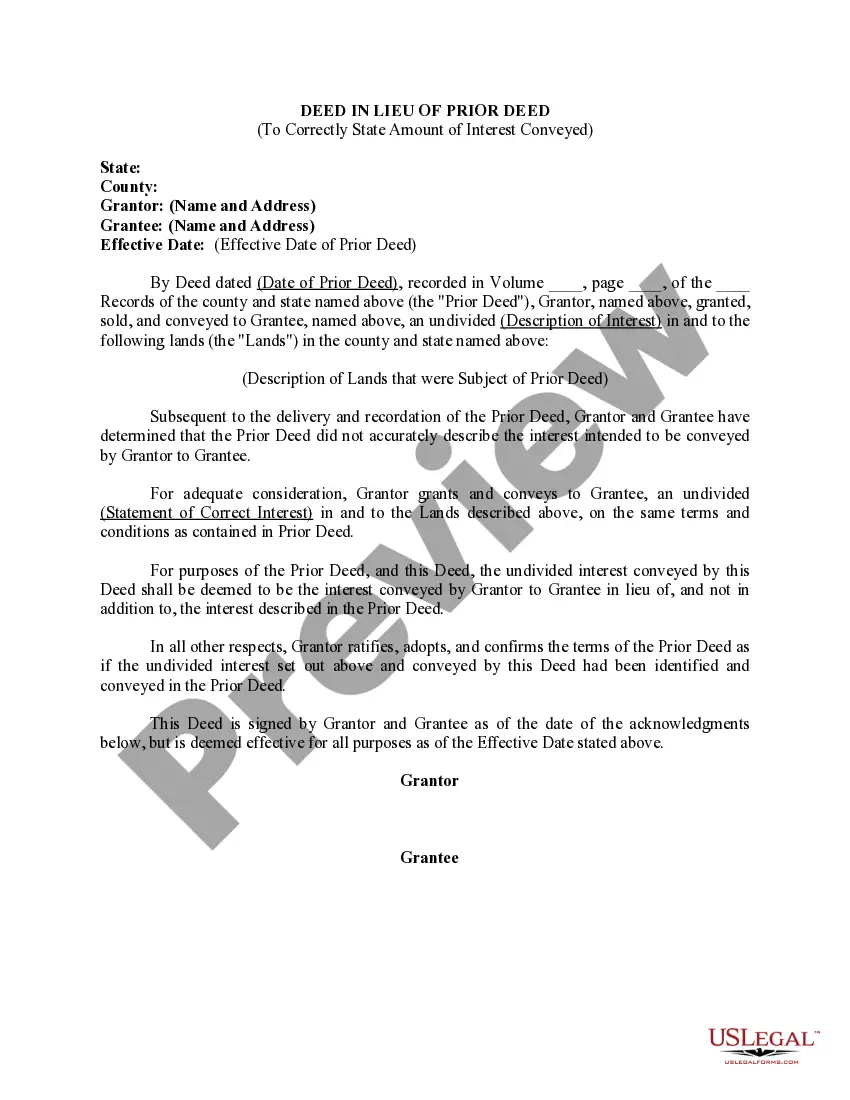

This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

Wisconsin Correction to Mineral Deed As to Interest Conveyed

Description

How to fill out Correction To Mineral Deed As To Interest Conveyed?

You may devote hours on the web looking for the legitimate document template that fits the federal and state demands you require. US Legal Forms provides a large number of legitimate varieties that are examined by professionals. You can easily down load or produce the Wisconsin Correction to Mineral Deed As to Interest Conveyed from my services.

If you already possess a US Legal Forms accounts, you may log in and then click the Down load switch. Afterward, you may complete, modify, produce, or indication the Wisconsin Correction to Mineral Deed As to Interest Conveyed. Each and every legitimate document template you buy is your own for a long time. To have one more duplicate of the purchased type, proceed to the My Forms tab and then click the related switch.

If you work with the US Legal Forms internet site for the first time, follow the basic guidelines listed below:

- First, make sure that you have selected the proper document template for your county/town of your liking. Browse the type information to make sure you have selected the correct type. If accessible, take advantage of the Preview switch to check throughout the document template also.

- If you would like find one more variation from the type, take advantage of the Search industry to find the template that fits your needs and demands.

- Once you have discovered the template you desire, click Buy now to continue.

- Pick the rates program you desire, key in your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal accounts to fund the legitimate type.

- Pick the formatting from the document and down load it to your system.

- Make modifications to your document if possible. You may complete, modify and indication and produce Wisconsin Correction to Mineral Deed As to Interest Conveyed.

Down load and produce a large number of document templates utilizing the US Legal Forms website, which offers the most important selection of legitimate varieties. Use skilled and express-distinct templates to handle your company or individual requirements.

Form popularity

FAQ

A TOD beneficiary is designated on a deed that must be recorded and is exempt from filing a transfer return. State the exemption from return and fee on the face of the document: "Exempt from transfer return and fee per state law (sec. 77.25(10m), Wis. Stats.)."

This new form combines into one form the prior Application for the Termination of Decedent's Interest (HT-110) and Transfer on Death to Beneficiary (TOD-110). The new form can be used with a deed that established a joint tenancy, life estate, or a recorded Transfer on Death Deed.

How do I make a change to property ownership (add, remove or change someone's name)? To change ownership of real estate, a new conveyance document (deed) must be drafted and submitted for recording along with an Electronic Real Estate Transfer Return Receipt (e-RETR) We do not carry blank forms in our office.

A $30 filing fee is typically required. Transfer Tax: Yes: 30 cents for each $100 value or fraction of $100.

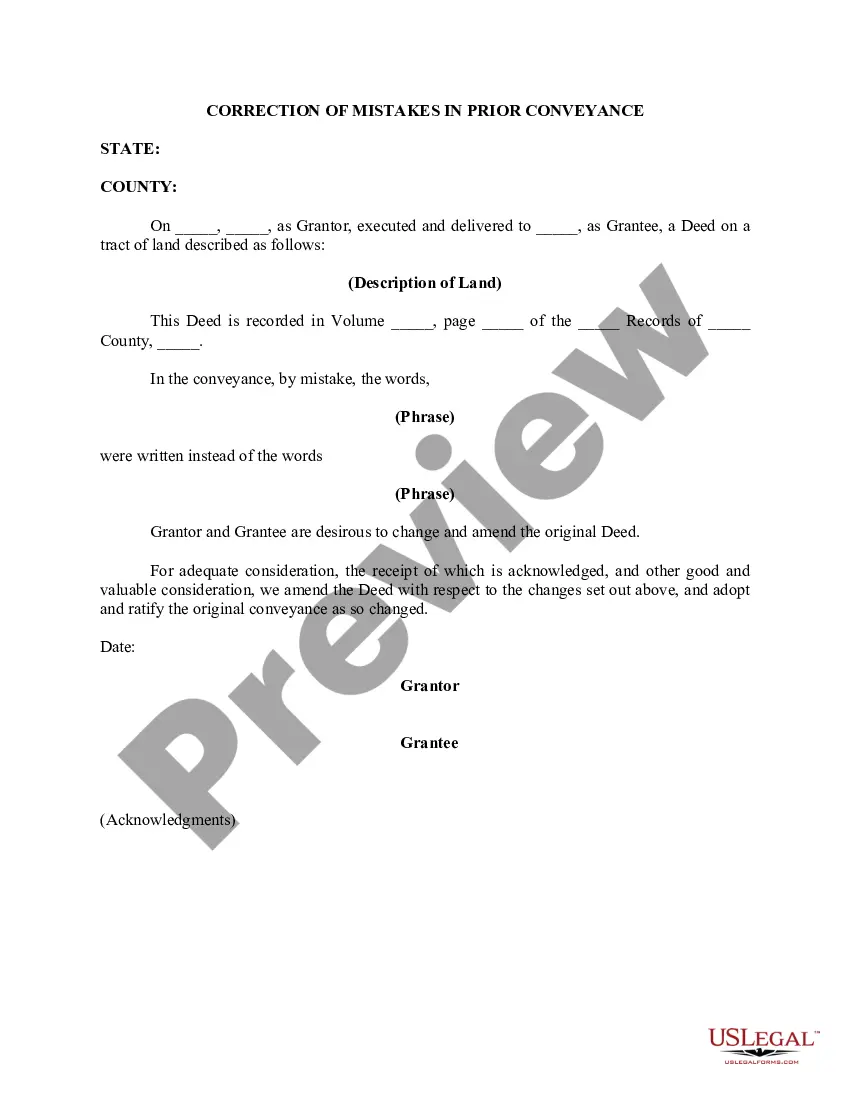

A Correction Instrument is a recorded affidavit prepared by a Wisconsin Professional Land Surveyor that attests to changes made to a recorded subdivision plat or Certified Survey Map as provided for by s.

Legal instruments such as warranty deeds, quit claim deeds, etc., that convey title from one property owner to a new owner, are usually drafted by attorneys, or paralegals or legal secretaries under the supervision of an attorney.

First, there's exposure to the co-owner's creditors. Once another person is added to the deed, the property can become exposed to their financial risks. If the other person has debts or legal issues, the property could potentially be seized by their creditors. Then, there's a loss of control to consider.

The Wisconsin real estate transfer fee (RETF) is imposed upon the grantor (seller) of real estate at a rate of $3.00 per $1,000 of value. The determination of the "value" of real estate for purposes of the fee depends upon the type of transfer being conducted.