Wisconsin Sample Letter to Include Deposit Slip from Sales

Description

How to fill out Sample Letter To Include Deposit Slip From Sales?

US Legal Forms - one of many largest libraries of authorized forms in the United States - delivers a wide range of authorized papers web templates you are able to down load or print. Utilizing the internet site, you will get a large number of forms for organization and specific purposes, categorized by classes, suggests, or key phrases.You can get the latest versions of forms such as the Wisconsin Sample Letter to Include Deposit Slip from Sales in seconds.

If you already possess a monthly subscription, log in and down load Wisconsin Sample Letter to Include Deposit Slip from Sales through the US Legal Forms local library. The Acquire option can look on each type you view. You get access to all in the past saved forms inside the My Forms tab of your own bank account.

If you want to use US Legal Forms initially, listed here are basic recommendations to get you started:

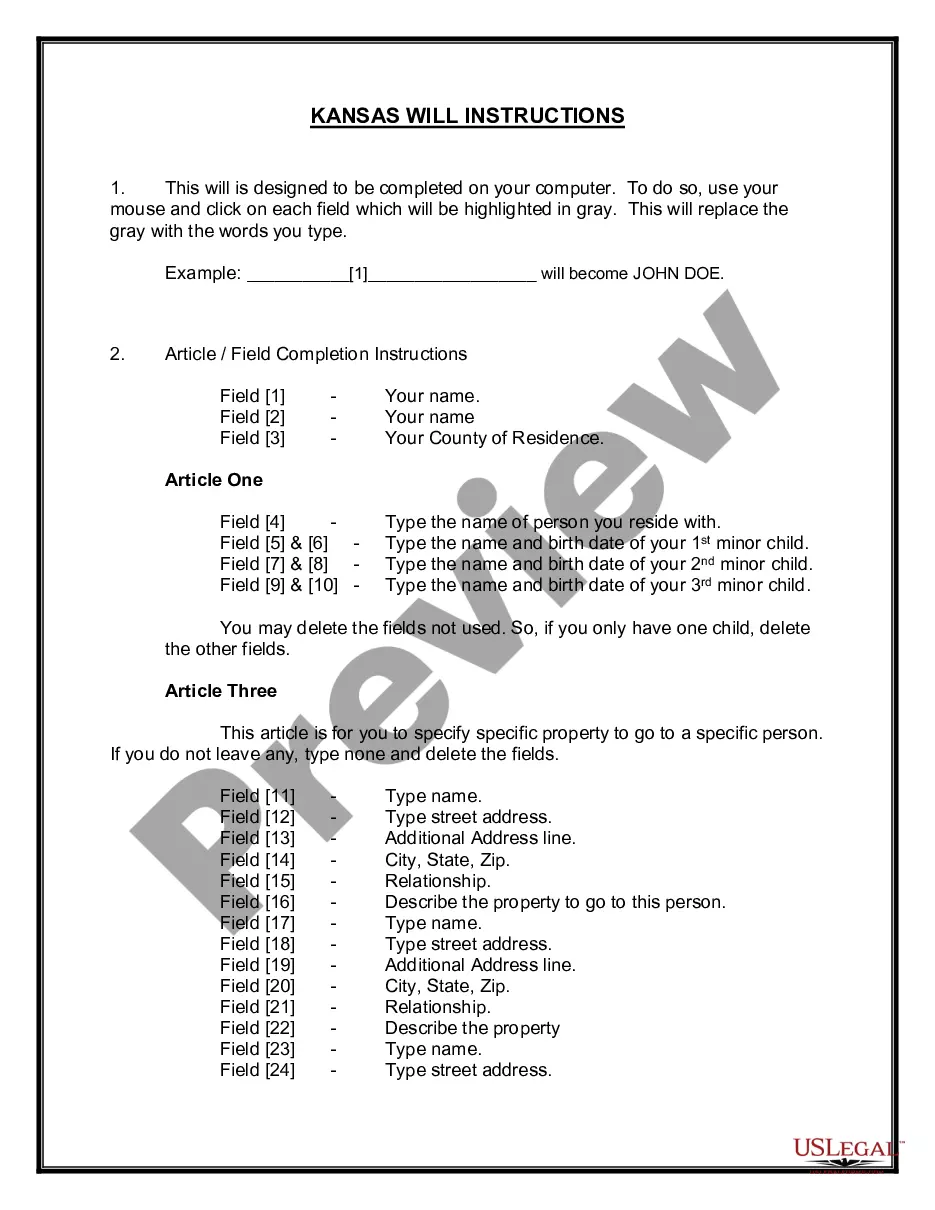

- Make sure you have picked the proper type for the town/state. Click the Review option to review the form`s information. Browse the type description to actually have selected the appropriate type.

- In case the type does not match your specifications, take advantage of the Research industry towards the top of the display screen to obtain the one who does.

- In case you are pleased with the shape, confirm your decision by visiting the Purchase now option. Then, opt for the costs program you favor and provide your accreditations to register for the bank account.

- Procedure the purchase. Make use of your Visa or Mastercard or PayPal bank account to complete the purchase.

- Pick the format and down load the shape in your device.

- Make alterations. Fill up, change and print and signal the saved Wisconsin Sample Letter to Include Deposit Slip from Sales.

Each and every design you added to your account does not have an expiration day and is your own property forever. So, in order to down load or print one more backup, just check out the My Forms area and click around the type you want.

Gain access to the Wisconsin Sample Letter to Include Deposit Slip from Sales with US Legal Forms, one of the most substantial local library of authorized papers web templates. Use a large number of expert and express-certain web templates that meet up with your small business or specific requirements and specifications.

Form popularity

FAQ

What information should be included in a deposit receipt template? A deposit receipt should include details such as the payer's name, the amount of the deposit, the purpose of the deposit, the date of the transaction, and a receipt number.

This would be a reference number, the date of payment, the amount received, the mode of payment, the reason for such, and the receiver. It can be made short and simple, as long as it contains all the necessary details of the transaction.

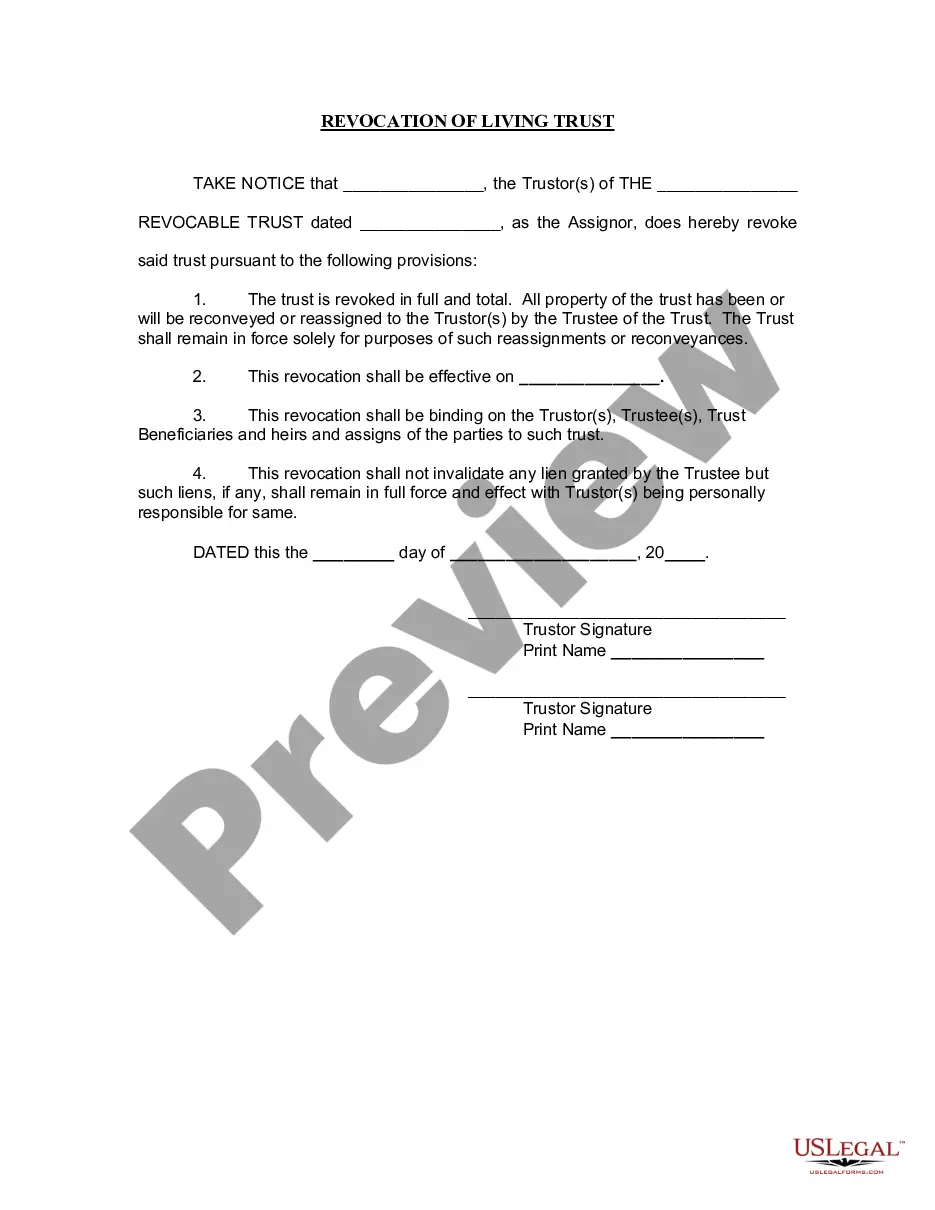

The deposit slip serves as proof that the bank acknowledged receiving the funds from the customer if the customer later checks the account balance and discovers the deposit was not reported correctly, The deposit receipt proves that the deposit was made, but the receipt only shows the total of the deposit.

A deposit receipt is a receipt issued by a bank to a depositor for cash and checks deposited with the bank. The information recorded on the receipt includes the date and time, the amount deposited, and the account into which the funds were deposited.

A deposit template defines which revenue sources and payment methods you want to associate with a specific bank account.

Steps on How to Fill Out a Bank Deposit Slip: Provide personal information, including your name and your account number. Fill in additional details such as the date. If you are cashing the check or any part of the check, it is also required you sign the signature line. List the cash amount of your deposit, if any.

Introduction. A deposit slip is a small physical form that a bank customer includes when depositing money into a bank account. A deposit slip contains the date of deposit, the name of the depositor, the depositor's account number, and the amount being deposited.

What to Include in Your Receipt of Payment Your brand/business logo. Your business name, address, and contact information. The date payment is made. The receipt or order number. Your customer's full name and contact information. A list of all products or services purchased.