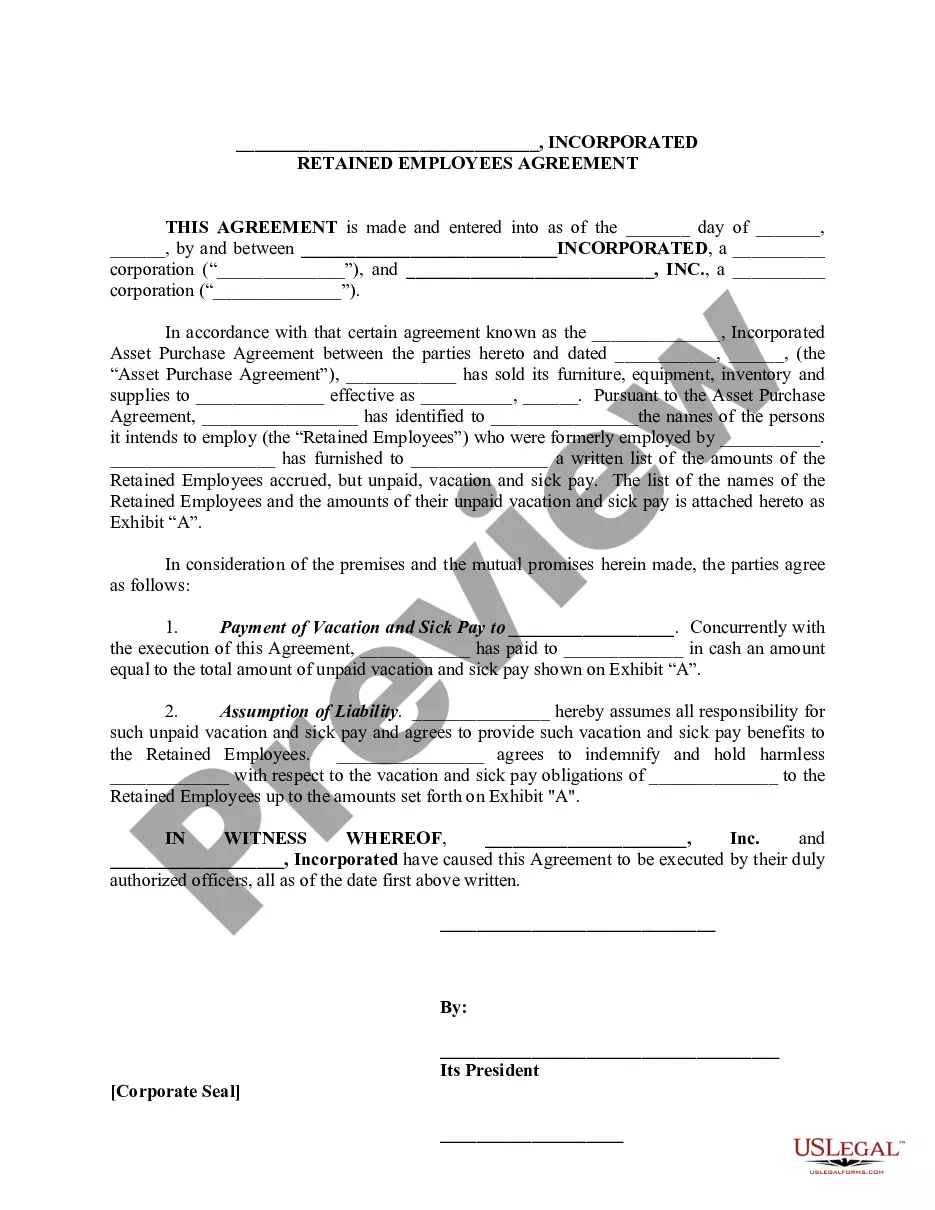

Wisconsin Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

US Legal Forms - one of the vastest collections of legitimate documents in the States - offers a broad selection of legitimate templates you can download or print.

By using the website, you will find thousands of forms for business and personal purposes, categorized by categories, states, or keywords. You'll discover the latest versions of forms like the Wisconsin Sale of Business - Retained Employees Agreement - Asset Purchase Transaction in just moments.

If you have a membership, Log In and download Wisconsin Sale of Business - Retained Employees Agreement - Asset Purchase Transaction from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Choose the file format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Wisconsin Sale of Business - Retained Employees Agreement - Asset Purchase Transaction. Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you need. Access the Wisconsin Sale of Business - Retained Employees Agreement - Asset Purchase Transaction with US Legal Forms, the most extensive collection of legitimate document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs.

- Ensure you have chosen the correct form for your city/state.

- Click the Preview button to review the form's content.

- Check the form outline to confirm that you have selected the appropriate form.

- If the form does not meet your requirements, utilize the Search area at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

If the merger or acquisition is the result of a stock purchase and employees are absorbed by the new entity, any current employment forms may remain intact unless substantive changes need to be addressed (e.g., policy changes, benefits changes, nondisclosure agreements, change in job duties or pay).

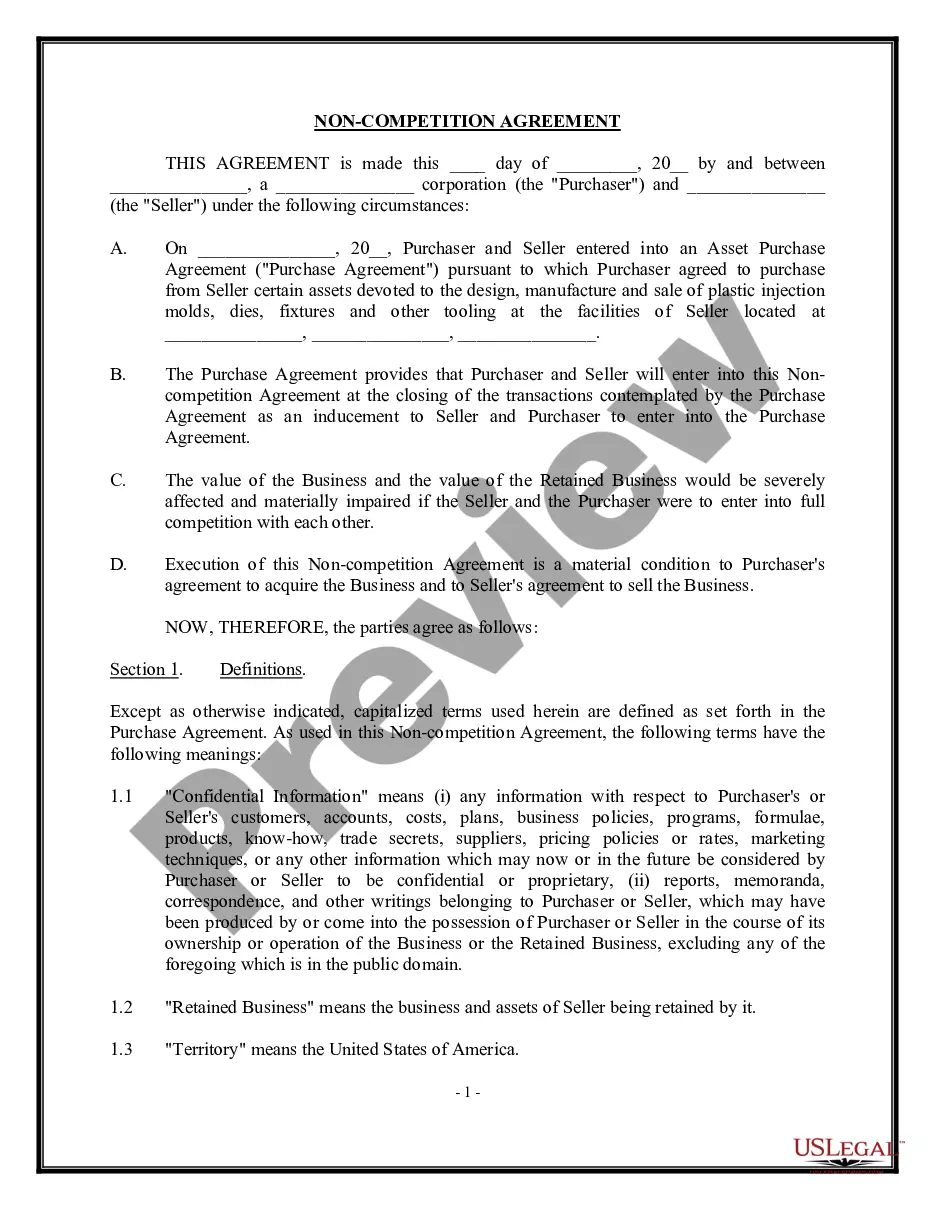

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

The employees who are employed by the target entity will generally come with the transaction, like a stock purchase. If certain employees at the seller/parent company provide significant services to the target entity, then the transaction will act like an asset purchase with respect to this group of employees.

At the closing of an asset purchase, employees of the seller are generally terminated as employees of the seller, and after closing, those employees are rehired by the purchaser.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

By definition, employees are not assets since companies do not have control over them. Workers must convert raw materials be they commodities or blank computer screens into finished inventory to be paid, but if these workers want to quit, they can take their skills and training with them.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.