Wisconsin Notice of Default under Security Agreement in Purchase of Mobile Home

Description

A secured transaction involves a sale on credit or lending money where a creditor is unwilling to accept the promise of a debtor to pay an obligation without some sort of collateral. The creditor (the secured party) requires the debtor to secure the obligation with collateral so that if the debtor does not pay as promised, the creditor can take the collateral, sell it, and apply the proceeds against the unpaid obligation of the debtor. A security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Personal property is basically anything that is not real property.

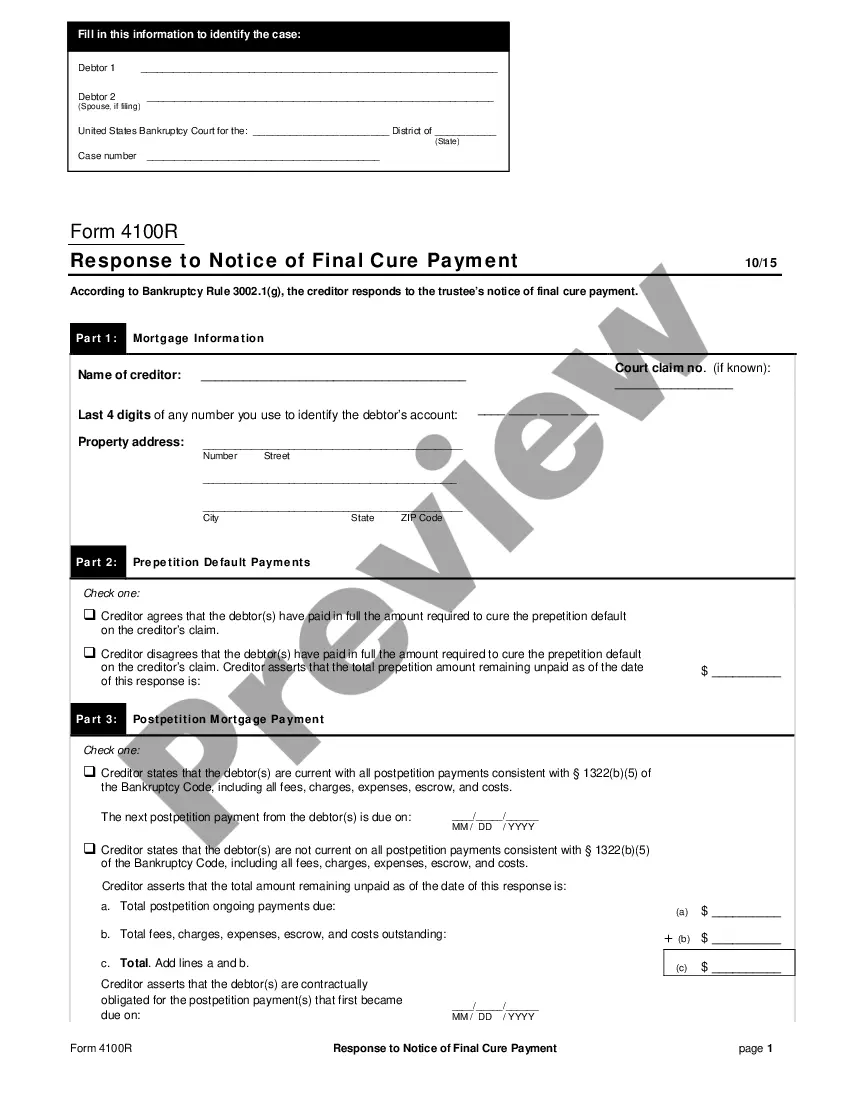

How to fill out Notice Of Default Under Security Agreement In Purchase Of Mobile Home?

If you need to compile, download, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and convenient search to locate the documents you require.

Various templates for business and personal applications are organized by categories and regions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other types of legal form templates.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and input your information to create an account.

- Utilize US Legal Forms to locate the Wisconsin Notice of Default under Security Agreement in the Purchase of Mobile Home with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to obtain the Wisconsin Notice of Default under Security Agreement in the Purchase of Mobile Home.

- You can also access forms you previously acquired from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct state/country.

- Step 2. Use the Review feature to examine the form’s contents. Remember to read any explanations.

Form popularity

FAQ

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.

A security agreement, in the law of the United States, is a contract that governs the relationship between the parties to a kind of financial transaction known as a secured transaction.

You can take a security interest in a promissory note owed to your debtor in the same way that you can take a security interest in account receivables. You can also take a security interest in any stocks or limited partnership interests owned by the debtor.

Mortgage is different from a security agreement. A mortgage is used to secure the lender's rights by placing a lien against the title of the property. Once all loan repayments have been made, the lien is removed. However, the buyer doesn't own the property till all loan payments have been made.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

Certain specific requirements are required for the security agreement to form the foundation for a valid security interest, namely 1) it must be signed, 2) it must clearly state that a security interest is intended, and 3) it must contain a sufficient description of the collateral subject to the security interest.

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.

Mortgage. A security agreement provides a legal title transfer from the borrower to the lender in while leaving equitable rights of the property with the debtor. The lender then provides the loan.

WHEREAS, it is a condition precedent to the Secured Party's making any loans to Debtor under the Credit Agreement that the Debtor execute and deliver a Security Agreement in substantially the form hereof. a. Overview: A security agreement is frequently one of many loan documents executed in conjunction with a loan.