Wisconsin Second Warrant Agreement by General Physics Corp.

Description

How to fill out Second Warrant Agreement By General Physics Corp.?

If you want to complete, obtain, or print out lawful papers layouts, use US Legal Forms, the greatest collection of lawful forms, which can be found on-line. Make use of the site`s basic and convenient search to obtain the files you want. Numerous layouts for enterprise and person purposes are sorted by classes and says, or search phrases. Use US Legal Forms to obtain the Wisconsin Second Warrant Agreement by General Physics Corp. with a few click throughs.

In case you are previously a US Legal Forms customer, log in to your profile and click on the Down load button to have the Wisconsin Second Warrant Agreement by General Physics Corp.. You can even accessibility forms you previously downloaded in the My Forms tab of your profile.

Should you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for the right metropolis/land.

- Step 2. Take advantage of the Review method to look over the form`s articles. Never forget about to learn the information.

- Step 3. In case you are not happy using the develop, use the Look for area at the top of the display screen to locate other versions from the lawful develop design.

- Step 4. Upon having identified the form you want, select the Purchase now button. Select the rates prepare you prefer and add your qualifications to sign up on an profile.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal profile to complete the transaction.

- Step 6. Choose the format from the lawful develop and obtain it in your product.

- Step 7. Total, edit and print out or sign the Wisconsin Second Warrant Agreement by General Physics Corp..

Every lawful papers design you get is the one you have eternally. You might have acces to each and every develop you downloaded within your acccount. Click on the My Forms portion and pick a develop to print out or obtain once again.

Compete and obtain, and print out the Wisconsin Second Warrant Agreement by General Physics Corp. with US Legal Forms. There are millions of professional and express-certain forms you may use for the enterprise or person requirements.

Form popularity

FAQ

Companies often issue stock warrants by attaching the warrant to a bond or other security that they use to raise capital. The warrant helps attract investors and also represents potential future capital for the issuing company.

The Warrants and the shares of Common Stock issuable upon exercise of the Warrants will be freely transferable by Holders that are not Affiliates of the Company.

What Is Warrant Coverage? Warrant coverage is an agreement between a company and one or more shareholders where the company issues a warrant equal to some percentage of the dollar amount of an investment. Warrants, similar to options, allow investors to acquire shares at a designated price.

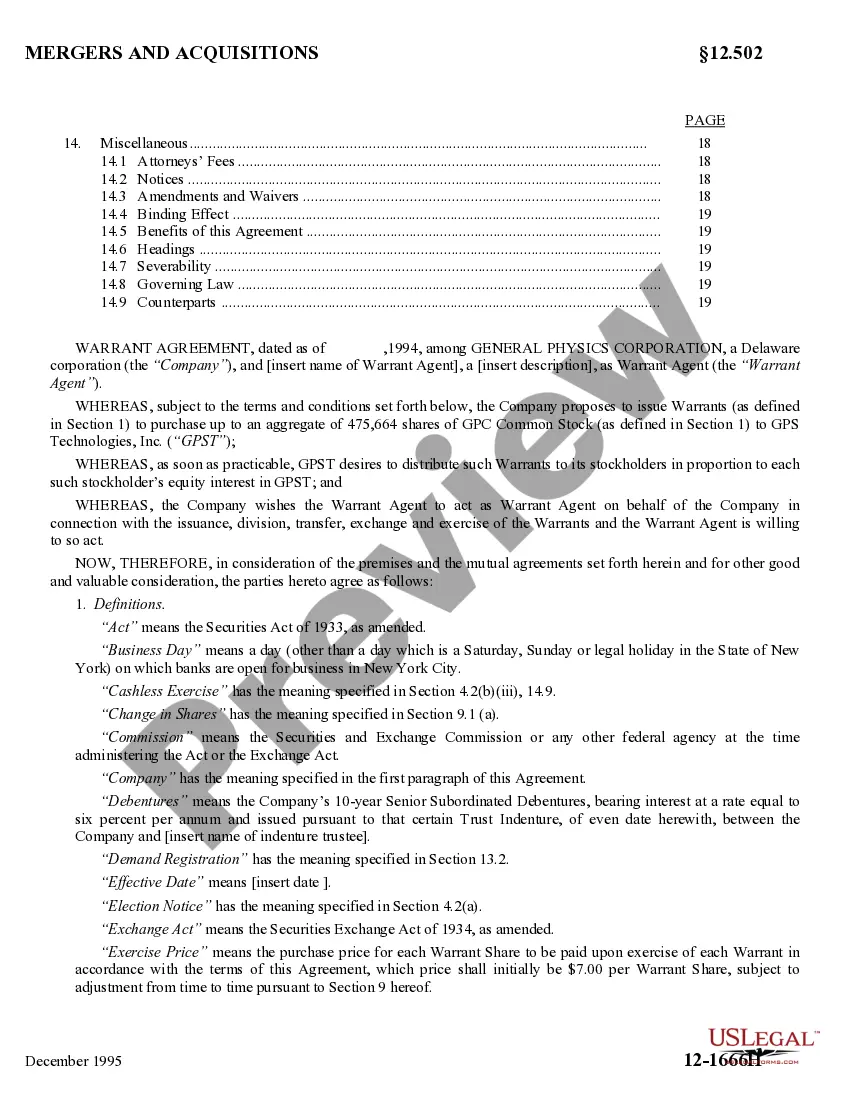

What is a Warrant? A warrant is an agreement between two parties ? the ?issuer? (i.e., a company) and the ?holder? of the warrant ? that entitles the holder to purchase the issuer's stock at a specified price within a certain time frame.