Wisconsin Contractor's Affidavit of Payment to Subs

Description

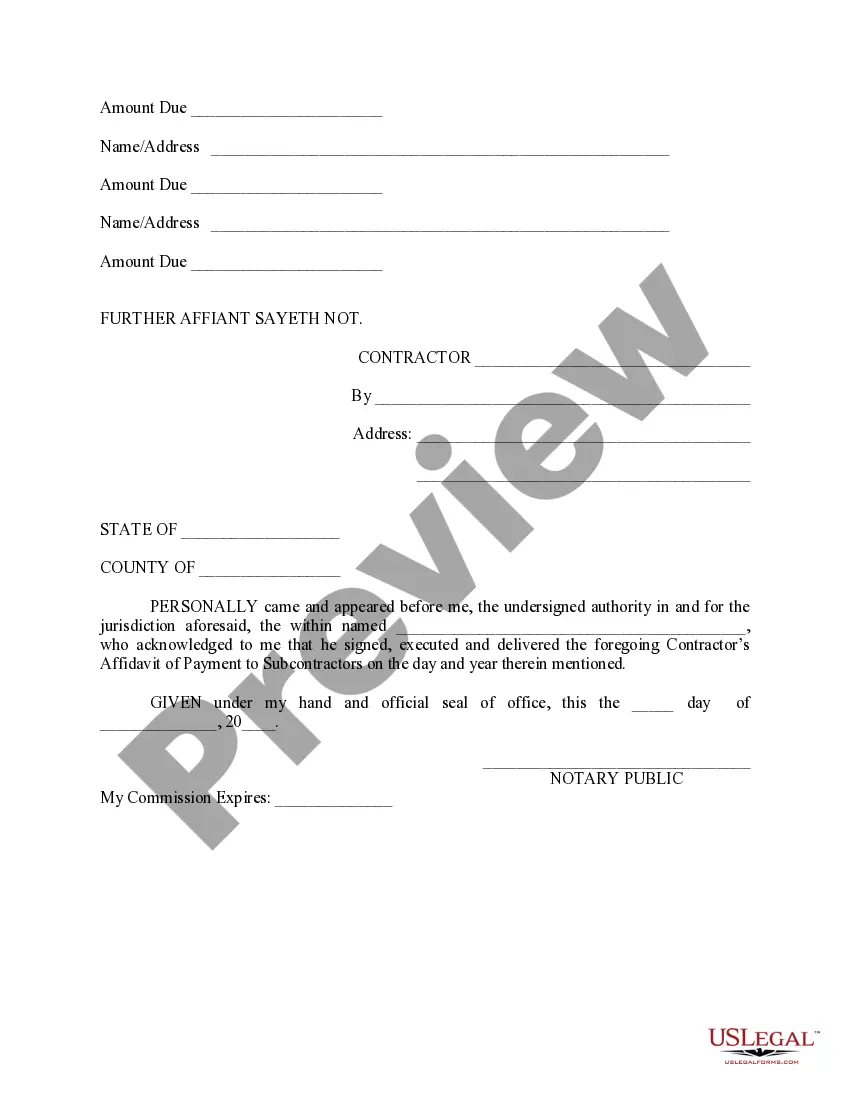

How to fill out Contractor's Affidavit Of Payment To Subs?

Are you presently in a circumstance where you need documents for occasional business or personal reasons almost daily.

There are numerous legal document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of template options, including the Wisconsin Contractor's Affidavit of Payment to Subs, designed to comply with both state and federal regulations.

Choose a suitable file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can acquire another copy of the Wisconsin Contractor's Affidavit of Payment to Subs at any time, if available. Just select the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Wisconsin Contractor's Affidavit of Payment to Subs template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- 1. Find the form you need and confirm it is for the correct region/state.

- 2. Utilize the Preview button to review the form.

- 3. Read the description to verify that you have chosen the appropriate form.

- 4. If the form isn’t what you need, use the Lookup field to find the form that meets your specifications.

- 5. Once you identify the correct form, click on Purchase now.

- 6. Select the pricing plan you desire, fill in the necessary information to create your account, and process the payment via PayPal or credit card.

Form popularity

FAQ

AIA Document G702®1992, Application and Certificate for Payment, and G703A®1992, Continuation Sheet, provide convenient and complete forms on which the contractor can apply for payment and the architect can certify that payment is due.

When Can Contractors Withhold Payment From Subcontractors? The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

AIA Document G70621221994 requires the contractor to list any indebtedness or known claims in connection with the construction contract that have not been paid or otherwise satisfied.

AIA Document G706 is intended for use when the Contractor is required to provide a sworn statement verifying that debts and claims have been settled, except for those listed by the Contractor under EXCEPTIONS in the document. AIA Document G706 is typically executed as a condition of final payment.

A nominated sub-contractor is one that is selected by the client to carry out an element of the works and then imposed on the main contractor after the main contractor has been appointed.

Contractors and subcontractors don't affect your payroll, because they're not employees. When you negotiate a job with the contractor, generally, you agree to pay them a flat fee not a salary or hourly rate.

The ability to withhold payment needs to be written out in the contract because, in most states, verbal agreements for commercial work are not binding and will not hold up in court. With a written contract that both parties agree to, it's safe for a contractor to withhold payment if a vendor becomes non-compliant.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

If the contractor defaults or otherwise doesn't take care of your wages, you can file a claim with the surety company to get at least part of your money. The surety company then takes the contractor to court to recover the amount.

The average pre-tax net profit for subcontractors is between 2.2 to 3.5 percent. To compensate for the risk, this is barely enough for most contractors to survive. Contractor markup is the percentage added to your direct costs to cover profit and overhead.