Wisconsin Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent

Description

How to fill out Domestic Subsidiary Security Agreement Regarding Ratable Benefit Of Lenders And Agent?

If you wish to full, obtain, or printing authorized papers themes, use US Legal Forms, the greatest selection of authorized types, which can be found on the Internet. Utilize the site`s easy and convenient lookup to discover the files you want. A variety of themes for business and personal functions are sorted by groups and states, or keywords and phrases. Use US Legal Forms to discover the Wisconsin Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent in a number of clicks.

In case you are currently a US Legal Forms customer, log in to your bank account and click on the Obtain key to find the Wisconsin Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent. Also you can accessibility types you previously saved in the My Forms tab of your respective bank account.

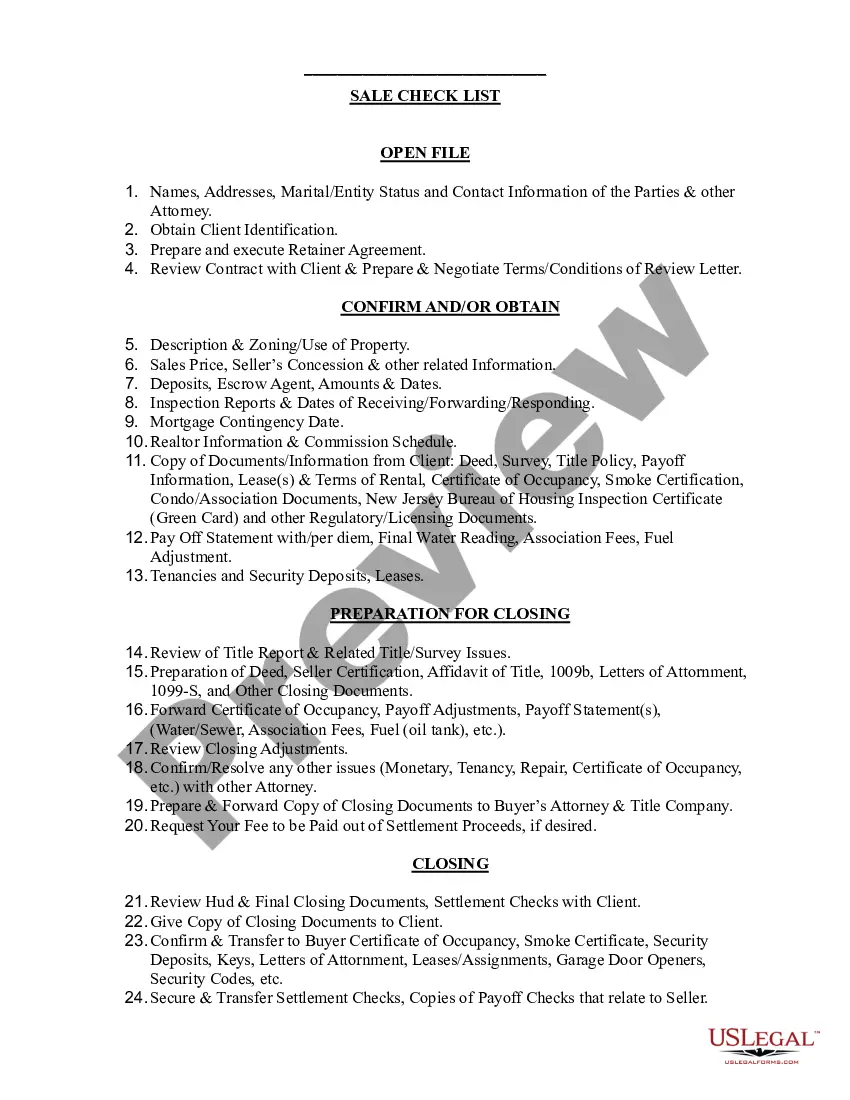

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have selected the shape to the appropriate area/region.

- Step 2. Take advantage of the Review method to look through the form`s information. Do not forget about to read the outline.

- Step 3. In case you are not satisfied using the type, use the Search industry at the top of the monitor to get other models in the authorized type web template.

- Step 4. When you have found the shape you want, click the Purchase now key. Pick the prices program you prefer and put your qualifications to register to have an bank account.

- Step 5. Method the purchase. You should use your Мisa or Ьastercard or PayPal bank account to finish the purchase.

- Step 6. Choose the file format in the authorized type and obtain it on the device.

- Step 7. Comprehensive, modify and printing or sign the Wisconsin Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent.

Each authorized papers web template you purchase is the one you have permanently. You have acces to each type you saved in your acccount. Click on the My Forms section and select a type to printing or obtain once again.

Compete and obtain, and printing the Wisconsin Domestic Subsidiary Security Agreement regarding ratable benefit of Lenders and Agent with US Legal Forms. There are millions of specialist and express-distinct types you can use to your business or personal requires.

Form popularity

FAQ

Collateral. Collateral is an asset you can pledge to the lender as an additional form of security, should you not be able to repay the loan. Collateral can help a borrower secure the financing they need and can help the lender recoup their investment if the borrower defaults on the loan.

Several types of collateral can be used for a secured personal loan. Your options may include cash in a savings account, a car or a house. There are two types of loans you can obtain from banks or other financial institutions: secured loans and unsecured loans.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

Ratable benefit means for the benefit of the Secured Parties in ance with the terms of Section 8.02 of the Credit Agreement.

Mortgages, charges, pledges and liens are all types of security. The main types of quasi-security are guarantees and indemnities, comfort letters, set-off, netting, standby credits, on demand guarantees and bonds and retention of title (ROT) arrangements.

Types of Collateral When you take out a mortgage, your home becomes the collateral. If you take out a car loan, then the car is the collateral for the loan. The types of collateral that lenders commonly accept include cars?only if they are paid off in full?bank savings deposits, and investment accounts.

This security is called collateral, which minimizes the risk for lenders by ensuring that the borrower keeps up with their financial obligation. The borrower has a compelling reason to repay the loan on time because if they default, they stand to lose their home or other assets pledged as collateral.