Wisconsin Sample Letter for Motion to Dismiss in Referenced Bankruptcy

Description

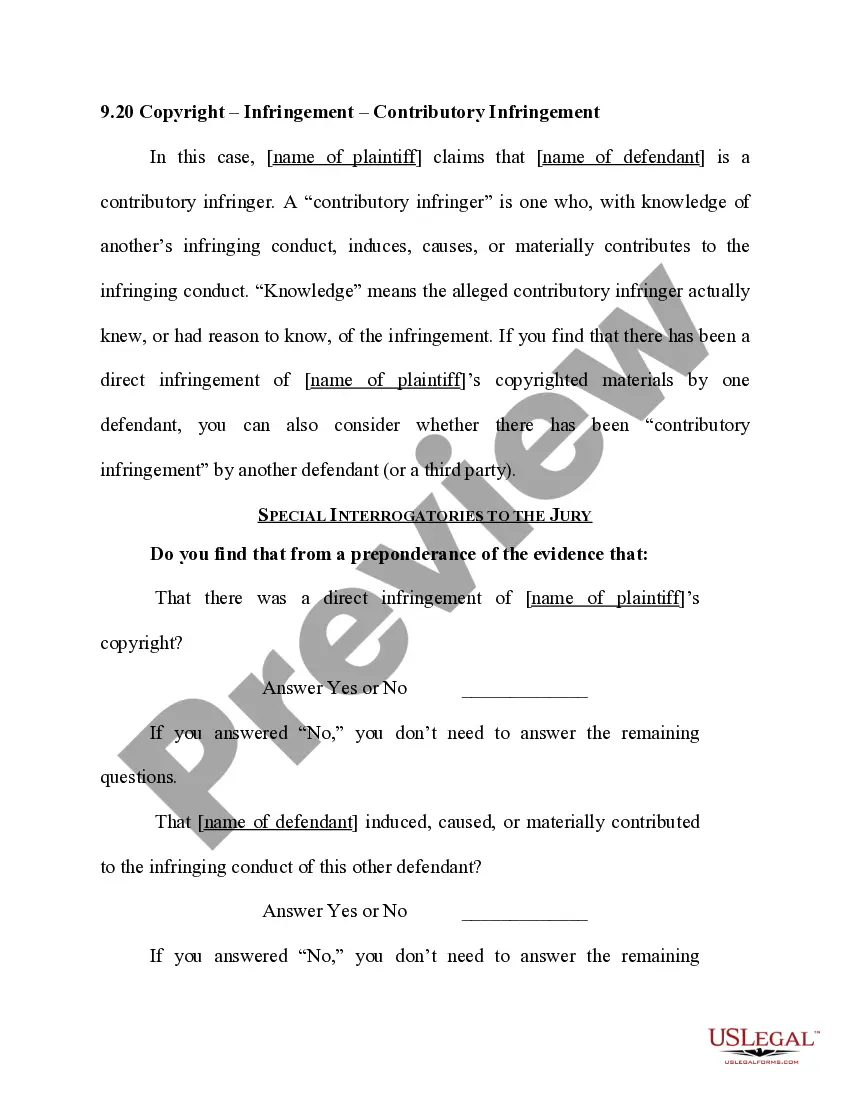

How to fill out Sample Letter For Motion To Dismiss In Referenced Bankruptcy?

Discovering the right legal papers template might be a have a problem. Naturally, there are plenty of web templates available online, but how do you find the legal type you need? Use the US Legal Forms site. The services delivers a large number of web templates, like the Wisconsin Sample Letter for Motion to Dismiss in Referenced Bankruptcy, that you can use for company and private requires. All the varieties are checked by specialists and meet up with federal and state requirements.

Should you be currently signed up, log in to the profile and then click the Acquire switch to find the Wisconsin Sample Letter for Motion to Dismiss in Referenced Bankruptcy. Make use of your profile to appear from the legal varieties you have acquired in the past. Check out the My Forms tab of your profile and obtain another backup from the papers you need.

Should you be a new customer of US Legal Forms, listed here are easy instructions that you should follow:

- First, make sure you have selected the proper type to your metropolis/county. It is possible to check out the form using the Review switch and browse the form outline to make certain this is basically the best for you.

- If the type is not going to meet up with your requirements, use the Seach field to obtain the proper type.

- When you are positive that the form is suitable, click the Get now switch to find the type.

- Select the pricing program you want and enter the necessary information. Build your profile and purchase the order with your PayPal profile or credit card.

- Opt for the document formatting and down load the legal papers template to the device.

- Full, edit and printing and indication the received Wisconsin Sample Letter for Motion to Dismiss in Referenced Bankruptcy.

US Legal Forms may be the most significant local library of legal varieties that you can discover a variety of papers web templates. Use the service to down load skillfully-manufactured documents that follow express requirements.

Form popularity

FAQ

Once you legally file for bankruptcy, your creditors should no longer phone you or sue you and any existing garnishees are lifted. An appointed Licensed Insolvency Trustee will distribute money to your creditors from your non-exempt assets and surplus income.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

The Minimum Percentage of Debt Repayments In A Chapter 13 Bankruptcy Is 8 To 10 Percent.

The simplest answer is that a bankruptcy eliminates most, if not all, of what are known as 'unsecured' debts. These include credit card debt, lines of credit, bank loans, payday loans and income tax debt. When you file for bankruptcy, you will no longer have to worry about repaying these debts.

The Chapter 13 Trustee is required to report to the Bankruptcy Court if you fail to make payments on time or in full. The Court may then enter an order dismissing your case and withdrawing the protection of the Bankruptcy Court. If that occurs, you then could be subject to creditor collection efforts and other actions.

If you're unable to pay your filing fees, the court will usually try to work with you. For Chapter 13 bankruptcy, you may be able to roll your court fees into your repayment plan, paying the court in monthly installments.

A Chapter 13 bankruptcy can remain on your credit report for up to 10 years, and you will lose all your credit cards. Bankruptcy also makes it nearly impossible to get a mortgage if you don't already have one.