Wisconsin Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Minutes Of Special Meeting Of The Board Of Directors Of (Name Of Corporation) To Adopt Stock Ownership Plan Under Section 1244 Of The Internal Revenue Code?

Are you presently in a circumstance where you frequently require documents for either business or personal reasons almost daily.

There are numerous authentic document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers thousands of document templates, such as the Wisconsin Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, which are designed to fulfill state and federal requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can get an additional copy of the Wisconsin Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code at any time if needed. Just select the required document to download or print the template. Use US Legal Forms, the largest collection of authentic forms, to save time and avoid errors. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Wisconsin Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you require and ensure it is for the correct area/state.

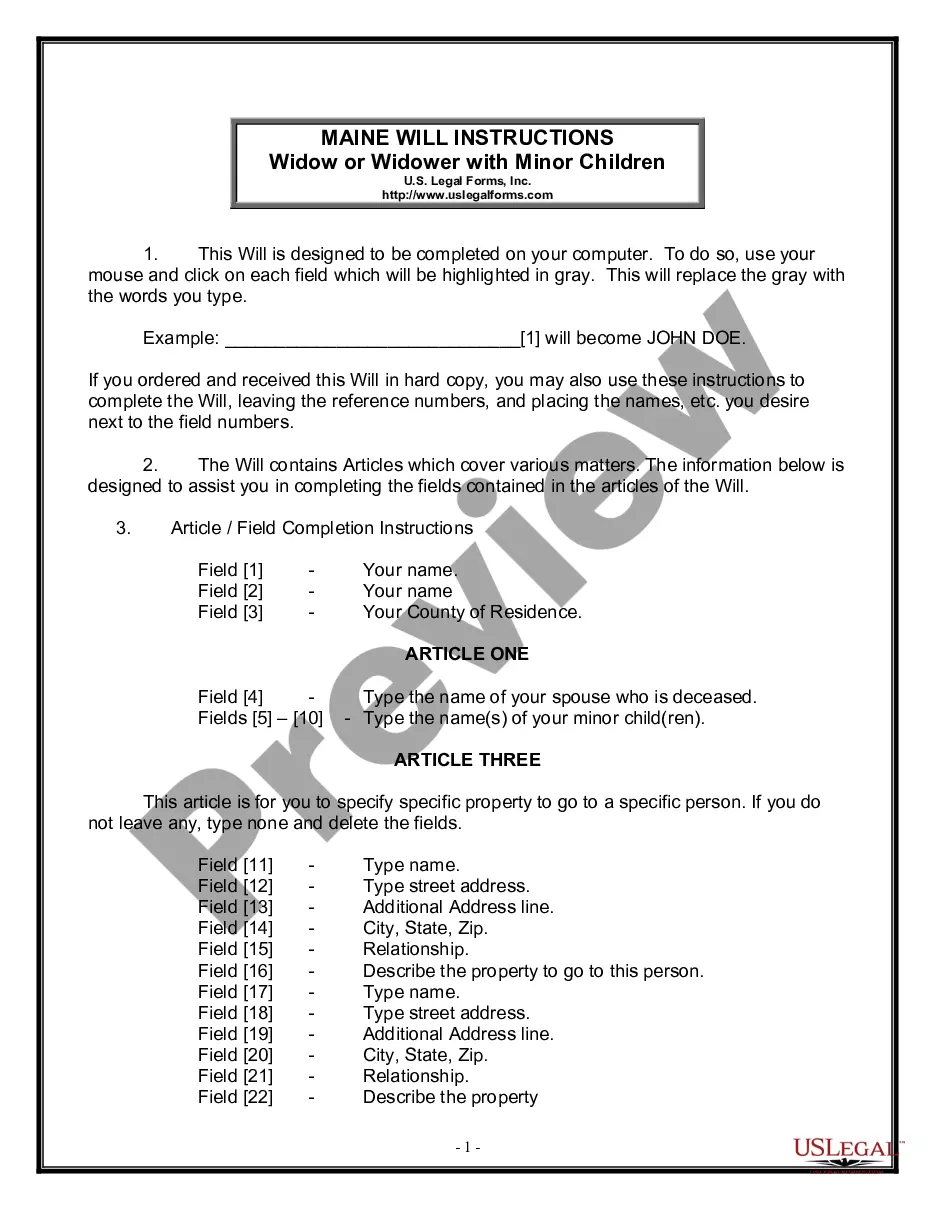

- Utilize the Preview button to review the form.

- Check the details to ensure you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the document that fits your needs and requirements.

- When you locate the right document, click on Purchase now.

- Choose the payment plan you desire, provide the necessary information to create your account, and pay for the transaction with your PayPal or credit card.

Form popularity

FAQ

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

When should I hold a shareholder meeting? An annual shareholder meeting is typically scheduled just after the end of the fiscal year. This allows for the previous year's financial performance to be fully assessed and discussed.

File their definitive proxy statement by the later of 25 calendar days before the shareholder meeting or five calendar days after the company files its definitive proxy statement; and. Solicit shareholders of the company representing at least 67 percent of the voting power of the shares entitled to vote at the meeting.

The corporation can allow others to call a special meeting, such as the BoD Chair, CEO, or yes, shareholders.

Even for a big, popular firm like Warren Buffett's Berkshire Hathaway, the business portion of the agenda takes only about 20 minutes. The election of directors and votes on shareholder proposals are handled in a largely scripted manner. At the conclusion of the meeting, the minutes are formally recorded.

The Board and shareholders are required to meet periodically (the frequency of meetings will depend based on where you are incorporated). The minutes are a record that the meeting occurred. The Board's role is to provide management and oversight of the company, its management and its activities.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.