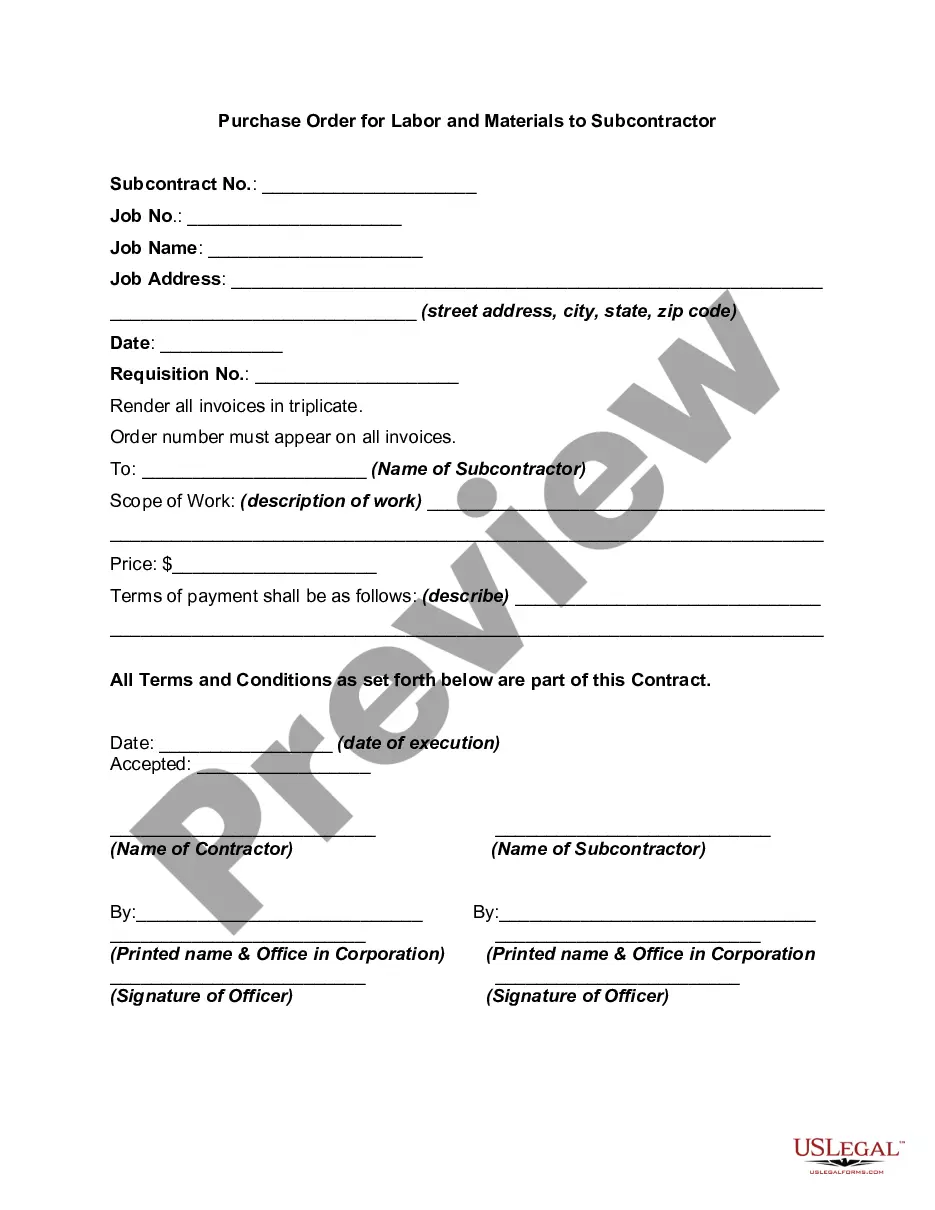

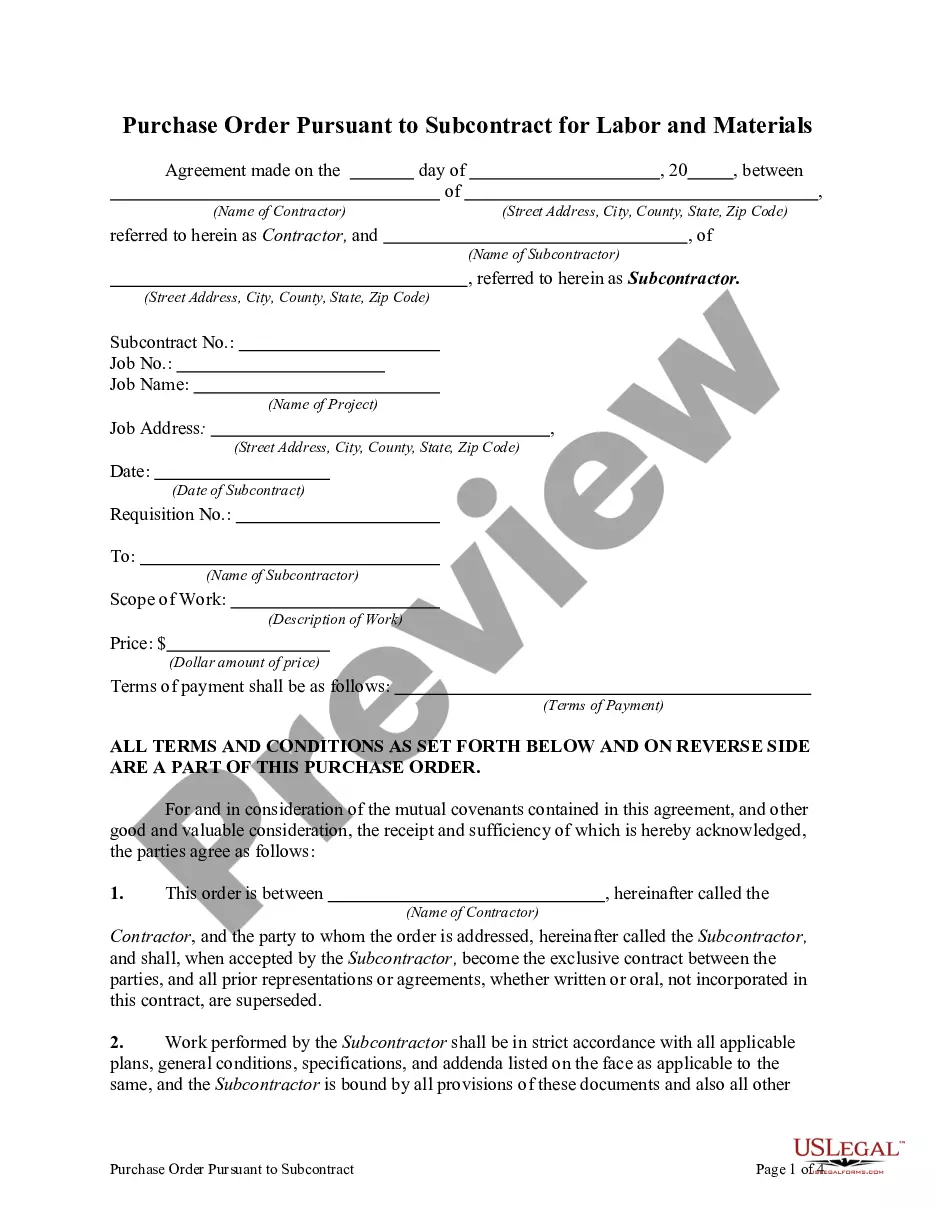

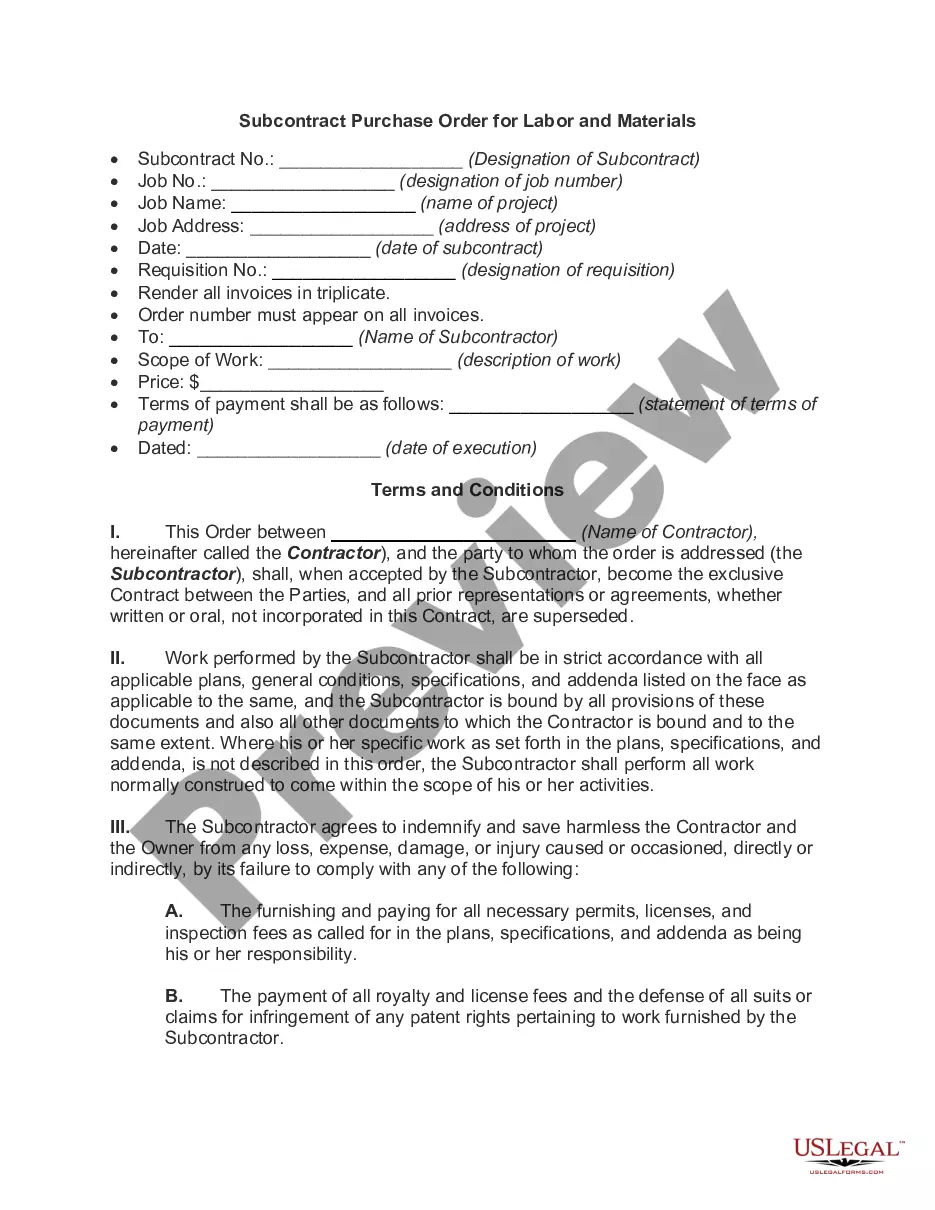

Wisconsin Purchase Order for Labor and Materials to Subcontractor

Description

How to fill out Purchase Order For Labor And Materials To Subcontractor?

Have you ever encountered a scenario where you require documents for both business or personal reasons consistently.

There are numerous legal document templates accessible online, but finding those you can trust isn't simple.

US Legal Forms provides thousands of template options, such as the Wisconsin Purchase Order for Labor and Materials to Subcontractor, that are created to comply with state and federal regulations.

Select the pricing plan you prefer, complete the required details to set up your account, and pay for your order using your PayPal or credit card.

Choose a suitable file format and download your copy. You can find all the document templates you have purchased in the My documents section. You can obtain another copy of the Wisconsin Purchase Order for Labor and Materials to Subcontractor at any time if needed. Simply select the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service offers properly crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Wisconsin Purchase Order for Labor and Materials to Subcontractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

- Make use of the Preview feature to examine the form.

- Read the description to confirm you have selected the appropriate form.

- If the form doesn't match your needs, use the Search field to find a form that suits your requirements and criteria.

- Once you locate the correct form, click Acquire now.

Form popularity

FAQ

Types of purchase ordersStandard purchase order (PO) The standard purchase order is the type most of us are familiar with.Planned purchase order (PPO)Blanket purchase order (BPO)Contract purchase orders (CPO)

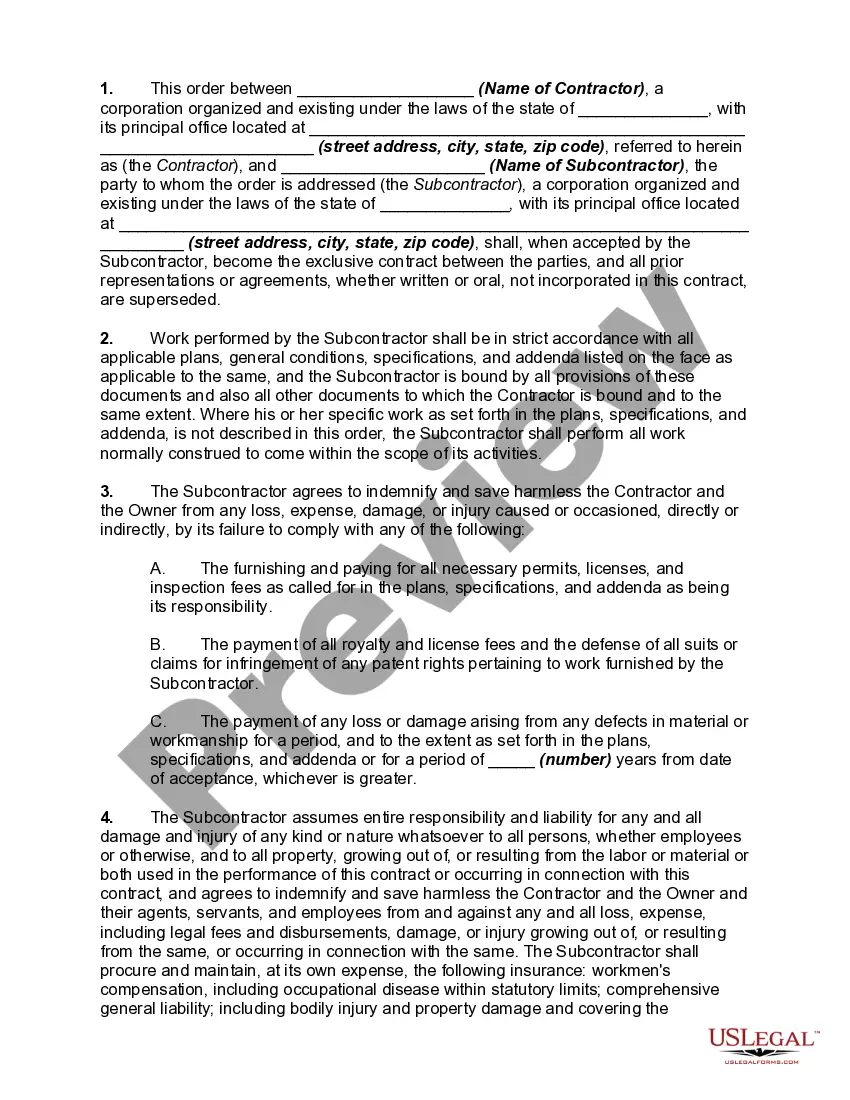

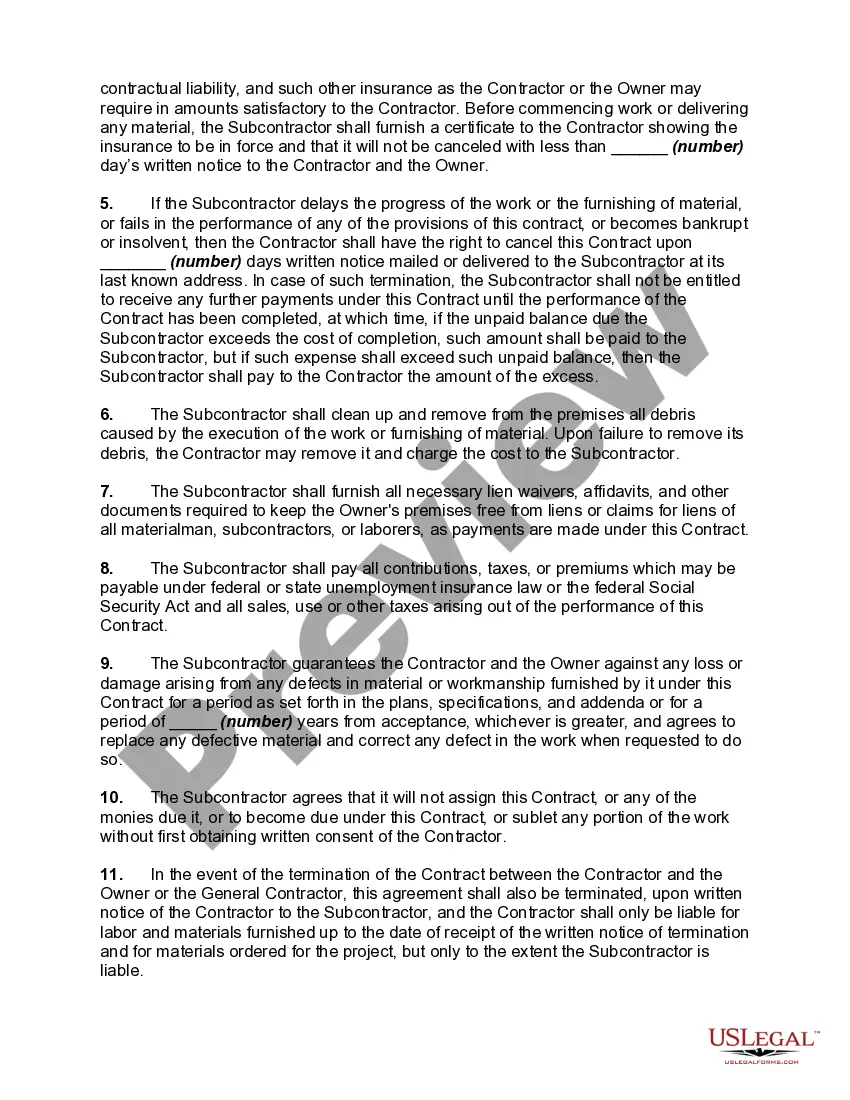

From a monetary standpoint, purchase orders help contractors track material billings and committed costs, while subcontract management systems help them monitor billings, retainage and committed costs associated with subcontractors.

General contractor charges sales tax to the end customer on materials and labor, unless customer issues exemption certificate.

Per Wisconsin law, if a contractor purchases construction materials for use in a real property construction project or repair, the contractor is considered the end user of those materials. That means the contractor must pay sales or use tax on those purchases, and the contractor's sale to their customer is not taxable.

(a) The sales price from charges by a retailer to a customer for taxable repair parts or taxable services performed under a maintenance contract or warranty and that are not reimbursed by the seller of the maintenance contract or warranty are subject to Wisconsin sales or use tax.

The tax rate of 5% is the same for both the Wisconsin state sales and use tax. The sales tax is based upon the sales price from retail sales.

The key difference is that a purchase order is sent by buyers to vendors with the intention to track and control the purchasing process. On the other hand, an invoice is an official payment request sent by vendors to buyers once their order is fulfilled.

Taxable services include:Admission and access privileges to amusement, athletic, entertainment, or recreational places or events.Access or use of amusement devices.Boat docking and storage.Cable television services.Contracts for future performance of services.Internet access (not taxable beginning July 1, 2020)More items...

A purchase order/subcontract creates a system for tracking the physical, or quantity, aspect of the purchase agreement so that contractors can better manage the materials/work needed for jobs or supplies held in inventory.

In general terms, a purchase order (also known as a PO) is a document sent from a buyer to a seller, distributor, or manufacturer requesting to purchase a product. Plus, a purchase order becomes a legally binding contract after the seller accepts the order.