Wisconsin Unrestricted Charitable Contribution of Cash

Description

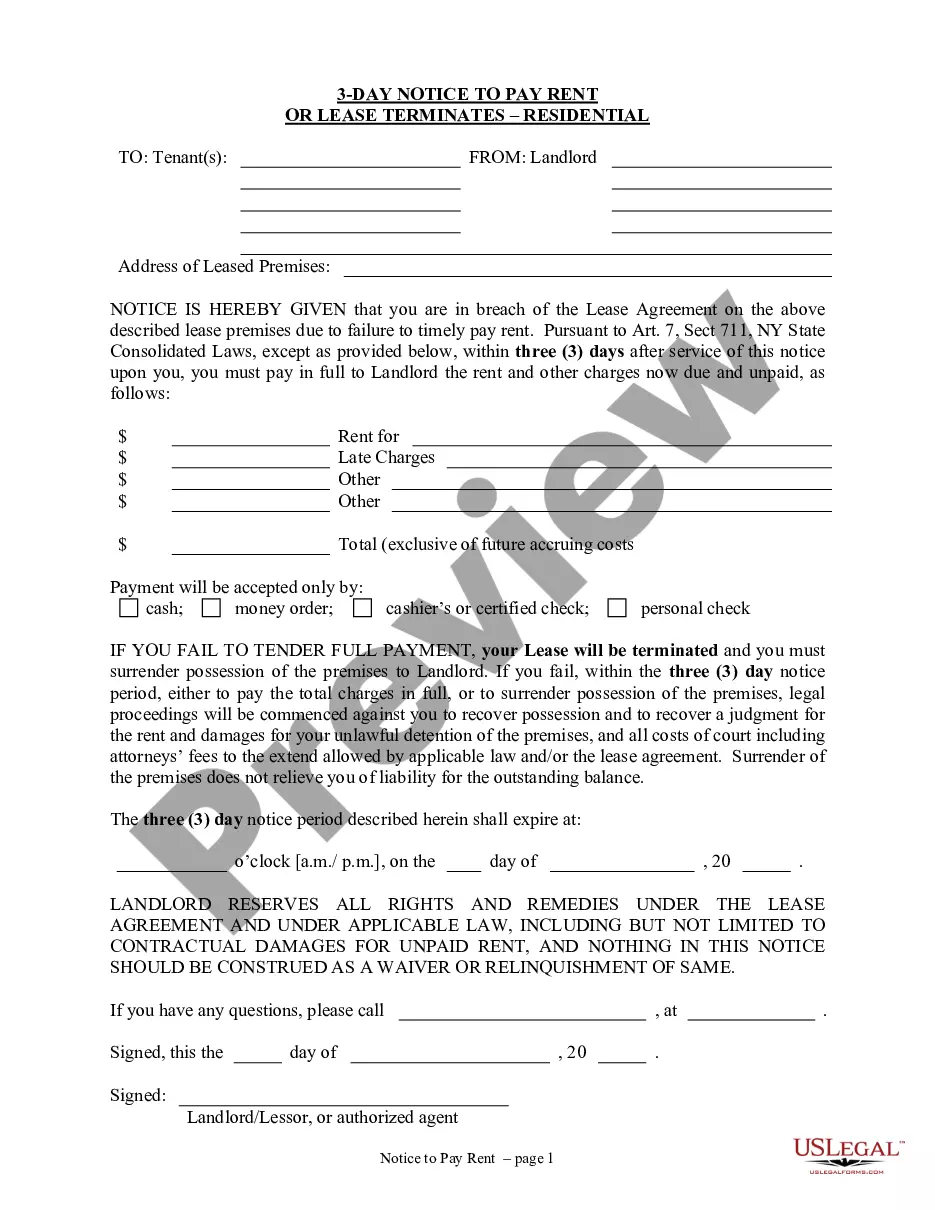

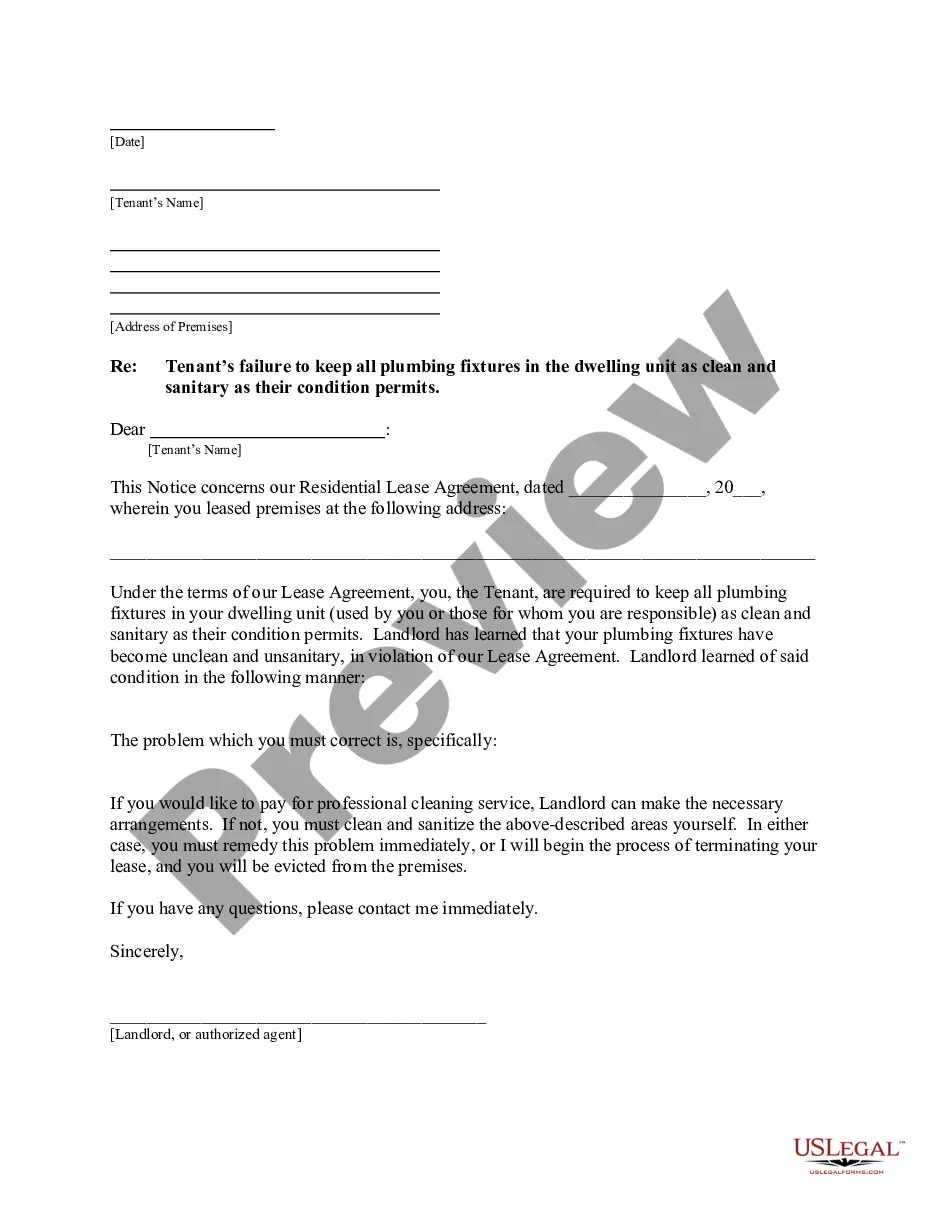

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you situated in a location where you require documents for both business and personal usage almost every day.

There are numerous legitimate form templates accessible online, but locating those you can rely on is not simple.

US Legal Forms provides thousands of document templates, such as the Wisconsin Unrestricted Charitable Contribution of Cash, designed to comply with state and federal requirements.

Once you find the correct form, click Purchase now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and complete your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Unrestricted Charitable Contribution of Cash template.

- If you do not have an account and wish to utilize US Legal Forms, follow these instructions.

- Identify the form you need and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Examine the information to confirm that you have selected the correct form.

- If the form is not what you are searching for, utilize the Search field to find the form that suits your requirements.

Form popularity

FAQ

The form for noncash charitable contributions is typically the IRS Form 8283, also known as the Noncash Charitable Contributions form. This form is essential for documenting the donation of noncash assets, such as property or stocks, to recognized charities. When making a Wisconsin Unrestricted Charitable Contribution of Cash, it's important to accurately complete this form to ensure compliance with tax regulations and maximize your benefits. For a user-friendly experience, consider using our US Legal Forms platform, which offers templates and guidance for filling out this form correctly.

To deduct your charitable contributions in Wisconsin, you need to ensure that you have maintained all necessary records, like receipts or bank statements. Deductible contributions include cash donations made to recognized charities. By accurately recording your Wisconsin Unrestricted Charitable Contributions of Cash, you can maximize your deductions when filing your tax return. Using platforms like uslegalforms can simplify the process of organizing and reporting these contributions.

To claim your Wisconsin Unrestricted Charitable Contribution of Cash, you must itemize your deductions on your tax return. Start by gathering all relevant receipts and documentation that verify your contributions. Make sure to fill out Schedule A of your Form 1040, where you can list these contributions. By following these steps, you can effectively showcase your generosity while reaping potential tax benefits.

The maximum amount you can write off for charitable donations depends on your income and the type of donation made. Typically, individuals can deduct up to 60% of their adjusted gross income for cash contributions made directly to qualified charities, including a Wisconsin Unrestricted Charitable Contribution of Cash. Keep in mind that limitations can vary based on the specific organization and type of donation. To ensure you maximize your deductions while complying with tax laws, utilizing resources like US Legal Forms can help you navigate the rules effectively.

Yes, charitable donations are generally tax deductible in Wisconsin, as long as they are made to qualified organizations. The Wisconsin Unrestricted Charitable Contribution of Cash allows taxpayers to help their communities while also benefitting from deductions. To ensure you receive these benefits, keep accurate records of your donations and consult a tax professional if needed. They can guide you through maximizing your tax advantages.

The deduction for exemptions in Wisconsin refers to the amount taxpayers can deduct for themselves and their dependents. Understanding this deduction is essential, especially when considering the Wisconsin Unrestricted Charitable Contribution of Cash, as it can affect your overall tax liability. This deduction may vary based on your marital status and number of dependents. Always verify current amounts and rules with trusted resources.

You can typically deduct charitable contributions if you meet specific requirements set by the IRS and state laws. The Wisconsin Unrestricted Charitable Contribution of Cash plays a significant role in this process, enabling individuals to support their favorite charities while enjoying tax benefits. Ensure you keep proper documentation of your contributions for accurate reporting. Consulting with a tax professional can help you navigate these deductions.

Yes, charitable contributions are deductible in Wisconsin, provided you contribute to qualified organizations. The Wisconsin Unrestricted Charitable Contribution of Cash allows taxpayers to lessen their tax burdens through donations. Staying informed about the specific eligibility criteria for deductions is crucial for maximizing benefits. Consult the Wisconsin Department of Revenue or a tax professional for detailed guidance.

In some instances, you can deduct charitable contributions without itemizing on your tax return. The IRS has made provisions that allow taxpayers to deduct certain charitable contributions directly. This aspect is especially pertinent for Wisconsin Unrestricted Charitable Contribution of Cash, as it could potentially simplify your filing process. Always double-check recent tax rules to ensure eligibility.

Charitable contributions in Wisconsin are classified based on the type of organization to which you donate. If you contribute cash to a qualifying charity, such as those recognized by the IRS, it generally falls under unrestricted contributions. Understanding these classifications is vital for maximizing your Wisconsin Unrestricted Charitable Contribution of Cash. When in doubt, consider seeking guidance from a tax advisor.