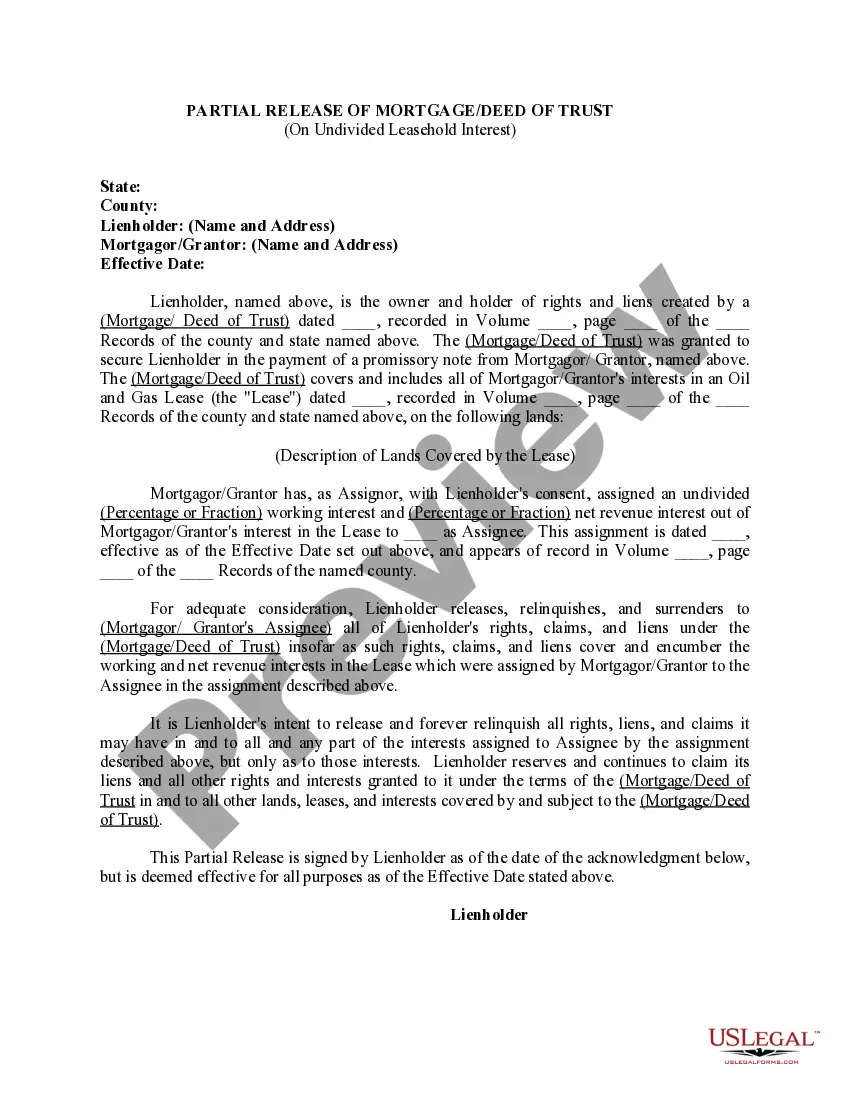

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

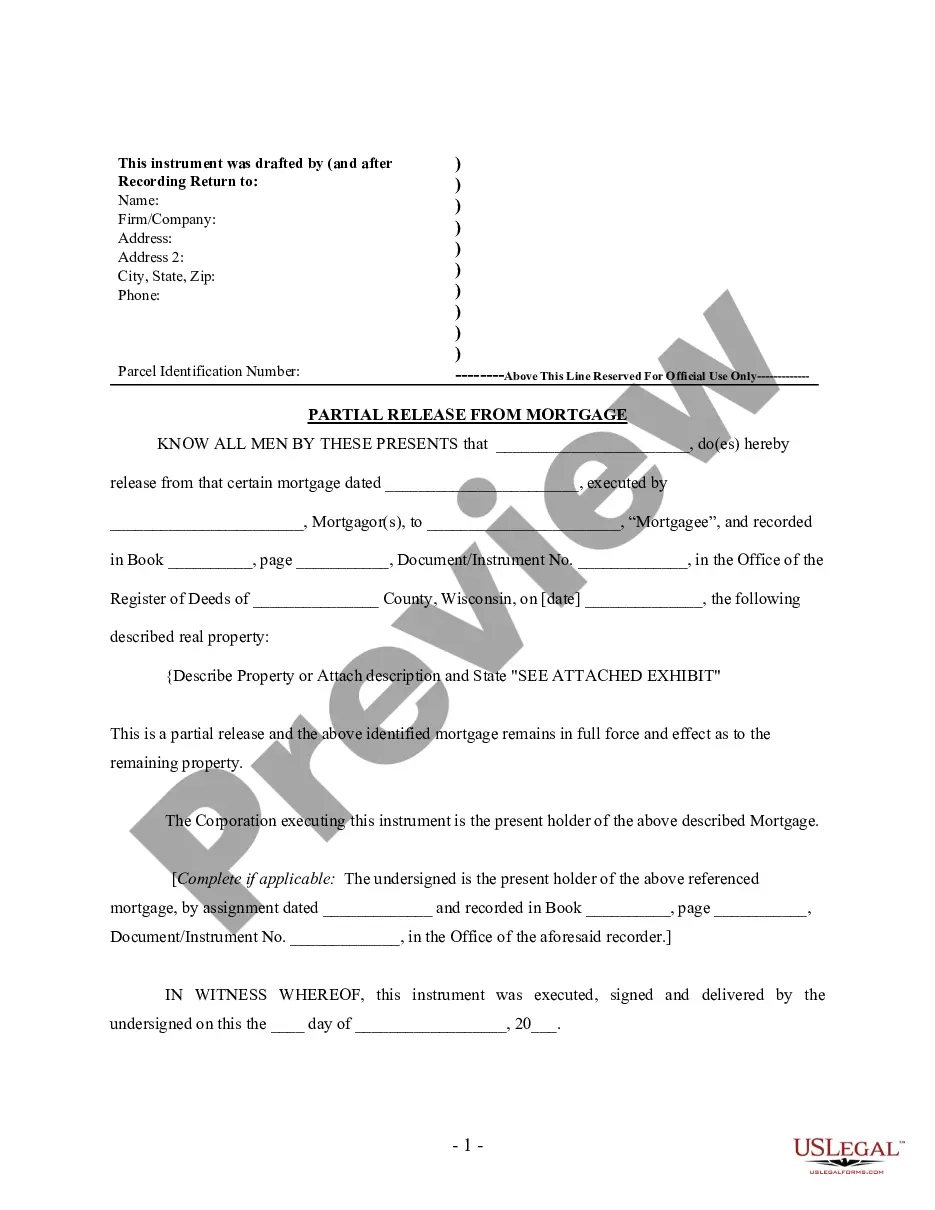

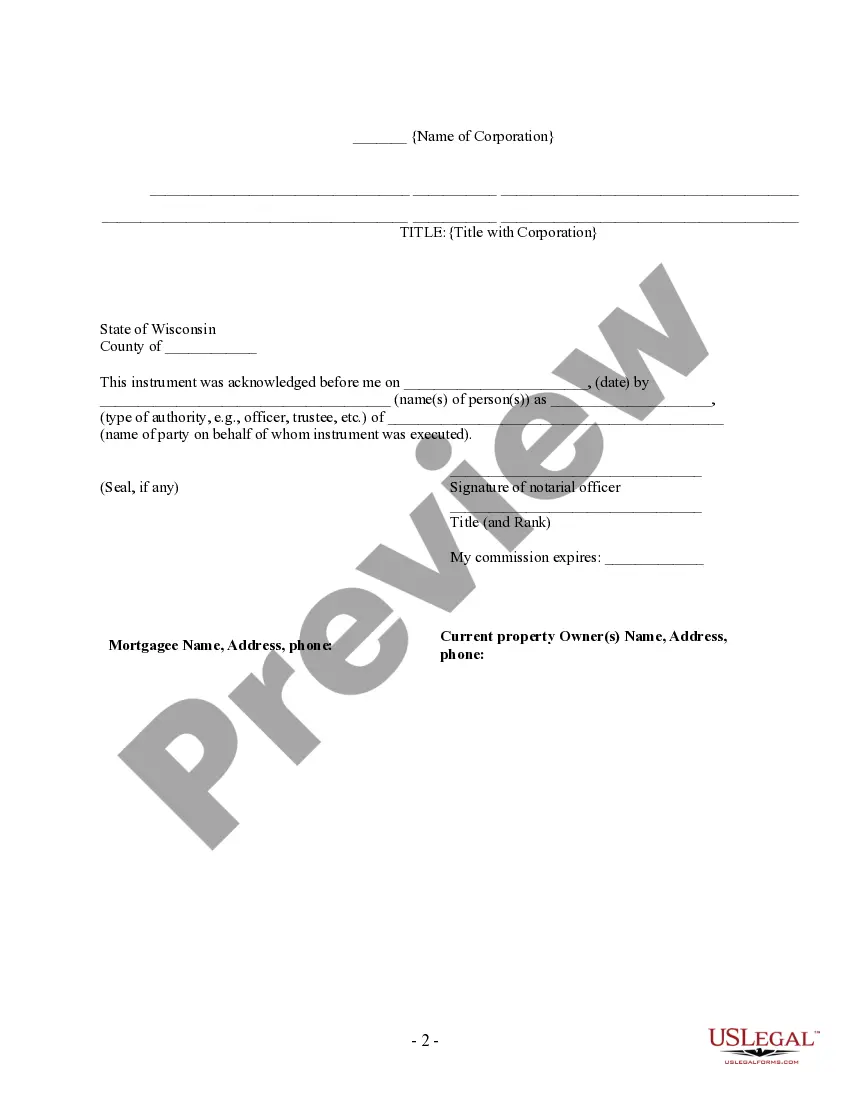

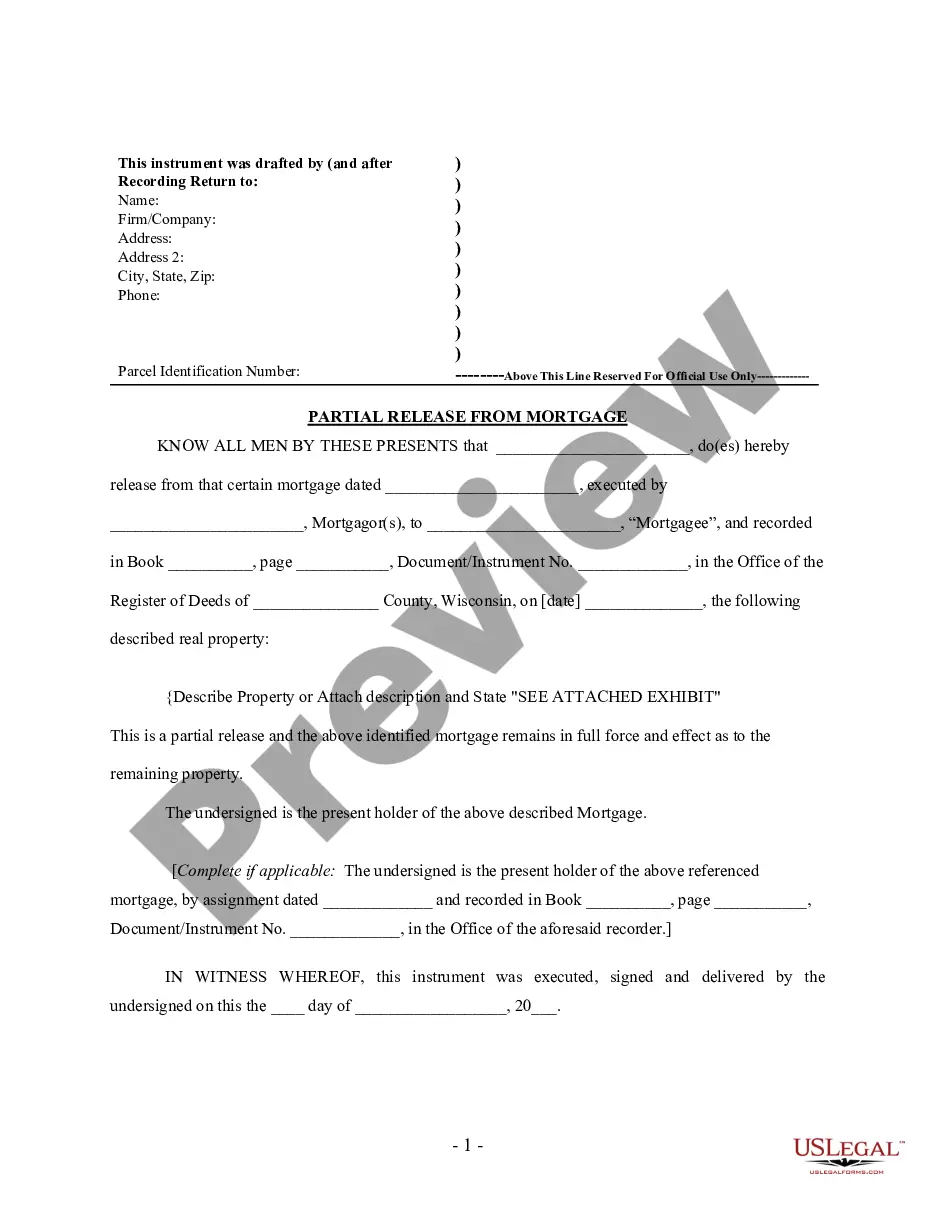

Wisconsin Partial Release of Property From Mortgage for Corporation

Description

How to fill out Wisconsin Partial Release Of Property From Mortgage For Corporation?

Out of the large number of services that provide legal templates, US Legal Forms offers the most user-friendly experience and customer journey while previewing templates prior to buying them. Its comprehensive library of 85,000 templates is categorized by state and use for efficiency. All of the documents on the platform have been drafted to meet individual state requirements by qualified lawyers.

If you have a US Legal Forms subscription, just log in, look for the form, click Download and gain access to your Form name in the My Forms; the My Forms tab holds all your downloaded documents.

Keep to the tips listed below to get the document:

- Once you find a Form name, make certain it is the one for the state you really need it to file in.

- Preview the form and read the document description prior to downloading the sample.

- Look for a new sample using the Search engine in case the one you’ve already found is not appropriate.

- Just click Buy Now and select a subscription plan.

- Create your own account.

- Pay with a credit card or PayPal and download the template.

Once you’ve downloaded your Form name, you may edit it, fill it out and sign it in an online editor of your choice. Any form you add to your My Forms tab can be reused many times, or for as long as it remains the most up-to-date version in your state. Our platform provides easy and fast access to samples that suit both legal professionals and their customers.

Form popularity

FAQ

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

Which situation would require a partial release? A borrower who wishes to sell a property that is part of a blanket mortgage(multiple properties and one mortgage loan) would need the lender to issue a partial release on the property being sold to release the lien and give the property a clean title.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

A mortgage release usually takes around 90 days to complete, but this could be shorter or longer depending upon your specific situation.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.