Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

How to fill out Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

You can dedicate effort online looking for the approved document template that satisfies the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by professionals.

It is easy to download or print the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock from the service.

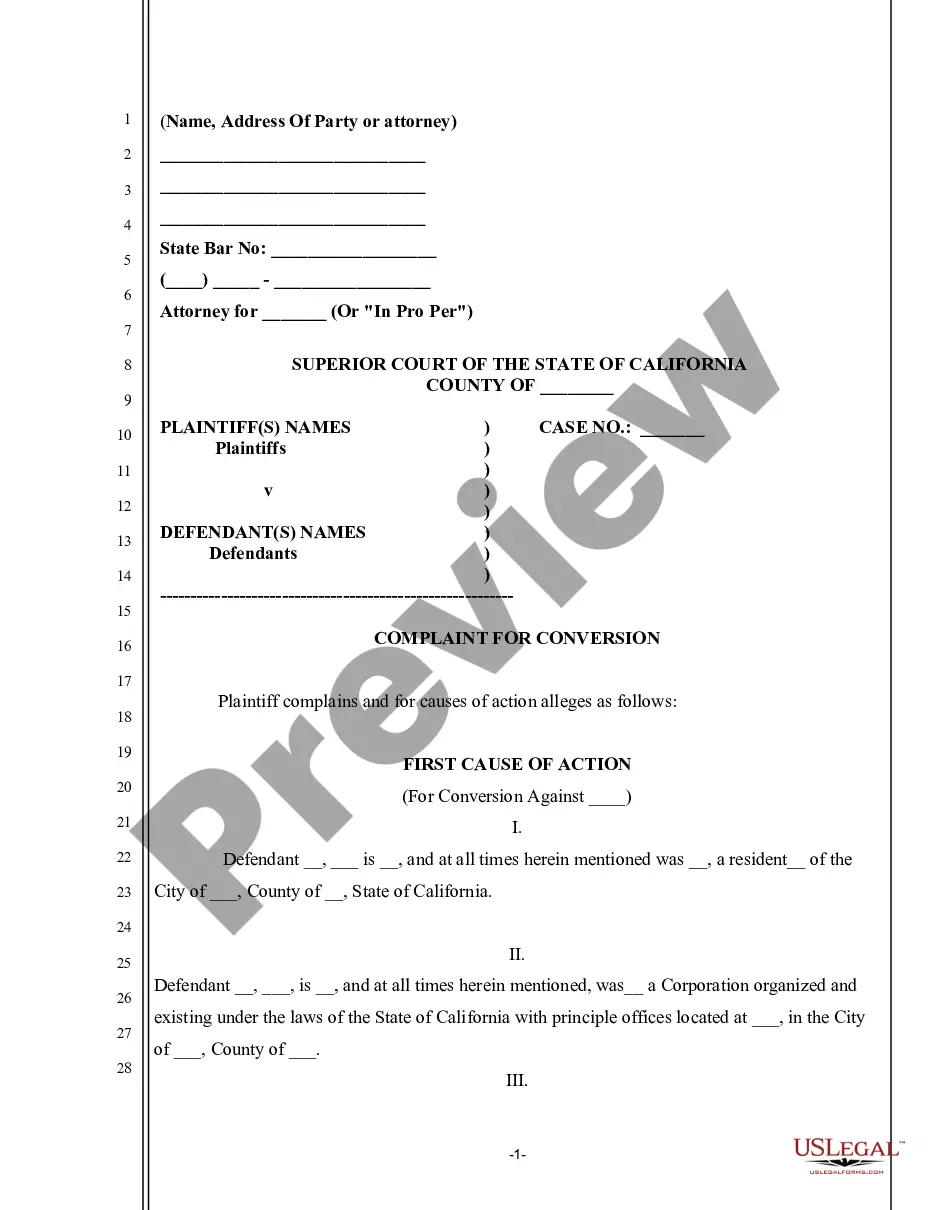

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Then, you can fill out, modify, print, or sign the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and choose the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the area/region you chose.

- Read the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Removing shareholders requires that you follow the protocols established in your corporate bylaws and state regulations. Typically, this involves drafting a resolution, such as a Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, to formalize the process. It's crucial to notify the shareholder in question and ensure all documentation is compliant with legal requirements. Our platform offers user-friendly templates and guidance to assist you through this process.

Transferring ownership of an AC corporation can be done through a sale or gift of shares. For a smooth transfer, you may utilize the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock to enable the repurchase of shares from the selling shareholder. It’s essential to adhere to your corporation’s governing documents and state laws during this process. You can find the resources you need at uslegalforms for an efficient transfer.

stock corporation in Wisconsin is an entity that does not issue stock to its members. Instead, its governance operates through membership rather than shares. Such organizations typically focus on charitable, educational, or social objectives. If you're forming a close corporation, understanding the difference helps in deciding whether to pursue a Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

Removing a shareholder from your AC corporation involves following specific procedures outlined in your corporate bylaws and state regulations. One method is to draft a Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock to facilitate the buyout. This process allows the corporation to repurchase the shares and helps maintain control among remaining shareholders. Our services at uslegalforms can assist with necessary documentation.

To remove an unwanted shareholder, you can utilize the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. This document outlines the process for buying back shares from the shareholder. It's important to follow your corporation's bylaws and state laws, as they dictate how the redemption should take place. Consider using our platform for templates and guidance to ensure a smooth transaction.

To write a shareholder resolution regarding the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, start by stating the purpose clearly. Include any relevant details and the specific action you want the shareholders to take. Finally, have the necessary signatures from the shareholders who are in agreement, and maintain a copy for your records.

The corporate resolution for the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock should be signed by the directors who approve the resolution. It is essential to have the signatures of those present during the authorization. Ensure that the signed resolution is kept in your corporate records.

No, a resolution does not need to be signed by all directors for it to be valid in the context of the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock. A majority can often suffice, depending on your corporate governance documents. Always verify your bylaws for specific signing requirements.

To fill out a corporate resolution form for the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock, start by including the corporation's name and the date. Next, detail the decision being made clearly, ensuring all necessary votes or approvals are recorded. Finally, have the appropriate directors sign the form to validate the resolution.

Typically, the directors present at the meeting where the Wisconsin Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is adopted will sign the resolution. If the resolution is written, those approving it must sign as evidence of their consent. Make sure to keep a record of all signatures for your corporate files.