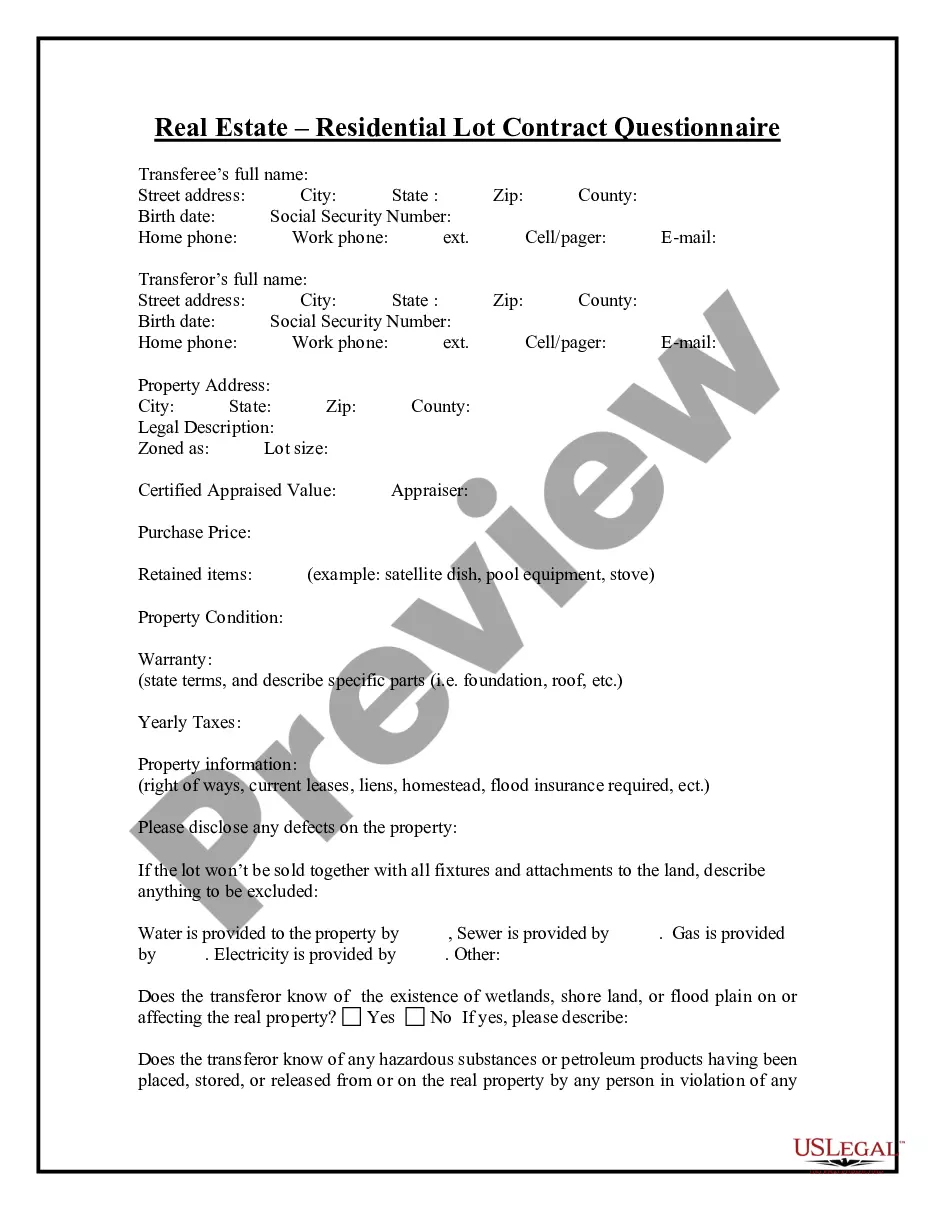

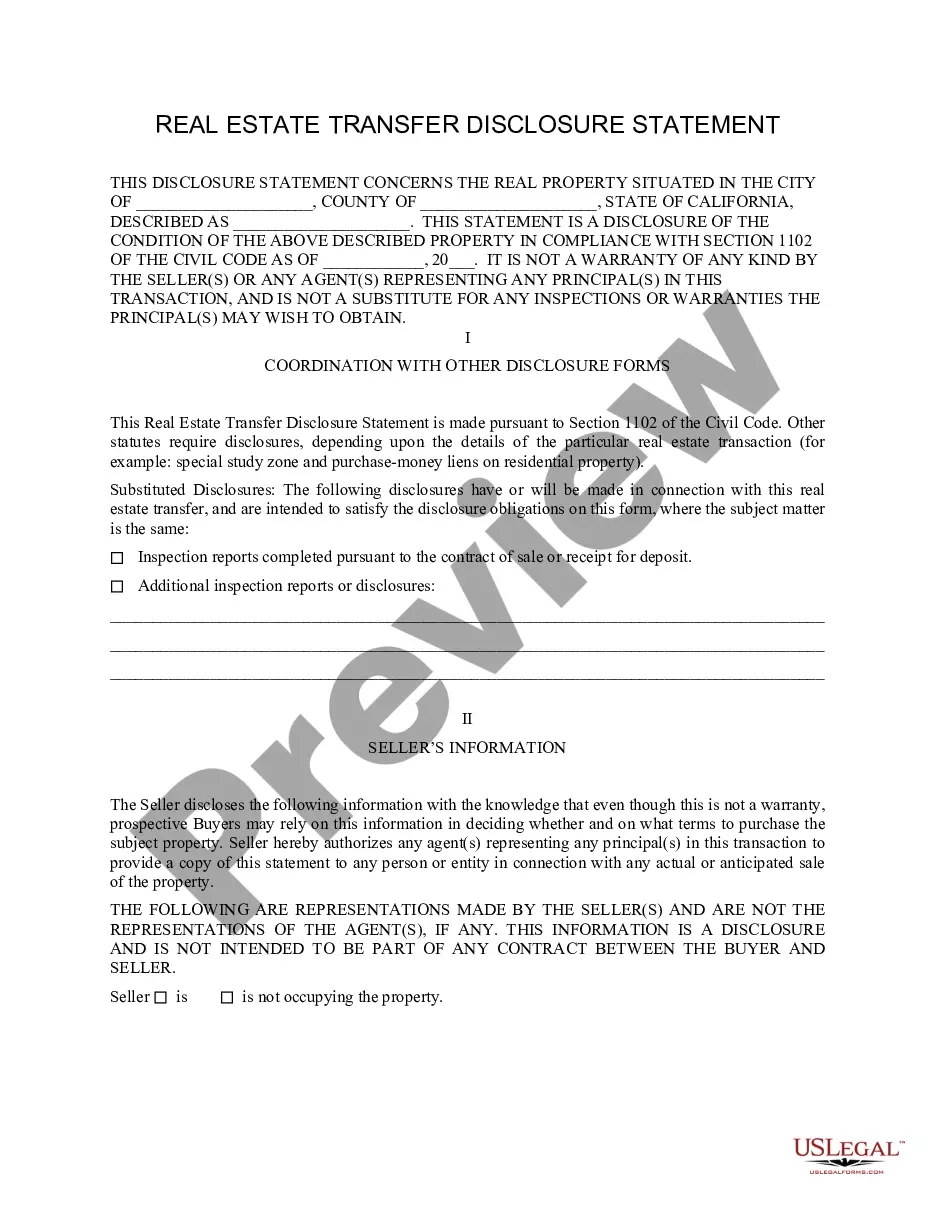

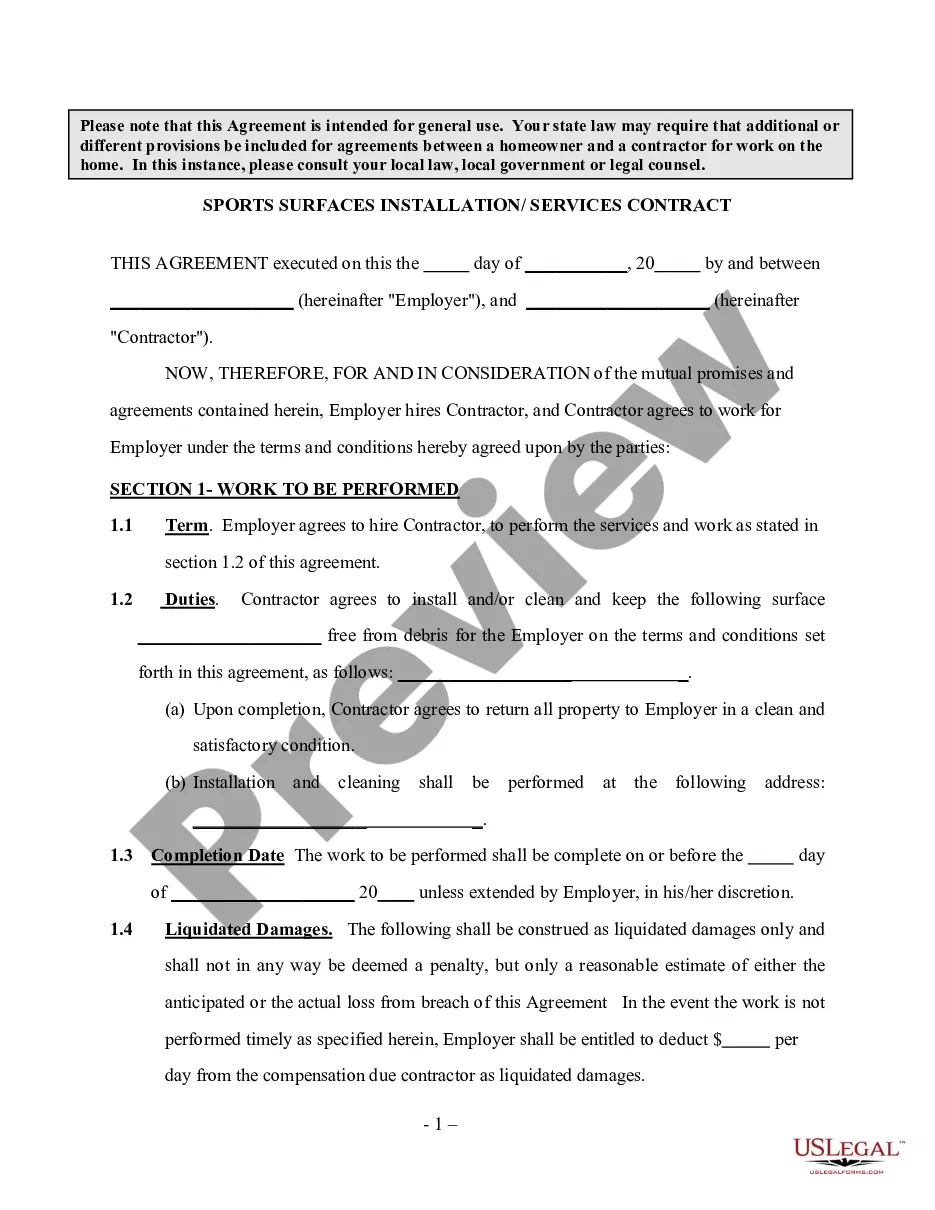

- Make sure you have chosen the proper form for the area/state. Select the Review key to check the form`s articles. Look at the form information to actually have selected the proper form.

- In the event the form does not satisfy your specifications, utilize the Look for discipline towards the top of the display to discover the the one that does.

- When you are satisfied with the shape, verify your choice by clicking the Buy now key. Then, pick the rates prepare you like and provide your references to sign up for the accounts.

- Process the financial transaction. Utilize your charge card or PayPal accounts to complete the financial transaction.

- Find the structure and obtain the shape in your system.

- Make modifications. Complete, revise and printing and sign the downloaded Wisconsin Deed Transfer Questionnaire.

Each and every format you included with your bank account does not have an expiration day and is also your own property forever. So, in order to obtain or printing another copy, just proceed to the My Forms section and click on on the form you want.

Get access to the Wisconsin Deed Transfer Questionnaire with US Legal Forms, one of the most comprehensive collection of authorized file themes. Use a huge number of skilled and state-specific themes that meet your company or specific requirements and specifications.