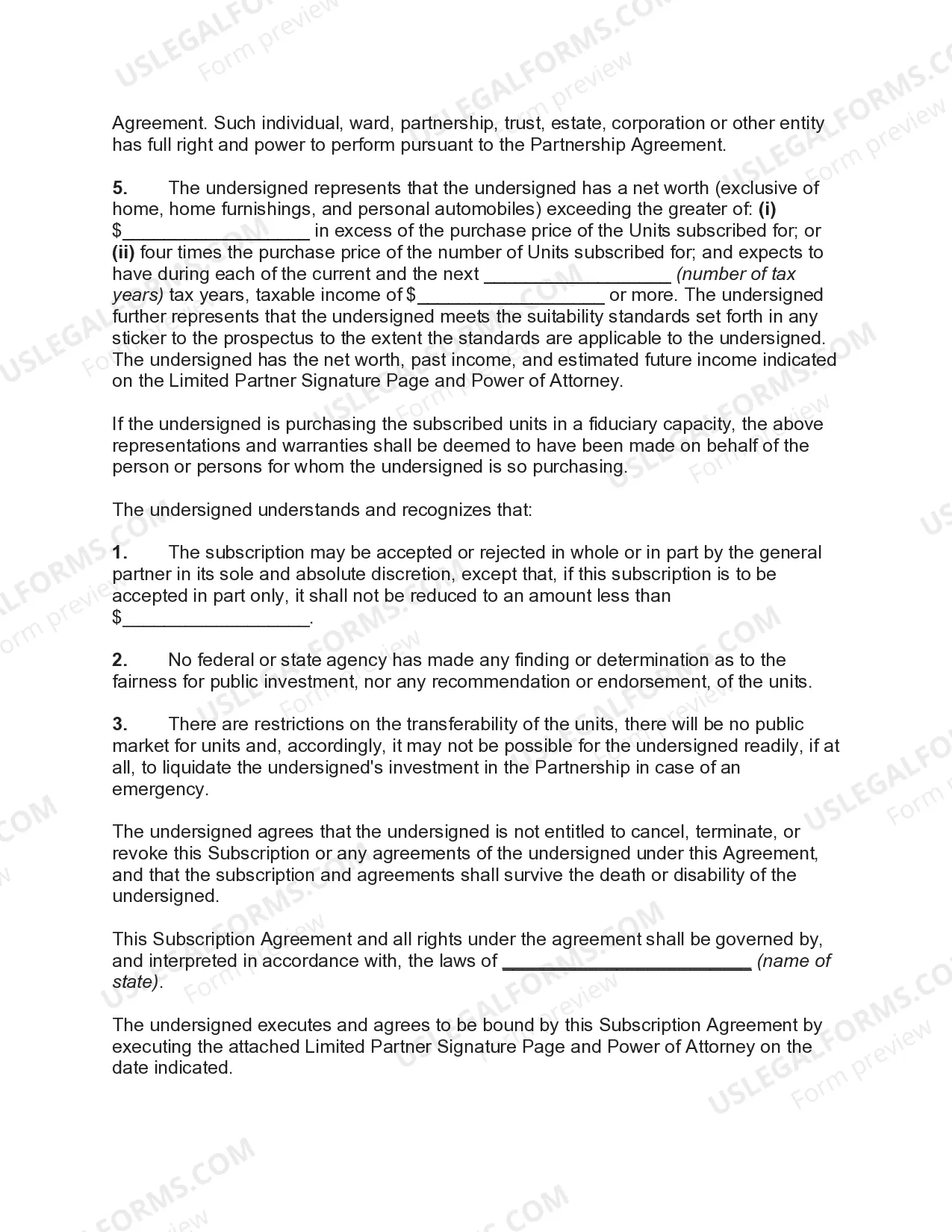

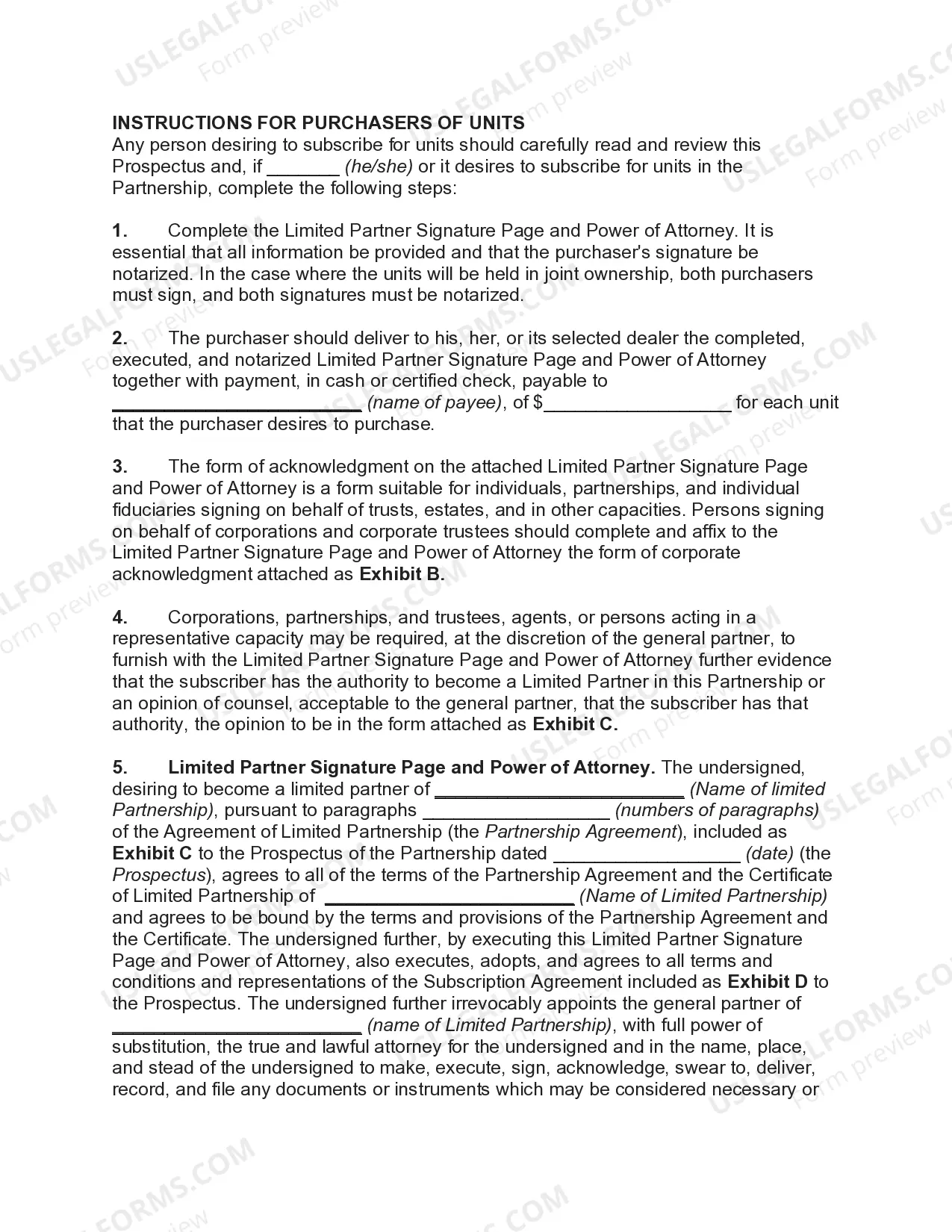

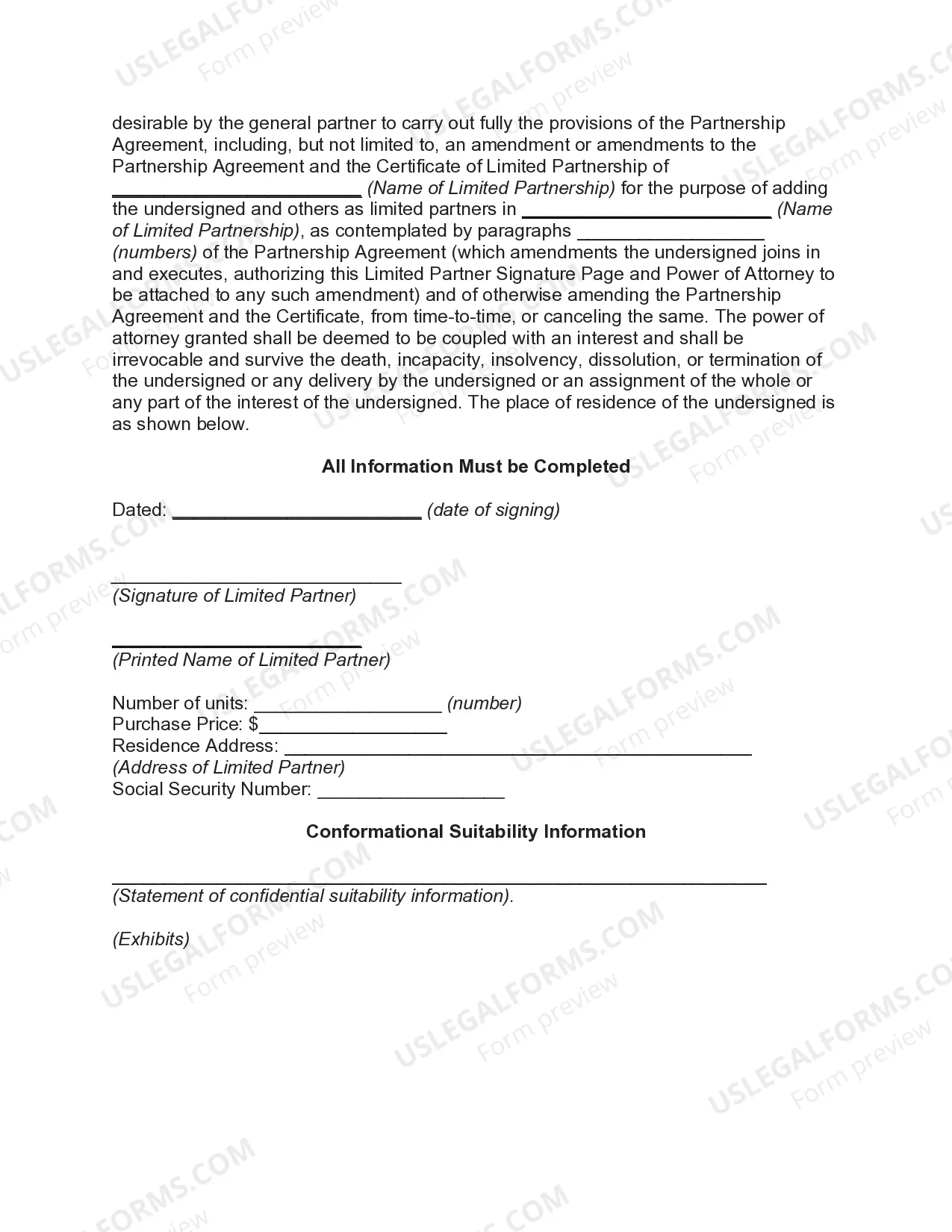

Wisconsin Subscription Agreement regarding Limited Partnership

Description

How to fill out Subscription Agreement Regarding Limited Partnership?

Have you ever been in a situation where you need documents for potential business or particular purposes on a daily basis.

There are numerous legal document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a wide array of form templates, such as the Wisconsin Subscription Agreement for Limited Partnership, crafted to comply with both federal and state regulations.

Once you find the correct form, click Purchase now.

Select the pricing plan you prefer, enter the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Wisconsin Subscription Agreement for Limited Partnership template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Utilize the Review button to inspect the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form does not meet your needs, use the Search section to find the form that fits your requirements.

Form popularity

FAQ

Can you change the Wisconsin LLC members or managers on an amendment? No. Articles of Amendment cannot be filed to add or remove members, managers or owners of the limited liability company. Member and manager information should be in the company's operating agreement, not the Articles of Organization.

To form a partnership in Wisconsin, you should take the following steps:Choose a business name.File a trade name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Trade Name Certificate. Fictitious Name Certificate. Certificate of Trade Name. Certificate of Assumed Business Name....The title of the organizing document will vary by state and may be called:Partnership Agreement.Certificate of Limited Partnership.Certificate of Limited Liability Partnership.Certificate of Good Standing.

To establish a partnership in Wisconsin, here's everything you need to know.Choose a business name.File a trade name.Draft and sign a partnership agreement.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Option 1: Access the Wisconsin Department of Financial Institutions' online services. Scroll down to the bottom and select Click here to start filing. Then, fill in the required fields and submit. Option 2: Download and mail in the Articles of Organization to Wisconsin's Department of Financial Institutions.

All LLC's should have an operating agreement, a document that describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. An operating agreement is similar to the bylaws that guide a corporation's board of directors and a partnership agreement.

To form a limited partnership, you have to register in your state, pay a filing fee and create a limited partnership agreement, which defines how much ownership each limited partner has in your company, and other terms of the partnership.

Every Wisconsin LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

General partners are individuals who do actively participate in the control of the limited partnership and who are fully liable for the debts of the limited partnership. Limited partnerships are generally required to utilize a written limited partnership agreement.

Every Wisconsin LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.