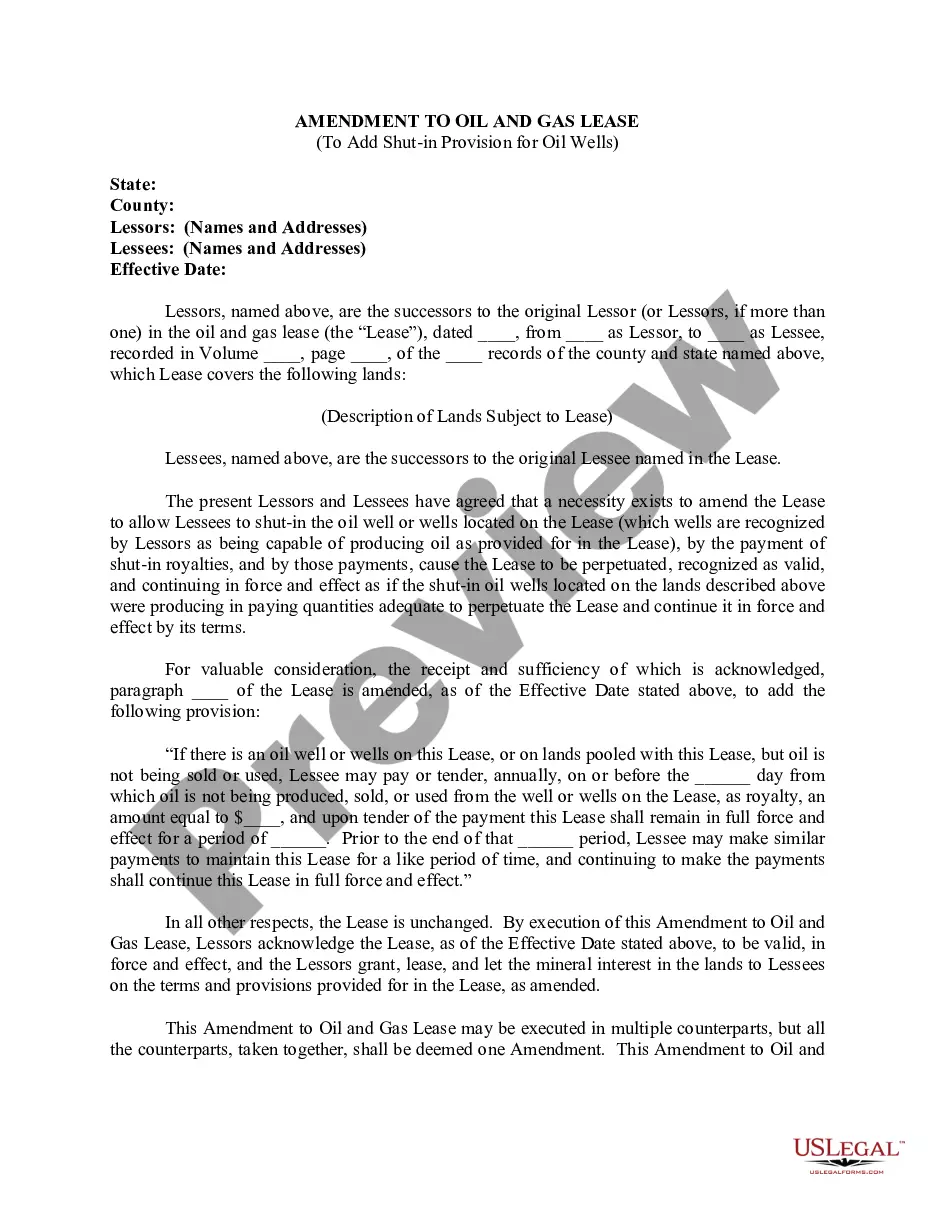

This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Wisconsin Use of Produced Oil Or Gas by Lessor

Description

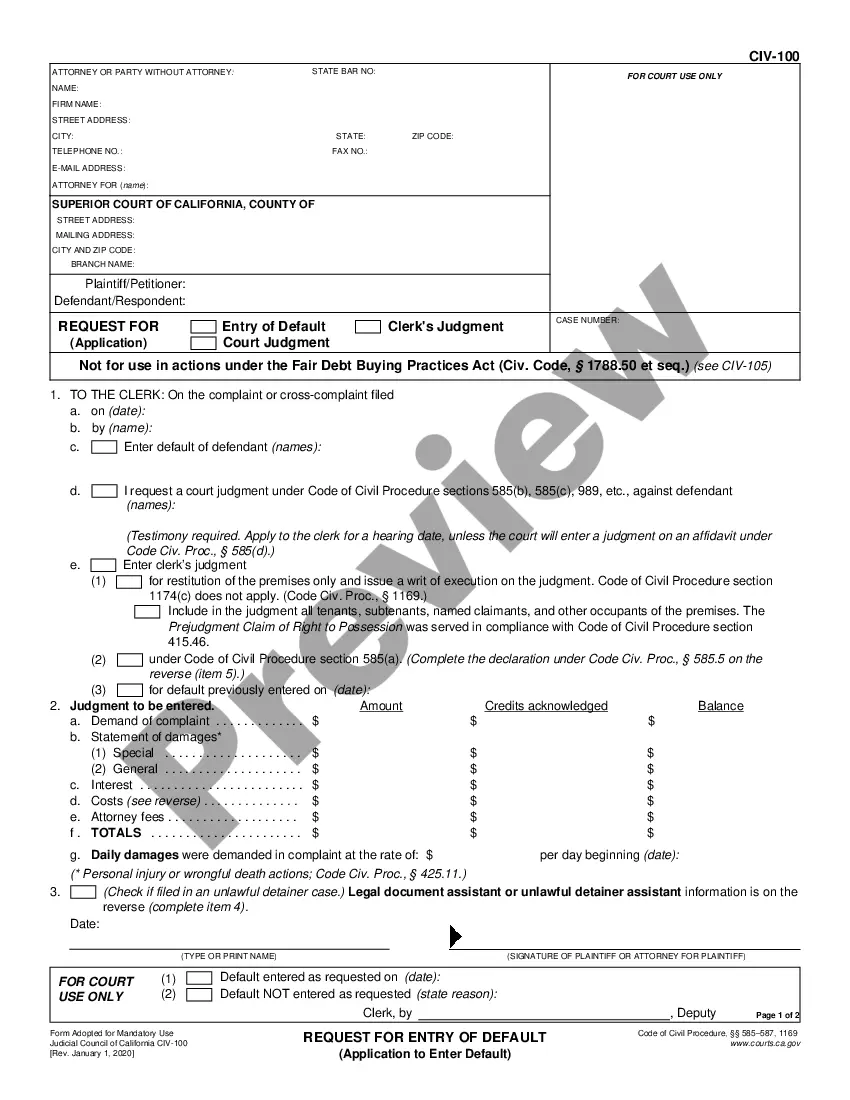

How to fill out Use Of Produced Oil Or Gas By Lessor?

If you want to full, download, or printing legal record web templates, use US Legal Forms, the greatest assortment of legal varieties, that can be found online. Utilize the site`s easy and convenient look for to discover the paperwork you will need. Different web templates for company and personal purposes are categorized by types and suggests, or key phrases. Use US Legal Forms to discover the Wisconsin Use of Produced Oil Or Gas by Lessor in a handful of mouse clicks.

If you are already a US Legal Forms customer, log in to the profile and click the Acquire switch to have the Wisconsin Use of Produced Oil Or Gas by Lessor. You can also access varieties you in the past saved from the My Forms tab of your own profile.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for that right metropolis/land.

- Step 2. Utilize the Preview method to check out the form`s content. Do not neglect to read through the explanation.

- Step 3. If you are not happy using the form, take advantage of the Look for area near the top of the display screen to get other versions in the legal form template.

- Step 4. When you have located the form you will need, select the Buy now switch. Choose the prices plan you prefer and add your accreditations to register for an profile.

- Step 5. Procedure the financial transaction. You can utilize your bank card or PayPal profile to finish the financial transaction.

- Step 6. Find the formatting in the legal form and download it in your device.

- Step 7. Comprehensive, revise and printing or sign the Wisconsin Use of Produced Oil Or Gas by Lessor.

Every legal record template you get is your own forever. You have acces to each and every form you saved inside your acccount. Click the My Forms area and decide on a form to printing or download again.

Be competitive and download, and printing the Wisconsin Use of Produced Oil Or Gas by Lessor with US Legal Forms. There are thousands of expert and express-distinct varieties you can use for your company or personal requirements.

Form popularity

FAQ

A manufacturing exemption is available for electricity and/or natural gas used or consumed in agricultural or industrial production. The exemption percentage is determined based on the actual percentage of the utility being used in the manufacturing process.

(b) The exemption for rolling stock includes: Tax 11.16(2)(b)1. 1. The sale or furnishing of repair, service, alteration, fitting, cleaning, painting, coating, towing, inspection, and maintenance to exempt rolling stock.

Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include: Admission and access privileges to amusement, athletic, entertainment, or recreational places or events. Access or use of amusement devices.

Does Wisconsin tax military retirement income? No. All retirement payments received from the U.S. military retirement system (including payments from the Retired Serviceman's Family Protection Plan and the Survivor Benefit Plan) are exempt from Wisconsin income tax.

Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. Sellers should exclude from taxable sales price, the transactions for which they have accepted an exemption certificate from a purchaser as described below.

Personal Exemptions A $700 personal exemption is provided for each taxpayer, the tax- payer's spouse, and for each individual claimed as a dependent.

This exemption includes the following items if they are assigned to and carried on vehicles used exclusively as common or contract carriers: dollies, pianoboards, ladders, walkboards, tire chains, fire extinguishers, flares, bug deflectors, engine block heaters, defroster fans, auxiliary heaters and cooling units and ...

The installation of the furnace is a real property construction activity. The contractor is the consumer of the furnace, and is liable for tax on its purchase of the furnace.