Wisconsin Demand for Payment of an Open Account by Creditor

Description

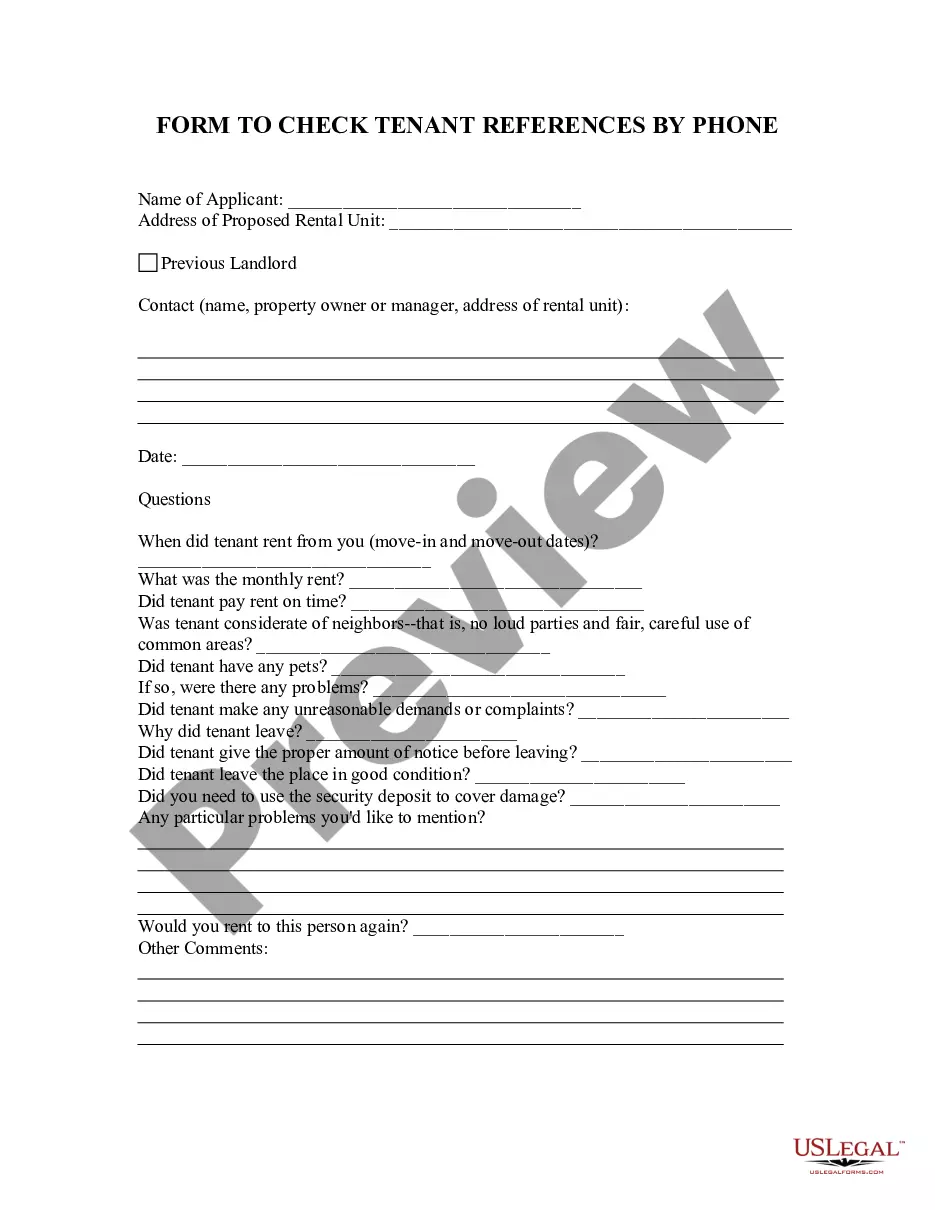

How to fill out Demand For Payment Of An Open Account By Creditor?

If you need to complete, down load, or print lawful file web templates, use US Legal Forms, the biggest assortment of lawful kinds, which can be found online. Use the site`s basic and hassle-free look for to find the papers you want. Different web templates for business and person reasons are sorted by classes and suggests, or keywords. Use US Legal Forms to find the Wisconsin Demand for Payment of an Open Account by Creditor in just a few click throughs.

In case you are previously a US Legal Forms buyer, log in in your profile and click the Obtain option to obtain the Wisconsin Demand for Payment of an Open Account by Creditor. You can even accessibility kinds you in the past downloaded within the My Forms tab of your profile.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for that appropriate area/land.

- Step 2. Utilize the Preview option to look over the form`s articles. Don`t forget about to see the information.

- Step 3. In case you are unsatisfied using the develop, take advantage of the Research field on top of the screen to discover other types in the lawful develop template.

- Step 4. Once you have identified the shape you want, click on the Purchase now option. Pick the rates plan you favor and add your references to sign up for an profile.

- Step 5. Procedure the transaction. You should use your charge card or PayPal profile to finish the transaction.

- Step 6. Select the file format in the lawful develop and down load it on the gadget.

- Step 7. Full, modify and print or indication the Wisconsin Demand for Payment of an Open Account by Creditor.

Every lawful file template you purchase is the one you have eternally. You might have acces to every single develop you downloaded inside your acccount. Select the My Forms segment and choose a develop to print or down load once more.

Compete and down load, and print the Wisconsin Demand for Payment of an Open Account by Creditor with US Legal Forms. There are millions of specialist and status-certain kinds you can use for your business or person requires.

Form popularity

FAQ

Under the right of survivorship, each tenant possesses an undivided interest in the whole estate. When one tenant dies, the tenant's interest disappears and the others tenants' shares increase proportionally and obtain the rights to the entire estate.

Interest Rates Laws in Wisconsin Legal Maximum Rate of Interest5% unless otherwise agreed in writing (§138.04)ExceptionsState-chartered banks, credit unions, savings and loans, etc. (§138.041); residential mortgage loans (§138.052(7)); loans to corporations (§138.05(5)); installment contract on auto (§218.0142)2 more rows

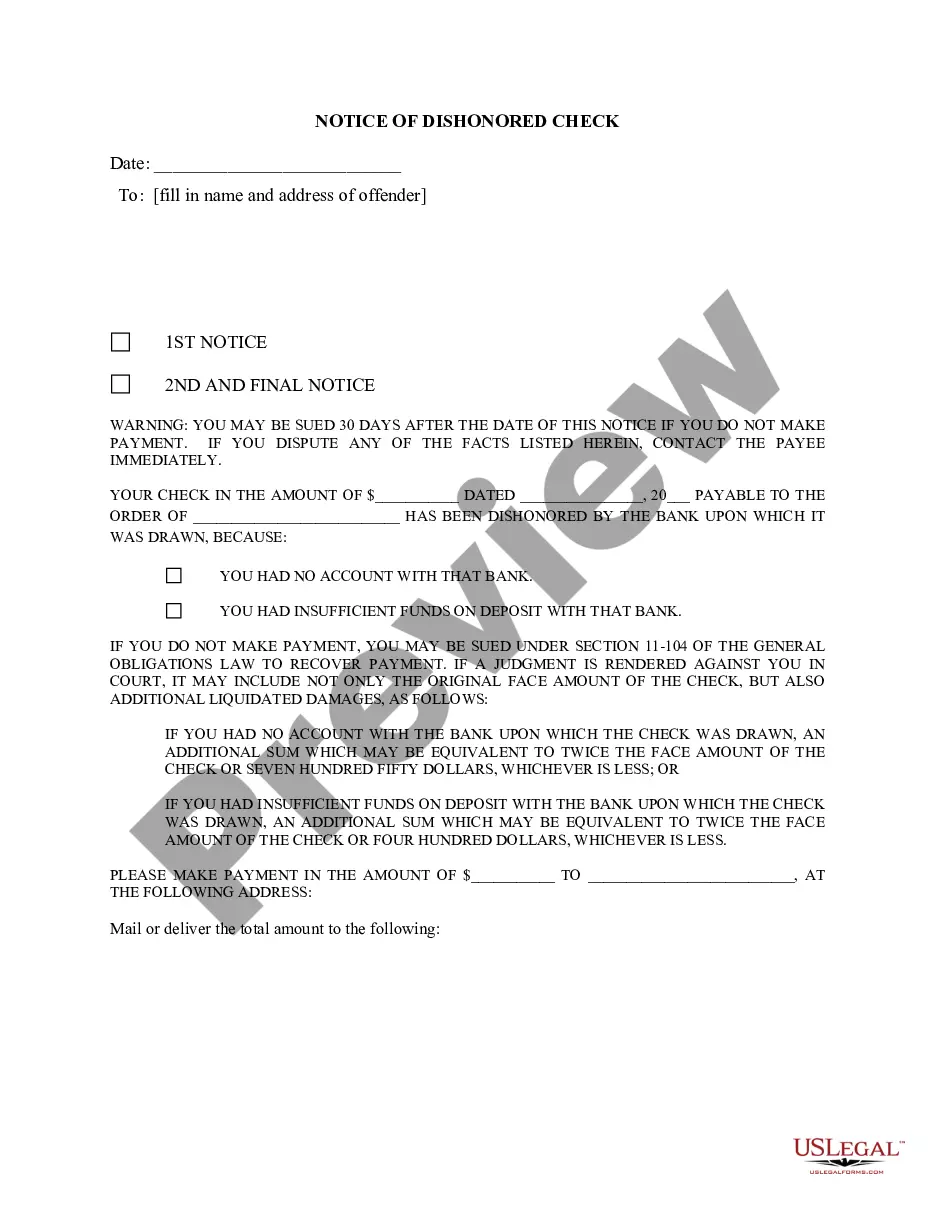

In Wisconsin, the statute of limitations is six years and begins on the date of the last payment on an account. This also means that if you make a payment on your debt at any time in the six-year span, the clock restarts.

On the death of a spouse, the ownership rights of that spouse in the property vest solely in the surviving spouse by nontestamentary disposition at death. The first deceased spouse may not dispose at death of any interest in survivorship marital property.

(1) Surviving spouse's one-half interest in marital property. Upon the death of either spouse, the surviving spouse retains his or her undivided one-half interest in each item of marital property.

A judgment can remain on your credit report for seven years or until the statute of limitations expires, whichever is longer. In Wisconsin, the statute of limitations on a judgment can be up to 20 years.

In community property states like Wisconsin, married couples are allowed to have property as survivorship marital property or community property with right of survivorship. What this means is, if one spouse passes away the remaining spouse is to receive the dead spouse's' half of the marital property.

Your spouse will inherit all of your community and separate property unless you have children or other descendants from a previous relationship. In that case, your spouse will not inherit your share of the community property. Instead, your spouse inherits only half of your separate property.