Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt, such as a judgment. The usual mode of attacking a garnishment directly is by a motion to quash or discharge the writ. This form is a generic motion and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wisconsin Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion

Description

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment And Notice Of Motion?

Are you currently in a situation in which you need to have files for either enterprise or personal uses just about every day? There are plenty of legal file themes accessible on the Internet, but locating ones you can depend on isn`t effortless. US Legal Forms offers 1000s of type themes, just like the Wisconsin Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion, which can be published to satisfy federal and state demands.

Should you be previously acquainted with US Legal Forms internet site and also have an account, merely log in. Afterward, you may download the Wisconsin Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion template.

Should you not come with an accounts and want to begin to use US Legal Forms, abide by these steps:

- Get the type you will need and ensure it is to the correct town/county.

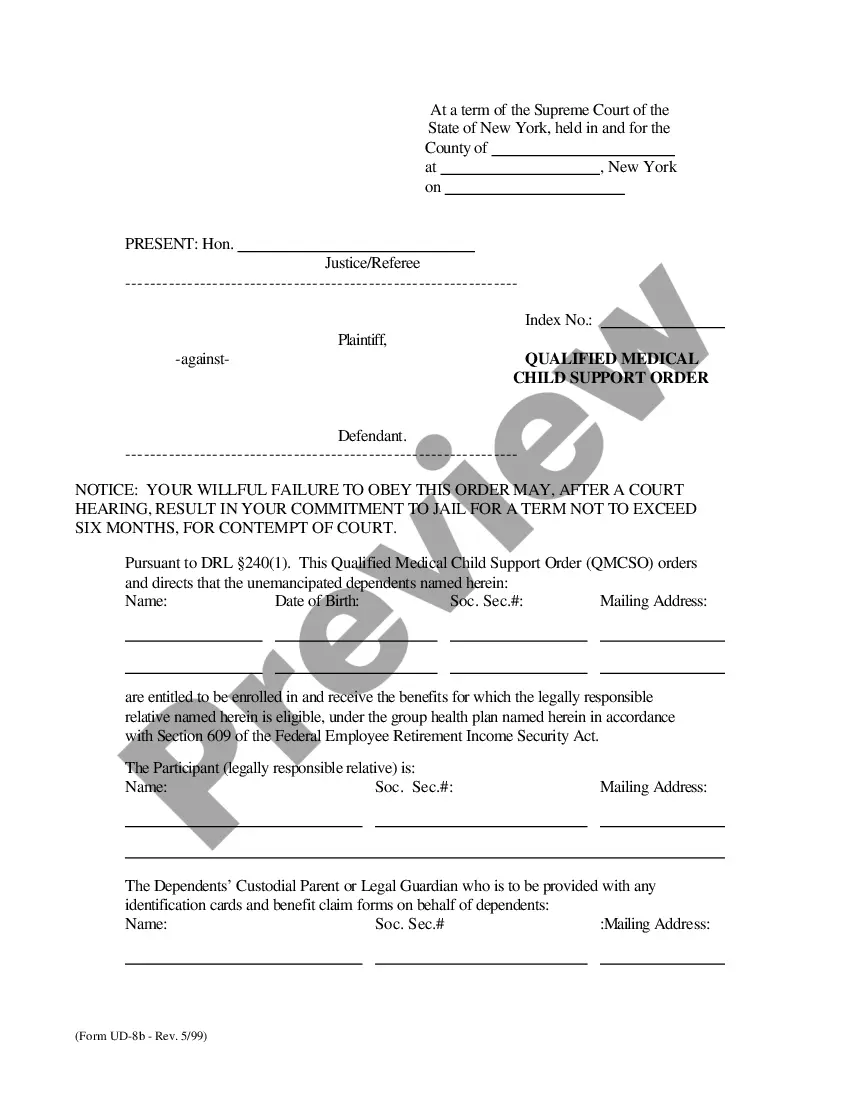

- Make use of the Preview button to examine the form.

- Look at the information to ensure that you have chosen the correct type.

- If the type isn`t what you`re seeking, use the Search area to obtain the type that suits you and demands.

- Once you find the correct type, click on Get now.

- Choose the rates strategy you desire, complete the specified information to produce your bank account, and purchase your order utilizing your PayPal or charge card.

- Pick a convenient document file format and download your backup.

Get all of the file themes you have bought in the My Forms menus. You can get a more backup of Wisconsin Motion of Defendant to Discharge or Quash Writ of Garnishment and Notice of Motion at any time, if required. Just click the essential type to download or produce the file template.

Use US Legal Forms, probably the most substantial selection of legal kinds, to conserve time as well as prevent blunders. The support offers skillfully made legal file themes which you can use for a selection of uses. Make an account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

Limits on Wage Garnishment in Wisconsin. Under Wisconsin law, most creditors can garnish the lesser of (subject to some exceptions?more below): 20% of your disposable earnings, or. the amount by which your disposable earnings exceed 30 times the federal minimum wage.

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

If your judgment has not been completely paid at the end of the 13 weeks and you wish to continue garnishing the debtor's wages, you may file and pay for a new garnishment action. Another option is for you and the debtor to agree in writing to extend the garnishment for another 13-week period.

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.

Legal options available to stop or reduce wage garnishment include objecting to the garnishment order, filing a claim of exemption, negotiating a repayment plan with your creditor, or filing for bankruptcy. This article will discuss these options.

By law, you are entitled to an exemption of not less than 80% of your disposable earnings. Your "disposable earnings" are those remaining after social security and federal and state income taxes are withheld.

Legal options available to stop or reduce wage garnishment include objecting to the garnishment order, filing a claim of exemption, negotiating a repayment plan with your creditor, or filing for bankruptcy. This article will discuss these options.