Wisconsin Subscription Agreement

Description

How to fill out Subscription Agreement?

Are you presently in a scenario where you frequently require documents for both organizational or individual purposes.

There are numerous reputable template options accessible online, but locating ones you can rely on is not easy.

US Legal Forms offers countless template options, such as the Wisconsin Subscription Agreement, which can be tailored to comply with federal and state regulations.

Select the pricing plan you desire, fill in the required details to create your account, and complete the purchase using your PayPal or credit card.

Choose a suitable document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Wisconsin Subscription Agreement template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these instructions.

- Obtain the template you need and ensure it corresponds to the correct city/region.

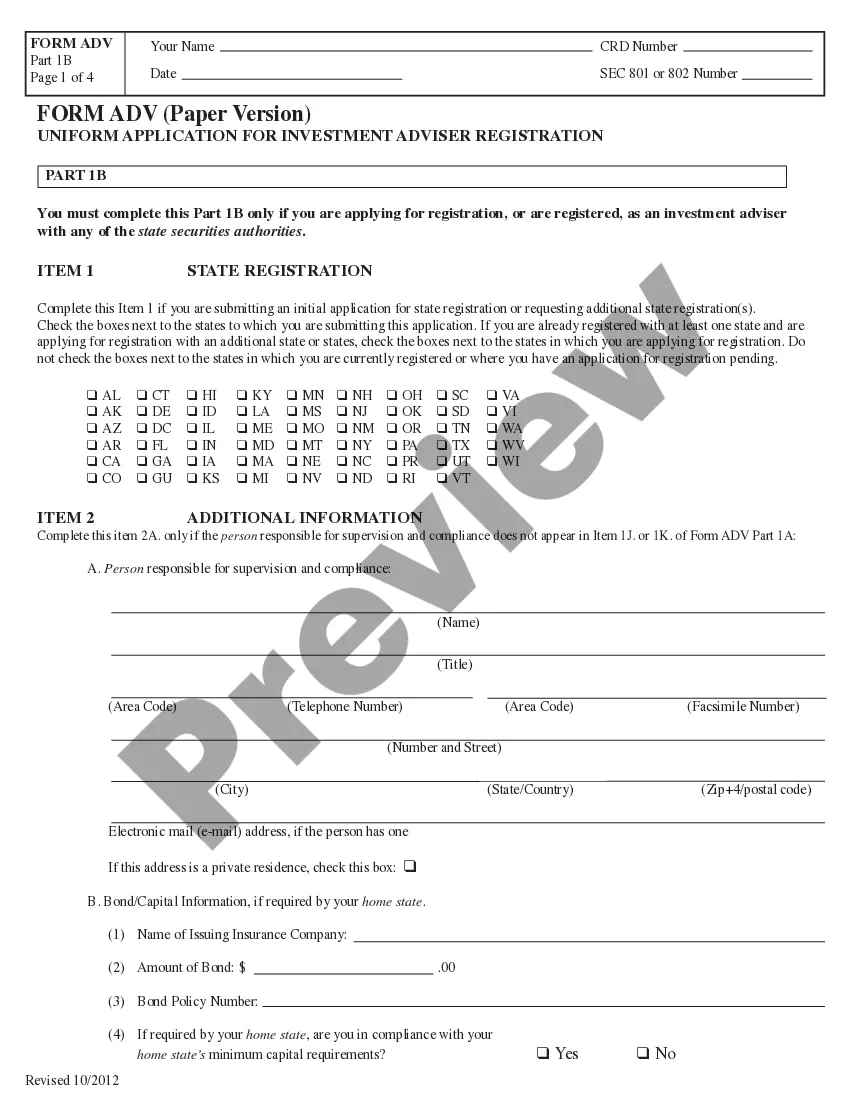

- Use the Preview button to review the document.

- Verify the details to confirm that you have chosen the correct template.

- If the template does not meet your requirements, utilize the Lookup field to locate the template that satisfies your needs.

- Once you find the suitable template, click Buy now.

Form popularity

FAQ

An operating agreement governs the internal workings of an LLC, detailing member roles, management structure, and decision-making processes. Conversely, a subscription agreement focuses specifically on the investment aspect, such as share purchases and member rights. Understanding these differences is vital for effectively structuring your business, particularly when creating a Wisconsin Subscription Agreement.

Yes, membership dues can be taxable in Wisconsin, depending on the nature of the organization. If the organization is a nonprofit, certain dues might be exempt from taxation. To ensure compliance, it is essential to consult with a tax professional. Being informed can help you navigate financial responsibilities related to your Wisconsin Subscription Agreement seamlessly.

In Wisconsin, an operating agreement is not legally required for an LLC, but it is highly recommended. This document provides a clear framework for managing the company and protects the members' interests. Without a well-structured operating agreement, potential conflicts may arise among members. Therefore, incorporating one into your Wisconsin Subscription Agreement can significantly enhance your business's effectiveness.

Another name for an operating agreement is a member agreement. This document outlines the ownership and managerial structure of a limited liability company (LLC). It clarifies the rights and responsibilities of members in relation to the company's operations. Understanding this can help in drafting your Wisconsin Subscription Agreement.

A Private Placement Memorandum (PPM) provides comprehensive information about the investment opportunity, including risks, and is designed to inform potential investors. In contrast, a Wisconsin Subscription Agreement is focused on the specific terms of subscribing to the investment. Both documents play crucial roles in the investment process but serve different purposes in the investor’s decision-making journey.

Yes, while Wisconsin does not mandate an operating agreement, it is highly recommended for LLCs. This document defines the management structure and operational guidelines of the company. Having an operating agreement in place protects the interests of the members by clarifying roles and expectations, particularly in the context of a Wisconsin Subscription Agreement.

Yes, online subscriptions may be subject to sales tax in Wisconsin depending on the nature of the subscription services. If the service provided falls under taxable categories, a Wisconsin Subscription Agreement must account for any sales tax obligations. It’s advisable to consult with a tax professional to ensure compliance with local regulations.

A credit agreement often involves two main parties: the lender and the borrower. In the context of a Wisconsin Subscription Agreement, the lender may provide the capital for the business, while the borrower uses those funds for a specific purpose, such as purchasing subscriptions. It is essential for both parties to detail their obligations to prevent disputes.

In a Wisconsin Subscription Agreement, the parties typically include the issuer, which is the entity offering the subscriptions, and the subscribers, who are the individuals or entities purchasing the subscriptions. Both parties must understand their roles, rights, and obligations within the agreement to ensure clear communication and legal compliance.