Wisconsin Sample Letter for Additional Documents

Description

How to fill out Sample Letter For Additional Documents?

Are you currently in the situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available on the web, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Wisconsin Sample Letter for Additional Documents, that are created to comply with federal and state requirements.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Sample Letter for Additional Documents template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your specific city/region.

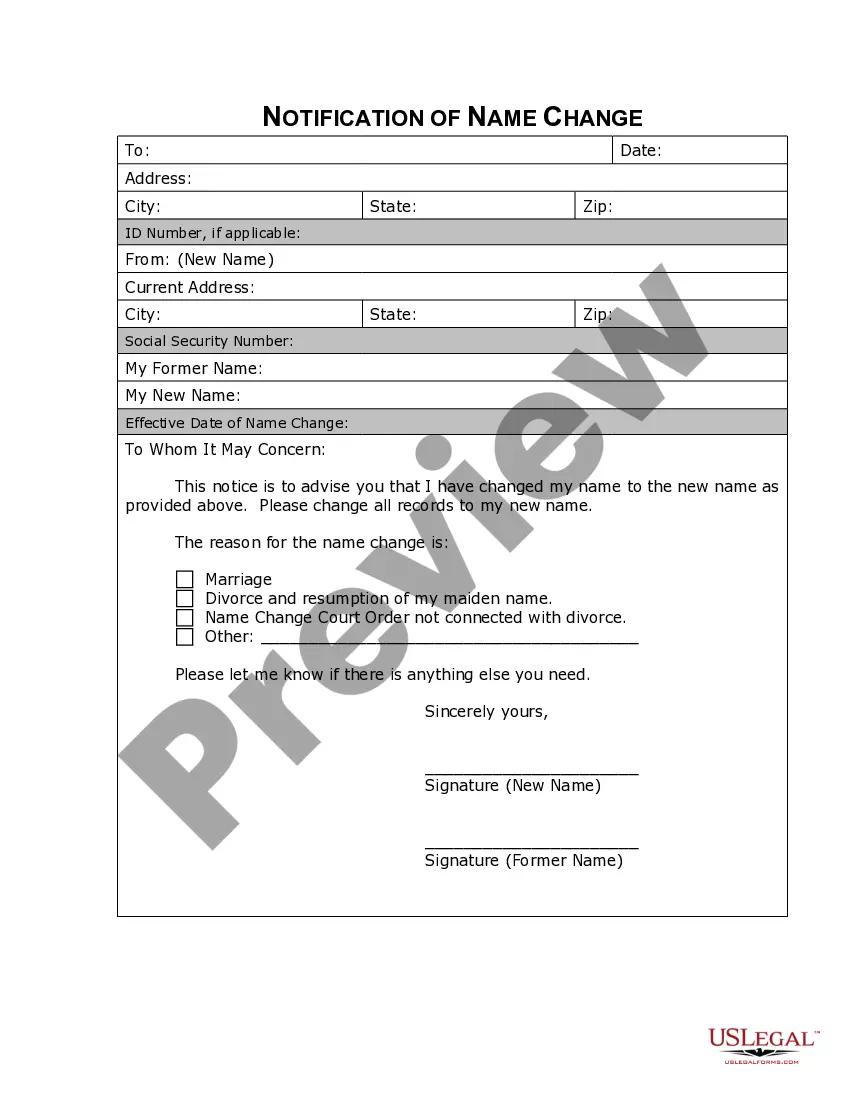

- Use the Review button to evaluate the form.

- Check the description to make sure you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the form that fits your needs and requirements.

- Once you find the right form, click on Purchase now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents menu.

- You can download another version of the Wisconsin Sample Letter for Additional Documents at any time, if needed. Just click the relevant form to download or print the document template.

Form popularity

FAQ

What State Has the Highest Income Tax? California has the highest state income tax, with a rate of up to 13.3%. California has graduated-rate income taxes that range from 1% to a 13.3% tax rate on income of more than $1 million. Middle-class Californians pay an income tax rate in the range of 6% to 9.3%.

You may obtain most Wisconsin tax forms and publications in one of the following ways: Download forms and publications in Adobe PDF format by visiting the Forms page or the Publications page. Between January and April, many libraries will have a supply of Wisconsin individual income tax forms on hand.

Your letter of qualifications should include: Highlights of your most relevant skills and experiences as they relate to the specific job you are applying for. Any education, training and experience you have specifically related to the ?Qualifications? section of the job announcement.

Yes. All income received by a Wisconsin resident is reportable to Wisconsin regardless of where it is earned. Wisconsin allows a credit for the net income tax you pay to other states on income that is taxed by both Wisconsin and the other state.

Wisconsin's tax rate is 5.3% for individual taxpayers in the middle tax bracket ? higher than the rate in the top tax bracket in 25 states as of January 2023, ing to the Tax Foundation.

Wisconsin individual income tax rates vary from 3.50% to 7.65%, depending upon marital status and income. Note: Nonresidents and part-year residents must prorate the tax based on the ratio of their Wisconsin income to their federal adjusted gross income.

Wisconsin also has a flat 7.90 percent corporate income tax rate. Wisconsin has a 5.00 percent state sales tax rate, a max local sales tax rate of 1.75 percent, and an average combined state and local sales tax rate of 5.43 percent. Wisconsin's tax system ranks 27th overall on our 2023 State Business Tax Climate Index.

Your Letter of Qualifications should provide examples to expand upon or supplement the qualifications addressed on your resume. It can be helpful to organize your document with a section for each of the qualification. You can just list the qualification, followed by your examples.