Wisconsin Revocable Living Trust for Minors

Description

How to fill out Revocable Living Trust For Minors?

If you need to thorough, acquire, or create authentic document templates, utilize US Legal Forms, the most extensive assortment of lawful forms, available online.

Employ the site`s straightforward and user-friendly search to locate the documentation you require. Numerous templates for commercial and personal purposes are organized by categories and regions, or keywords.

Use US Legal Forms to find the Wisconsin Revocable Living Trust for Minors in just a few clicks.

Every legal document format you obtain is yours indefinitely. You’ll have access to every form you saved within your account. Click on the My documents section and select a form to print or download again.

Finish and download, and print the Wisconsin Revocable Living Trust for Minors with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are currently a US Legal Forms member, sign in to your account and click the Download button to obtain the Wisconsin Revocable Living Trust for Minors.

- You can also access forms you previously stored in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

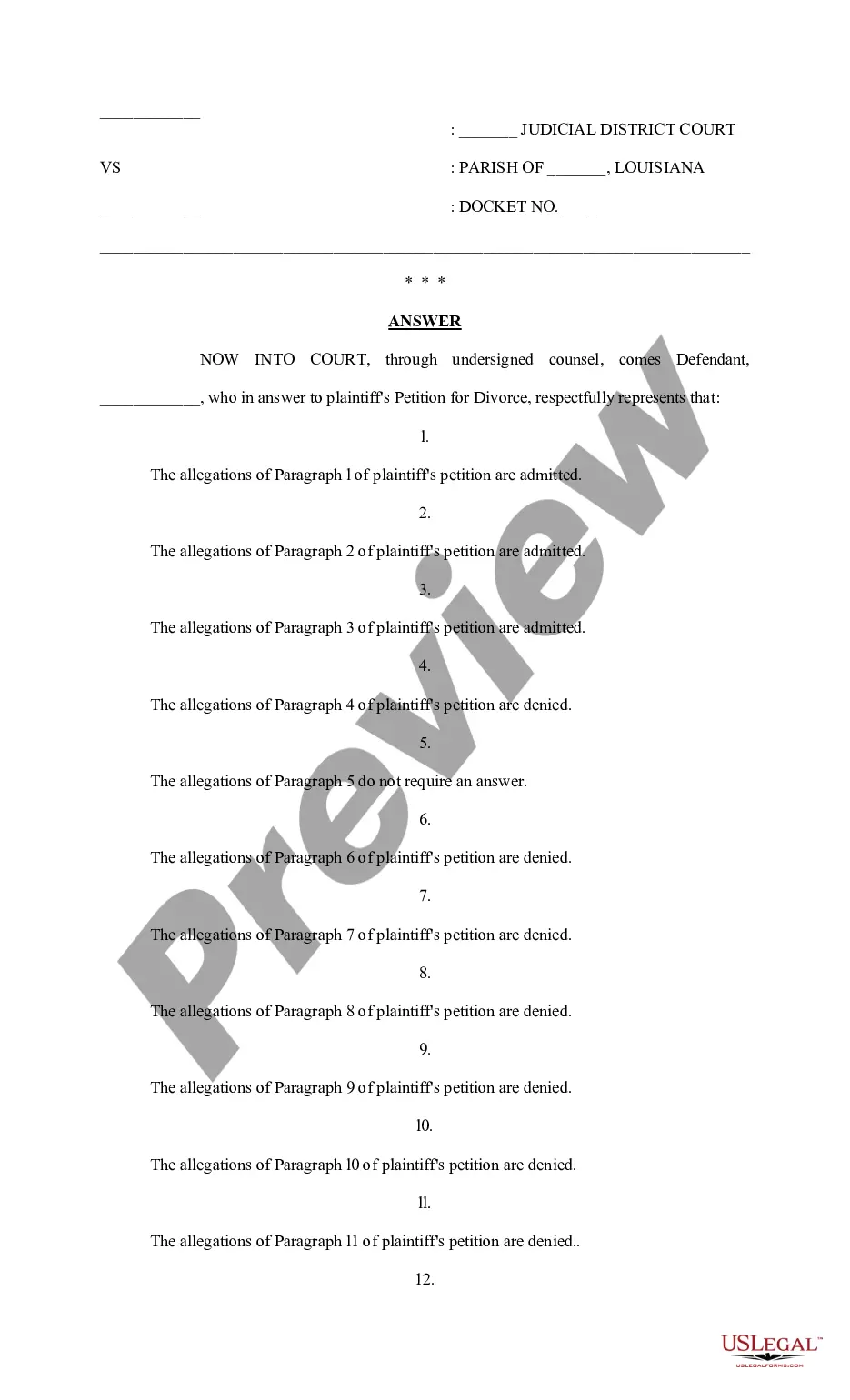

- Step 2. Use the Preview option to review the form`s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal document format.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and enter your credentials to register for the account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Wisconsin Revocable Living Trust for Minors.

Form popularity

FAQ

Yes, you can create your own living trust in Wisconsin. However, it is wise to consider the complexities involved in establishing a Wisconsin Revocable Living Trust for Minors, especially to ensure it aligns with your specific needs. While you can find templates and guides online, using legal services from uslegalforms can offer you peace of mind and help avoid potential pitfalls in the trust creation process.

Wisconsin trust laws are encapsulated in the Uniform Trust Code, which governs the establishment and management of trusts. A Wisconsin Revocable Living Trust for Minors must adhere to these laws, ensuring proper handling of the trust's assets and responsibilities. The laws cover various points, including the rights of beneficiaries and the duties of trustees. Engaging with platforms like uslegalforms can provide clarity on these laws and assist in creating your trust.

In Wisconsin, a trust is governed by the Wisconsin Trust Code, which outlines how trusts should be created, managed, and terminated. A Wisconsin Revocable Living Trust for Minors must follow specific guidelines, including the requirement that the creator must be of legal age and mentally competent. Furthermore, the trust must have a clear purpose, such as providing for the welfare of minors. It is advisable to consult a legal professional to ensure compliance with all laws.

Yes, a minor can benefit from a Wisconsin Revocable Living Trust for Minors. However, the trust must be managed by an appointed adult trustee until the child becomes of age. This arrangement ensures that the assets are used wisely for the child's benefit. It also provides parents with the ability to dictate how and when the assets will be distributed.

Setting up an irrevocable trust for your child can be beneficial in certain situations, but it also comes with limitations. Unlike a Wisconsin Revocable Living Trust for Minors, an irrevocable trust cannot be altered once established, which means you lose control over the assets. This type of trust can provide tax benefits and asset protection, but it's essential to weigh those advantages against the need for flexibility.

A trust for minors operates by designating a trustee to manage the assets until the minor reaches a certain age. In the case of a Wisconsin Revocable Living Trust for Minors, the trustee can disburse funds for the minor’s education, health, and general welfare. This structure protects the assets from being mismanaged and ensures that they are used in the best interest of the child. Moreover, it provides peace of mind for parents, knowing their children's financial future is secure.

A Wisconsin Revocable Living Trust for Minors is often considered one of the best options. This trust allows parents to manage assets on behalf of their children until they reach adulthood. It also offers flexibility, as you can modify or revoke the trust as your circumstances change. With this trust, you ensure that your children are protected financially, even if you are no longer able to provide for them.

While a Wisconsin Revocable Living Trust for Minors offers flexibility, it has some downsides. One of the main issues is that assets in a revocable trust are still considered part of your taxable estate. This means that your beneficiaries may face estate taxes. Additionally, if you ever become incapacitated, you must still have a plan in place to manage your trust effectively.

Filling out a Wisconsin Revocable Living Trust for Minors involves several steps. You start with identifying the trust maker, the beneficiaries, and the assets you want to include. Next, you draft the trust document, ensuring to include instructions for managing and distributing the assets after your death. Finally, it's crucial to sign the document in front of a notary to make it legally binding.

The best type of trust ultimately aligns with your financial goals and family situation. A Wisconsin Revocable Living Trust for Minors typically stands out because of its flexibility and control. It allows you to manage assets for the benefit of your children while adjusting provisions as needed. Consider your specific needs, and consult professionals to determine the trust that works best for you.