Wisconsin Instructions and Worksheet to Calculate Temporary Partial Disability Payments is a set of guidelines and worksheets used to determine the amount of Temporary Partial Disability Payments a worker may be entitled to receive in the state of Wisconsin. The Temporary Partial Disability Payments are intended to cover lost wages due to a work-related injury or illness that prevents the worker from performing their normal job duties or from earning their regular wages. These payments are paid out in weekly installments and are calculated based on the individual's wages prior to the injury or illness, the amount of time they are expected to be out of work, and the amount of wages they are able to earn while on disability. There are two types of Wisconsin Instructions and Worksheet to Calculate Temporary Partial Disability Payments: the Initial Payment Worksheet and the Continued Payment Worksheet. The Initial Payment Worksheet is used to calculate the first payment amount and the Continued Payment Worksheet is used to calculate ongoing payments after the initial payment. Both worksheets require the worker to provide information about their wages prior to the injury/illness, the amount of time they are expected to be out of work, and the amount of wages they are able to earn while on disability.

Wisconsin Instructions and worksheet to calculate Temporary Partial Disability Payments.

Description

How to fill out Wisconsin Instructions And Worksheet To Calculate Temporary Partial Disability Payments.?

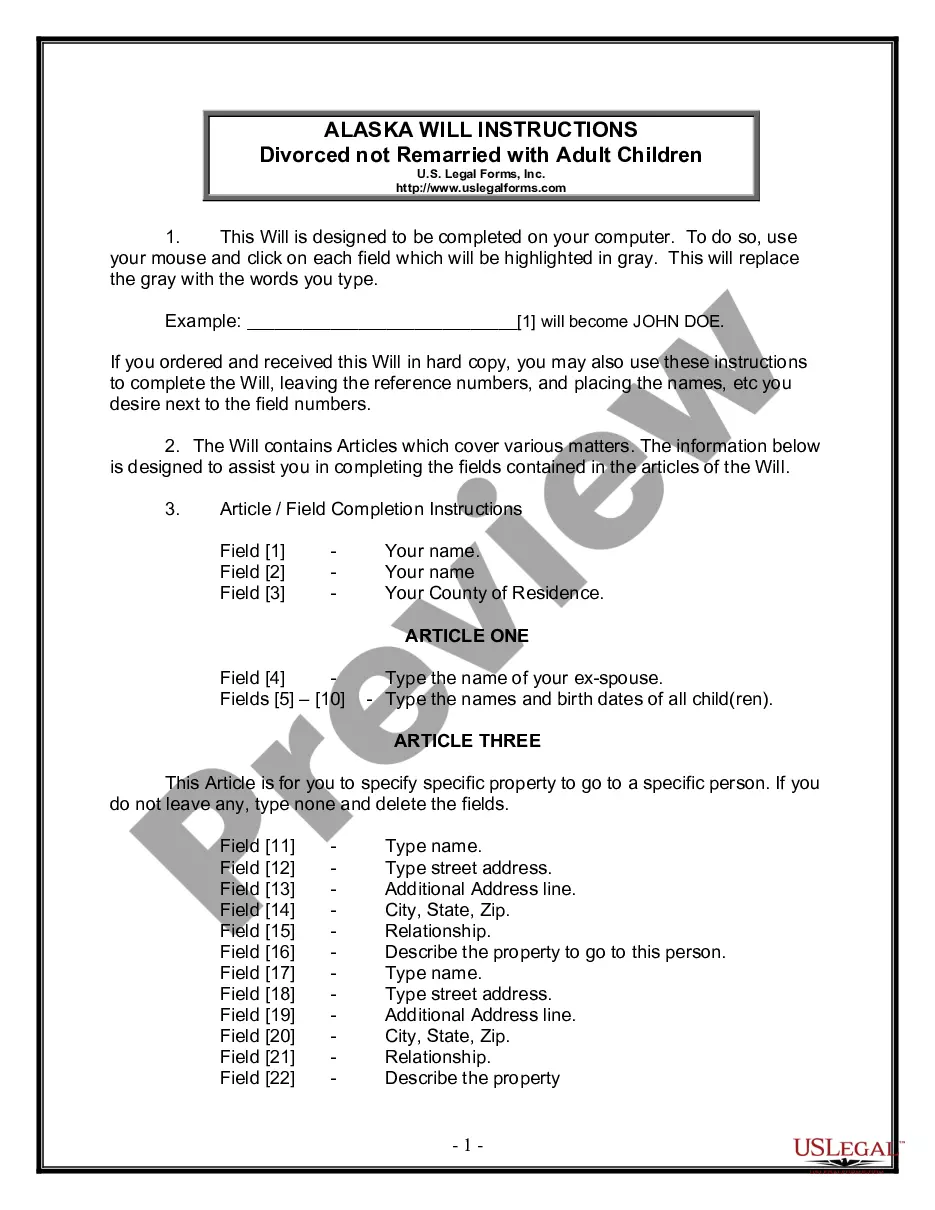

Handling official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Wisconsin Instructions and worksheet to calculate Temporary Partial Disability Payments. template from our library, you can be sure it meets federal and state laws.

Working with our service is simple and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Wisconsin Instructions and worksheet to calculate Temporary Partial Disability Payments. within minutes:

- Remember to attentively look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Wisconsin Instructions and worksheet to calculate Temporary Partial Disability Payments. in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Create an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are drafted for multi-usage, like the Wisconsin Instructions and worksheet to calculate Temporary Partial Disability Payments. you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

The PPD rate is based on 66.67% of what the wage would be if the injured worker did not self-restrict, not to exceed the maximum PPD rate for the year of injury.

File for Disability in Wisconsin Online: Apply online on the SSA's website ssa.gov. Telephone: Apply over the telephone by calling the SSA's toll-free customer service line at 1-800-772-1213 (TTY 1-800-325-0778) In-person: Apply in-person at your local Social Security field office. Find your local office here.

Temporary Partial Disability Benefits Per Week The amount of this disability benefit is determined by multiplying the injured worker's Average Weekly Wage (AWW) by 80%, subtracting any gross wages earned working light duty, and multiplying that number by 80%.

Wisconsin Temporary Partial Disability Benefits Temporary partial disability benefits are paid to a worker who sustained an employment injury after which an employee can still work, but only fewer hours or in a lesser-paying position due to the industrial accident or disease.

The gross taxable wages earned in the 52-week period prior to the week of injury (exclude tips). divide by the number of weeks worked in the 52-week period prior to the week of injury.

A partial disability designation typically occurs when a physician determines that the employee's injury affects 25 percent to 50 percent of the employee's physical or mental capabilities.

Partial disability = Key functions of your occupation, limiting your ability to work full-time in your previous capacity and earning level. Total disability = All of the duties of your occupation or any occupation (depending on your insurance policy terms), preventing you from gainful earnings.