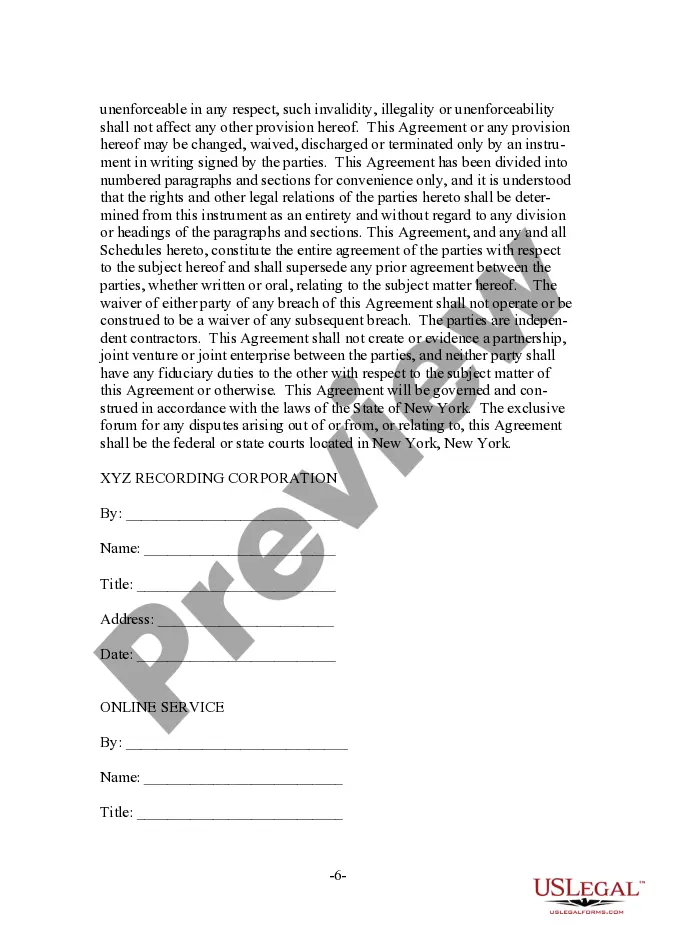

Wisconsin Form - Audiovisual Streaming - Downloading License Agreement

Description

How to fill out Form - Audiovisual Streaming - Downloading License Agreement?

You can spend time on the web searching for the legitimate record design that suits the federal and state needs you require. US Legal Forms offers a huge number of legitimate types which can be evaluated by pros. It is possible to acquire or printing the Wisconsin Form - Audiovisual Streaming - Downloading License Agreement from our support.

If you currently have a US Legal Forms profile, you may log in and then click the Download switch. Afterward, you may complete, edit, printing, or sign the Wisconsin Form - Audiovisual Streaming - Downloading License Agreement. Every single legitimate record design you acquire is your own permanently. To acquire yet another version of the obtained develop, go to the My Forms tab and then click the related switch.

If you use the US Legal Forms internet site initially, follow the basic recommendations listed below:

- Initially, make certain you have selected the right record design to the state/city of your choice. See the develop information to ensure you have chosen the right develop. If readily available, utilize the Review switch to check from the record design as well.

- In order to discover yet another variation from the develop, utilize the Research discipline to discover the design that meets your needs and needs.

- Once you have found the design you want, just click Get now to carry on.

- Find the costs program you want, type in your accreditations, and register for an account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to fund the legitimate develop.

- Find the formatting from the record and acquire it to the product.

- Make adjustments to the record if required. You can complete, edit and sign and printing Wisconsin Form - Audiovisual Streaming - Downloading License Agreement.

Download and printing a huge number of record themes while using US Legal Forms Internet site, which provides the most important selection of legitimate types. Use expert and condition-certain themes to deal with your business or personal requires.

Form popularity

FAQ

The service of cleaning items of tangible personal property is generally subject to sales tax. Exceptions include cleaning services provided by veterinarians, and services provided when installing tangible personal property or other taxable items that will constitute an addition or improvement to real property.

Section 77.52 (2) (a) 13m., Stats., imposes Wisconsin sales tax on the sale of contracts, including service contracts, maintenance agreements, computer software maintenance contracts for prewritten computer software, and warranties, that provide, in whole or in part, for the future performance of or payment for the ...

On November 30, 2021, the Wisconsin Department of Revenue (?Department?) updated Publication No. 240, which provides guidance on the application of Wisconsin sales and use tax to sales and purchases of digital goods.

Some customers are exempt from paying sales tax under Wisconsin law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

Generally speaking, most professional services in Wisconsin are not taxable. Contracts for future performance of services are subject to tax as are digital goods.

Only certain services sold, performed, or furnished in Wisconsin are subject to Wisconsin sales or use tax. Taxable services include: Admission and access privileges to amusement, athletic, entertainment, or recreational places or events. Access or use of amusement devices.

Charges for a subscription to an online version of a newspaper are exempt under sec. 77.54(50), Wis. Stats. Additional examples of applying this exemption to sales and purchases of digital goods are available in Part 13 of Publication 240, Digital Goods.

Sales of food and food ingredients, except candy, dietary supplements, prepared foods, and soft drinks are exempt from tax under s. 77.54 (20n), Stats.