Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

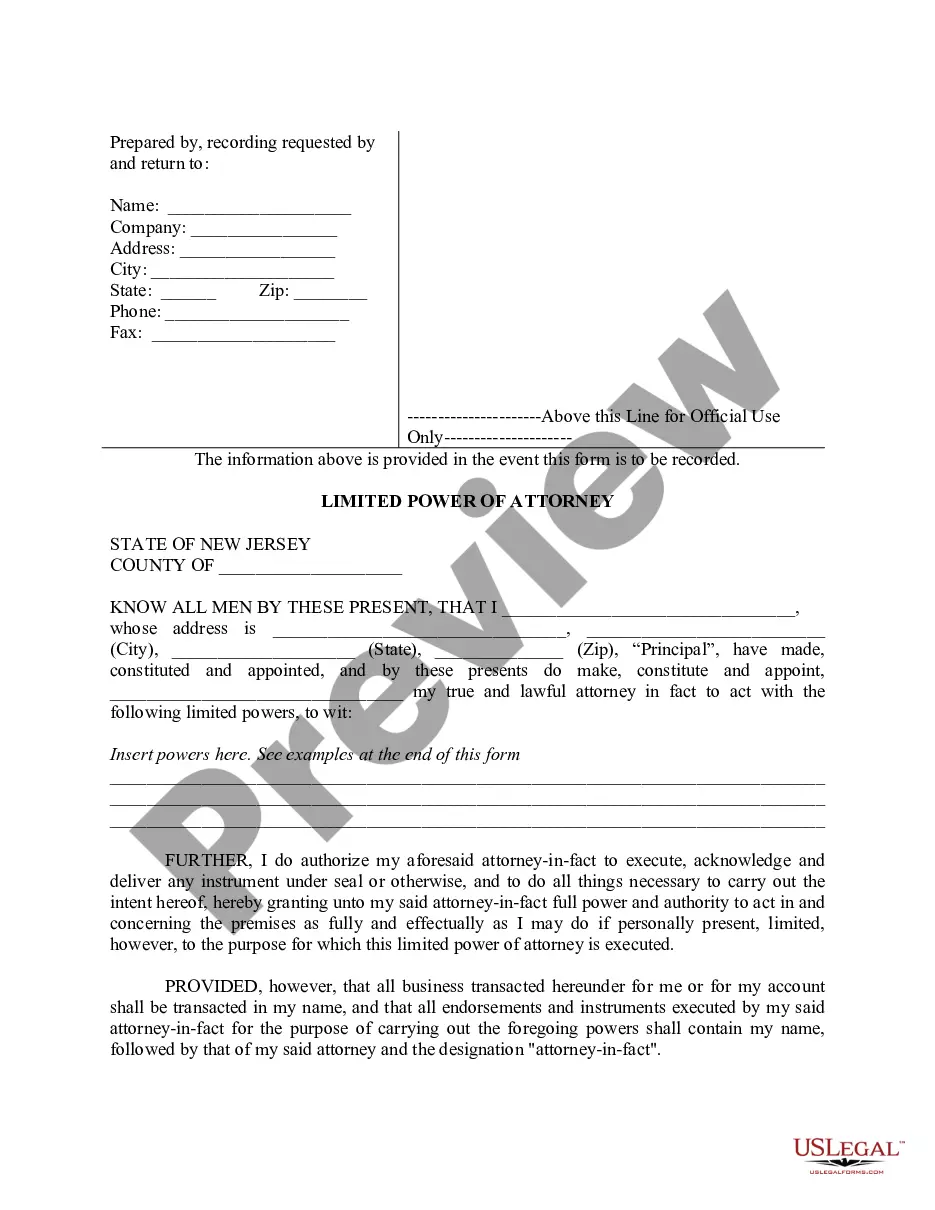

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

It is feasible to spend numerous hours online trying to locate the legal document template that meets the state and federal criteria you require. US Legal Forms offers a vast array of legal forms that are examined by professionals.

You can conveniently download or print the Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor from our services. If you already possess a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor.

Every legal document template you obtain is yours permanently. To get another copy of the purchased form, visit the My documents tab and click the corresponding button. If you are using the US Legal Forms website for the first time, follow the simple instructions below: Firstly, ensure you have selected the correct document template for the state/town of your choice. Review the form description to confirm you have selected the accurate form. If available, utilize the Review button to examine the document template as well.

Utilize professional and state-specific templates to address your business or personal needs.

- To find another version of the form, use the Search area to locate the template that meets your needs and requirements.

- Once you have found the template you desire, click Get now to proceed.

- Choose the pricing plan you want, enter your details, and sign up for an account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form.

- Select the format of the document and download it to your device.

- Make adjustments to the document if necessary. You can complete, modify, sign, and print the Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor.

- Download and print a multitude of document templates using the US Legal Forms website, which offers the largest collection of legal forms.

Form popularity

FAQ

Filling out a Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor form requires clear information about the contractor's services and payment expectations. Begin with the essential details like names, dates, and address information. Next, outline the terms of the agreement, ensuring both parties understand the conditions. Utilizing tools from US Legal Forms can streamline this task and provide clarification on necessary fields.

To effectively fill out a Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor, start by entering the names and addresses of both parties. Detail the scope of work and deliverables clearly, and specify payment terms, including amounts and frequency. Remember to check for any required legal provisions, and consider using US Legal Forms for templates that ensure you cover all important aspects.

Creating a Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor involves several key steps. First, outline the services the contractor will provide, specifying any relevant deadlines. Next, include payment terms, such as rates and invoicing instructions. Finally, ensure both parties sign the agreement for legal assurance; using a platform like US Legal Forms can simplify this process.

Yes, you need work authorization to work as an independent contractor in the United States. This requirement applies even if you're providing services under a Wisconsin Translator And Interpreter Agreement - Self-Employed Independent Contractor. Make sure you're compliant with federal and state laws regarding employment status and tax obligations. If you're uncertain about your work authorization status, consider consulting with a legal professional or using resources available on the uslegalforms platform.

The independent contractor agreement in Wisconsin is a legal document that defines your working relationship with an independent contractor. Specifically, the Wisconsin Translator and Interpreter Agreement - Self-Employed Independent Contractor ensures that both parties understand their rights, responsibilities, and the specifics of the work to be performed. Creating a clear and concise agreement helps prevent misunderstandings and provides a framework for collaboration. It is vital for anyone engaging contractors in this field.

Billing insurance for interpreter services involves accurate documentation and compliance with the insurance provider’s guidelines. When utilizing the Wisconsin Translator and Interpreter Agreement - Self-Employed Independent Contractor, it’s important to keep your invoices detailed, specifying the service provided and the duration. This clarity helps facilitate faster payment and reduces the likelihood of disputes. Consult resources or platforms like uslegalforms for templates to streamline this process.

Legal requirements for independent contractors can vary by state but generally include proper licensing and tax compliance. For those utilizing the Wisconsin Translator and Interpreter Agreement - Self-Employed Independent Contractor, ensuring you meet state and federal regulations is crucial. Independent contractors must also maintain their own insurance in many instances, which protects them as they serve clients. Keeping informed about these requirements safeguards your business.

Yes, an interpreter can operate as an independent contractor. With the Wisconsin Translator and Interpreter Agreement - Self-Employed Independent Contractor, interpreters establish their terms of service, set their own schedules, and manage their taxes. This arrangement allows interpreters the flexibility to work with multiple clients while ensuring they remain compliant with legal standards. It is a practical choice for many in the field.

A basic independent contractor agreement outlines the relationship between you and the contractor. In the case of the Wisconsin Translator and Interpreter Agreement - Self-Employed Independent Contractor, it details payment terms, responsibilities, and the scope of work. This agreement helps both parties understand their obligations and protects their rights. It is essential for compliance and clarity in your business dealings.