Wisconsin Assignment of Assets

Description

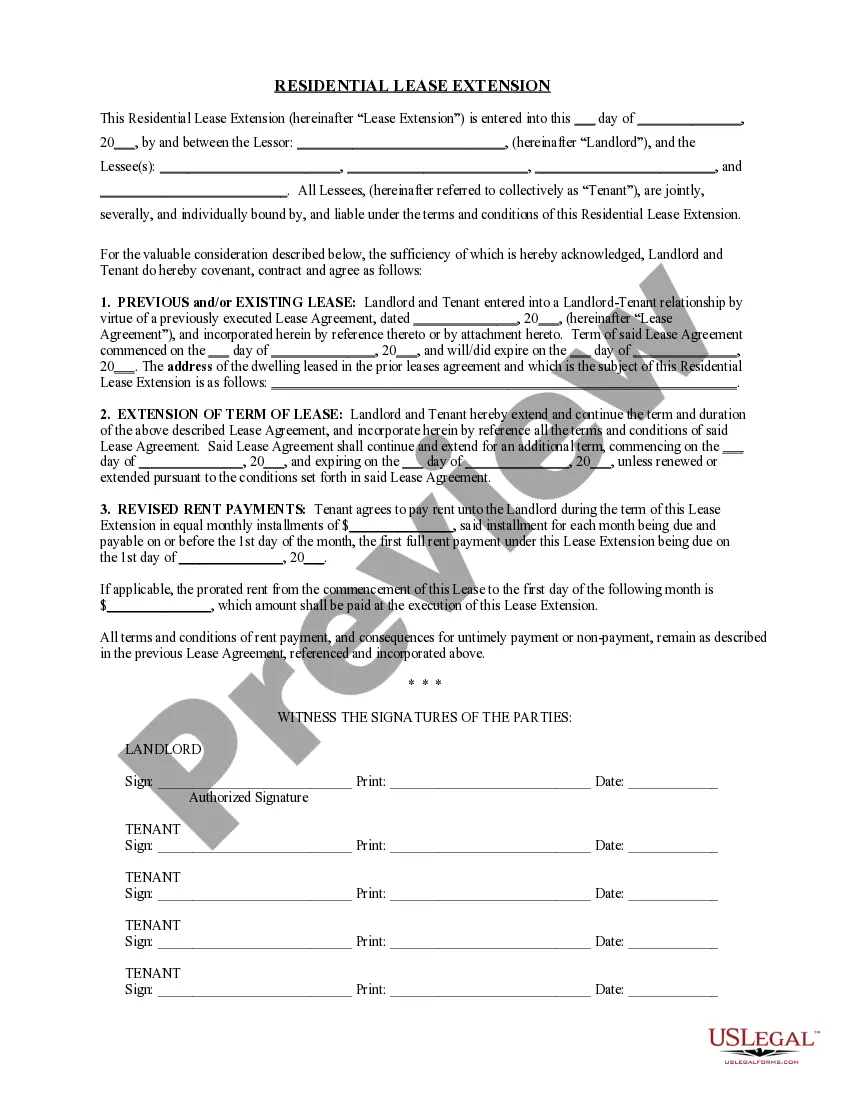

How to fill out Assignment Of Assets?

You can spend time online attempting to locate the legal document template that satisfies the state and federal requirements you have.

US Legal Forms provides thousands of legal templates that are examined by experts.

You can indeed download or print the Wisconsin Assignment of Assets from my service.

If available, use the Review button to check the document template as well.

- If you already possess a US Legal Forms account, you can sign in and subsequently click the Download button.

- After that, you can complete, modify, print, or sign the Wisconsin Assignment of Assets.

- Every legal document template you purchase is yours indefinitely.

- To acquire an additional copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple directions below.

- First, ensure you have chosen the correct document format for your selected state/city.

- Review the form details to confirm you have selected the correct form.

Form popularity

FAQ

To fill out a transfer by affidavit in Wisconsin, begin by gathering essential information about the deceased and their assets. You’ll need to include the deceased’s name, date of death, and a complete list of assets being transferred. Once the affidavit is filled out, sign it and have it notarized. This process simplifies the transfer of assets, making it a useful tool in managing Wisconsin Assignment of Assets.

Non-probate assets in Wisconsin refer to properties and investments that do not pass through the probate process upon death. Common examples include jointly owned properties, life insurance policies, and retirement accounts with designated beneficiaries. Understanding non-probate assets is vital for those looking to streamline the Wisconsin Assignment of Assets, as these assets transfer directly to beneficiaries without court intervention.

To fill out a Wisconsin quit claim deed, start with the title, 'Quit Claim Deed,' followed by the names of the grantor and grantee. You should then provide the legal description of the property and the county where it's located. Make sure to sign the document, have it notarized, and include any applicable fees for recording. This meticulous attention to detail supports the effective management of Wisconsin Assignment of Assets.

Filling out a quit claim deed in Wisconsin involves several straightforward steps. First, clearly identify the parties involved, including the grantor and grantee. Next, describe the property in detail and include relevant information such as the legal description. Lastly, ensure you include your signature and have the deed notarized to facilitate the Wisconsin Assignment of Assets process.

Yes, in Wisconsin, a quit claim deed must be notarized to be valid. Notarization ensures that the identity of the signer is verified and that they willingly signed the document. This step is critical for recording the deed, which is essential for transferring ownership effectively. Properly notarizing your quit claim deed contributes to a smoother process when dealing with Wisconsin Assignment of Assets.

In Wisconsin, estate settlement generally takes around 6 to 12 months, but it can vary based on several factors, such as the complexity of the estate and the assets involved. The process includes filing necessary documents, addressing debts, and distributing assets, all of which are crucial in the Wisconsin Assignment of Assets. Timely management of these tasks can expedite the settlement process and benefit all parties involved.

In Wisconsin, estates valued over $50,000 require probate. This threshold applies to the total value of all assets owned solely by the decedent. Understanding the value of the estate is essential for the proper management of the Wisconsin Assignment of Assets and determining if probate is necessary.

To transfer ownership of a property in Wisconsin, the owner must execute a deed, which outlines the transfer details and is then recorded with the county register of deeds. If the property is part of a decedent's estate, the Wisconsin Assignment of Assets will guide the legal process involved in the transfer. Utilizing services like USLegalForms can help simplify the creation of the necessary documents for this transfer.

In Wisconsin, whether a car must go through probate depends on how the title is held and the car's value. If the vehicle is solely owned by the deceased and has significant value, it may need to go through the probate process. However, if the car's value is under the small estate limit, it may be transferred using a simple affidavit, making it easier to manage under the Wisconsin Assignment of Assets.

Yes, in Wisconsin, you must file a will with the court after a person passes away to initiate the probate process. This step is crucial for validating the will and ensuring that the Wisconsin Assignment of Assets is properly managed. Failure to file the will may lead to complications in settling the estate and distributing assets.