In this form, the beneficiary of a trust acknowledges receipt from the trustee of all monies due to him/her pursuant to the terms of the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

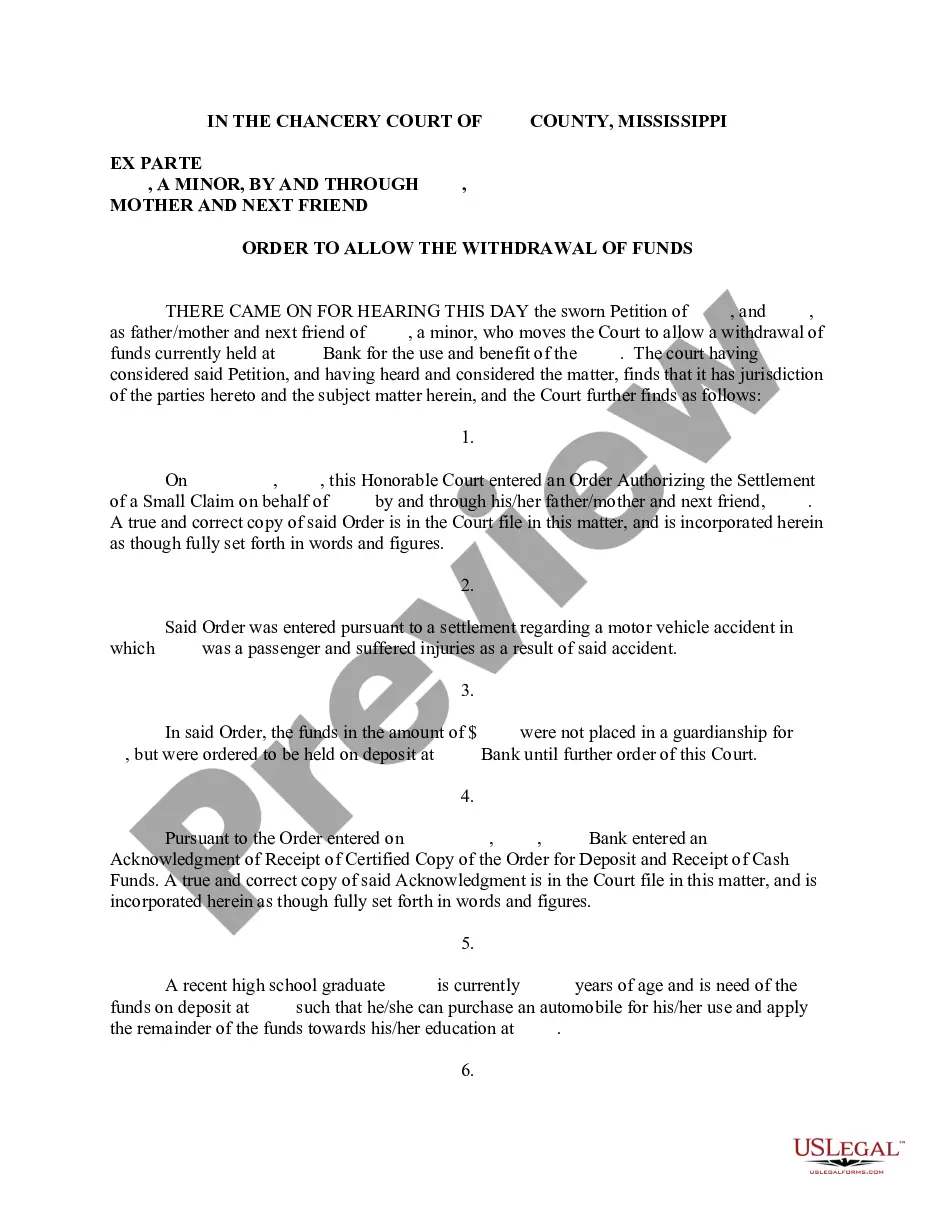

Wisconsin Receipt for Payment of Trust Fund and Release

Description

How to fill out Receipt For Payment Of Trust Fund And Release?

Are you in a location where you require documents for both business or personal use almost every day.

There are many legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Wisconsin Receipt for Payment of Trust Fund and Release, which are designed to comply with state and federal regulations.

Once you have found the correct form, click on Get it now.

Select the pricing plan you prefer, provide the required information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Receipt for Payment of Trust Fund and Release template.

- If you don't have an account and wish to start using US Legal Forms, follow these procedures.

- Locate the form you need and ensure it is for the correct city/region.

- Click the Preview button to review the form.

- Check the description to ensure you've selected the correct form.

- If the form is not what you are looking for, use the Search field to find one that meets your needs.

Form popularity

FAQ

Certain types of assets cannot be held in a trust, such as specific retirement accounts or assets with restrictions based on legal or contractual obligations. Additionally, personal items that are not formally valued or documented cannot be effectively managed through a trust. Using the Wisconsin Receipt for Payment of Trust Fund and Release can help clarify the nature of transactions involving these types of assets.

A Grantor Trust is identified primarily by the fact that the grantor retains control over the assets held in the trust. They may alter the trust, remove assets, or even dissolve it while alive. Understanding the implications of this control is vital, especially when utilizing documents like the Wisconsin Receipt for Payment of Trust Fund and Release to track transactions or distributions.

Yes, one of the primary benefits of establishing a trust in Wisconsin is the avoidance of probate. Assets held within a trust pass directly to beneficiaries without the delays and costs associated with probate court. As part of this process, the Wisconsin Receipt for Payment of Trust Fund and Release can serve as important documentation for asset distribution.

When the grantor of an irrevocable trust dies in Wisconsin, the trust typically remains in effect and continues to be administered according to its terms. The assets within the trust do not go through probate, which can be a significant advantage. The Wisconsin Receipt for Payment of Trust Fund and Release may be necessary to manage and document any ongoing transactions as instructed by the trust.

To place your home in a trust in Wisconsin, you will need to prepare a deed transferring the property into the trust's name. This deed must be properly executed and recorded with the local register of deeds. Additionally, using the Wisconsin Receipt for Payment of Trust Fund and Release can help track any financial transactions related to the property post-transfer.

Trusts are not generally required to be recorded in Wisconsin like some other legal documents. However, certain assets within a trust, like real estate, may require recording. Utilizing the Wisconsin Receipt for Payment of Trust Fund and Release can help document trust activities and asset management without the need for formal recording.

One common mistake parents make is failing to specify the distribution terms of the trust fund clearly. Ambiguity can lead to misunderstandings or disputes among heirs. To avoid this, ensure that your trust's provisions are clear, and consider utilizing the Wisconsin Receipt for Payment of Trust Fund and Release to manage fund transactions effectively.

In Wisconsin, trusts must adhere to specific rules to ensure they are legally valid. The document creating the trust must clearly define its purpose and stipulate how assets are managed and distributed. Furthermore, the Wisconsin Receipt for Payment of Trust Fund and Release must be completed correctly to document any transactions involving trust assets.

To obtain your Wisconsin property tax statement, start by visiting your local county assessor’s office website. Here, you can often find online access to your tax information. If you prefer a physical copy, you may also request it directly through your local municipal office. Remember, having a Wisconsin Receipt for Payment of Trust Fund and Release may help streamline any related transactions or inquiries regarding your property tax.

Non-taxable income from a trust typically includes distributions that fall under certain exemptions, such as principal amounts. The 'Wisconsin Receipt for Payment of Trust Fund and Release' can aid in identifying what portions of income might be non-taxable. To ensure compliance with tax laws, consider consulting a financial advisor. Understanding your trust details can lead to more effective estate planning.