A debt collector may not use unfair or unconscionable means to collect a debt. This includes causing a person to incur charges for communications by concealing the true propose of the communication.

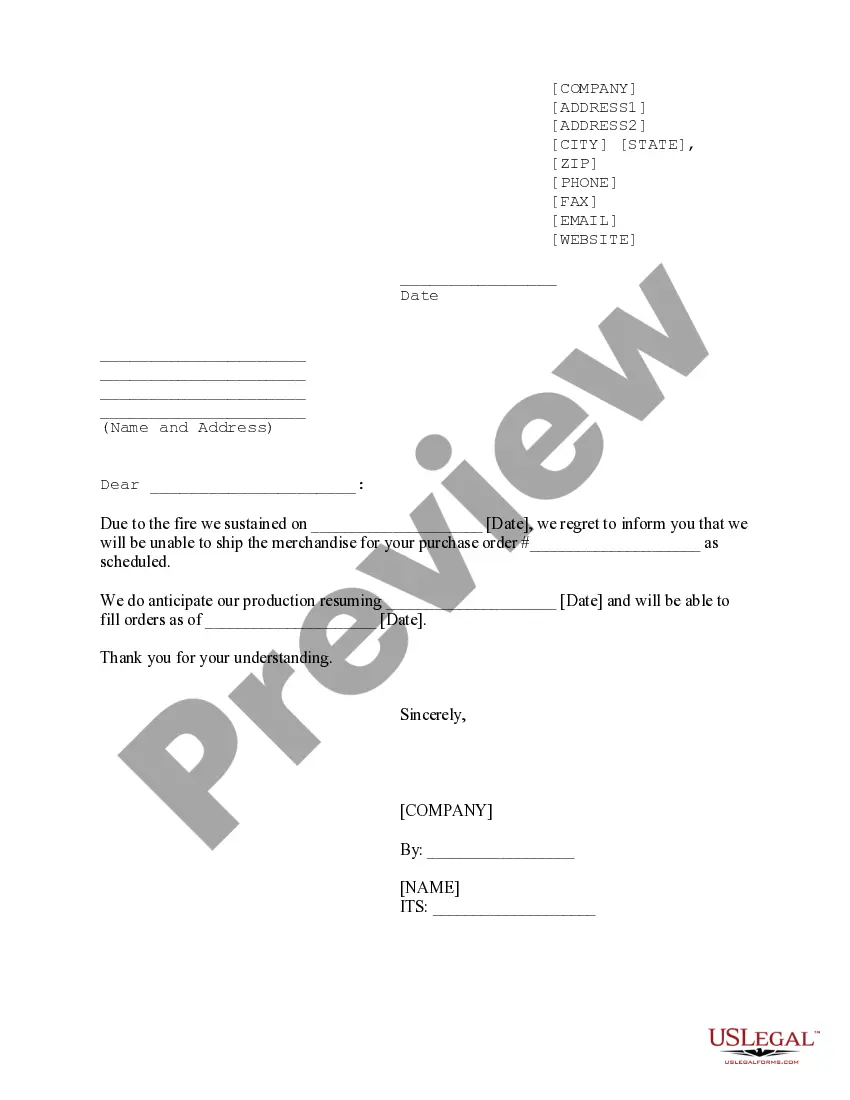

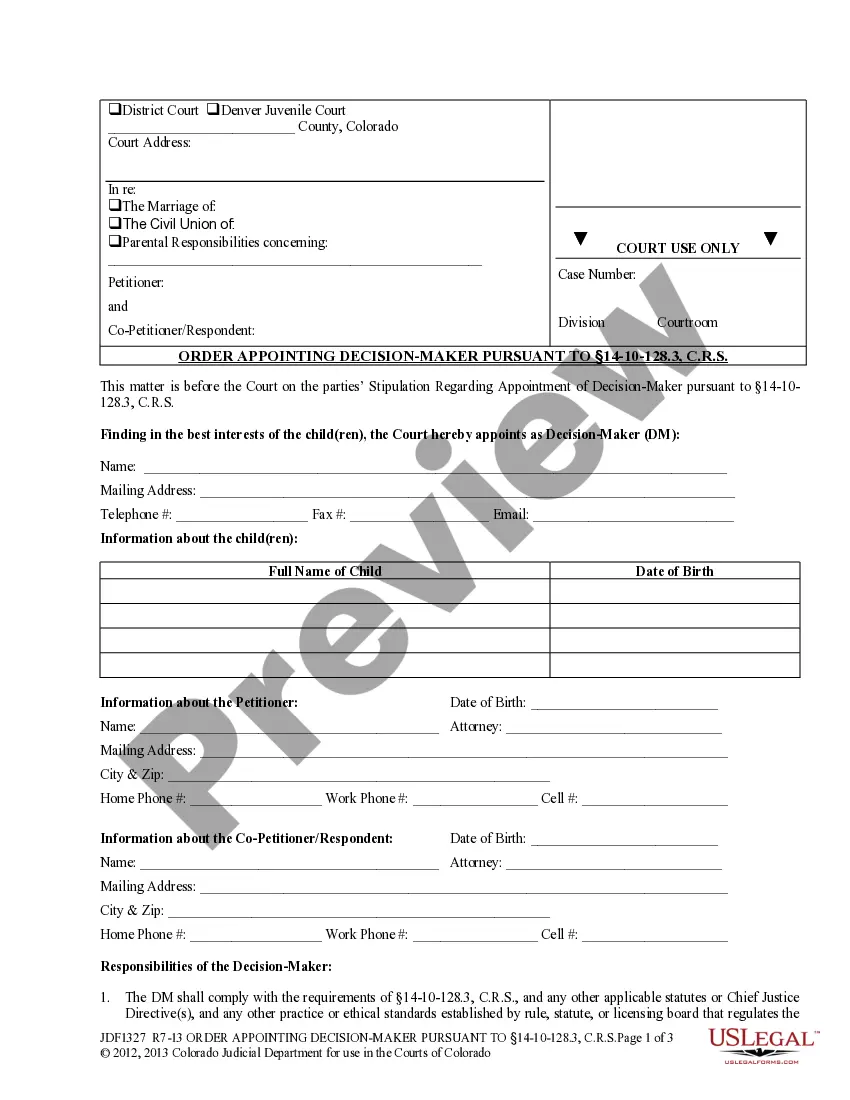

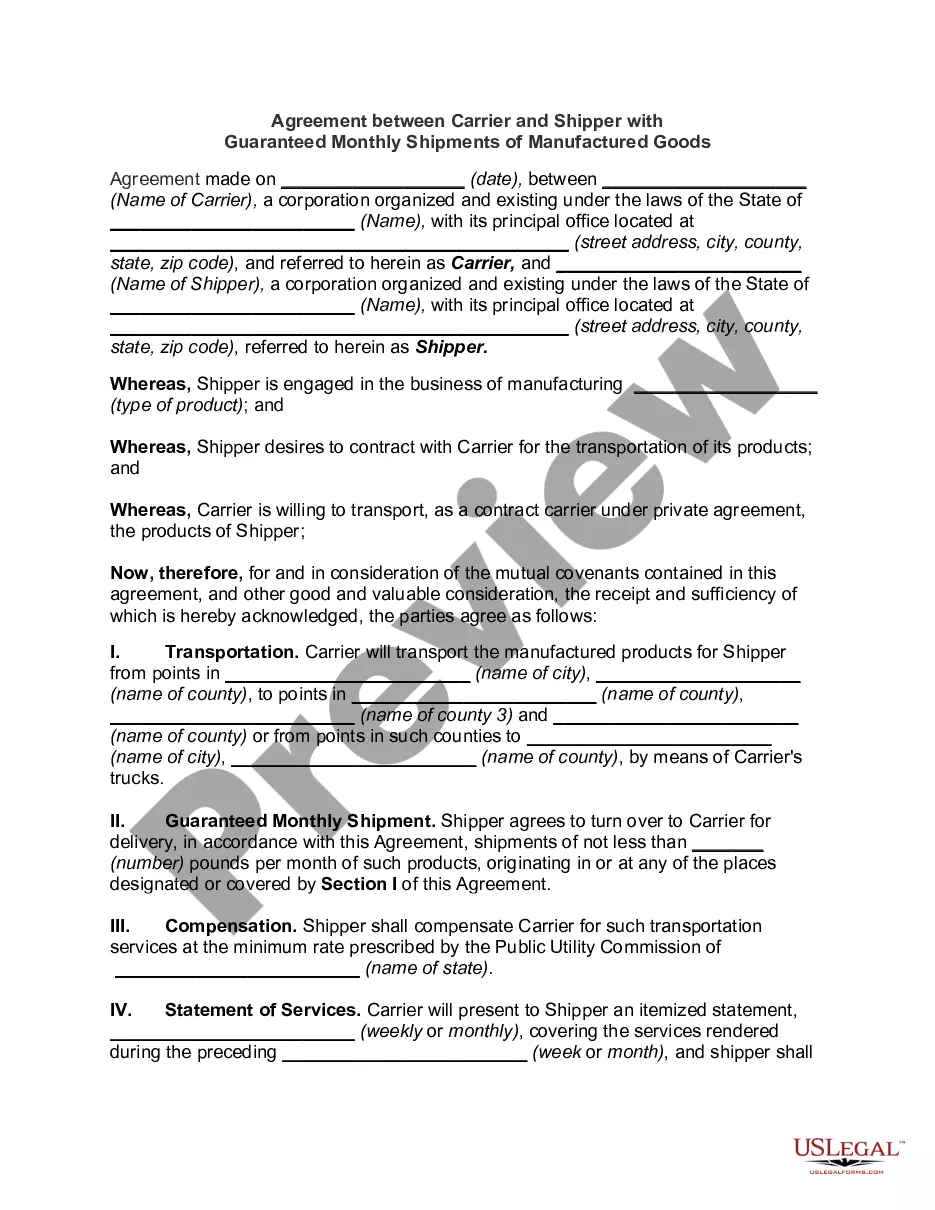

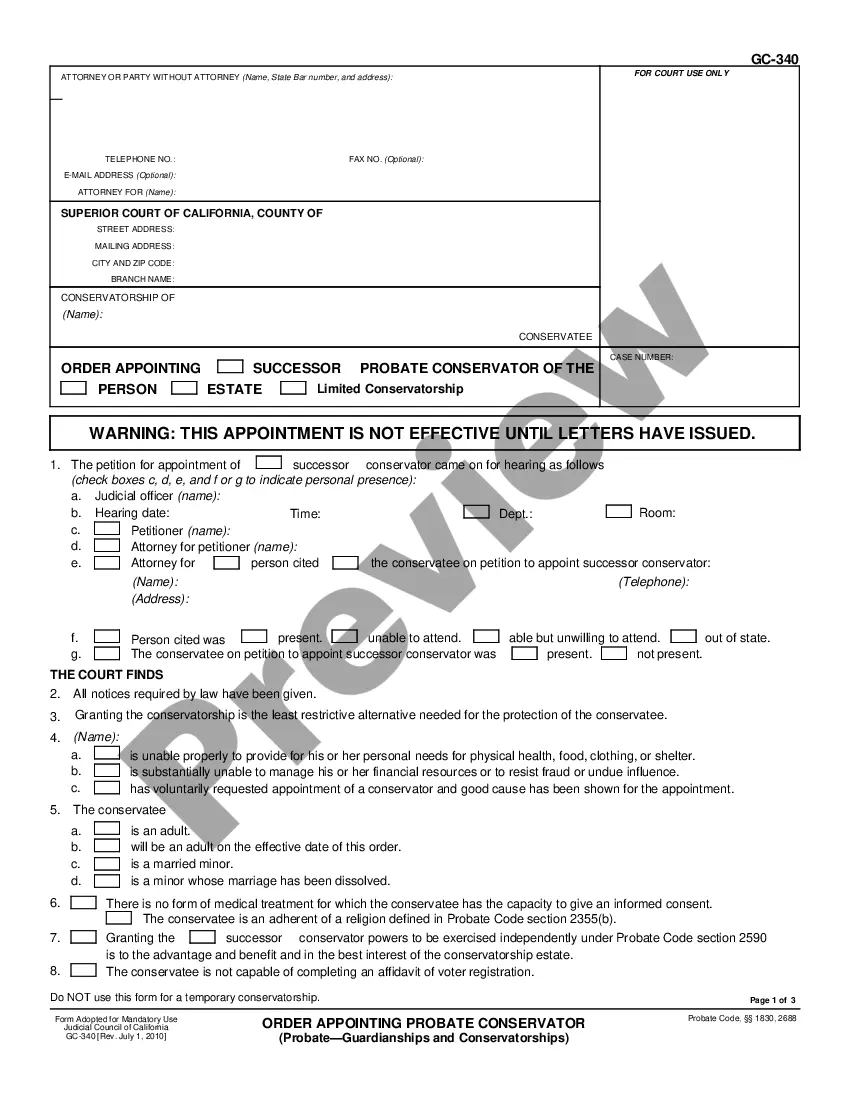

Wisconsin Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication

Description

How to fill out Notice To Debt Collector - Causing A Consumer To Incur Charges For Communications By Concealing The Purpose Of The Communication?

You can spend multiple hours online attempting to locate the legal document template that complies with the state and federal regulations you need.

US Legal Forms provides a vast selection of legal documents that are reviewed by experts.

You can conveniently download or print the Wisconsin Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication from your account.

If available, use the Review button to go through the document template as well. To find another version of the form, utilize the Search field to discover the template that satisfies your needs and requirements.

- If you have a US Legal Forms account, you may Log In and click the Obtain button.

- Subsequently, you are able to complete, modify, print, or sign the Wisconsin Notice to Debt Collector - Causing a Consumer to Incur Charges for Communications by Concealing the Purpose of the Communication.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the county/town of your choice.

- Review the form details to ensure you've chosen the right document.

Form popularity

FAQ

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

You have 30 days to dispute a debt or part of a debt within 30 days from when you first receive the required information from the debt collector.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

The Fair Credit Reporting Act is a federal law that regulates the collection and reporting of credit information from consumers. The law governs how a consumer's credit information is collected and shared with others.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.