Wisconsin Tax Release Authorization

Description

How to fill out Tax Release Authorization?

It is possible to invest time online searching for the legal file design that fits the state and federal needs you require. US Legal Forms supplies a huge number of legal types that happen to be analyzed by pros. It is possible to download or print out the Wisconsin Tax Release Authorization from our support.

If you already possess a US Legal Forms account, you are able to log in and click on the Obtain switch. Afterward, you are able to complete, change, print out, or indicator the Wisconsin Tax Release Authorization. Every single legal file design you acquire is the one you have eternally. To have one more duplicate associated with a bought develop, check out the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website for the first time, adhere to the straightforward directions listed below:

- First, make certain you have chosen the best file design for the region/city of your choice. Look at the develop information to ensure you have picked out the appropriate develop. If readily available, take advantage of the Preview switch to check with the file design too.

- If you wish to get one more model of your develop, take advantage of the Lookup industry to get the design that meets your requirements and needs.

- After you have located the design you need, click on Acquire now to carry on.

- Find the pricing strategy you need, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal account to pay for the legal develop.

- Find the file format of your file and download it to your system.

- Make alterations to your file if necessary. It is possible to complete, change and indicator and print out Wisconsin Tax Release Authorization.

Obtain and print out a huge number of file web templates making use of the US Legal Forms website, that offers the largest collection of legal types. Use professional and condition-particular web templates to tackle your company or individual demands.

Form popularity

FAQ

File Form 8821 to: Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form.

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

Availability varies based on the method you used to file your return and whether you have a refund or balance due. refund amount or no balance due, allow 2-3 weeks after return submission before you request a transcript. allow 6-8 weeks after you mailed your return before you request a transcript.

Requesting an IRS tax transcript online If you have an online IRS account, you can simply log in to your account and navigate to the "Tax Records" tab. There you'll be able to select, view or download the tax transcript you need.

You may register to use Get Transcript Online to view, print, or download all transcript types listed below. If you're unable to register, or you prefer not to use Get Transcript Online, you may order a tax return transcript and/or a tax account transcript through Get Transcript by Mail or by calling 800-908-9946.

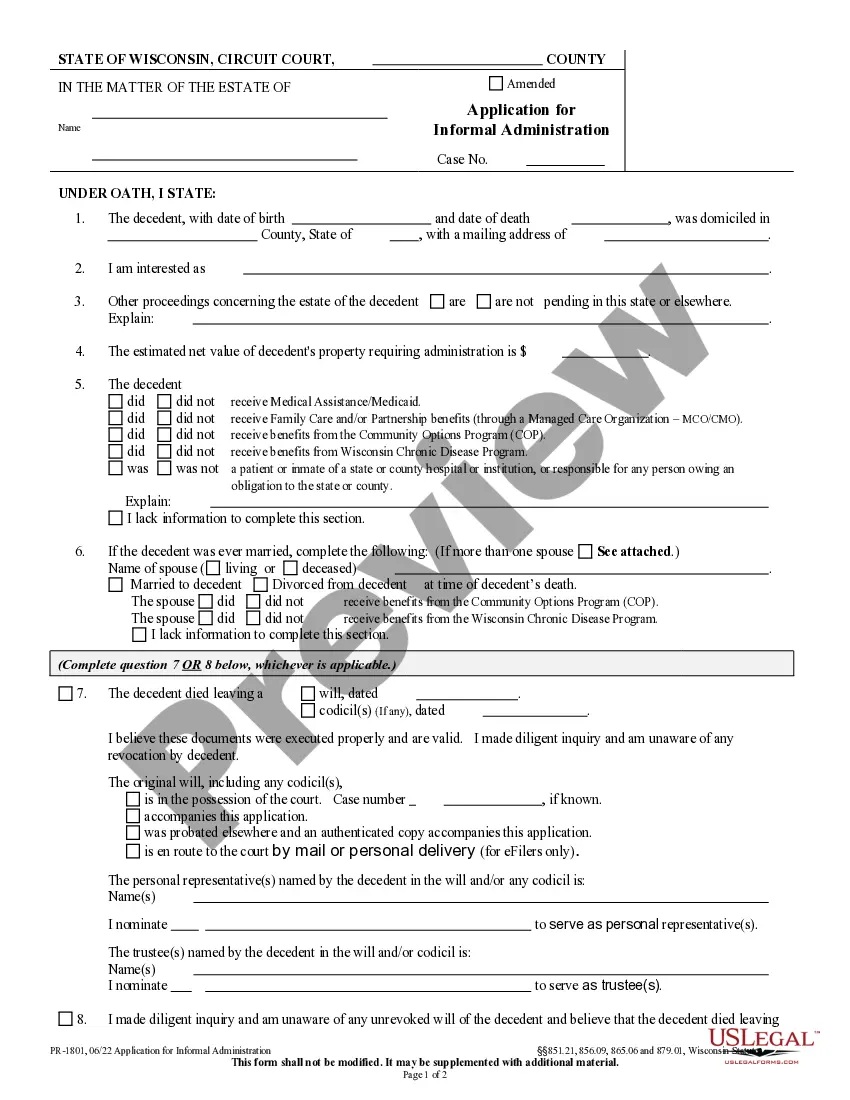

Form W-RA is required to be mailed to the Wisconsin Department of Revenue, along with supporting documentation, when you're claiming certain credits or other items on your e-filed return.

Some possible reasons for refund delays: The proper homestead credit attachments were not timely received. The taxpayer or spouse owes delinquent Wisconsin taxes* The taxpayer or spouse owes a debt to another Wisconsin state agency*

We recommend requesting a transcript online since that's the fastest method. If you can't get your transcript online, you can request a tax return or tax account transcript by mail instead.