An assignment by a beneficiary of a portion of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust

Description

How to fill out Assignment By Beneficiary Of A Percentage Of The Income Of A Trust?

If you aim to be thorough, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Leverage the site's straightforward and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are organized by categories and claims, or keywords.

Each legal document template you purchase is yours indefinitely. You will have access to every form you have purchased in your account. Click on the My documents section and select a template to print or download again.

Compete and obtain, and print the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to secure the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust.

- You can also retrieve forms you have previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the template for the appropriate city/state.

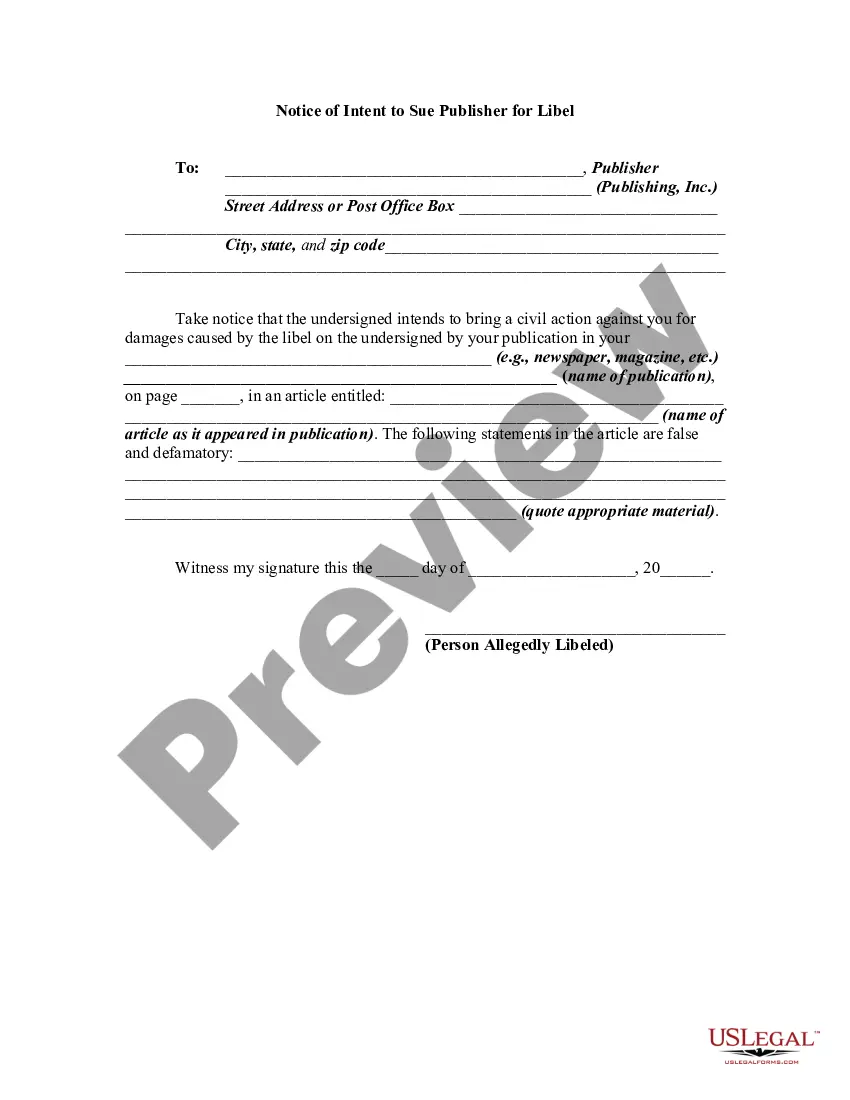

- Step 2. Use the Preview option to review the template’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to discover other versions in the legal form template.

- Step 4. After identifying the template you need, click the Buy now button. Choose your preferred pricing plan and enter your information to create an account.

- Step 5. Complete the payment. You can use your Visa, MasterCard, or PayPal account to finalize the purchase.

- Step 6. Download the form from the legal template and save it to your device.

- Step 7. Fill out, modify, and print or sign the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust.

Form popularity

FAQ

A beneficiary generally refers to anyone entitled to receive assets from a trust or estate. In contrast, an income beneficiary specifically receives income generated by the trust during its existence. Understanding this distinction is crucial when dealing with the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust, as it impacts how distributions are structured. Ensuring you know who qualifies as an income beneficiary can clarify the dynamics of income distribution.

Filling out a beneficiary percentage requires clarity on how much each beneficiary will receive from the trust income. You should identify each beneficiary and specify their respective percentage of the income, often based on their entitled shares. Make sure to follow the terms laid out in the trust agreement, as it directly affects how the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust is executed. For assistance, you might consider using the resources available on the US Legal Forms platform.

To distribute trust income to beneficiaries in Wisconsin, you first need to review the trust document for specific instructions. Generally, the trustee will calculate the income generated by the trust assets. After calculating this income, the trustee must distribute the appropriate percentage to each beneficiary as outlined in the trust. Using the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust can help streamline this process, ensuring compliance with state laws.

Income from a trust may indeed be taxable to the beneficiary, depending on several factors. Generally, if the trust distributes income to you, you must report that income on your tax return. This includes any distributions resulting from a Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust. It's wise to work with tax experts to ensure compliance and understand your tax obligations in these situations.

Yes, Wisconsin does tax trust income. When a trust generates income, it may be subject to state taxation, which can affect beneficiaries receiving distributions. It is essential to understand the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust, as this can influence the tax implications for individuals involved. Consult with a tax professional to navigate the complexities of trust income taxation in Wisconsin.

Yes, Wisconsin does tax trusts, and the rates can vary based on the type of trust and its income. When considering the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust, it's crucial to note how these arrangements are treated under the state's tax laws. Utilizing resources such as uslegalforms can help you navigate trust-related tax obligations and ensure you understand what is required for compliance.

To report beneficiary income in Wisconsin, you must complete the necessary forms that detail the income received from the trust. An important aspect of managing this is understanding the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust, which outlines how income should be reported. It is advisable to seek assistance from a tax professional or legal expert to ensure accurate reporting of all applicable income and compliance with state laws.

In Wisconsin, certain types of income may not be taxable, including some Social Security benefits and certain pensions. Notably, under the Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust, specific distributions may also be exempt from taxation. It’s essential to consult a tax professional to fully understand what income applies to your situation, as tax laws can change and vary by individual circumstances.

Allocating trust income to beneficiaries typically follows the guidelines laid out in the trust agreement. Each beneficiary may receive a percentage of the income based on predetermined criteria. The Wisconsin Assignment by Beneficiary of a Percentage of the Income of a Trust can assist in establishing an agreement among beneficiaries, providing a straightforward approach to income distribution.

In Wisconsin, beneficiaries generally have the right to access a copy of the trust document. This right helps ensure transparency and allows beneficiaries to understand their rights concerning trust income and distributions. Utilizing the Assignment by Beneficiary of a Percentage of the Income of a Trust can further clarify the entitlements beneficiaries have under the trust.