Wisconsin Terminate S Corporation Status - Resolution Form - Corporate Resolutions

Description

How to fill out Terminate S Corporation Status - Resolution Form - Corporate Resolutions?

Have you entered a situation that requires documentation for either business or personal matters almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

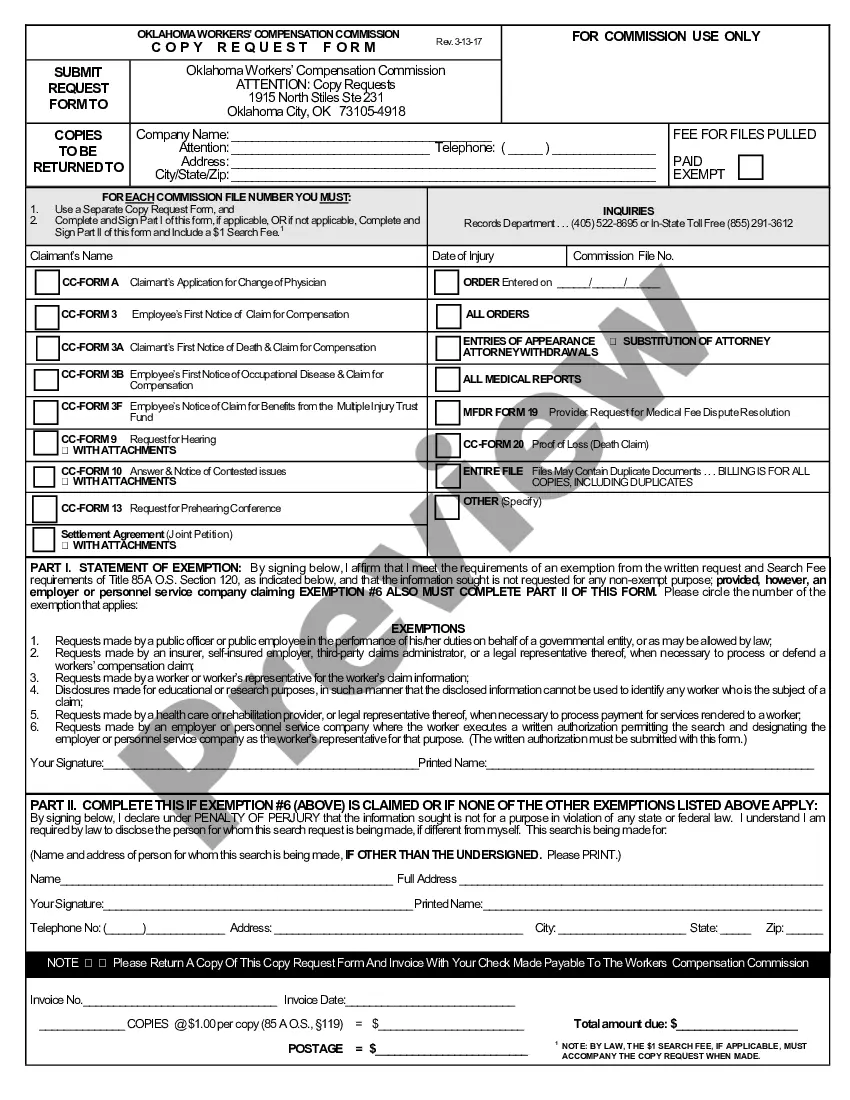

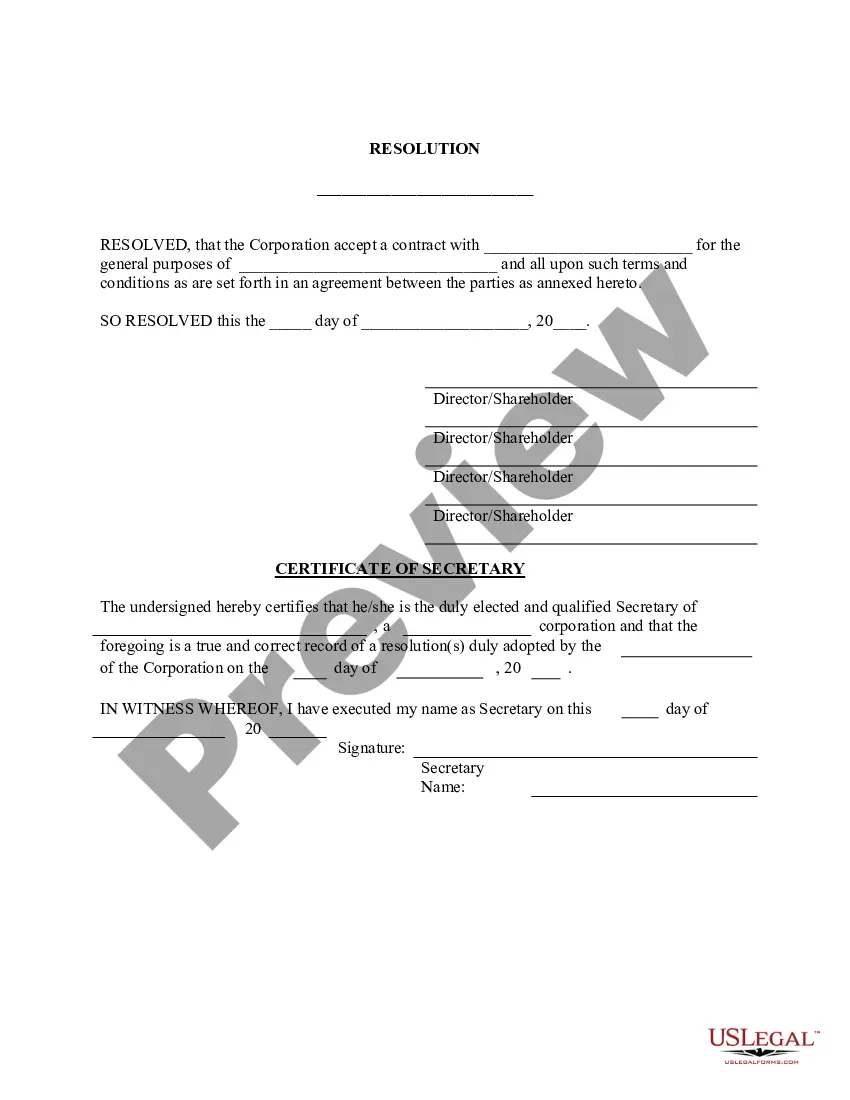

US Legal Forms offers a vast array of form templates, such as the Wisconsin Terminate S Corporation Status - Resolution Form - Corporate Resolutions, which are designed to meet federal and state requirements.

Select a preferred document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Wisconsin Terminate S Corporation Status - Resolution Form - Corporate Resolutions whenever needed. Simply click on the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and reduce errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Wisconsin Terminate S Corporation Status - Resolution Form - Corporate Resolutions template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the description to verify that you have selected the right form.

- If the form is not what you're looking for, use the Search field to locate the form that satisfies your requirements and specifications.

- Once you have the correct form, click on Get now.

- Choose the pricing plan you want, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

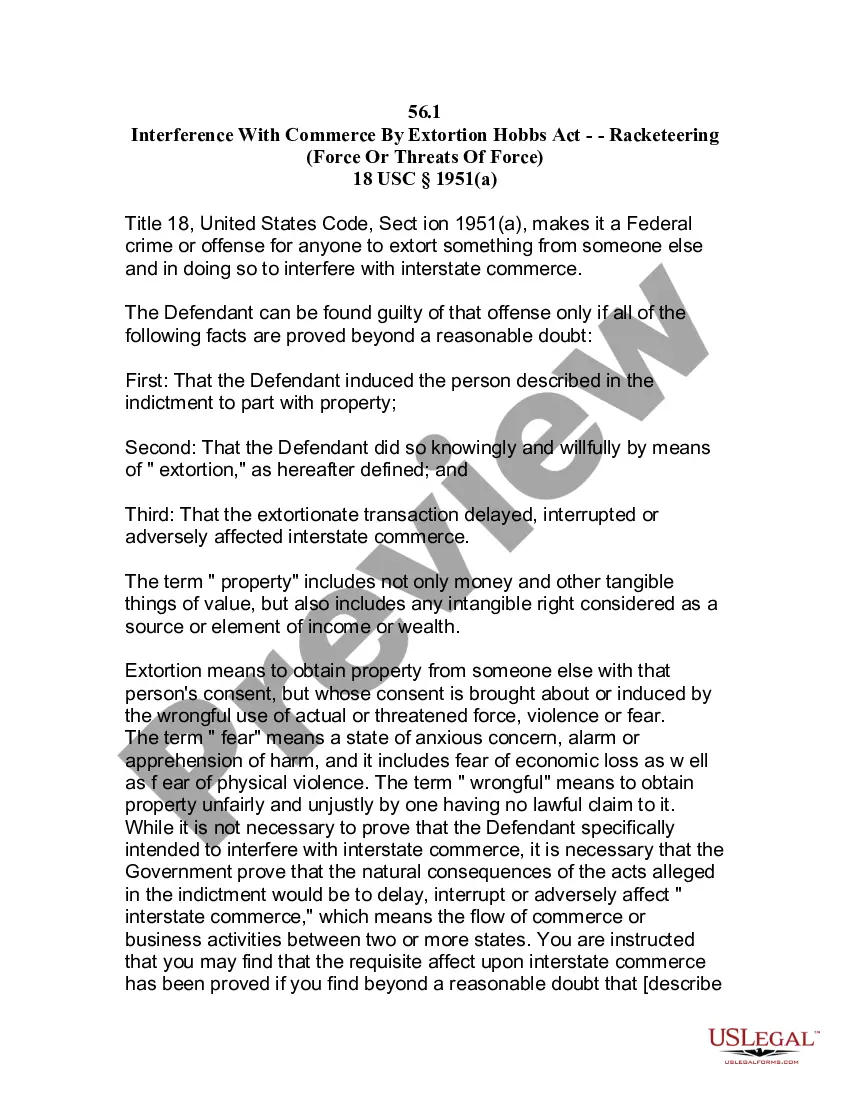

§ 1.1362-3 Treatment of S termination year. (a) In general. If an S election terminates under section 1362(d) on a date other than the first day of a taxable year of the corporation, the corporation's taxable year in which the termination occurs is an S termination year.

Losses of an S corporation suspended under the at-risk rules of Sec. 465 are carried forward to the S corporation's PTTP. The losses can be deducted at the end of the PTTP to the extent stock basis and at-risk limits increase by capital contributions during the PTTP (Sec.

When an entity loses its S corporation status, the entity becomes treated for U.S. federal tax purposes as a C corporation. In general, the S corporation's tax year is deemed to end the day before the failure to adhere occurs and the C corporation's tax year begins on the day of the failure to adhere.

When an S Corporation distributes its income to the shareholders, the distributions are tax-free.

If you want to take money out of your S Corp, you have three options:Take a distribution.Pay yourself a salary.Give yourself a loan.

The two ways to take earnings out of an S corporation are either as earned wages required when corporate officers perform services for the company or as shareholder distributions. Profits are attributed to shareholders at the same percentage as each shareholder's percentage of ownership interest.

When an entity loses its S corporation status, the entity becomes treated for U.S. federal tax purposes as a C corporation. In general, the S corporation's tax year is deemed to end the day before the failure to adhere occurs and the C corporation's tax year begins on the day of the failure to adhere.

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to the service center where you file your annual return. The statement should state: The corporation revokes the election made under Section 1362(a)

Termination of S corporation status can be voluntary or involuntary. While this may be so, once the election is made to become an S corporation, requirements must be met to avoid the termination of S status inadvertently.

If business owners want to revoke the S Corp election retroactively to the first day of their tax year, they must submit their statement by the 16th day of the third month of the tax year.