This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

You can spend multiple hours online searching for the correct document format that meets the federal and state requirements you need. US Legal Forms provides a vast array of legal templates that can be reviewed by experts.

It is easy to download or print the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure from their services. If you have a US Legal Forms account, you can Log In and click on the Obtain button.

After that, you can complete, modify, print, or sign the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure. Each legal document template you acquire is your own property indefinitely. To obtain another copy of a purchased form, visit the My documents tab and click on the appropriate button.

Select the file format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure. Obtain and print a multitude of document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

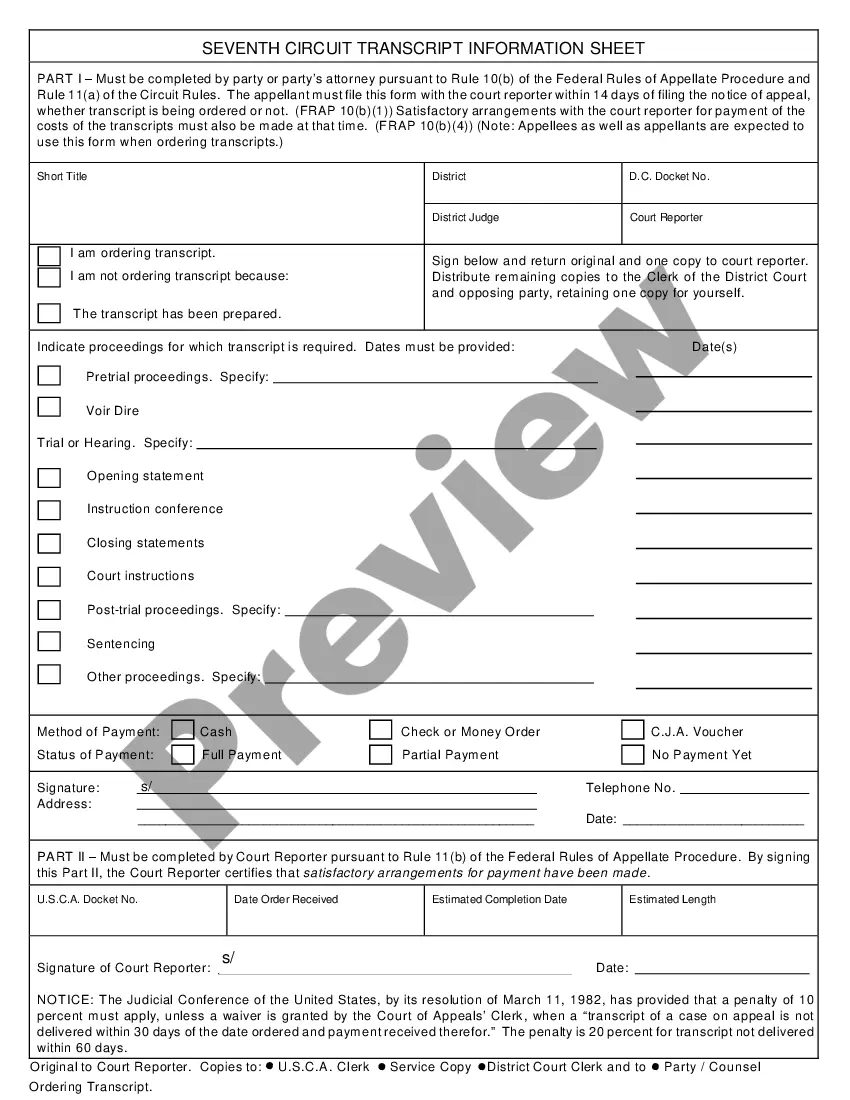

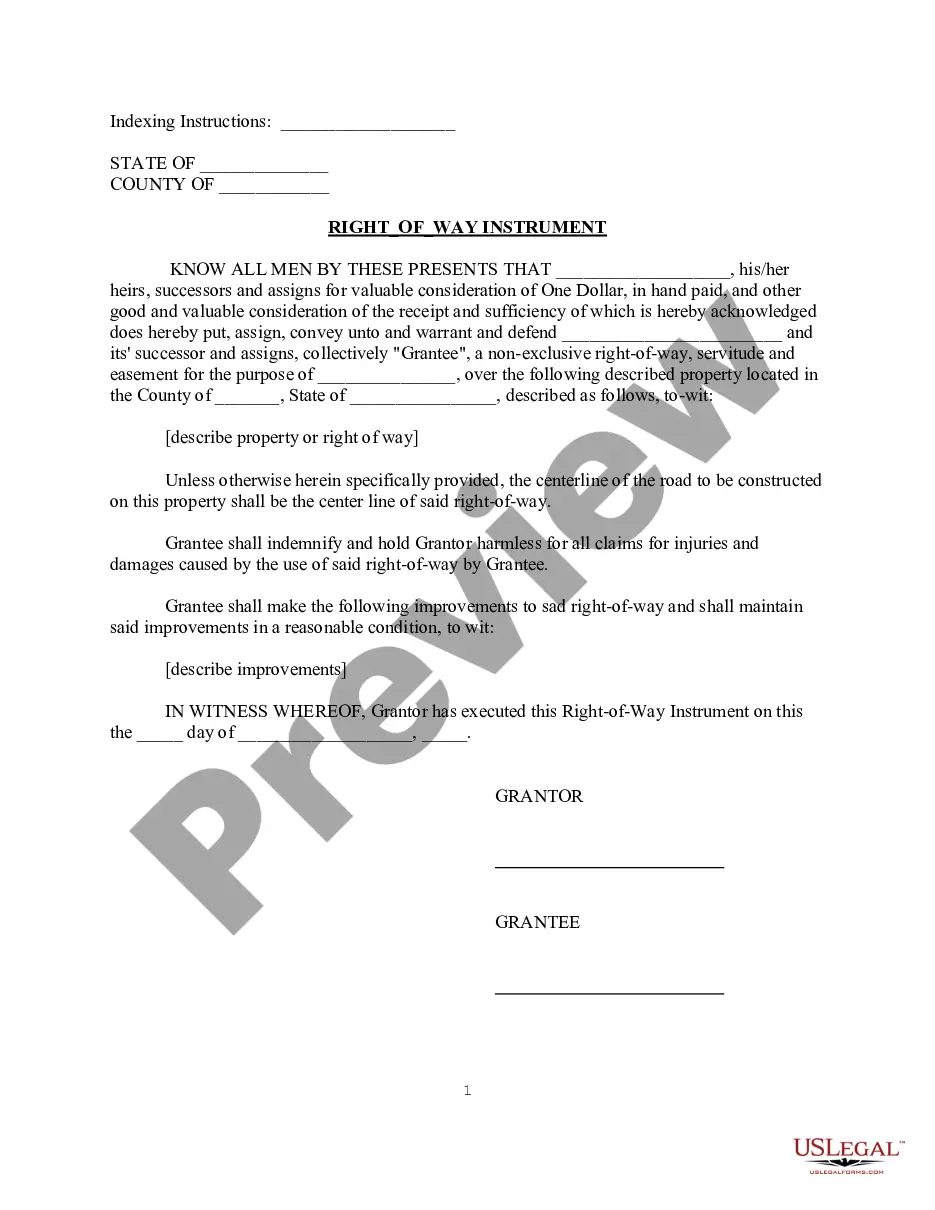

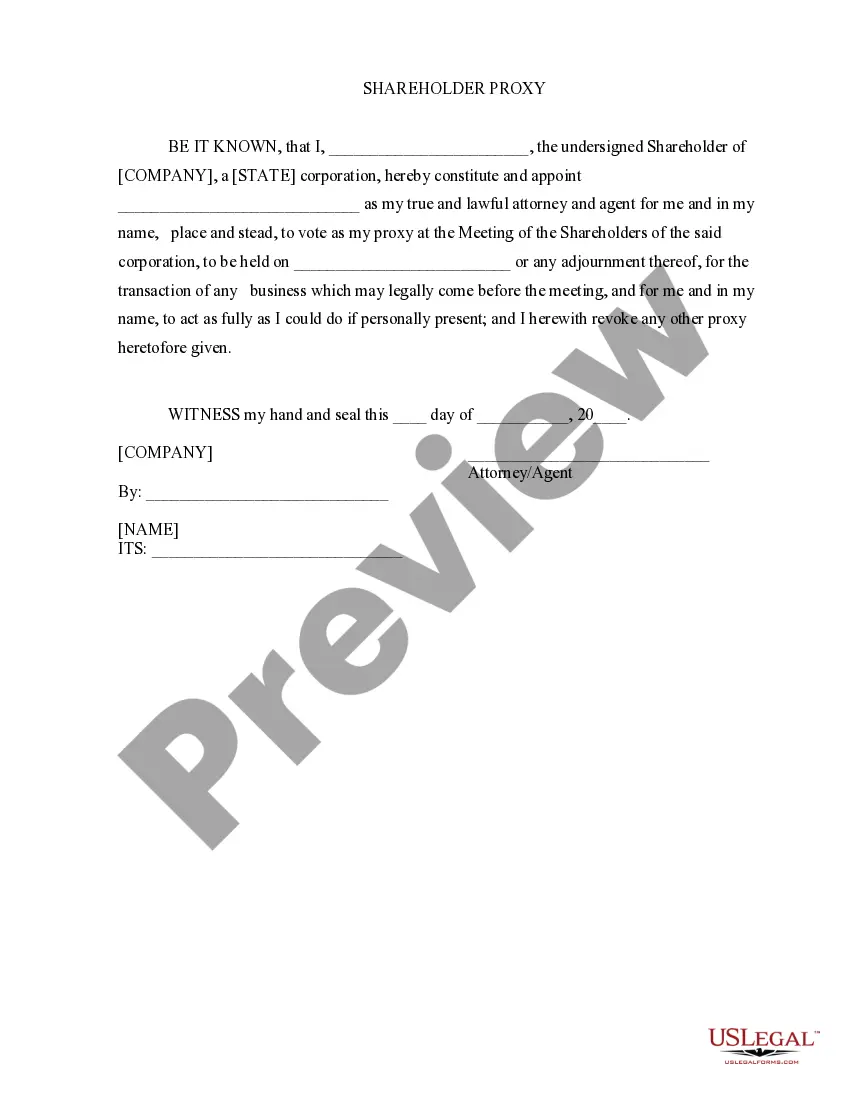

- First, ensure that you have selected the correct document format for the county/city of your choice. Read the form description to confirm you have chosen the right form.

- If available, use the Review button to browse through the document format as well.

- If you wish to find another version of the form, use the Search field to locate the format that fits your needs and requirements.

- Once you have found the format you need, click Acquire now to proceed.

- Select the pricing plan you want, enter your details, and create your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

The IRS right to redeem foreclosure allows the IRS to reclaim the property in case of unpaid federal taxes, usually within a specific timeframe. This right ensures the IRS can recover its dues before the property can be sold to new owners. Knowing how to use the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure can help you understand your rights and responsibilities in this regard.

After foreclosure, the federal tax lien typically remains attached to the property and may continue to affect your financial situation. However, once the lien is discharged, you can move forward without that burden. The Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure can help you navigate the steps necessary to obtain this discharge.

The IRS 7 year rule refers to the timeframe within which a tax lien remains on your credit report. Generally, a lien can stay on your record for up to seven years from the date it was filed. Understanding the implications of this rule is crucial, especially when considering the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure, as it may influence your financial decisions.

To get a lien payoff from the IRS, you need to request a payoff statement, which indicates the total amount owed. You can obtain this by contacting the IRS directly or through their online portal. Additionally, the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure provides a structured approach to managing lien payoffs and ensuring you meet all necessary requirements.

The right to redeem property after a foreclosure means you can recover your property by paying off the existing debts, such as taxes or other liens. This right gives you a chance to reverse the foreclosure and maintain ownership. Utilizing the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure can assist you in exercising this right effectively.

The IRS right of redemption in a foreclosure allows you to reclaim your property after the sale by paying the full amount of the tax debt. This right typically lasts for a specific period post-foreclosure. Understanding the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure can help you navigate this complex process and protect your interests.

Form 14135 is an application you file to obtain a certificate of discharge of property from a federal tax lien. This form serves to release the IRS's claim against your property, allowing you to sell or refinance it without the burden of the lien. By completing the Wisconsin Application for Release of Right to Redeem Property from IRS After Foreclosure, you can streamline this process and regain control of your property.