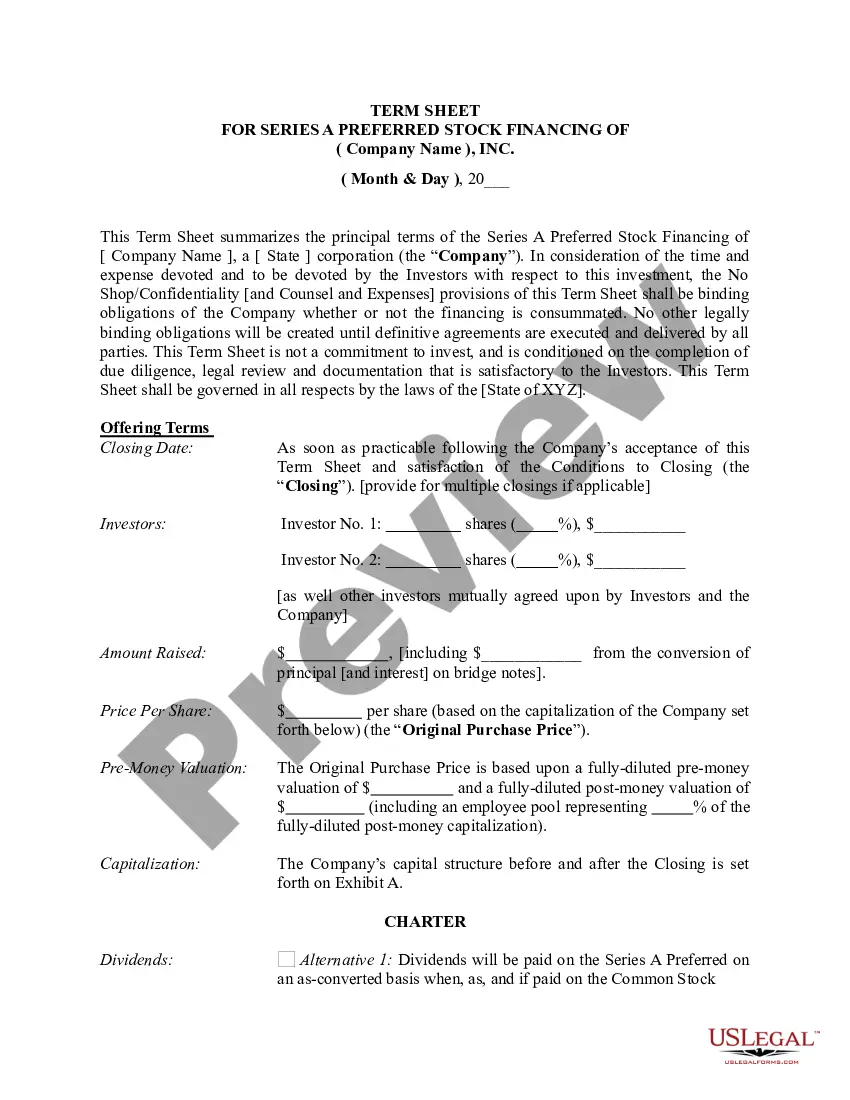

Wisconsin Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

Are you inside a situation in which you require documents for both organization or person uses virtually every day? There are tons of legal papers themes available on the Internet, but getting types you can rely is not easy. US Legal Forms offers a huge number of kind themes, like the Wisconsin Term Sheet - Series A Preferred Stock Financing of a Company, which can be written to meet state and federal requirements.

Should you be previously familiar with US Legal Forms web site and also have a merchant account, basically log in. Following that, you can down load the Wisconsin Term Sheet - Series A Preferred Stock Financing of a Company design.

If you do not offer an bank account and need to begin using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is to the appropriate town/state.

- Make use of the Preview button to check the shape.

- Browse the outline to actually have selected the proper kind.

- If the kind is not what you are trying to find, make use of the Look for field to get the kind that fits your needs and requirements.

- Whenever you discover the appropriate kind, click Buy now.

- Select the rates prepare you want, submit the specified info to produce your account, and purchase your order with your PayPal or charge card.

- Choose a hassle-free file file format and down load your duplicate.

Locate every one of the papers themes you may have purchased in the My Forms menus. You can get a more duplicate of Wisconsin Term Sheet - Series A Preferred Stock Financing of a Company anytime, if required. Just click the required kind to down load or printing the papers design.

Use US Legal Forms, one of the most substantial assortment of legal kinds, to conserve efforts and prevent errors. The service offers professionally produced legal papers themes that you can use for a range of uses. Make a merchant account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

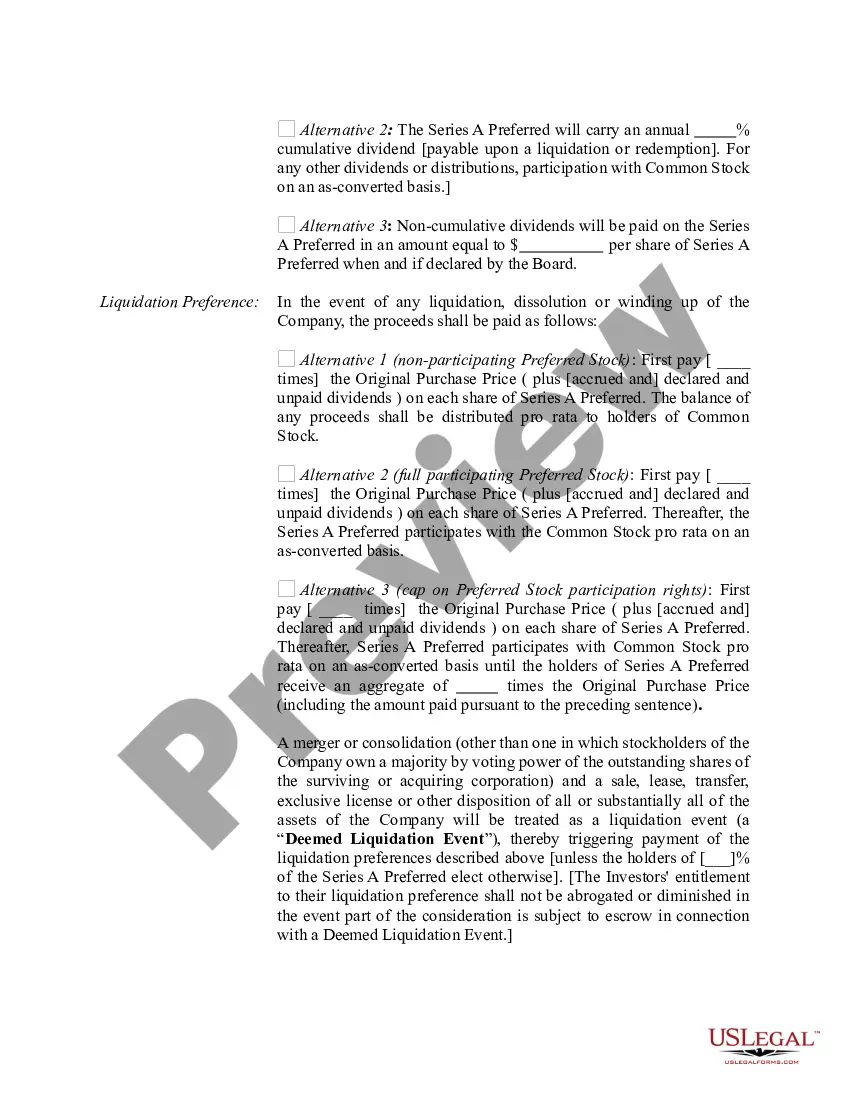

Preference shares, more commonly referred to as preferred stock, are shares of a company's stock with dividends that are paid out to shareholders before common stock dividends are issued. If the company enters bankruptcy, preferred stockholders are entitled to be paid from company assets before common stockholders.

A term sheet outlines the basic terms and conditions of an investment opportunity and is a non-binding agreement that serves as a starting point for more detailed agreements ? like a commitment letter, definitive agreement (share purchase agreement), or subscription agreement.

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions.

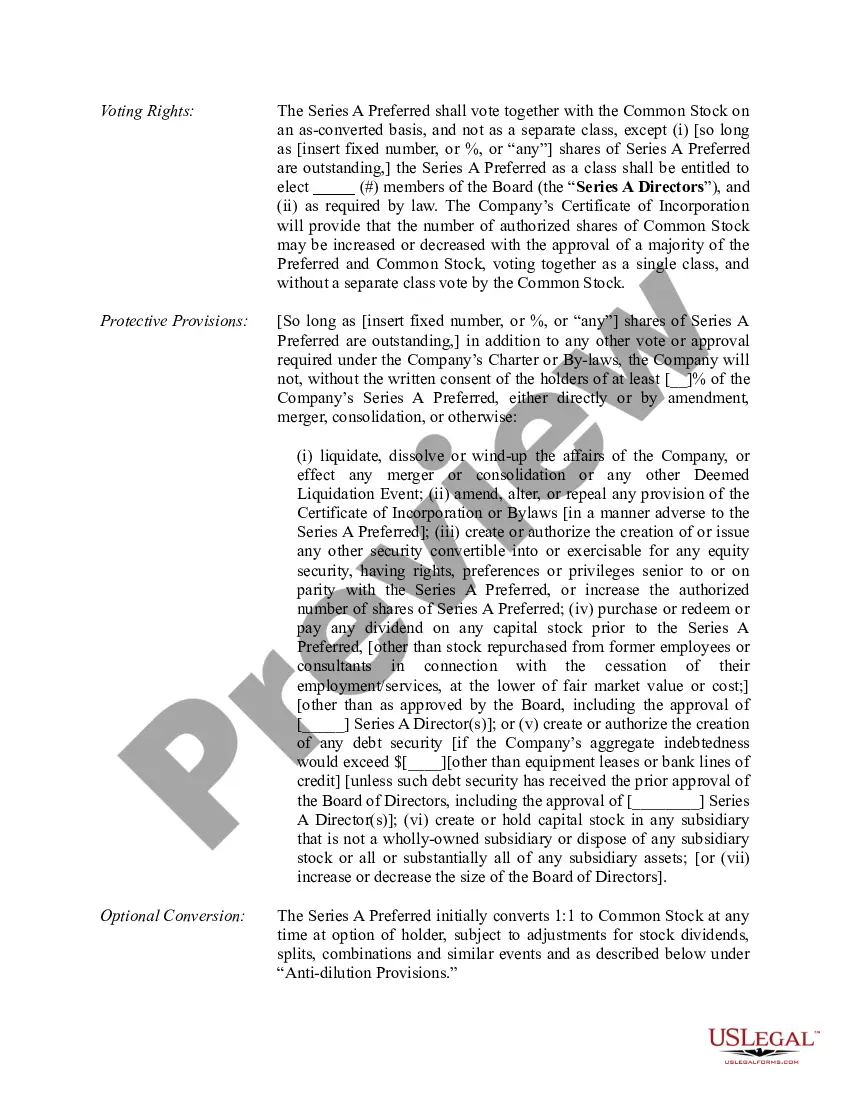

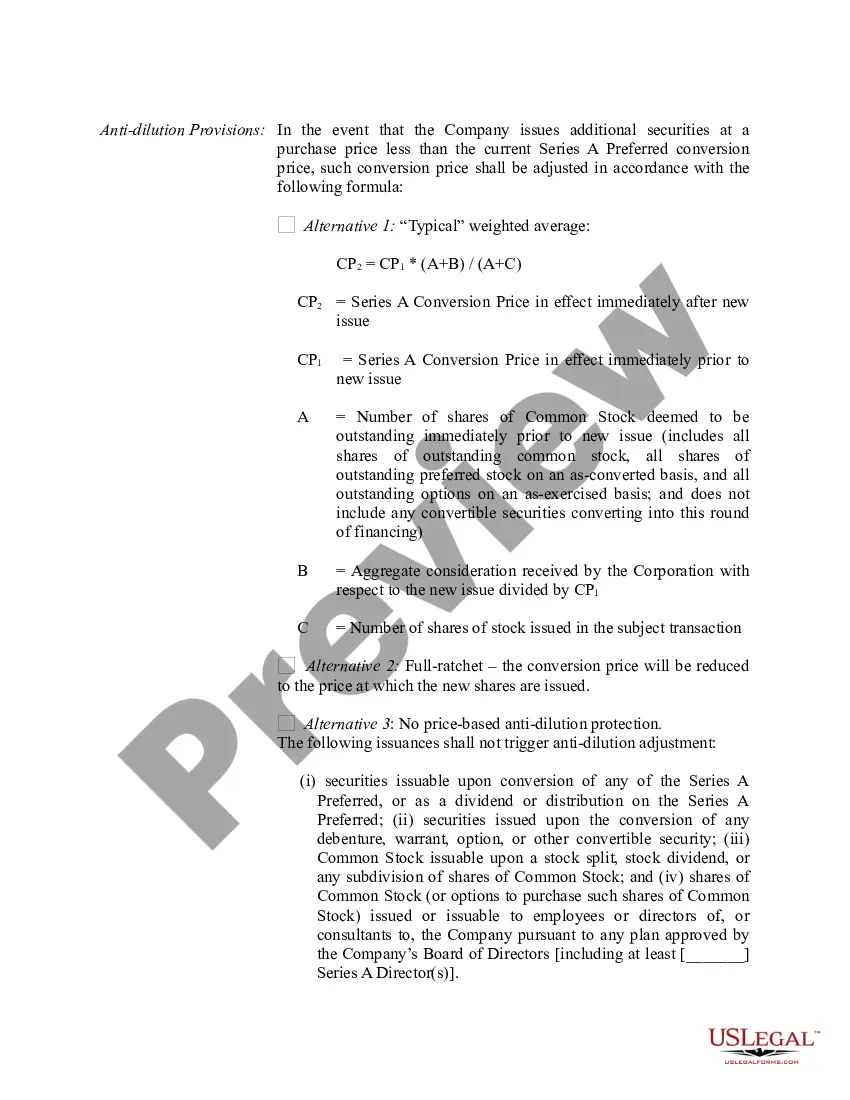

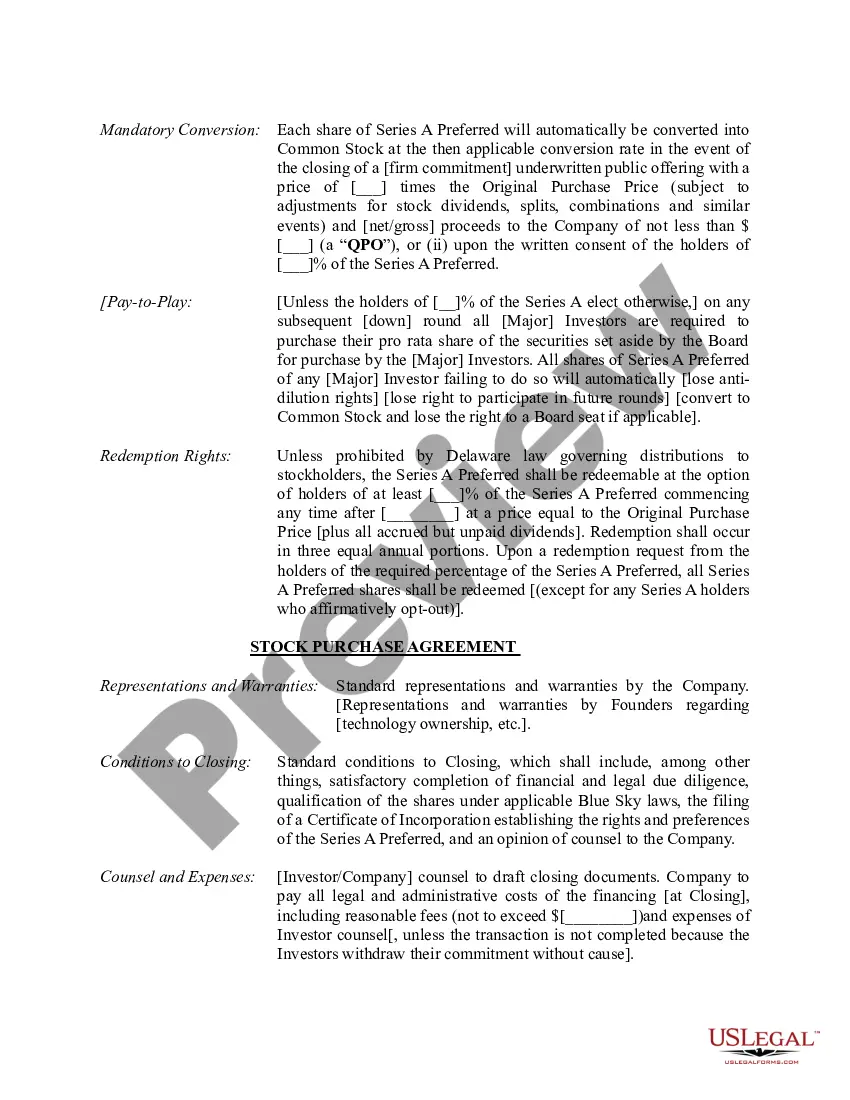

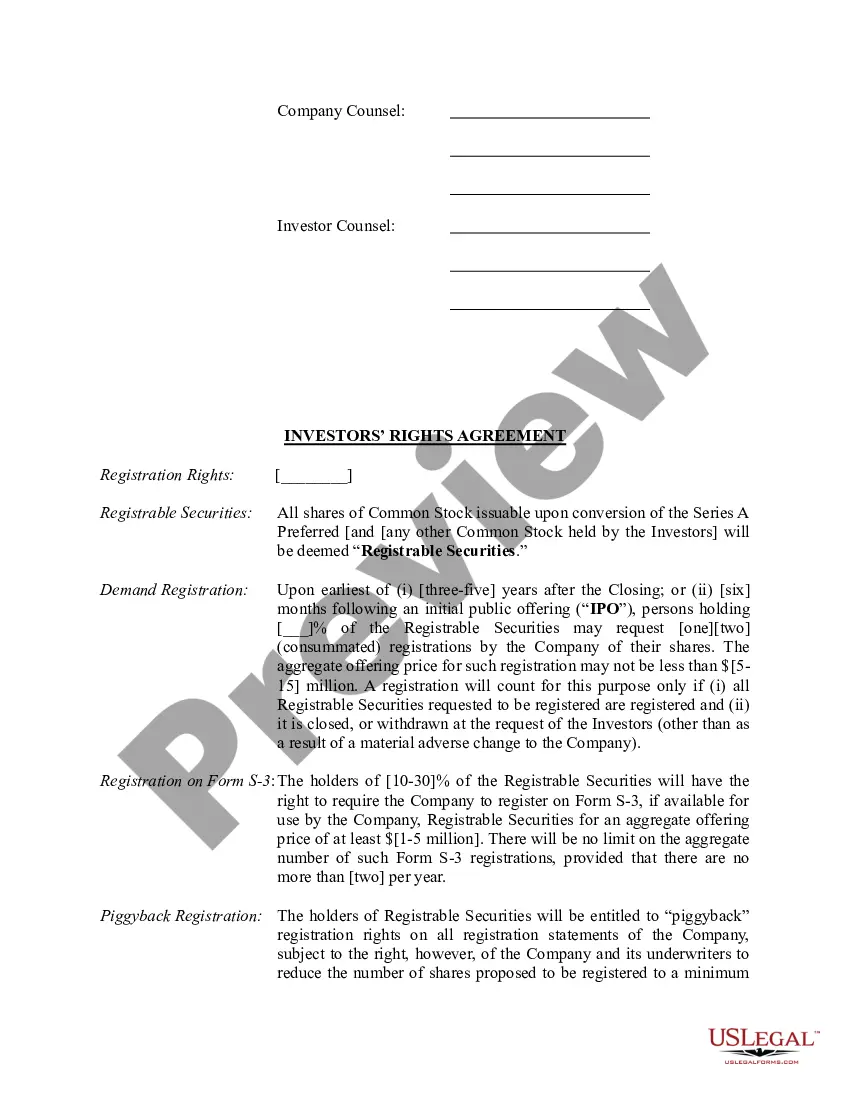

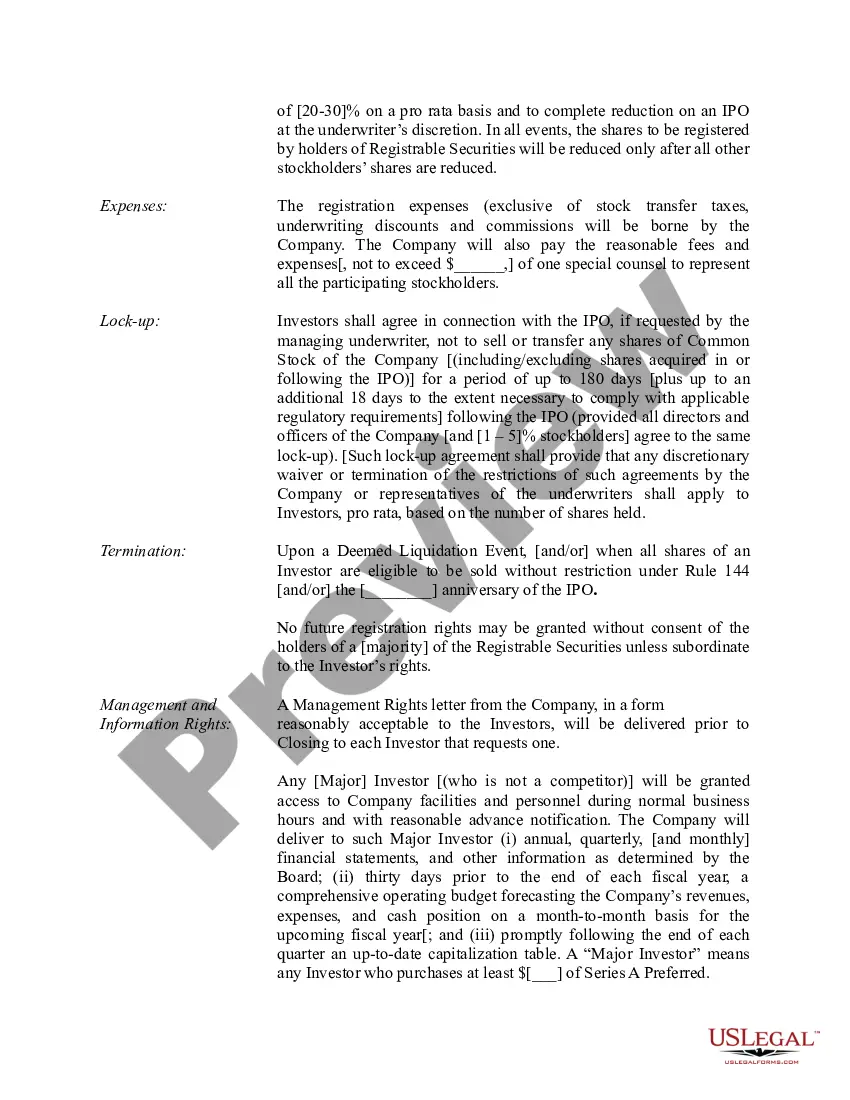

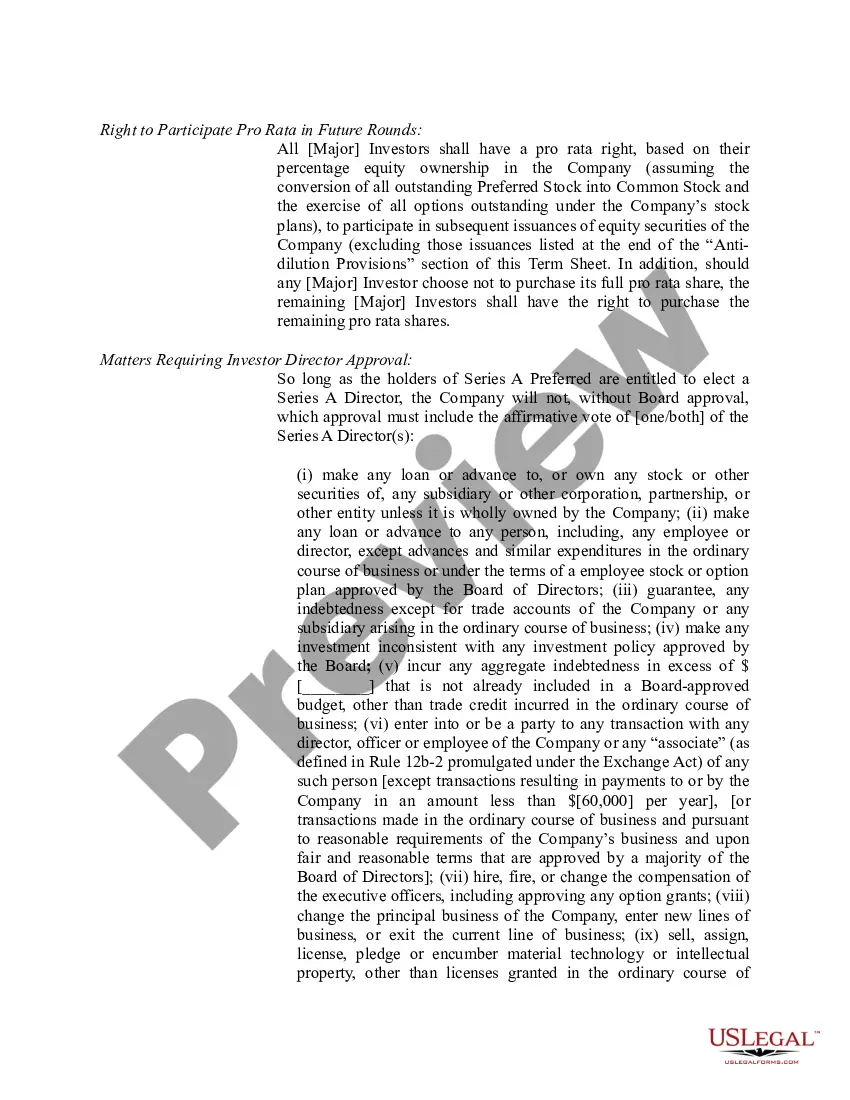

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

Key Takeaways. Preferred stock is a different type of equity that represents ownership of a company and the right to claim income from the company's operations. Preferred stockholders have a higher claim on distributions (e.g. dividends) than common stockholders.

Term sheet examples: What's included? Along with setting the valuation for the company, a term sheet details the amount of the investment and detailed terms around the calculations of pricing for the preferred shares the investor will receive for their money. A term sheet also establishes the investor's rights.