Wisconsin Revocable Trust for Married Couple

Description

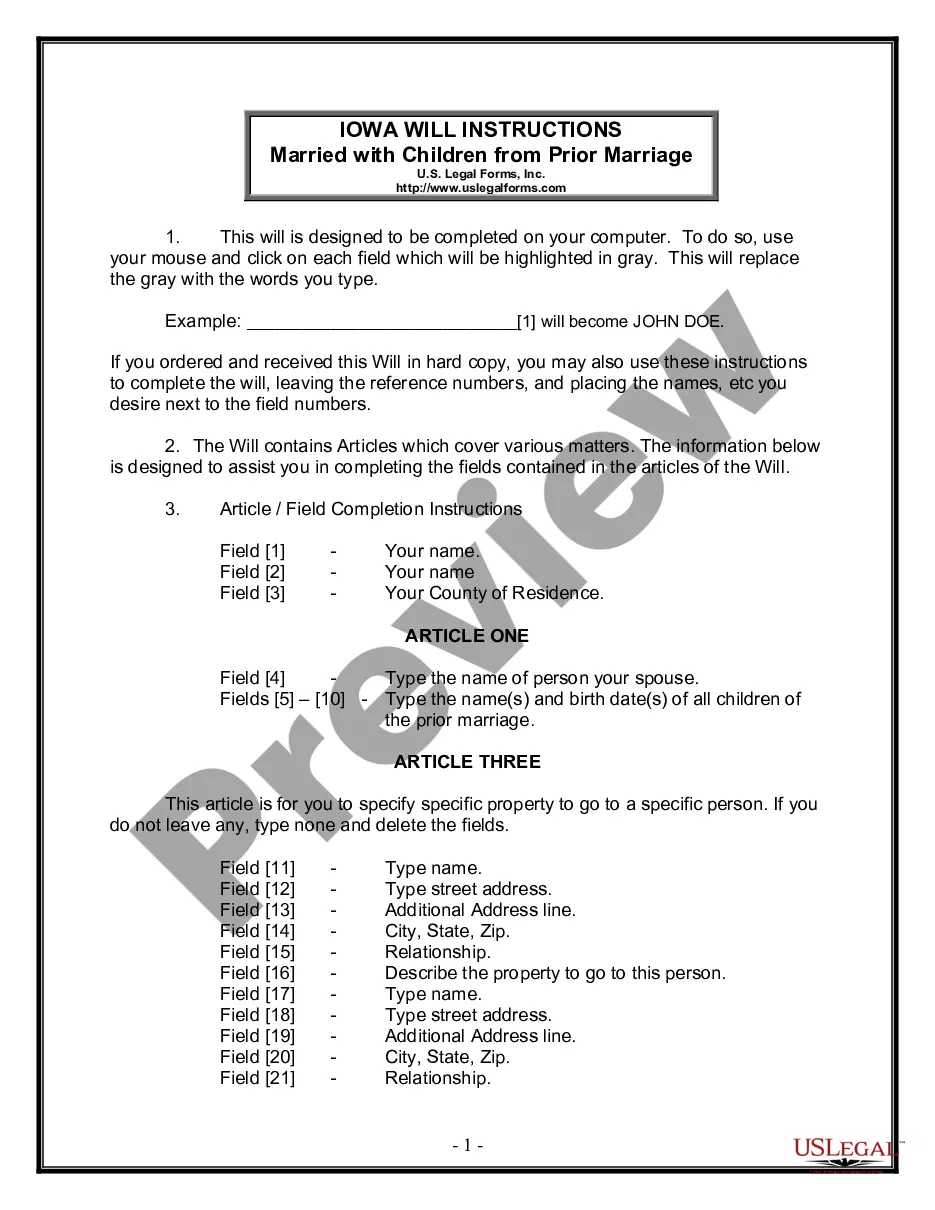

How to fill out Revocable Trust For Married Couple?

It is achievable to spend hours online searching for the legal document template that fulfills the federal and state criteria you require.

US Legal Forms offers a vast array of legal forms that can be assessed by professionals.

You can effortlessly download or print the Wisconsin Revocable Trust for Married Couple from our service.

If needed, utilize the Review option to peruse the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can complete, modify, print, or sign the Wisconsin Revocable Trust for Married Couple.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents tab and select the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the county/town you desire.

- Check the form description to confirm that you have selected the appropriate template.

Form popularity

FAQ

The benefits of a Wisconsin Revocable Trust for Married Couple include avoiding probate, maintaining privacy regarding your estate, and allowing for seamless management of assets if one spouse becomes incapacitated. This trust type also provides clarity regarding asset distribution, which can reduce conflicts among heirs. Overall, it serves as a powerful tool for estate planning.

Yes, a married couple can certainly establish a Wisconsin Revocable Trust together. This trust allows both partners to manage their assets collaboratively while maintaining flexibility and control throughout their lives. Additionally, it can ease the transition of asset distribution, providing peace of mind for both partners.

Yes, you can create your own living trust in Wisconsin, especially with the help of accessible resources. Using platforms like uslegalforms can simplify the process by providing templates and instructions tailored to your needs. However, consulting with a legal professional is recommended to ensure compliance with Wisconsin laws and to address any complex situations.

To set up a revocable living trust in Wisconsin, you can begin by drafting a trust document outlining the terms, the assets included, and the trustees. You may choose to use online legal services like uslegalforms, which provide templates and guidance for creating an effective trust. Once the document is notarized and assets are transferred into the trust, it becomes functional.

In Wisconsin, the rules governing trusts, including a Wisconsin Revocable Trust for Married Couple, are outlined in the Wisconsin Statutes. Trusts must be established with a legally competent person, and the trust document should clearly detail the terms and conditions. It's important to follow specific legal formalities to ensure that the trust is valid and enforceable.

For a married couple, a Wisconsin Revocable Trust is often the best option as it offers flexibility and control over asset management. It allows both partners to make decisions about their assets while providing a clear plan for distribution upon death. This trust type also helps avoid probate, simplifying the transfer of assets.

One of the biggest mistakes parents make when creating a Wisconsin Revocable Trust for Married Couple is failing to update the trust after significant life events. Life changes, such as the birth of a child or a change in financial circumstance, should prompt a review of the trust. Neglecting these changes can lead to unforeseen complications or unintended beneficiaries.

To file taxes for a Wisconsin Revocable Trust for Married Couple, you typically use your personal tax return, as the IRS treats the trust income as part of your income until it becomes irrevocable. This means you report the trust's income on your Form 1040, and it is subject to your individual tax rate. Working with a tax professional can help ensure you meet all tax obligations and maximize tax benefits.

While a joint trust, such as the Wisconsin Revocable Trust for Married Couple, provides many benefits, there are a few disadvantages. One major concern is that both spouses have equal control, which can lead to disagreements over financial decisions. Additionally, if one spouse passes away, it can complicate the handling of assets and estate distribution. Consider these aspects carefully when deciding if a joint trust is the right fit for your family.

Remarried couples may consider the Wisconsin Revocable Trust for Married Couple as a fitting option. This trust allows for the inclusion of children from previous marriages, ensuring that everyone is considered in estate planning. Additionally, it offers the flexibility to adapt the trust terms based on changing family dynamics. This makes it a robust tool for managing complex family situations.