Statutory Guidelines [Appendix A(3) IRC 130] regarding certain personal injury liability assignments.

Wisconsin Certain Personal Injury Liability Assignments IRS Code 130

Description

How to fill out Certain Personal Injury Liability Assignments IRS Code 130?

Have you been in the situation the place you require documents for either organization or personal functions virtually every day? There are tons of authorized papers web templates available online, but getting versions you can depend on isn`t straightforward. US Legal Forms provides thousands of type web templates, like the Wisconsin Certain Personal Injury Liability Assignments IRS Code 130, which can be composed to meet federal and state needs.

Should you be already knowledgeable about US Legal Forms website and also have your account, basically log in. After that, you can acquire the Wisconsin Certain Personal Injury Liability Assignments IRS Code 130 format.

Should you not come with an profile and need to begin to use US Legal Forms, adopt these measures:

- Get the type you require and make sure it is for your correct city/region.

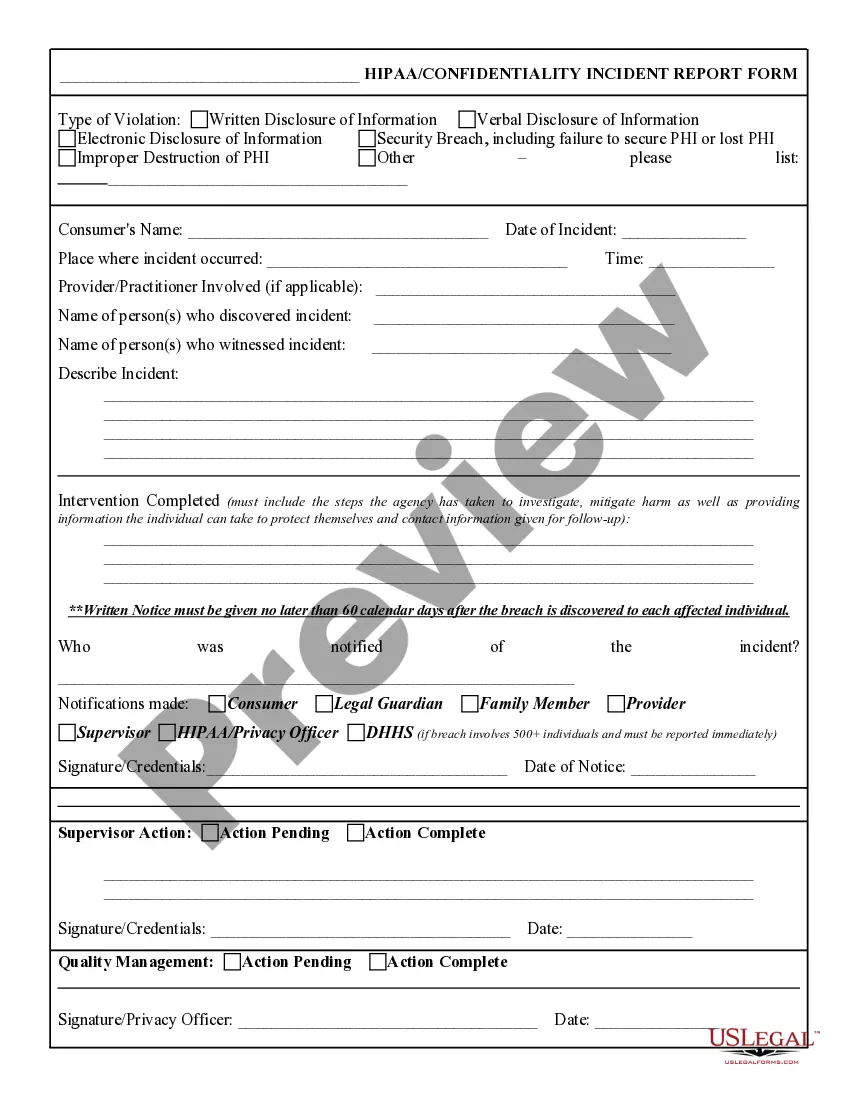

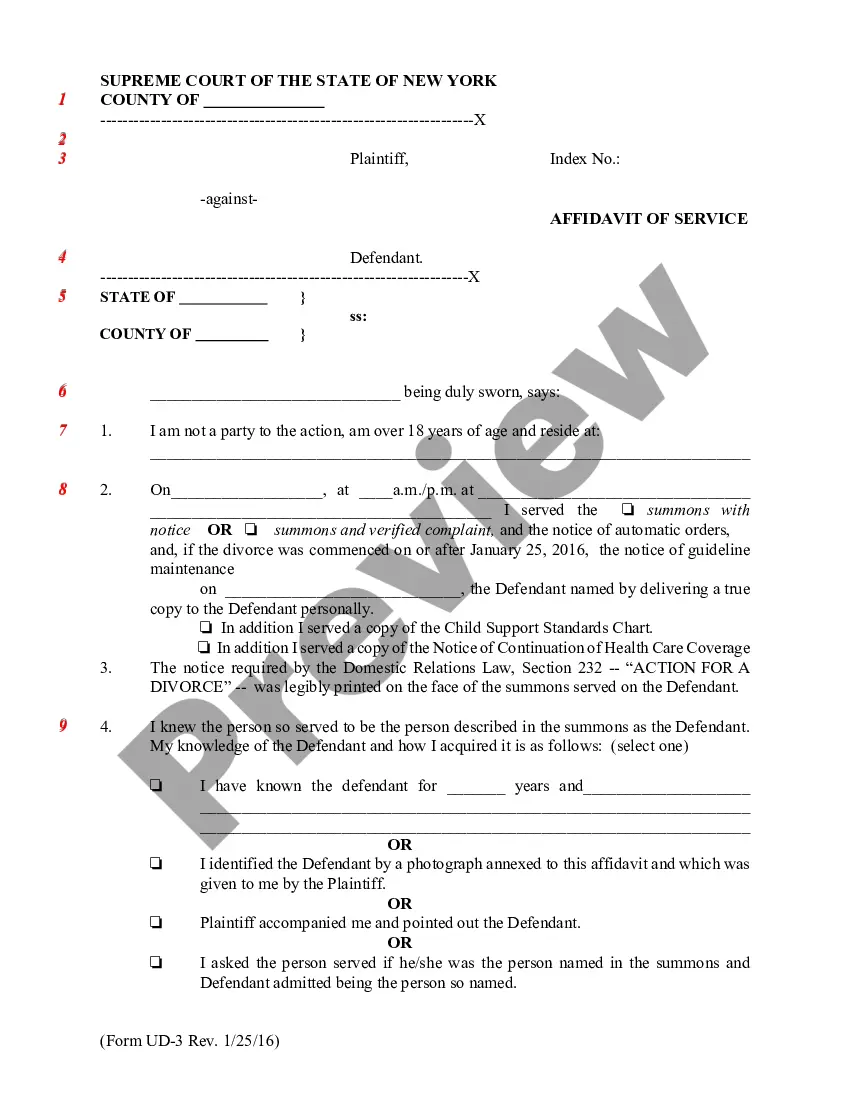

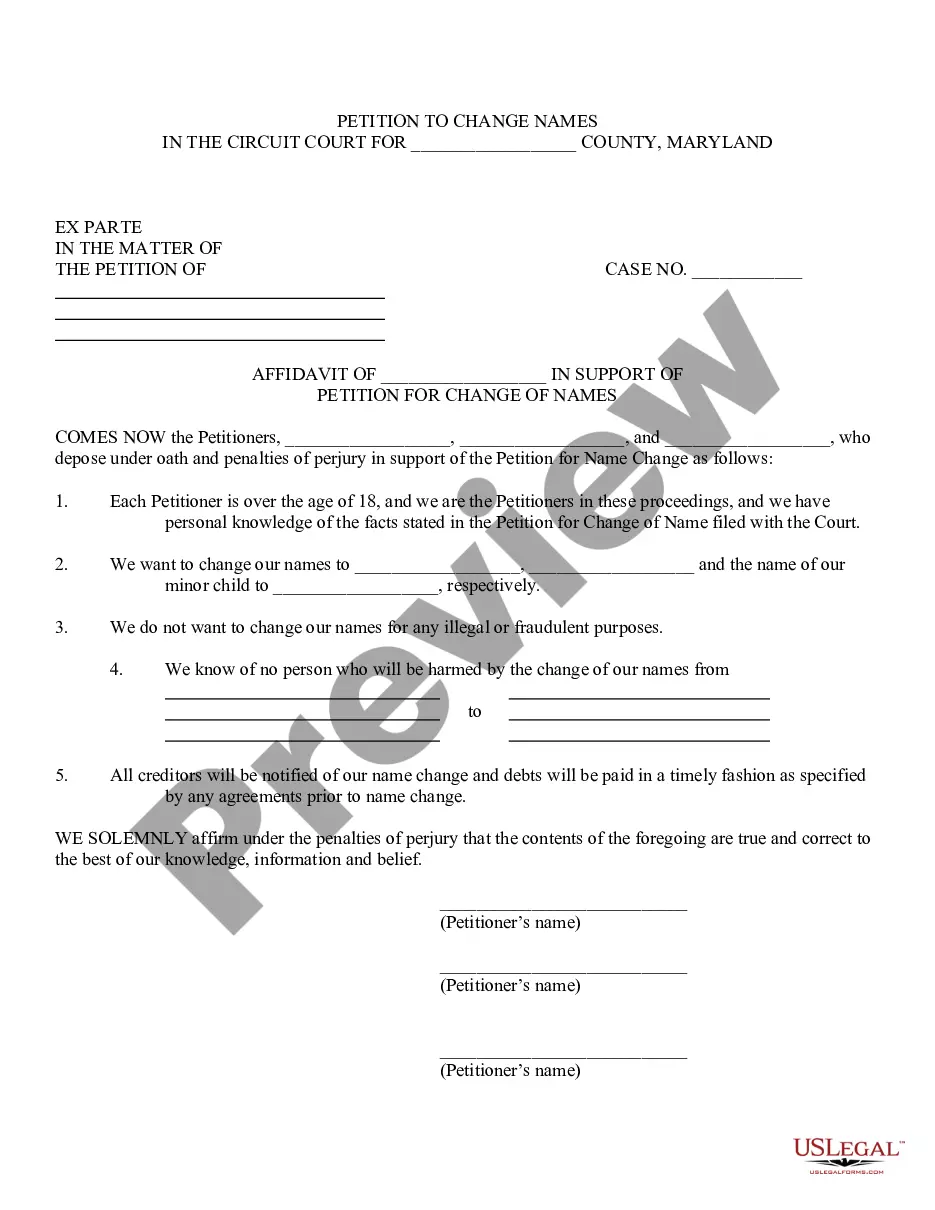

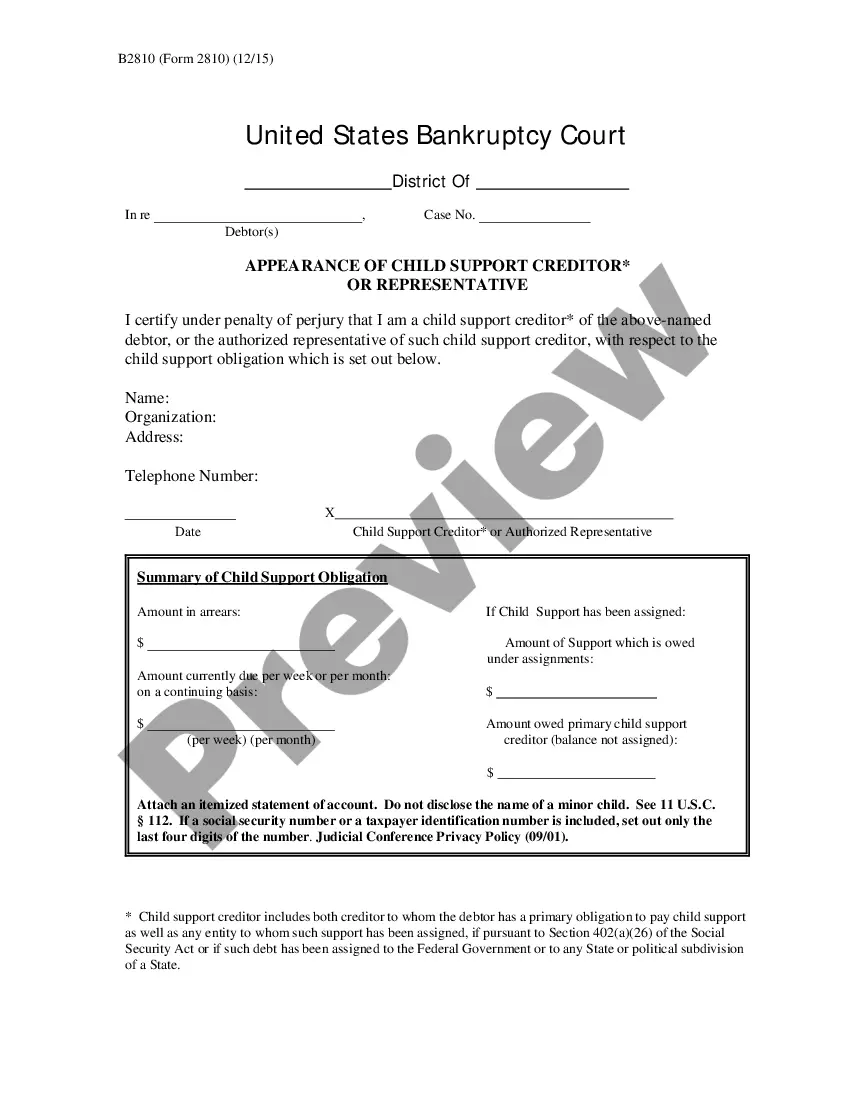

- Use the Review switch to analyze the form.

- Browse the description to ensure that you have selected the proper type.

- When the type isn`t what you`re looking for, make use of the Look for area to get the type that fits your needs and needs.

- If you find the correct type, simply click Buy now.

- Pick the costs plan you want, submit the specified info to create your account, and purchase your order using your PayPal or Visa or Mastercard.

- Pick a hassle-free data file structure and acquire your backup.

Get each of the papers web templates you have bought in the My Forms menus. You can get a extra backup of Wisconsin Certain Personal Injury Liability Assignments IRS Code 130 any time, if necessary. Just go through the necessary type to acquire or produce the papers format.

Use US Legal Forms, the most substantial variety of authorized kinds, to save time as well as avoid errors. The service provides expertly produced authorized papers web templates that you can use for a selection of functions. Generate your account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...

A qualified assignment is a formal arrangement wherein a defendant or its insurance company or other representative agrees to transfer their obligation to make future periodic payments to a third party (?an assignment company?). This is generally done using a uniform qualified assignment (?UQA?) document.

For purposes of this section, the term ?qualified funding asset? means any annuity contract issued by a company licensed to do business as an insurance company under the laws of any State, or any obligation of the United States, if? 130(d)(1)

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...

Income tax exemption: Structured settlement payments?including growth?are 100% income tax-free. While lump sum cash settlements are income tax-free for physical injury cases, growth on funds placed in a traditional investment may be taxable.

Any amount received for agreeing to a qualified assignment shall not be included in gross income to the extent that such amount does not exceed the aggregate cost of any qualified funding assets.