Wisconsin Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

Have you ever been in a situation where you need documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms provides thousands of form templates, including the Wisconsin Resolution of Meeting of LLC Members to Sell or Transfer Stock, which are crafted to meet federal and state requirements.

Select the payment plan you prefer, complete the required information to create your account, and process the payment using your PayPal or credit card.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Next, you can download the Wisconsin Resolution of Meeting of LLC Members to Sell or Transfer Stock template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/state.

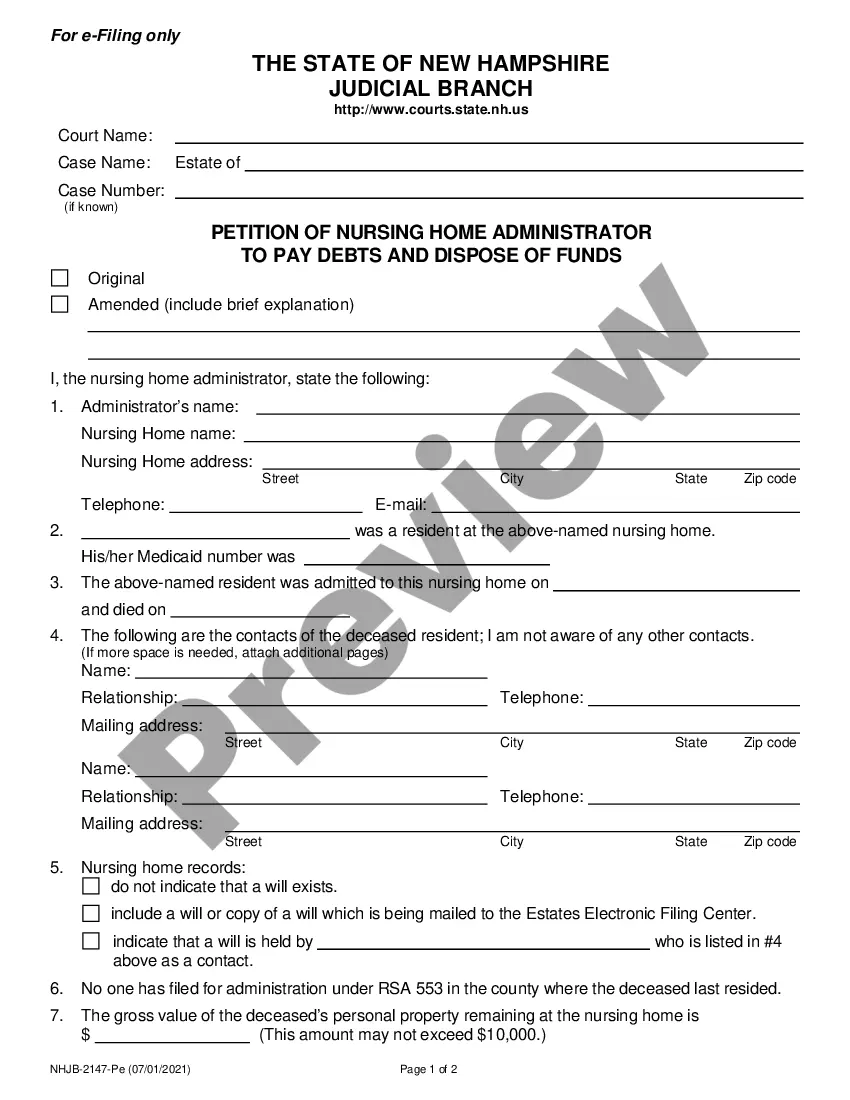

- Utilize the Preview button to review the form.

- Check the summary to confirm that you have selected the right form.

- If the form is not what you are searching for, use the Search field to find a form that meets your needs and requirements.

- Once you find the correct form, click Get now.

Form popularity

FAQ

How to Transfer Shares of a Private Limited CompanyStep 1: Obtain share transfer deed in the prescribed format.Step 2: Execute the share transfer deed duly signed by the Transferor and Transferee.Step 3: Stamp the share transfer deed as per the Indian Stamp Act and Stamp Duty Notification in force in the State.More items...

Have the member submit written notice of resignation to the LLC or conduct a vote among members of the LLC if there is no operating agreement and you are removing a member. Under the Wisconsin LLC statute, more than 50 percent of LLC members must approve of the removal of a member.

To make a change, submit your request using one of the following methods:Email DORRegistration@wisconsin.gov.Fax (608) 327-0232, ATTN: Registration Unit.Call (608) 266-2776 (except for a name change, where we require a copy of the Articles of Amendment)Mail: ATTN: Registration Unit. PO Box 8902. Madison, WI 53708-8902.

Does an LLC have shares? No. Only businesses structured as a corporation issue shares. With a limited liability company, ownership is expressed by percentage and membership units.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

To make amendments to your Wisconsin LLC's articles of organization, provide Wisconsin Department of Financial Institutions Form 504, Articles of Amendment Limited Liability Company. The form is optional; you may draft your own Articles of Amendment.

You can fill out the Transfer Document and then bring it to a notary. Once the document is notarized, you can file the original deed/title and the Transfer Document with the filing agency. A new deed/title will be issued showing that your LLC is now the owner.

Have the member submit written notice of resignation to the LLC or conduct a vote among members of the LLC if there is no operating agreement and you are removing a member. Under the Wisconsin LLC statute, more than 50 percent of LLC members must approve of the removal of a member.

In a corporation, shares of stock are issued and may be transferred freely or even gifted to other owners. In LLCs, however, this does not apply. Since LLCs are more like partnerships, you cannot force partnerships between people without their agreement.

Every Wisconsin LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.