Wisconsin Resolution of Meeting of LLC Members to Dissolve the Company

Description

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

Are you presently in the situation that you require documents for either business or personal purposes almost every day? There are numerous legal document templates available online, but finding ones you can trust isn't simple.

US Legal Forms offers thousands of form templates, such as the Wisconsin Resolution of Meeting of LLC Members to Dissolve the Company, that are crafted to comply with state and federal requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you can download the Wisconsin Resolution of Meeting of LLC Members to Dissolve the Company template.

- Obtain the form you need and ensure it is for the correct city/state.

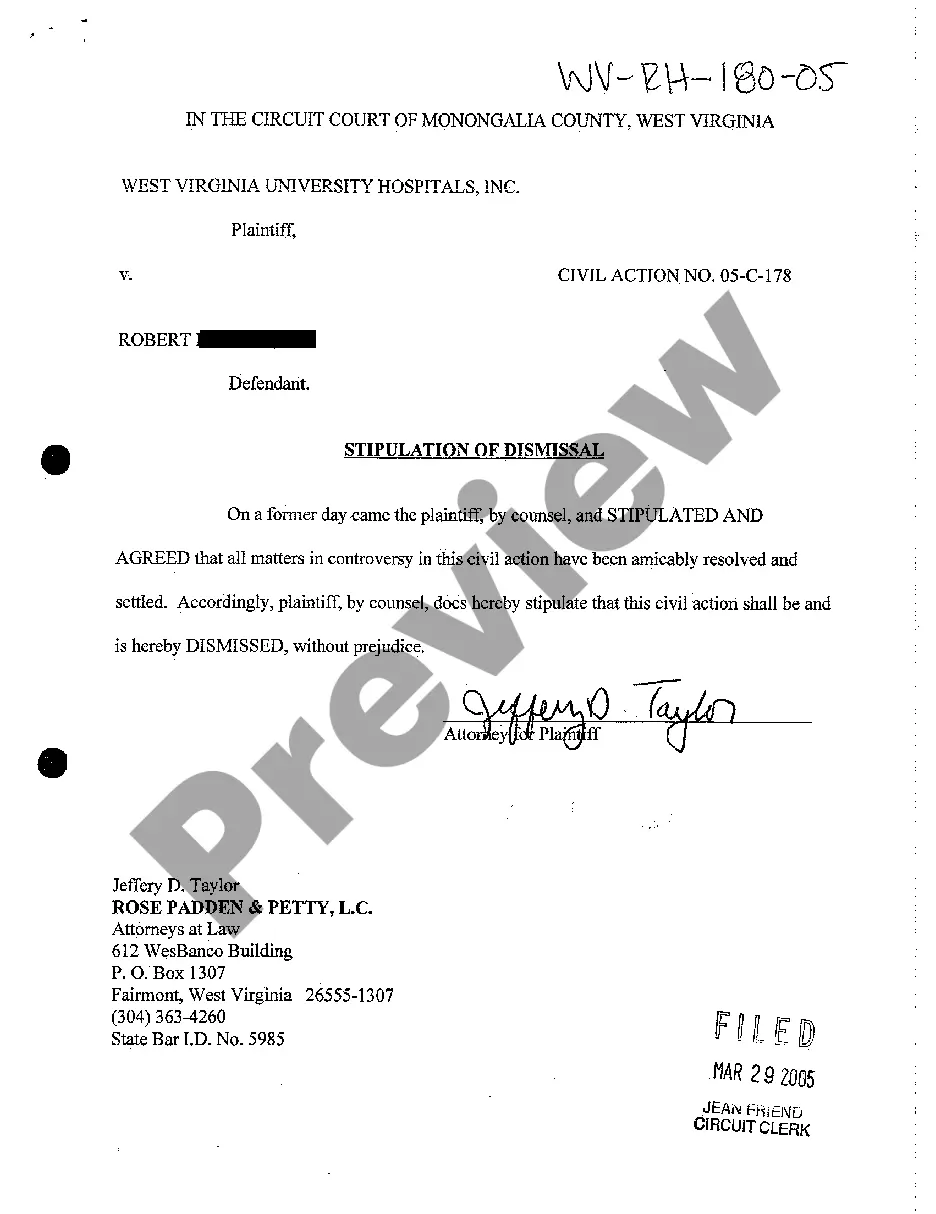

- Use the Preview button to review the document.

- Check the description to ensure that you have selected the right form.

- If the form isn’t what you’re looking for, utilize the Search area to find the document that meets your needs and requirements.

- When you find the right form, click Acquire now.

- Choose the pricing plan you prefer, fill out the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Removal may be as simple as the member submitting a letter of resignation, depending on the relevant provisions. However, if the member is not willing to voluntarily resign, the provisions might provide, for example, a voting procedure allowing the other members to vote for the removal of the recalcitrant member.

Have the member submit written notice of resignation to the LLC or conduct a vote among members of the LLC if there is no operating agreement and you are removing a member. Under the Wisconsin LLC statute, more than 50 percent of LLC members must approve of the removal of a member.

Generally, a majority vote, or sometimes a unanimous vote, is necessary to dissolve a company. In partnerships, the partnership agreement should address the process for dissolution. If it does not, you must make sure that you follow Wisconsin business statutes.

A: The only way to dissolve an entity is by filing Articles of Dissolution with the Department of Financial Institutions. If Articles of Dissolution were received and filed by this department, then we would not have grounds to Administratively Dissolve the entity.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

There is a $20 file fee. Filings usually take about five business days to process. You can get expedited processing for an additional fee. An articles of dissolution form is available for download from the WDFI website.

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?19-Oct-2021

Closing Correctly Is ImportantOfficially dissolving an LLC is important. If you don't, you can be held personally liable for the unpaid debts and taxes of the LLC. A few additional fees you should look for; Many states also levy a fee against LLCs each year.

How to Close an Inactive BusinessDissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved.Pay Any Outstanding Bills.Cancel Any Business Licenses or Permits.File Your Final Federal and State Tax Returns.06-Dec-2013

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.